CWS Market Review – July 5, 2013

“Do you know the only thing that gives me pleasure?

It’s to see my dividends coming in.” – John D. Rockefeller

This will be an abbreviated issue of CWS Market Review. Trading this week was shortened due to Independence Day, and most of the fat-cat Wall Streeters are relaxing at their cribs in the Hamptons.

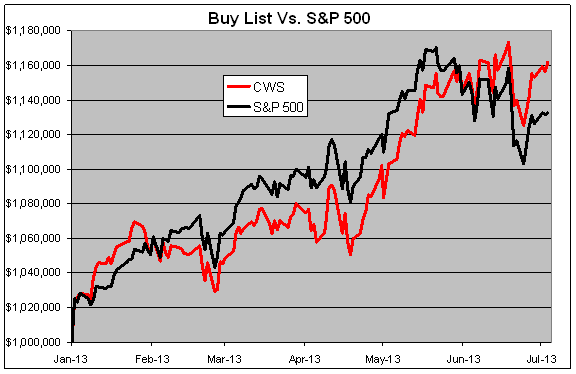

Don’t fear, my friends. My vigilant team and I are still on the watch, protecting you from whatever mayhem comes our way. The good news is that our Buy List continues to do very well. Through Wednesday, our Buy List is up 16.18% for the year compared with 13.27% for the S&P 500. That’s our widest lead all year.

In this week’s CWS Market Review, I’ll discuss the recent good news from Moog and Ford. Both stocks have been big winners for us lately. I’ll also talk about the upcoming Q2 earnings season. JPMorgan Chase and Wells Fargo will be our first stocks to report on Thursday, July 11th. But first, let’s look at why Ford just broke out to a new two-year high.

Good News for Ford and Moog

On Wednesday, shares of Ford ($F) closed at $16.43, which is the automaker’s highest close in 29 months. The catalyst for the move was a very strong sales report for June. Ford reported that sales were up 13% last month. The best news was that sales of F-150 pickups, which are a key moneymaker for Ford, jumped 24%. Ford said that sales in China are up 44% from last year. In May, China sales were up 45%. Ford has been busy playing catch up to GM in China.

Ford is due to report Q2 in a few weeks. The current estimate on Wall Street is for earnings of 36 cents per share, which would be a 20% increase over last year’s Q2. I should add that Ford has been creaming its estimates lately. I like this stock a lot. Ford remains a very solid buy up to $18 per share.

In last week’s CWS Market Review, I raised our Buy Below on Moog ($MOG-A) to $55 per share. That was pretty good timing! This week, Moog said that it’s looking at strategic options for its medical-devices division. That’s Wall Street-ese for “we’re looking to sell it.” I like when companies sell off units, and usually, so do investors. The stock broke $54 on the news, which is an all-time high.

The medical devices unit comprises just 5.7% of Moog’s overall business, but sales were down last year. As much as the market responds to the financial benefits of the divestiture, I think the market appreciates management’s willingness to shake things up. The company is due to report earnings at the end of the month. Wall Street currently expects earnings of 89 cents per share. Moog remains a good buy up to $55 per share.

Second-Quarter Earnings Season Begins Next Week

We’ve heard a lot of talk of how well companies should be doing, but beginning next week, we’ll finally see hard evidence of how well companies have performed. Earnings season is Judgment Day for Wall Street, and we’ll soon learn who’s been pulling their weight and who hasn’t. Fifteen of the 20 stocks on our Buy List ended their quarter on June 30th. This means that three-fourths of our portfolio will report earnings over the next month.

Wall Street is clearly nervous going into this earnings season. The analyst community currently expects index-adjusted earnings of $26.40 for the S&P 500. In the past year, that estimate has been revised downward by $2.50, including more than $1 in the last three months. Citigroup recently noted that negative pre-announcements have been outrunning positive ones by a ratio of 6.5 to 1. That’s the worst ratio since 2009, back when the world was falling apart.

I actually think the pessimists have gotten ahead of themselves here. While earnings expectations did need to come down, I suspect that growth is ramping up in several sectors. I especially think the damage from Europe won’t be as bad as is feared. The big trend recently has been share buybacks. For Q1, buybacks were up 17% from the year before. I think that will continue to be a major theme this year.

Our first two Buy List stocks to report this earnings season will be both of our big banks, JPMorgan Chase ($JPM) and Wells Fargo ($WFC). This is fortuitous for several reasons. First, both are excellent stocks. They’re also good bellwethers for the rest of the financial sector. Also, both banks made a decision recently to go all in on the mortgage business, which has been a huge winner for them. Both stocks are 20% winners for us this year.

JPMorgan had an insanely good first quarter. As much as Jamie Dimon annoys me, I have to admit that the bank still gets it done. Q1 earnings came in at $1.59 per share, which was 20 cents more than the Street’s consensus. There was some pushback from traders’ saying that the earnings beat was solely due to a tax benefit and some accounting adjustments.

But don’t let the bears scare you. JPM is doing very well. Wall Street expects Q2 earnings of $1.43 per share, and I think they’ll have little trouble beating that. Thanks to a pullback from the May high of $55.90, JPM is going for just 9.2 times this year’s earnings estimate. Jamie also recently raised the dividend by 26.7% to 38 cents per share. JPM currently yields 2.88%. The stock is an excellent buy up to $56 per share.

The business at Wells Fargo tends to be more stable than what we see at JPMorgan, and by extension, it tends to be more predictable. For Q1, Wells saw its earnings rise 22%, and they beat expectations by four cents per share. Their community banking division has been especially strong. Wells rewarded shareholders with a 20% dividend boost. Interestingly, the current yield is 2.91%, which is nearly the same as JPM.

For Q2, the Street expects 92 cents per share for Wells. That sounds about right, maybe a penny or two too low. The important thing for us to see is that business is continuing to improve. I also like that Wells and JPM took advantage of low rates to raise tons of cash from investors. Wells Fargo is a good buy up to $46 per share.

New Buy Belows for WEX and BBBY

I’m again going to raise my Buy Below on WEX Inc. ($WEX). The stock has taunted us long enough! WEX did dip below our $75 Buy Below recently, and it’s started to run up again. I’m raising our Buy Below to $80 per share.

I’m also raising Bed Bath & Beyond ($BBBY) to $75 per share. The stock has responded well to its recent earnings report, and I don’t want it to run away from us. BBBY remains a very good buy.

That’s all for now. I told you this would be a short one. Don’t forget: earnings season kicks off next week. The stock and bond markets are still recuperating from the last Fed meeting. On Wednesday, we’ll finally get a look at the minutes from that meeting. I suspect that these minutes will confirm the view that the Fed is in no rush to shut off the money spigots. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on July 5th, 2013 at 8:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His