-

Morning News: March 6, 2025

Posted by Eddy Elfenbein on March 6th, 2025 at 7:04 amSouth Korea Inflation Moderates in February

China Says It Has ‘Ample’ Policy Tools to Spur Growth

Europe Tackles Its Orban Problem After Trump Rips Up Ukraine Aid

Euro’s Rally Vindicates Banks Betting Against Parity With Dollar

Eurozone’s Retail Sector Continued to Struggle at Start of 2025

ECB Cuts Key Deposit Rate by 25 Basis Points to 2.50%

Germany’s Shock Turns to Anger — and Animal Spirits

Germany, Once a Beacon of Frugality, Jolts Europe With Planned Spending Splurge

Worst German Bond Rout Since 1990 Sparks Global Debt Selloff

Many Chinese See a Cultural Revolution in America

Trump to Delay Canada, Mexico Tariffs on Autos for One Month

Tariff Whiplash Spooks U.S. Consumers

Who’s Got Trump’s Ear on Tariffs?

The Case Against Tariffs Is Getting Stronger

Walmart Asks Chinese Suppliers for Major Price Cuts on Trump Tariffs

Trump’s Cuts to Federal Work Force Push Out Young Employees

MAGA Wants to End Capitalism as We Know It

A $1.5 Billion Hack: How the Biggest Crypto Heist in History Went Down

F.D.A. Nominee to Face Grilling Over Cutbacks and Policy Shifts

Federal Grant Program Opens Door to Elon Musk’s Starlink

Canada’s Anti-Musk Pivot Hits Starlink’s Second-Biggest Market

China’s New AI Tools Ignite Stock Market Frenzy as Alibaba Soars

An All-American Finance Empire Drew Billions—and a Regulator’s Attention

7-Eleven to Split U.S. Stores and Buy Back Shares to Prevent Takeover

Wendy’s Sets Long-Term Financial Targets Ahead of Investor Day

Macy’s Sees Sales Dropping Again This Year

Be sure to follow me on Twitter.

-

Morning News: March 5, 2025

Posted by Eddy Elfenbein on March 5th, 2025 at 7:09 amUkraine’s DTEK in Talks With U.S. Suppliers to Boost Gas Supply to Europe, CEO Says

Trump Hails Tariffs as US Economy Barrels Into Trade Wars

Trump Celebrates His Disruption but Slides Over Its Costs

A Speech Long on Gloating, Short on Plans

Trump’s Trade War Could Be His Biggest Economic Gamble

Gaming Out Trump’s Next Tariff Moves

Tariffs Add a New Shock to Food Supply Chains

How Uncertainty From Trump’s Tariffs Is Rippling Through the Economy

The Two-Headed Monster Stalking the Economy Has a Name: Stagflation

Traders Watch for Trump Put After Lutnick Hints at Relief

US Mortgage Rates Near Three-Month Low in Boost to Demand

Mexico’s Secret Weapon in Trade War? Its Popular President

Canada and China Retaliate Against U.S. Tariffs, Which Trudeau Derides as ‘Dumb’

China Sets Strong Growth Target as It Hits Back at U.S. Tariffs

China Sets 2025 Growth Target at About 5% Despite Looming Trade Tensions

Xi’s Growth Goal Will Need Big Stimulus If Trade War Escalates

Beijing Ramps Up Efforts For Tech Independence

Judge Denies Musk’s Request to Block OpenAI’s For-Profit Plan

How Elon Musk Muscled His Way Into the FAA

Tesla Sales Plunge in Germany, Reflecting Broader Slump in Europe

Bayer Warns of Lower Earnings as Turnaround Continues

Goldman Wins Rare Solo Role on Blockbuster $19 Billion Port Deal

Phillips 66 Pushes Back Against Activist Elliott in Board Fight

McDonald’s Gives Its Restaurants an AI Makeover

KKR, Walmart to Sell Japan Supermarket Chain Seiyu for $2.5 Billion

Concert Ticket Prices Are Soaring, and Busting Gen Z’s Budgets

Be sure to follow me on Twitter.

