CWS Market Review – July 4, 2014

“We hold these truths to be self-evident, that all men are created equal.”

I hope everyone is having a wonderful Fourth of July weekend. The stock market is closed today in honor of Independence Day, but we had an eventful—albeit shortened—trading week.

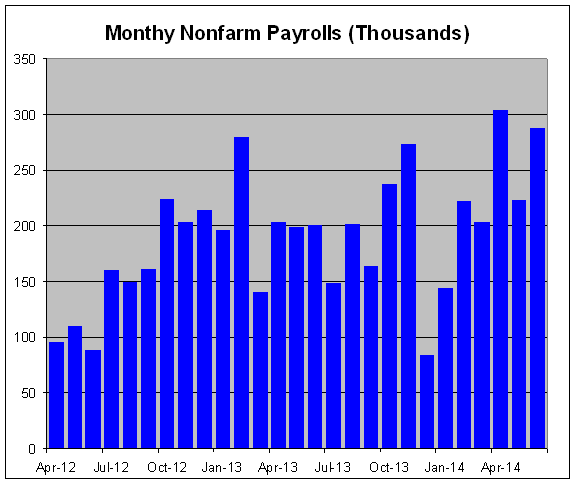

The big news was Thursday’s excellent jobs report. The economy added 288,000 jobs last month. That was far more than expected, and it marked the first time the U.S. economy has added more than 200,000 for five straight months since the Tech Bubble (check out the chart below). The unemployment rate dropped to 6.1%, which is its lowest level since September 2008, the same month that Lehman Brothers went kablooey.

The good economic news helped power the stock market to more new highs. On Thursday, the Dow Jones Industrial Average topped 17,000 for the first time. The index needed only 227 days to rise from 16,000 to 17,000. For some context, the Dow first broke 1,700 on February 21, 1986, so we’re up 10-fold in a little over 28 years. The S&P 500 also broke into record territory. The index finished the week at 1,985.44 for its 25th all-time closing high this year.

In this week’s CWS Market Review, we’ll take a closer look at the jobs report and focus on what it means for us and our portfolios. I’ll also run down how our Buy List did during the first half of the year. I also want to discuss a few of our Buy List stocks. Second-quarter earnings season begins in a few days, and I expect to see good results from our stocks. Wells Fargo ($WFC) will be our first Buy List stock to report next Friday. I’ll have more on that in a bit. But first, after a long winter, the U.S. jobs market is finally showing some strength.

The U.S. Economy Created 288,000 Jobs Last Month

Since the market is closed today, Jobs Day fell on a Thursday this month. Jobs Day, of course, is very important on Wall Street. Investors around the world stop what they’re doing to see what the government has to say. The monthly jobs report is probably the best month-to-month barometer of how well the economy is doing. It’s also the report that the Fed watches most closely. We know that Fed policy is largely determined by the jobs market, or at least where they think the jobs market is going.

Yesterday, the Department of Labor said that the U.S. economy created 288,000 net new jobs last month. That’s a very impressive number. Economists were expecting an increase of 215,000. (I was much closer with my guess.) On top of that, the jobs gains for April and May were revised higher.

In the last five months, the U.S. economy has created 1.241 million jobs. I was also pleased to see that the jobs-to-population ratio finally topped 59%. The ratio had been stuck between 58% and 59% for a staggering 57 months in a row. The story had been that any gains in the employment rate were caused by folks leaving the job market. That’s still a factor, but make no mistake, there’s real hiring going on as well.

The unemployment rate fell to 6.1%, which is its lowest level in more than five years. In March, the Federal Reserve released its economic projections for 2014. The central bank saw unemployment between 6.1% and 6.3% by the end of this year. Well, things have been running ahead of schedule. Last month, the Fed revised its year-end range to 6.0% to 6.1%. The economy looks to beat that soon. The year’s only halfway done, and we’re already at 6.1%. After years of consistently overestimating the economy, the Fed has apparently underestimated the strength of the jobs market.

This week, we also had another good ISM report. For June, the ISM Manufacturing Index came in at 55.3, which was 0.1 below May’s report. The manufacturing sector came very close to increasing its growth rate for five months in a row. On Wednesday, the factory-orders report for May was sluggish (-0.5%); however if you exclude military hardware, then orders rose by 0.2%.

Of course, the ultimate judge of the economy is the notoriously ornery bond market. However, to be fair, the bond market has been well behaved. We all know how the bond market can act like World Cup soccer players—writhing around in spurious agony when they’ve been lightly grazed by another player. The strong jobs report pushed the yield on the 10-year Treasury up to 2.65%, which is still quite modest. After all, the yield is 28 basis points lower than where it started the year.

Watching the bond market is important because that, combined with the Fed’s plans, is the key to the stock market. With the economy running ahead of the Fed’s projections, I think Janet Yellen could alter her plans. I still think the Fed will taper QE at each meeting this year. That way, it will be completely wrapped up by January 1st. Previously, Chairwoman Yellen said to expect the first rate increase “something on the order of six months” after QE is done. That would be about one year from today. Now I think that date will be pushed up to the first quarter of 2015. As I’ve mentioned before, there are now signs that inflation is starting to heat up.

