CWS Market Review – April 29, 2016

“The intelligent investor is a realist who sells to optimists and buys from pessimists.”

– Jason Zweig

This was a very good week for us. We had a slew of strong Buy List earnings reports. AFLAC beat Wall Street’s consensus by 10 cents per share, and the stock jumped to a new all-time high. Ford Motor creamed expectations by more than 40% and rallied strongly. CR Bard also crushed estimates; plus they raised their full-year guidance, and the stock jumped to a new high.

In this week’s CWS Market Review, I’ll run through all our earnings reports. I’ll also preview three more Buy List earnings reports coming our way next week. We also got a half-penny dividend increase from Wells Fargo. Don’t spend it all in one place.

There was also a Federal Reserve meeting this week. Janet and her pals on the FOMC decided to hold off raising rates, but they left the door open to a rate hike in June. I’ll have all the details in a bit. But first, let’s look at the Q1 GDP report.

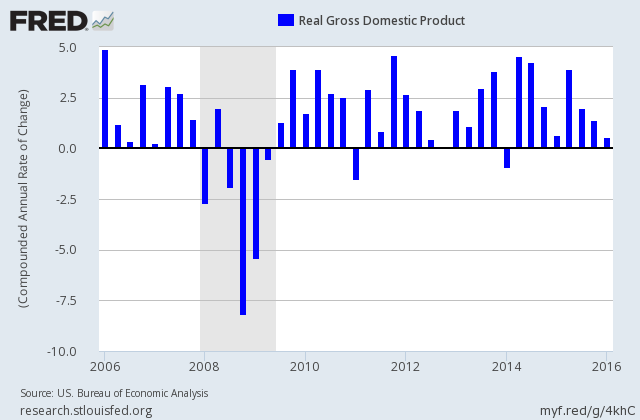

Weakest GDP in Two Years

On Thursday, the government said that the economy expanded by just 0.5% during the first three months of the year. This was the weakest quarter in two years. Wall Street had been expecting 0.7%. There’s been a typical pattern for the last several years. The economy does poorly during Q1 but ramps up during the spring and summer.

The economy has been in a frustrating position. It’s not strong, but it’s consistently weakly positive. Digging into the details, we see that personal consumption expenditures grew by 1.9% in Q1. That’s not terrible. The weak overall number was due to inventories, government spending and trade. I expect those components to improve.

What’s odd is that even as growth has been sluggish, the labor market has improved. Last week, initial jobless claims hit another multi-decade low. Next Friday we’ll get a look at the jobs report for April, and there’s a very good chance that the unemployment rate will fall to an eight-year low.

Wage growth, however, has been weak. That leads us to this week’s Fed meeting. As expected, the central bank held off on raising interest rates. They did, however, leave open the possibility of a rate hike in June. The Fed noted that the jobs market is improving, and the external risks to the economy seem to have dissipated.

I think that’s right, but for now, I doubt they’ll hike in June. A rate increase could come later this year. Until then, interest rates are low and stocks remain the best game in town. Now let’s look at this week’s earnings.

This Week’s Buy List Earnings Reports

On Monday, Express Scripts (ESRX) kicked off this week’s earnings parade when they reported Q1 earnings of $1.22 per share. That matched Wall Street’s view, and it was at the top of the company’s own view. Earnings were 11% higher than last year’s Q1.

Express’s CEO, George Paz, who will be retiring in a few days after ten outstanding years on the job, said that he expects Express will keep Anthem as a customer. I admire his optimism, but the fight between the two companies seems pretty nasty. I hope the two companies can work something out.

For Q2, the pharmacy-benefits manager expects earnings to range between $1.55 and $1.59. Wall Street had been expecting $1.57 per share. That sounds about right. Express felt optimistic enough to raise its full-year forecast. Previously, they had been expecting this year’s earnings to range between $6.10 and $6.28 per share. Now they see 2016 earnings coming in between $6.31 and $6.43 per share. That’s good to see.

Unfortunately, Express has been a loser for us this year (-14.3% YTD), but it’s recovered a bit lately. The shares are going for less than 12 times this year’s estimate. I’m keeping our Buy Below at $76 per share. This is one for the long run.

On Tuesday morning, Wabtec (WAB) reported Q1 earnings of $1.05 per share, which was five cents better than Wall Street’s consensus. Quarterly revenues fell 5.7% to $772.03 million. That was below the consensus of $798.86 million. The company reaffirmed its 2016 guidance of $4.30 to $4.50 per share. Overall, this was a solid earnings report.

Raymond T. Betler, Wabtec’s president and chief executive officer, said: “We continue to expect another record earnings year, even as we face challenges in some of our key markets. We are responding to these challenges with aggressive cost- and efficiency-improvement programs, while continuing to invest in growth opportunities around the world. We remain optimistic about our long-term prospects and expect to continue to benefit from our diversified business model, balanced growth strategies and rigorous application of the Wabtec Performance System.”

Traders liked what they saw. In Tuesday’s trading, shares of WAB jumped 4.5%, followed by a 3.7% gain on Wednesday. Wabtec is now our second-best performing stock on the year, with a 17.6% YTD gain. (It’s always those wallflowers.) This week, I’m raising my Buy Below price on Wabtec to $87 per share.

After the closing bell on Tuesday, AFLAC (AFL) reported outstanding earnings. For the first quarter, the duck stock had operating earnings of $1.73 per share. That was 10 cents more than Wall Street had been expecting.

In recent years, we’ve gotten used to the weak dollar hurting AFLAC’s bottom line. Now that the yen is rallying, we’ve had something we haven’t seen in a long time—the exchange rate added a bit to earnings. The company said the impact came to three cents per share. Ignoring the impact of currency, AFLAC’s operating EPS grew by 10.4% last quarter. That’s quite good.