-

CWS Market Review – March 4, 2025

Posted by Eddy Elfenbein on March 4th, 2025 at 4:19 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Ninety-two years ago today, Franklin Roosevelt was sworn in as president. In his inaugural address, President Roosevelt said, “Let me assert my firm belief that the only thing we have to fear is fear itself—nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance.”

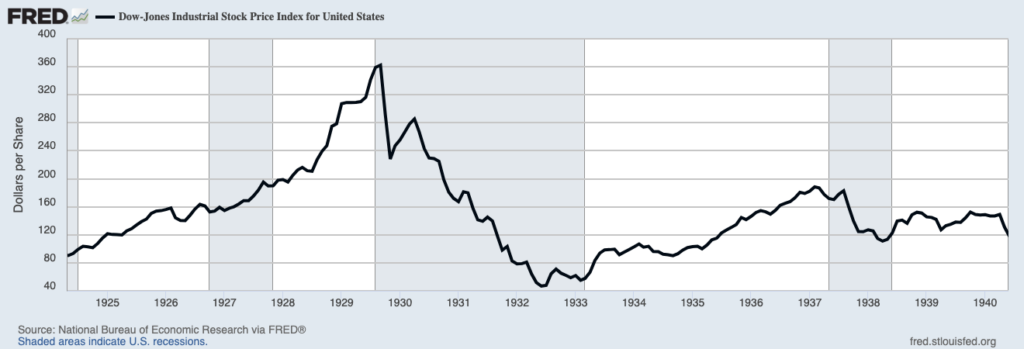

Indeed, fear is a scary thing, and there was a lot to be afraid of back then. The thing about fear is that it can easily lead to more fear, and that will compound on itself. During the Great Depression, the Dow dropped from 380 to 40. The Dow didn’t make a new high for 25 years. That certainly puts our fears of a 10% or 20% pullback into some context.

Back in FDR’s time, the new president wasn’t sworn in until March 4. That wide length and uncertainty between the Hoover and Roosevelt administrations led Americans to move the inauguration date to January 20.

Once he became president, Roosevelt got busy. Thirty-six hours into his presidency, FDR declared a bank holiday. Every bank in the country was shut down. Can you imagine that! Americans couldn’t take their money out, or even put new money in. The government inspected every bank in the country and only fiscally sound banks were allowed to reopen.

On March 9, Congress passed the Emergency Banking Act. The measure was rushed through Congress as quickly as possible. In fact, it was done so quickly that there was only one copy of the bill for the entire House of Representatives.

FDR’s order extended to the New York Stock Exchange. The stock market ended the day of March 3, 1933, at 53.84. After that, all trading was halted. The NYSE didn’t open again until March 15.

The paused worked, and the panic faded. Americans returned more than $1 billion to their banks. The Dow closed March 15 at 62.1, a gain of 15.3%. That was the single-largest gain in market history, and the record still stands today.

But in my opinion, that record deserves a small asterisk. While it’s technically true that March 15, 1933, was the best day in market history, that includes the buildup of nearly two weeks without any trading.

There’s a lesson for investors here. What’s interesting to me is how panic can build on itself, but so can calmness. Once people were forced to stop selling, other people lost the need to sell which, in turn, caused less selling. Sanity slowly returned. As it turned out, the initial problem was fear itself.

The High Beta Correction

That brings us to this week’s panic. Actually, panic is too strong a word, but the financial markets are certainly not happy. The stock market fell for the eighth time today in the last nine sessions, and five of those drops were by more than 1%.

The S&P 500 has now wiped out its entire gain since the election. That’s a loss of $3.4 trillion. The combined loss truly is not that much (about 6%), but it comes on the heels of a very placid time for the market.

The market could be in worse shape than it superficially appears. For example, 70% of the stocks in the S&P 500 are down over 10% off their 52-week highs. More than 38% are down more than 20%. It’s as if there’s a stealth bear market that’s quickly taking out some of Wall Street’s favorites. Tesla, for example, is 44% below its 52-week high.