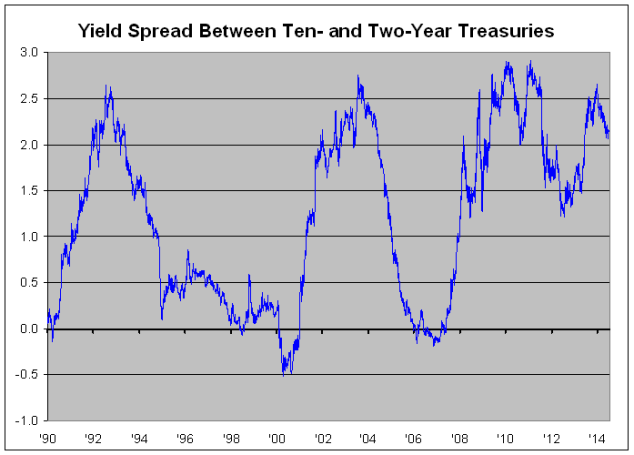

Here’s my take: As long as the yield curve is wide, meaning the difference between long-term and short-term interest rates is big, that’s good news for stocks. But that’s not going to last forever. Long-time readers know that I’m a fan of Dr. Twotenspread, one of the greatest economic forecasters of all time. The spread between the ten- and two-year Treasuries has been far more accurate than a lot of higher-paid folks on Wall Street (see the chart above). On Thursday, the two-year yield got to 0.52% for the first time since last September, and it’s very close to making a three-year high. But the spread between the two and ten is still a very bullish 213 basis points.

The bottom line is that this is a very good environment for stocks. Valuations have climbed, but they’re not excessive. Earnings are growing, and we’ll see more evidence of that once Q2 earnings season starts. We should also remember that stock prices have chilled out in a major way. Volatility is the lowest it’s been in years. The S&P 500 has now gone 34 days in a row without a gain or loss of more than 0.8%.

Buy List First-Half Review

This past Monday was the final trading day of the first half of 2014, and I wanted to update you on the Buy List’s performance. The good news is that we’re in the black. The bad news is that we’re trailing the market, but not by much.

Through Monday, our Buy List was up 1.99% for the year, while the S&P 500 was up 6.05%. If we include dividends, then the Buy List gained 2.70% through Monday, compared with 7.14% for the S&P 500.

At the end of the first quarter, our Buy List was ahead of the S&P 500. But during Q2, we had a small loss (-0.09%), while the market rallied 4.69%. Part of the reason is our big losers like Bed Bath & Beyond and Ross Stores. All by itself, our BBBY position knocked 1.6% off our YTD gain. Another weakness is that we don’t have any energy stocks, and that sector has heated up since March.

For the first half, our biggest winner was DirecTV (+23.1%), followed by Wells Fargo (15.8%) and Stryker (12.2%). Our biggest loser was, not surprisingly, Bed Bath & Beyond (-28.5%), followed by CA Technologies (-14.6%) and Ross Stores (-11.7%).

As I’ve mentioned many times, our Buy List has beaten the market for the last seven years in a row. Even though we’re trailing the market now, I have no plans to depart from our proven strategy. We’re not even close to being out of it, and I’m confident we can catch the S&P 500 before the year is up. Now let’s look at some recent news affecting our stocks.

Buy List Updates

Wells Fargo ($WFC) will start earnings season for us next week. The bank is due to report Q2 earnings on July 11, before the opening bell. The stock just made another new 52-week high yesterday. Wall Street expects quarterly earnings of $1.01, which WFC should be able to top. The shares have done well for us this year, but Wells is far from fully priced. The bank is currently going for less than 13 times this year’s earnings estimate. Plus, it yields more than 2.6%. For now, I’m going to keep our Buy Below somewhat tight. Wells Fargo remains a very good buy up to $54 per share.

Oddly enough, Bed Bath & Beyond ($BBBY) showed some life on Thursday as the shares gained 2.7%. There’s been some talk of a potential buyout, but it seems to be only rumors for now. For now, I’m keeping our Buy Below at $61 per share.

On Thursday, shares of Ford ($F) closed at $17.32, which is its highest closing price since October. On Tuesday, the auto maker reported a monthly sales decline, but that’s due to some technical factors as Ford retools its production facilities. Overall, sales fell by 5.8%, but that was less than expected. The good news is that Fusion sales were up 14%. Ford is due to report Q2 earnings on July 24. Wall Street currently expects earnings of 38 cents per share. Ford remains a solid buy up to $18 per share.

That’s all for now. Next week will probably be fairly quiet. Most of the Wall Street big shots are chilling at the Hamptons. Alcoa will kick off earnings season on Tuesday. Our own Wells Fargo is due to report on Friday morning. On Wednesday, the Fed will release the minutes of its last meeting. Traders will scour the minutes for any hint of tight money, but I doubt they’ll find it. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on July 4th, 2014 at 7:07 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His