CWS Market Review – September 5, 2014

“The expectation of an event creates a much deeper impression

on the exchange than the event itself.” – Jose de la Vega, 1688

We’re now past Labor Day, and the stock market keeps on rolling. There are times when it seems like all the news is bad news for the market; then it suddenly switches, and everything is good for stocks! On Thursday, the S&P 500 got as high as 2,011.17, which is yet another new all-time intra-day record high. But in the course of the day, the bears showed up and pushed the index back below 2,000. Still, the bulls have been the rulers of Wall Street for the past month.

As impressive as this rally has been, we have to bear in mind some important facts—the market’s volume and volatility have been low. Very low. Daily trading is the lightest it’s been in years. And look at the S&P 500’s recent price action. The index has now gone 11 days in a row of closing up or down by less than 0.5%. Seven of those days were less than 0.2%. Dear Lord, that’s barely a blip, and it’s especially small compared with the hyper-volatility of just a few years ago. The hot summer has been the Big Chill for Wall Street.

I’m also pleased to see that many of our Buy List stocks are joining in on the rally. Fiserv ($FISV) continues to push to new highs. Bed Bath & Beyond ($BBBY) finally broke above $65 per share. Even CA Technologies ($CA) has perked up recently.

The big news this week didn’t come out of the U.S. market. Instead, it came from Europe. Mario Draghi, the head of the ECB, said that the central bank will start buying asset-backed securities. In other words, they’re doing QE, too. The ECB also cut interest rates. Just like ours, their rates are on the floor, so they need a little experimenting to go negative. The ECB also cut their GDP forecasts for this year and next year.

My take: Draghi is sending a message: “Please, please, pleeezze bring the euro down!” If that works—and I can’t say it will—that would take a lot of heat off the ECB, and it would help the Eurozone get back on its feet.

I do want to caution investors that the U. S. market may be in store for a rough few weeks. Nothing dire, mind you. But I think some bears will soon be bold enough to launch assaults on some high-profile stocks (even Apple felt the sting this week), and the market as a whole may take a dip. You may have noticed that I’ve kept a leash on many of our Buy Below prices. Please understand that I only mean a few weeks, and nothing protracted. As always, investors should protect themselves by owning a diversified list of our Buy List stocks.

In this issue, I’ll cover some of the recent economic news impacting our portfolios. I also want to focus on the goings-on in the gold market. The Midas Metal has been getting squeezed lately, and I think this will go on for some time. I’ll also highlight a few especially good bargains on our Buy List. But first, let’s take a look at the best ISM report in more than three years.

August ISM Index = 59.0

On Tuesday morning, the ISM Index for August came in at 59.0. That’s a very good number, and it tells us that the manufacturing sector is thriving. Let me explain why the ISM report is so important. It’s a survey of manufacturers, and they’re asked whether business is better or worse compared with last month. What’s interesting is that it doesn’t tell us the overall result, just where we are compared with one month ago. The ISM is also a “diffusion” index, which is a fancy way of saying it measures how broad the changes are.

I like to keep a close eye on the ISM report for several reasons. One is that it’s reported on the first business day of each month. Other reports, like trade or GDP, take weeks or months before we know what’s truly happening. Also, the ISM isn’t subjected to countless revisions. What you see is what you get.

With the ISM, any number above 50 means that the manufacturing sector of the economy is expanding. Below 50 means it’s contracting. The ISM has been 50 or better for 60 of the last 61 months. I’ve spliced the data carefully and found that we usually don’t hit recession territory until the ISM gets down to 45 or so. In other words, we’re well within the safe zone.

The August ISM was at its highest level since March 2011. It came very close to matching the highest ISM in the last ten years (59.2 for February 2011). The ISM has now risen for six of the last seven months. The only downer was a small 0.1 drop in June. The ISM is important because if the manufacturing sector is doing well, it’s likely to spill over into other areas of the economy.

The trouble spot continues to be the labor market. I’m writing to you on Friday morning ahead of the big August jobs report. All of Wall Street will be waiting to see how many jobs were created in August. Nonfarm payrolls have grown by more than 200,000 for the last six months, and August may make it seven. We got a sneak preview of the jobs report when ADP, the private-payroll firm, released its report showing a gain of 204,000 private-sector jobs last month. The weekly initial-unemployment claims have also been well behaved.

I think The Wall Street Journal captured it well when they described the economy’s “solid-if-unremarkable growth.” The economy is indeed growing, but at a subdued pace. The good news is that it can keep this up for several more quarters.

This past week, the Federal Reserve released its Beige Book report. If you want to get a good report on how well the economy is doing, the Beige Book is a good place to start. I’ll warn you, though, it’s fairly wonky. The most recent Beige Book confirmed a lot of what we already know: the economy continues to expand at a slow-to-moderate pace.