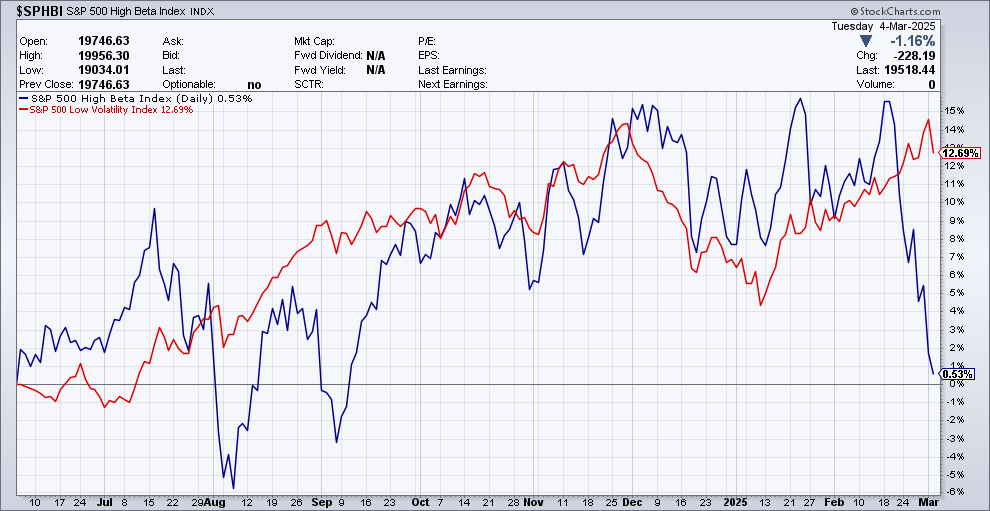

I’ve mentioned this before, but it bears repeating. The selling is falling disproportionally on riskier stocks. Low risk stocks have barely been hit.

Here’s a chart of the S&P 500 High Beta Index (in blue) along with the S&P 500 Low Vol Index (in red):

Notice how sharply the blue line has fallen. The chart above is a good way of seeing how the market swings between fear and greed. See how stable the red line is in comparison. The same effect is happening between value stocks and growth stocks. The Nasdaq Composite is down 8.7% since February 14.

There are sound reasons for the market to get more conservative. At the top of the list is the escalating trade war between the United States and Mexico and Canada. The tariffs are set to go into effect at midnight tonight. Last year, the United States had imports worth $1.4 trillion from Canada, China and Mexico.

According to the New York Times, “All goods imported from Canada and Mexico are now subject to a 25 percent tariff, except Canadian energy products, which face a 10 percent tariff, according to the executive orders.”

We’ve also been getting a raft of softer economic news. For example, the Atlanta Fed’s GDPNow model now estimates that the U.S. economy shrank at a 2.8% rate during Q1. Just a few days ago, the model was forecasting 2% growth. We also learned that in January, construction spending fell by 0.2%. The ISM Manufacturing Index fell to 50.3. That still indicates a growing factory sector but not by much.

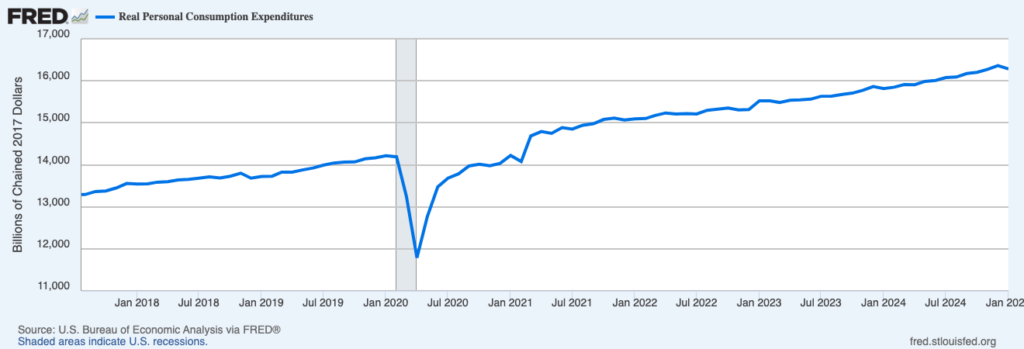

Last week, the government revised its report on Q4 GDP growth to 2.3%, but the shocking news came with the personal income report. That usually comes out the day after the GDP report. For January, personal income rose by 0.9%, but spending (officially called “personal consumption expenditures”) fell by 0.2%.

