CWS Market Review – September 25, 2015

“I anticipate that it will likely be appropriate to raise the target range

for the federal funds rate sometime later this year.” – Janet Yellen

If the Fed were purposely trying to confuse Wall Street, they could not have done a better job. The above quote is from Federal Reserve Chairwoman Janet Yellen’s speech on Thursday in Amherst, and it’s completely changed Wall Street’s outlook. Allow me to explain.

Instead of rallying after last week’s “no go” decision, Wall Street got spooked. It looked like the Fed might put the whole higher-rates project on the back burner for several more months. There was even talk of another round of QE. The S&P 500 closed lower for the last three days in a row, and it finished Thursday at its lowest level in three weeks.

Now Janet tells us rates are going higher? Before the end of the year? What in the name of William McChesney Martin is going on here?

This has been a terrible case of bad policy communication from the central bank. In this week’s CWS Market Review, I’ll try to clean up some of the mess. I’ll also preview the upcoming third-quarter earnings season. This will be the fourth quarter in a row of declining earnings, but it looks like that streak will end next quarter. I’ll also discuss the earnings report from Bed Bath & Beyond (BBBY). Later on, I’ll highlight some good bargains on our Buy List. Thanks to the recent ruckus, several stocks have dropped down to be attractive values, especially for investors with a long-term focus. But first, what’s up with the Fed and their mixed signals?

Yellen Plans to Raise Rates Soon

In the last few issues of CWS Market Review, I’ve cautioned you not to get too worked up about the Federal Reserve and its plans for interest rates. All we have to concern ourselves with is that interest rates will be going up soon. When and how much is largely irrelevant for now.

Obviously, the Fed’s September meeting was highly anticipated. Lots of observers thought there was a good chance that this would be the first time in nine years that the Fed would raise interest rates.

But then in August, we got a curveball. China shocked world markets by deciding to devalue the yuan. That gave a super atomic wedgie to several Asian markets. It also ruffled our feathers but to a much lesser extent.

Ever since the devaluation, the market grew more and more doubtful that a rate hike was coming in September, and it was right. Last week, the Fed decided to hold off. Instead of calming the markets down, though, it caused frayed nerves to get even more frazzled. Soon, the futures markets weren’t expecting a rate hike until early next year. Maybe as far away as March. As I said in last week’s CWS Market Review, “If there’s one key takeaway from the Fed’s ‘do nothing,’ it’s that the central bank has taken a clear dovish stance.”

Apparently not! But in this case, I won’t blame myself for getting the message wrong. All of Wall Street seems to have heard the same thing. What caught a lot of people’s attention was that the Fed specifically highlighted the problems with “recent global economic and financial developments.” In other words, China.

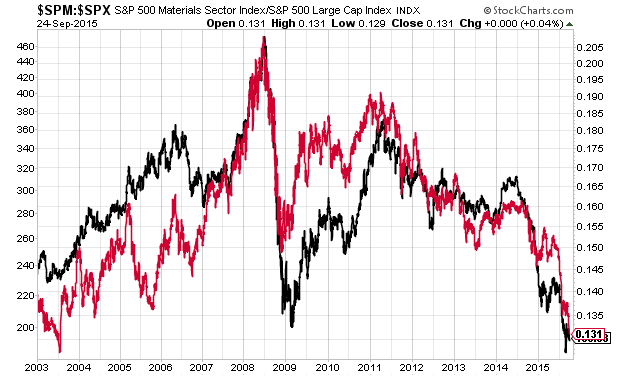

The overriding issue impacting the global economy is commodity deflation. Name just about any commodity and its price has been falling. Plunging! Oil is down. Copper is down. Sugar is down. The CRB Index is near a 40-year low. Check out this chart, which shows the relative strength of Materials stocks, along with the CRB Index. Sometimes a simple chart tells you all you need to know.

Stocks like ExxonMobil (XOM), DuPont (DD) and Chevron (CVX) are near 52-week lows.

Which brings us back to China. So did that mean the Fed was adding China to its list of concerns? Of course, the Fed is in charge of U.S. monetary policy, so they shouldn’t be worried about China’s mess. But Wall Street’s takeaway was that they had to look at China to get a clue as to what the Fed was going to do.

That leads us up to this week, when China released its latest PMI report. Normally, Wall Street doesn’t care too much about this report, but not this week. Suddenly, everyone wanted to know. The report was terrible. It was the worst PMI for China in more than six years. That only added to the concern that the Fed wasn’t going to move. And that’s why Janet Yellen’s Thursday speech was such a surprise.

Let me try to boil this down to simple terms. The Fed has done a very poor job of communicating its intentions to the markets. Janet Yellen is a smart economist, and I think she realized how bad it had gotten. That’s why she took the opportunity this week to state clearly that rates are going higher this year. There are only two meetings left in 2015, one in October and another in December.

Rates are going up, and that’s that. The Fed is probably moving too soon, but I don’t think one hike can cause too much damage. The open question is, “Will the dollar continue to rise with higher rates?” If so, that will cause even more commodity deflation, and a rotation away from Energy and Materials stocks.

There’s still a healthy demand for Treasury bonds. This week, the U.S. Treasury auctioned off three-month T-bills at 0.005%, which is the lowest yield ever. Investors paid $9,999.87 for the privilege of getting $10,000 three months from now. Some six-month bills went off at 0.115%.

For now, investors don’t have much to fear from higher interest rates. The key is for the economy to keep growing. In two weeks, the third-quarter earnings season kicks off. Let’s take a closer look at the numbers.