On our Buy List, we saw more evidence of this trend in the surprisingly good sales report from Ford Motor. Wall Street had been expecting a sales drop for August. Instead, it was a small increase. Ford had its best August in eight years.

Next week we’ll get more info on how consumers are behaving, but it looks as if the lower gas prices have lured more consumers to open their wallets. Remember the recent strong earnings report from Ross Stores ($ROST) and the higher guidance? In my book, watching business at a deep discounter like Ross is a lot more useful than a roomful of well-regarded government econ reports.

What does this mean for us? The fundamentals of the economy are better than they were a year ago. All the signs point to a moderate expansion. Nothing great, but the arrows are finally pointing in the right direction. I expect to see more strength in consumer-related areas like eBay ($EBAY), McDonald’s ($MCD), Wells Fargo ($WFC) and others.

What Does the Recent Weakness in Gold Mean?

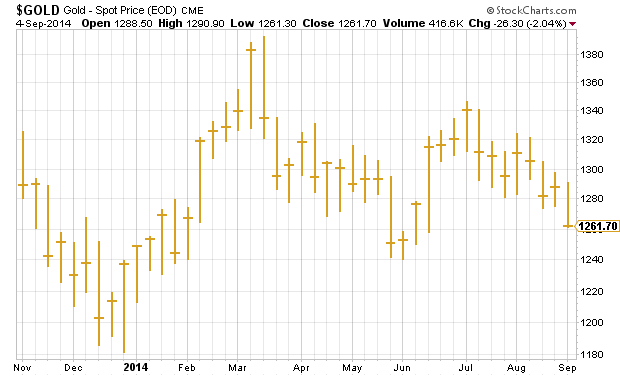

While the stock market has been quietly bullish lately, the gold market’s been in rougher shape. On Wednesday, the yellow metal dropped more than $20 an ounce. On Thursday, gold closed at its lowest level since June 11.

Interestingly, this Saturday will mark the three-year anniversary of gold’s all-time intra-day high of $1,923.70. (Dear Lord, was it really that high?) Needless to say, this has been a rough bear market for the gold bugs. Gold is currently off by more than one-third from its peak price.

Gold closed Thursday at $1,261.70, and I think there’s a chance it could soon test its closing low of $1,187.10 from last December. Here’s the important thing: Gold tends to move in long multi-year trends. Once the trend is in place, it’s darn hard to stop. At least, that’s been the historical behavior.

So why has gold been heading down? I suspect that it’s in anticipation of the Fed’s raising interest rates sometime next year. There’s still some debate as to when that will happen, but I think more investors have reconciled themselves to the fact that it will be an event in calendar year 2015.

Once real interest rates start to rise, gold will come under more and more pressure. I think a lot of gold investors got used to easy times. Gold had an amazing run for more than a decade. That’s over. For right now, I’m staying away from gold.

Three Buy List Stocks That Are Especially Attractive Right Now

I wanted to highlight a few Buy List names that look particularly good right now. I’m surprised by the recent weakness of McDonald’s ($MCD). I realize the company faces a number of hurdles, but I think this price is quite reasonable. The shares recently came very close to breaking below their low from February. The stock currently yields nearly 3.5%, which is quite good in this market. This is also the time of year when MCD traditionally raises its dividend. Since this year’s earnings will probably be about the same as last year’s, the company may forego a dividend increase. But it won’t lower it either. This one may take some time, but MCD is at a bargain price here.

I also like Cognizant Technology Solutions ($CTSH). The shares took a big hit a few weeks ago, and I think the selling pressure has passed. Bear in mind that Cognizant didn’t plunge on lower earnings guidance; the stock fell due to the lower sales guidance. The company was very clear that its earnings forecast for this year ($2.54 per share) was the same. Also, CTSH’s lower sales guidance works out to a lowering of its growth rate from 16.5% to 14%. That’s still quite impressive. I’m keeping my Buy Below at $48 per share, but if you can snag these shares below $46, you got a very good deal.

Shares of Ford Motor ($F) pulled back a bit on Wednesday and Thursday. The automaker reported another good month for sales. Last month was their best August in eight years. Ford’s sales rose 0.4%, while the Street had been expecting a decrease of 1.9%. The Ford Fusion did especially well. Some of Ford’s sales numbers are impacted by consumers’ waiting for the rollout of the aluminum-body trucks late this year. This could be a game changer.

That’s all for now. The big August jobs report will come out later this morning. Next week we’ll get important reports on Consumer Credit and Retail Sales. It will be interesting to see how strong consumers were this summer. I suspect that shopping has been aided by the recent drop in gasoline prices. We’ll also get a clue when Bed Bath & Beyond reports later this month. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 5th, 2014 at 7:12 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His