Here’s a look at real PCE, which means adjusted for inflation. That little dip at the right is what freaked out Wall Street. I’m not concerned about one or two bad months, but I don’t want to see a bad trend develop here.

President Trump will be speaking this evening. Early reports suggest he’ll be talking about Ukraine and his tariff policies.

This Friday, we’ll get the jobs report for February. Wall Street expects to see a gain of 170,000 net new jobs. I’ll be curious to see if that number is as strong as expected. In January, only 143,000 jobs were created which was below expectations. The unemployment rate is expected to be 4.0%.

If the jobs numbers are bad, it could convince investors that they were right to exit High Beta stocks.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: March 4, 2025

Posted by Eddy Elfenbein on March 4th, 2025 at 7:04 amEurozone Labor Market Stays Resilient Despite Weak Economy

Trump Pauses Military Aid to Ukraine After Clash With Zelenskiy

Is It Time to Transfer Frozen Russian Assets to Ukraine? Calls Grow Louder.

Trump’s Blowup With Zelenskiy Spurs Taiwan to Rethink US Tactics

Putin Agrees to Help Trump Broker Nuclear Talks With Iran

Aramco Trims World’s Biggest Payout in Blow to Saudi Budget

The ‘Oil Grand Bargain’ Isn’t Mere Fantasy

Trump Escalates Global Trade War, Sparking Tit-for-Tat Tariffs

China Retaliates Against Trump Tariffs as Superpower Trade War Escalates

Trump’s Tariffs on Canada, Mexico and China Snap Into Effect

Trump Tariffs Usher In New Era of Protectionism

In Face of Trump’s Tariffs, Mexico Embraces Its President and Nationalism

Tariff War Risks Sinking World Into New Great Depression, International Chamber of Commerce Warns

The Problem with Car Tariffs: What’s an Import?

Iowa Farmers Don’t See Much ‘Fun’ in Trump Tariffs

China Targets San Diego Biotech Firm in Broadening Blacklist

Can Trump Deliver on His Promises? These 12 Metrics Will Tell Us

A Key Interest Rate Falls, but Not for the Reasons Trump Wanted

Crypto’s Next Bubble Will Be Politically Motivated

Commerce Secretary’s Comments Raise Fears of Interference in Federal Data

After the Apocalypse, Will We Decamp to a Suburb or a High-Rise?

Tesla for Sale: Buyer’s Remorse Sinks In for Elon Musk’s E.V.-Owning Critics

Xiaomi and Vivo’s Cameras Set New Smartphone Standard Far Above iPhone

Honeywell’s Transformation Continues With $2.2 Billion Deal for Pump Maker

Target Warns That Tariffs and Consumer Uncertainty Will Hurt Profit

Walgreens Nears Roughly $10 Billion Deal to Go Private

Kraft Heinz Dips a Toe Into Booze

The Mysterious Billionaire Behind the World’s Most Popular Vapes

Be sure to follow me on Twitter.

-

Morning News: March 3, 2025

Posted by Eddy Elfenbein on March 3rd, 2025 at 7:07 amAmerica’s Loss of Soft Power Is Putin’s Gain

Russia Sanctions Hamper Delivery of Moscow’s Oil

For Greenland’s Minerals, the Harsh Reality Behind the Glittering Promise

ECB Primes Fresh Rate Cut as Inflation Begins to Ease Again

The ‘Hustling Expert’ Behind Argentina’s $250 Million Crypto Scandal

Trump Crypto Rally Proves Fleeting as Reserves Plan Questioned

Asia’s Manufacturing Gauges Signal Growth But Outlook Remains Cloudy

Trump Turns Up Trade Pressure on China After Beijing Fails to Come Running

Clock Ticks Down Toward Sweeping Tariffs on Canada, Mexico and China

Mexico’s Star Economy Dreams Crumble Under Donald Trump’s Tariff Threats

How Much Do Tariffs Raise Prices?