AFLAC is standing by its full-year forecast of $6.17 to $6.41 per share, but that’s based on the yen being at 120.99. Lately, it’s been much stronger than that. On Thursday, in fact, the yen had its biggest jump against the dollar in seven years. The exchange rate is very close to dropping below 108.

For Q2, AFLAC sees earnings ranging between $1.55 and $1.82 per share. That assumes the yen averages 105 to 115. Wall Street had been expecting $1.64 per share. Again, traders liked what they saw. The stock jumped over $69 per share and reached a new all-time high. I’m very happy with AFLAC’s progress, and I’m raising my Buy Below this week to $73 per share. The duck abides.

After Wednesday’s close, CR Bard (BCR) had a terrific earnings report. The company made $2.34 per share for the first three months of the year. That topped Wall Street’s consensus by 17 cents per share. Sales rose 7% to $873.5 million. Adjusting for currency, sales were up 8%

Timothy M. Ring, chairman and chief executive officer, commented, “Our strong results in the first quarter reflect continued momentum from the returns we have seen from our strategic investment plan. We continue to be in investment mode as we focus on shifting the mix of the portfolio to faster growth areas, including product and technology platforms, delivery platforms and increasing our presence in emerging markets.”

Bard also raised its full-year guidance for sales and earnings. They now see sales rising between 6% and 8%. Adjusting for currency, that’s an increase of 7% to 8.5%.

The old EPS range was $9.90 to $10.05. The new range is $10.05 to $10.18. That represents growth of 11% to 12% over last year. They see Q2 coming in between $2.43 and $2.47 per share.

This was another solid quarter for Bard. I’m very pleased with their execution. The stock rallied 2% on Thursday, and the shares touched a new high. I’m raising my Buy Below by $20 to $219 per share.

In last week’s CWS Market Review, I wrote, “The consensus on Wall Street is for Ford to report earnings of 46 cents per share. I think they’ll beat that.” Wow, did they ever! For Q1, Ford Motor (F) earned 68 cents per share. That was 20 cents per share higher than the final estimate of 48 cents per share.

The company is doing very well in nearly every aspect. Last quarter was a company record for Ford. In North America, the company’s operating margin is 12.7%. That’s well ahead of GM and Fiat Chrysler. Quarterly revenue rose 11% to $37.7 billion. Sales in the U.S. were up 8.4%.

Ford’s stock jumped 3.1% on Thursday. Even with the rally, Ford still yields 4.16%. We had to wait through a tough period last year, but now things are paying off for Ford. I’m raising our Buy Below on Ford to $15 per share.

After Thursday’s closing bell, Stericycle (SRCL) became our second earnings miss this season. For Q1, the company earned $1.11 per share, which was four cents below Wall Street’s forecast. Frankly, this was a disappointment.

Despite the miss, the waste-management company is growing at a pretty quick pace. Last quarter, sales rose 31.8% to $874.2 million. Adjusting for currency, sales were up 35.4%, and the company’s gross profit rose 31.2% to $369.2 million.

On the earnings call, Stericycle said they expect full-year earnings to range between $4.90 and $5.05 per share. This reflects the “unfavorable impact of the timing of the Shred-It synergies, softer industrial hazardous waste volume, and higher costs associated with our international operations.” Wall Street had been expecting 2016 earnings of $5.22 per share. Stericycle remains a buy up to $125 per share.

Three Buy List Reports Coming Next Week

We have three more Buy List earnings reports coming next week: Cerner, Fiserv and Cognizant Technology Solutions. They’re all due on Thursday, May 5.

Shares of Cerner (CERN) got smacked hard after the last earnings report. I didn’t think the punishment was entirely fair, but if you’re expecting fair results, Wall Street ain’t the place for you. Fortunately, the shares have made up some lost ground.

The healthcare IT firm said to expect Q1 earnings between 52 and 54 cents per share, and revenue between $1.2 billion and $1.5 billion. That sounds about right. The company has a full-year target of $2.30 to $2.40 per share.

Last year was Fiserv’s (FISV) 30th straight year of double-digit earnings growth. I think they can make this year #31. They’ve already forecast 2016 earnings of $4.32 to $4.44 per share, which would be an increase of 11.6% to 14.7% over last year. Wall Street expects Q1 earnings of $1.02 per share.

Cognizant Technology Solutions (CTSH) surprised me earlier this year. The IT outsourcer said they expected earnings for this year to range between $3.32 and $3.44 per share. That seemed light to me, but I can’t say I’m fully confident they’ll raise guidance. That’s why I’m curious for this earnings report. The company said they expect Q1 to range between 78 and 80 cents per share.

A few things before I go. Due to Microsoft’s (MSFT) dip after last week’s earnings report, I’m going to lower its Buy Below to $54 per share. I really like the stock here. Also, Investor’s Business Daily recently ran a good profile of HEICO (HEI). I’m glad to see this “undiscovered” stock get some positive coverage.

Last month, I said that Wells Fargo (WFC) could “easily” raise its quarterly dividend from 37.5 cents to 40 cents per share. Apparently, it wasn’t so easy. The big bank announced it’s raising its dividend by a half a penny to 38 cents per share. They’ve submitted their capital plan for this year. If it’s approved, I think Wells may increase their dividend again. Wells now yields 3.02%.

That’s all for now. Stay tuned for more earnings next week. With the first week of the month, we’ll get several key economic reports. The ISM report is on Monday. There’s been a good trend here. Auto sales are on Tuesday. The productivity report comes out on Wednesday, as does the ADP payroll report. That leads us up to the big jobs report on Friday. There’s a good chance the unemployment could fall to an eight-year low. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on April 29th, 2016 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His