Third-Quarter Earnings Preview

The third quarter officially comes to an end next week. Soon after, we’ll start getting third-quarter earnings reports. Within one month, 17 of our 21 stocks will report earnings. This is a very important time for investors like us who seek out high-quality stocks.

Analysts on Wall Street have been busy hacking their earnings estimates for earnings season. Generally, I don’t pay too much attention to what the analysts think, but it’s a good way to see what the conventional wisdom is.

For Q3, Wall Street now expects the S&P 500 to earn $28.74 per share. That’s the index-adjusted number. (Every one point in the S&P 500 is worth about $8.83 billion.) To put this in perspective, at the start of the year, analysts were expecting Q3 to come at $33.35 per share. In other words, they slashed expectations by nearly 14% in nine months. Most of that is due to the strong dollar.

This is expected to be the fourth quarter in a row with a year-over-year earnings decline. In fact, the full-year earnings for 2015 will probably come in just a hair below the earnings for last year. Once again, that’s due to the strong dollar which has weighed heavily on commodity-based businesses.

For 2016, analysts expect the S&P 500 to earn $129.73 per share. Again, I don’t place a huge amount of faith in that figure, but it’s useful to see where Wall Street’s head is. That number means the S&P 500 is going for less than 15 times next year’s estimate. That’s hardly excessive. The key is that if the economy continues to grow, there’s no danger of the stock market falling on its face.

Until there’s hard evidence that the commodity bust is impacting employment, you can expect the economy to grow moderately over the next few months. Stocks are still the place to be. Now let’s look at our one Buy List earnings report from last week.

Bed Bath & Beyond Earns $1.21 per Share

After the closing bell on Thursday, Bed Bath & Beyond (BBBY) reported fiscal Q2 earnings of $1.21 per share. That’s not so bad. If you remember, the company had told us to expect earnings to range between $1.18 and $1.23 per share. So they’re hitting their numbers.

Like a lot of companies, BBBY has felt the sting of the strong dollar, but the impact is far less than that felt by other companies. Bed Bath reported that Q2 sales rose by 1.7% to $2.995 billion. But in constant-currency terms, sales were up 2.2%. Compare that to Oracle (ORCL), where the similar numbers for last quarter were -1.7% and +7%.

The key figure I like to watch is same-store sales. For Q2, that was up 0.7%, and 1.1% in constant currency. That’s below the company’s guidance of 2% to 3%.

Once again, Bed Bath continues to gobble up its own shares at a rapid clip. The number of outstanding shares fell from 191.5 million one year ago to 166.6 million last quarter. That’s a 13% reduction! BBBY’s net income fell by 10%, but the per-share figure rose from $1.17 to $1.21.

As I’ve said, I’m not much of a fan of share buybacks, but I’ll tip my cap to companies that truly act to reduce share count, and Bed Bath is one. They just announced that they’re adding another $2.5 billion to the existing buyback program. That’s huge. Now let’s look at guidance.

For Q3, which ends in November, BBBY sees earnings ranging between $1.14 and $1.21 per share. That’s fine. They see same-store sales for the rest of the fiscal year coming in between 1% and 3%. The previous guidance was for 2% to 3%, so that’s a small downgrade.

Once again, Bed Bath & Beyond reiterated its full-year earnings forecast. They expect earnings to rise from flat to mid-single-digits. Let’s say that’s 0% to 5%. Since BBBY made $5.07 per share last year, this year’s guidance works out to $5.07 to $5.32 per share. While I’m not crazy about the sluggish same-store sales, the full-year guidance isn’t too bad.

I’m going to keep my Buy Below at $65 per share. Although the company’s performance hasn’t been as strong as I’d like, the stock is going for a good value. If the guidance is correct, BBBY is trading at less than 12 times earnings. This will take some patience, but BBBY has long-term value.

Four Buy List Bargains

Thanks to the market’s recent case of rattled nerves, a few of our Buy List stocks look especially good at the moment. I consider any of our stocks trading below their Buy Below prices to be a buy, but these are especially good buys.

Last week, I highlighted Cognizant Technology Solutions (CTSH) and Express Scripts (ESRX), and I continue to see them as solid bargains. But don’t expect much movement from either one until earnings season. Microsoft (MSFT) continues to look good, especially with its shiny new dividend. If you can get it below $44, you got yourself a good deal. I also like Wabtec (WAB) below $90 per share.

As always, make sure that you’re diversified. Pay attention to our Buy Below prices, and don’t worry about stocks that run away from you. Wait for good stocks to come to you.

We may be in for some more turbulence. I wouldn’t be surprised if the S&P 500 tries to “retest” its low of 1,870. That often happens before the bears’ party comes to an end. I’ve said that I’m ready to give the all-clear once the VIX closes below 20. We haven’t had that yet, but we’re getting close.

I also want to lower my Buy Below prices on two of our stocks. I’m lowering Ball Corp. (BLL) to $68 per share, and Moog (MOG-A) to $60 per share. This is the second week in a row that I’m lowering Moog.

That’s all for now. The third quarter officially comes to a close this Wednesday. I’ll have a summary of how well the Buy List is doing. We still have a pretty good lead over the S&P 500. On Monday, we’ll get revised personal-income and spending reports for Q2. On Wednesday, ADP will release its payroll report. Then on Thursday we have ISM. That sets us up for Friday and the big September jobs report. I suspect it will be a good number. I also think the figure for August will be revised higher. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 25th, 2015 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His