On Another Tariff Eve, Here Is the Impact to U.S. Autos

2 Troubled Carmakers, Nissan and Stellantis, Could Be Hit Hardest by Tariffs

US Stocks Lagging Behind World Portends Tough Year for Equities

Short Sellers Are a Useful Menace

US Narrative Veers From ‘Exceptionalism’ to Alarm Over Growth

Here’s How Government Spending Has Grown—and Where the Money Is Going

Dalio Warns of US Debt Crisis ‘Heart Attack’ Within Three Years

Are Home Values About to Fall? It Depends on the Location

Elon Musk Wants to Be a Kingmaker Again

Can the Media’s Right to Pursue the Powerful Survive Trump’s Second Term?

The US Is Withdrawing From Global Health at a Dangerous Time

BlackRock’s GIP Joins Investment Firms Setting Up Qatar Offices

HP’s Deal for Humane AI Startup Creates an Unlikely Partnership

Southwest Airlines Promised to Take Care of Employees—Until It Couldn’t

Forget McDonald’s. This Chinese Fast-Food Chain Is Now the World’s Biggest.

Kroger CEO Rodney McMullen Resigns After Investigation Into Personal Conduct

Snack Makers Are Removing Fake Colors From Processed Foods

Be sure to follow me on Twitter.

-

Morning News: February 28, 2025

Posted by Eddy Elfenbein on February 28th, 2025 at 7:02 amIndia’s Economy Picks Up Speed

What Is Japanification and Is it Happening to China?

China Vows ‘All Necessary Measures’ Against New US Tariffs

All the Ways China Could Respond to Trump’s Ramped Up Trade War

Global Shares Fall After Renewed U.S. Tariff Threats Spook Investors

Trump’s Tariff Onslaught Is Coming Faster Than His Team Can Carry It Out

America’s Trade War With China Should Be a Team Sport

When It Comes to Tariffs, Trump Can’t Have It All

The Oil Market Has a Growing Gas Supply Problem

Team Trump Can’t Have It Both Ways on Oil and Gold

Feeling ‘Slapped Across the Face by Trump,’ Canadians Say They’ll Skip U.S. Trips

Egg Crisis Forces Trump to Seek Bigger Imports

Trump Dials Back Fed-Bashing, Seeks a Different Kind of Rate Cut

The Fed’s Hand Might Be Forced to Lower Rates

Traders Are Racing to Bet on the End to Russian Sanctions

‘Trump Put’ Looms as S&P 500 Reverses Election Rally, BofA Says

Bitcoin Down 25% From All-Time High as Crypto Rout Worsens

S.E.C. Declares Memecoins Are Not Subject to Oversight

Rich People Are Firing a Cash Cannon at the US Economy—But at What Cost?

“Low Buy 2025”: What Does It Take to Quit Shopping? Mute, Delete and Unsubscribe.

Indonesia’s $1 Billion Win in Apple Negotiations Sets New Precedent

Tumbling Tesla Shares Leave Investors Bracing for More Losses

Nissan Needs a Savior to Swoop to Its Rescue Again

BASF Expects Earnings Growth on Cost Cuts

Videogaming’s All-In Bet: Can Two Titans Lift a $58 Billion Industry?

Be sure to follow me on Twitter.

-

Morning News: February 27, 2025

Posted by Eddy Elfenbein on February 27th, 2025 at 7:04 amEurozone Business Sentiment Improves as Rates Fall, Despite Looming Tariffs

Polish Zloty Surges to 10-Year High Fanned by Hawkish Central Bank

LSEG Shares Rise on $633.8 Million Share Buyback

HKEX Profit, Revenue Hit Quarterly Highs

Trump Aims at Chinese Shipping, Risking Another Shock for Businesses

Reagan’s ‘Peace Through Strength’ Never Looked So Weak

‘Buy Canada, Bye America’: Trump’s Taunts Spur Fury in the North

Republicans Gamble on a Regressive Economic Agenda

From Egg Prices to Housing, US Inflation Is Heating Up Again

U.S. Economy Shows Signs of Strain From Trump’s Tariffs and Spending Cuts

Bessent Gets His Lower Bond Yields But for the Wrong Reasons

US Treasuries Slip as Traders Await GDP Data for Growth Hints

Big Money Flocks Back to a Levered Trade That Went Bust in 2008

Squeezed by Strong Dollar, Companies Try to Neutralize Currency Swings

Musk’s Empire Tells Its Own DOGE Story

A Disastrous Buyout Exposes Fuzzy Math in Private Equity Deals

When Central Banks Hit Instagram, Cue the Cringe

Nvidia Sees Mixed Outlook After Two Years of Blowout Results

Tencent Releases Turbo AI Model It Says Is Faster Than DeepSeek

PayPal Needs Help From Its Oldest Friends—Consumers

NFL Teams Gathered Detailed Consumer Data Without Standard Notice or Opt-Outs

Breaking Up BP Would Risk Its Profitable Trading Edge

Founding Family Fails in Bid to Buy Out 7-Eleven

The Most Important Person (in Japanese Food) You’ve Never Heard Of

Becoming a Beer Sommelier is Almost Impossible. Explaining It Is Harder.

They Broke Up. Then Came the Brand Deals.

‘Jeopardy!’ and ‘Wheel of Fortune’ to Leap to Streaming

YouTube Star MrBeast Is Raising Money at a $5 Billion Valuation

Be sure to follow me on Twitter.

-

Morning News: February 26, 2025

Posted by Eddy Elfenbein on February 26th, 2025 at 7:05 amBP to Slash Green Spending, Pivot Back to Oil

Trump Announces Inquiry That Could Lead to Tariffs on Copper

Trump Ends US Initiative to Boost Electricity Access in Africa

Trump’s New Crackdown on China Is Just Beginning

Trump Aims at Chinese Shipping, Risking Another Shock for Businesses

Hong Kong Looks to Shore Up Economy as Trade Risks Loom

China to Inject at Least $55 Billion of Fresh Capital Into Several Big Banks

Trump to Offer ‘Gold Card’ Visas for $5 Million to the Rich

Federal Funding Crackdown Imperils Global Newsrooms

What Will Become of U.S.A.I.D.’s Funding? A Billionaire’s Son Has Some Ideas.

Trump 2.1 Arrives With a Whimper Rather Than a Bang

US Mortgage Rates Decline to 6.88%, Lowest Level This Year

The Economy Is Still Fine. Americans Are Still Gloomy.

Tax Cut Chances Rise as House Passes Budget Targeting Safety Net

Why ‘Probationary’ Employees Are a Target in Federal Job Cuts

Mass Federal Firings May Imperil Crops, Cattle and Pets

Egg Prices Are Soaring. Bird Flu May Not Be the Only Culprit.

Is Warren Buffett’s True Successor Bill Ackman?

Apple’s UK Privacy Fight Is Noble But Shortsighted

Elon Musk’s DOGE Adventure Leads to Knotty Accounting Question for Tesla

Tesla Feels the Wrath of Anti-Elon Musk Backlash

GM Boosts Investor Payout With New Buybacks, Dividend Hike

Aston Martin to Shrink Workforce, Delay EV Launch in Cost-Cutting Drive

Bud Brewer AB InBev Stock Jumps After Higher Prices Boost Revenue, Profit

How a Plastic Panic Gave New Life to Steel and Wood Utensils

Be sure to follow me on Twitter.

-

CWS Market Review – February 25, 2025

Posted by Eddy Elfenbein on February 25th, 2025 at 6:35 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

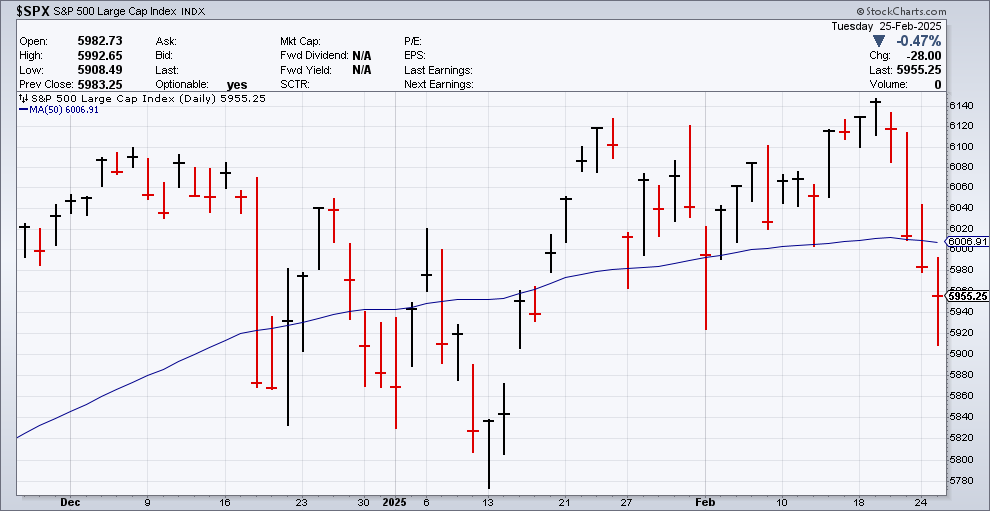

Wall Street has had a case of the jitters recently, and I can’t blame it. On Tuesday, the S&P 500 fell for the fourth day in a row. The index has dipped below 6,000, and it’s fallen beneath its 50-day moving average.

Of course, we should put this in context. Yes, the market is down, but that’s measuring from its all-time high from last Wednesday. Also, markets are naturally very volatile. The stock market pulls back all the time, even in roaring bull markets. There’s nothing unusual about this latest move. The combined loss is a little over 3%.

Still, there are some areas of concern. The economy could be getting weaker. The last retail-sales report was a dud. The jobs report was less than expected. Also, the inflation report came in hot. I noticed that the wage gains for January were the exact same as the inflation figure for January. In other words, every penny in raises was eaten up by higher prices.

Consumer Confidence Plunges

We got more bad news today in the Consumer Confidence report. The Conference Board said that the consumer confidence index fell to 98.3 for February. That’s down seven points from January, and it came in below Wall Street’s estimate for 102.3. If shoppers aren’t happy, then the economy will not do well.

This was the biggest drop in consumer confidence in more than three years, and it was the lowest reading since last June. Inflation expectations increased to 6%. That’s three times the Fed’s target. This comes at the same time that tariffs appear ready to go into effect. We really have no idea yet what the impact could be. The CEO of Alcoa said that it could cost 100,000 jobs in the aluminum industry.

“Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income,” said Stephanie Guichard, the board’s senior economist for global indicators. “Pessimism about future employment prospects worsened and reached a ten-month high.”

There’s another consumer confidence report put out by the University of Michigan. Last week, it reported a larger-than-expected drop of nearly 10%.

We’re currently in a fairly quiet period for economic reports. The new-home sales report is out tomorrow. Later this week, the government will revise the Q4 GDP numbers. While that’s an important report, Q4 is already a bit dated for our purposes. Markets move quickly but econ reports move slowly. A lot of guessing is done in the middle.

One interesting aspect of the market’s recent downturn is that it’s been heavily tilted toward riskier stocks. I like to track the S&P 500 High Beta Index which is a group of high-volatility stocks within the S&P 500. Over the past week, the S&P 500 has lost 2.8%, but the S&P 500 High Beta Index has lost 7.6% while the S&P 500 Low Volatility Index has gained 2.2%.

That’s a big spread for just a few days. It’s further evidence that investors are shying away from risk and that they’re looking for safe havens. I’ll also note that our ETF has been performing well versus the rest of the market in recent days.

In no sense are riskier stocks better or worse than conservative stocks. Instead, there’s a cycle to both and it reflects investor outlook. Sometimes investors become more willing to shoulder risk, and in other times, they seek shelter from the storm. Riskier assets had been doing well, but they got some pushback this week.

It’s not just stocks; we can see the same effect playing out in other markets. For example, bitcoin got dinged hard yesterday and today.

At the end of next week, March 7 to be exact, we’ll get the jobs report for February and that will tell us more about the economy’s recent behavior. The expectation that there will be fewer jobs six months from now rose to its highest level in over a decade.

The simple story is that Wall Street is bracing for bad news, but we don’t know if the upcoming news will be bad just yet. The market prefers to move before the news is certain. For now, Wall Street is adjusting itself to the possibility of bad news.

Buffett Has $330 Billion in Cash

Over the weekend, Warren Buffett released his annual shareholder letter. These are always fun to read. The 94-year-old CEO has a great ability to make complicated topics easy to understand.

What’s caught people’s attention is that Buffett’s cash holding has soared to more than $330 billion. A lot of commenters think that the large cash position reflects a bearish outlook from Buffett.

He was quick to allay those fears. Buffett wrote, “Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities – mostly American equities although many of these will have international operations of significance.”

For the ninth quarter in a row, Buffett has been a net seller of stocks. Last year, Buffett sold $134 billion worth of stock. Still, Buffett has not been buying back his own stock. Perhaps he simply doesn’t see any compelling buys right now.

By the way, if you like Wall Street history, then today is your day. Several important moments have come on February 25:

The first Bank of the United States was chartered on February 25, 1791. Twenty years later, Congress decided by one vote not to renew the charter.

The first cabinet meeting was held on February 25, 1793.

On February 25, 1817, the New York Stock and Exchange Board was organized. (Sorry, but the Buttonwood stuff wasn’t that important.)

On February 25, 1862, The U.S. formed the Bureau of Engraving & Printing.

On February 25, 1863, Congress created the National Currency Bureau.

On February 25, 1893, the Philadelphia & Reading Railroad bankruptcy launched a Panic.

On February 25, 1901: JP Morgan created the first billion-dollar company, US Steel.

On February 25, 1913: The 16th Amendment authorized the first federal income tax.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: February 25, 2025

Posted by Eddy Elfenbein on February 25th, 2025 at 7:06 amEurozone Wages Slow, Opening Way For Rate Cut

ECB Can Keep Cutting Rates as Inflation Approaches Target, Bundesbank’s Nagel Says

Germany Confirms Economic Contraction, Emphasizing Challenge for Next Government

Bank of Korea Cuts Rate, Lowers Growth Forecast

America’s Turning Its Alliances Into a Protection Racket

Trump Team Seeks to Toughen Biden’s Chip Controls Over China

Chinese Manufacturers Speed Up Efforts to Dodge Trump Tariffs

US-China Decoupling Fears Drive Slide in Chinese Tech Shares

Trump’s SALT Tax Promise Hinges on an Obscure Loophole

To Do Its Job Right, the Fed Must See What’s Wrong

Bitcoin Slides Below $90,000 as Crypto Selloff Gathers Steam

The Bond Market Isn’t Fully Buying What Musk’s DOGE Is Selling

Some of DOGE’s Damage Can’t Be Undone

Hedge Funds Face Fresh Watchdog Scrutiny Over Huge Macro Wagers

Egg Prices Are a Problem. So Where Are the Solutions?

Nippon Steel to Discuss U.S. Steel Deal With U.S. Officials

ANA to Order $14 Billion of Jets From Boeing, Airbus, Embraer

Tesla Moves One Step Closer to Self-Driving Cars in China

Trump’s Threat to EV Trucking Rules Undermines Big-Rig Bets

Thermo Fisher Nears Deal for Solventum’s Filtration Unit

Fresenius Medical Care Narrows Key Earnings Metric View on Profit Slump

Lilly Cuts Price of Zepbound Vials to Battle Cheaper Copycats

Unilever Replaces CEO to Speed Up Turnaround Efforts

Home Depot Expects Tepid Recovery in Housing Demand

Middleby Plans to Spin Off Food Processing Business

Krispy Kreme Sees Higher Sales After Cyberattack Dents Quarterly Results

Be sure to follow me on Twitter.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His