CWS Market Review – September 16, 2016

“I don’t expect the consensus to be right. I’m just

surprised by how wrong it has been.” – Jim Bianco

The volatility gnomes have returned to Wall Street! As I suspected, they didn’t wait long after Labor Day to make their appearance. This was a long, boring, low-vol summer for the stock market. Each day’s trading turned into a snoozefest.

That all came to an end last Friday when the S&P 500 dropped 2.45%. The horror! Of course, that’s really not a huge move, but it’s jarring when compared with a summer market that barely registered a pulse. Friday also snapped a string of 43-straight days without a 1% move, either up or down. It also started a three-day run of moves greater than 1%. Check out the high-low-close chart:

Investors need to understand that the volatility gnomes like to move in wolf packs: nothing, nothing, nothing—then suddenly, they’re everywhere. The cause for the recent uptick in volatility is next week’s Federal Reserve meeting. Or more accurately, what the market thinks the Fed is thinking ahead of the Fed’s meeting. The Fed, of course, is equally obsessed with what the market’s thinking.

In this week’s CWS Market Review, I’ll break it down for you. I’ll also cover the troubling news at Wells Fargo. The bank has been fined $185 million for illegal sales practices. It’s pretty ugly stuff. I’ll also preview the upcoming earnings report from Bed Bath & Beyond. But first, let’s look at the market’s newly found fondness for volatility.

What to Expect at Next Week’s Fed Meeting

Financial markets were exceedingly calm this summer. The only exception was the period immediately following the Brexit vote. But even then, the market quickly returned to its somnolence within a few days.

Next week, the Federal Reserve gets together again, and it’s one of their two-day meetings. This includes a post-meeting press conference by Janet Yellen. The Fed members will also update their economic projections.

The difference from this meeting is that more Fed members have been vocal about the need to raise rates soon. Bear in mind that central bankers are bred not to say anything remotely interesting. So if they’re speaking this forthrightly, it’s wise to take notice.

Sure, it’s possible the Fed could raise rates next week, but I’m in the doubter camp. For one, the election is less than two months away. The Fed probably wants to avoid even the appearance of being partisan. Another reason why I think the Fed will stand pat is that we got dovish comments from Fed Governor Lael Brainard. She’s known to be skeptical on the need to raise interest rates, so folks were curious to see if she had changed her tune. She hadn’t.

Specifically, on Monday Governor Brainard said:

This asymmetry in risk management in today’s new normal counsels prudence in the removal of policy accommodation. I believe this approach has served us well in recent months, helping to support continued gains in employment and progress on inflation.

Geez. Even when they say something interesting, it’s still dull.

Still, these comments helped spark a strong rebound from Friday’s selloff. After her remarks, Goldman Sachs cut their odds of a rate hike from 40% to 25% (still too high, in my opinion) while raising the odds of a rate hike at the Fed’s December meeting from 30% to 40% (still too low, in my opinion). I think a rate hike in December is very much in play.

Jeffrey Gundlach, who is always interesting to listen to, said the Fed may want to surprise the world by hiking rates next week. Counter-intuitively, Gundlach thinks that by doing this, the Fed could show they’re not swayed by politics or the market.

The Fed has certainly noticed that the economy is improving, but there are still weak spots out there. For example, on Thursday, we got a disappointing retail-sales report for August. The Census Bureau said that retail sales fell 0.3% last month. That was our first monthly decline since March. This report is disappointing because the numbers relating to consumer spending had been pretty good. Retail sales for July were revised from “unchanged” to 0.1%.

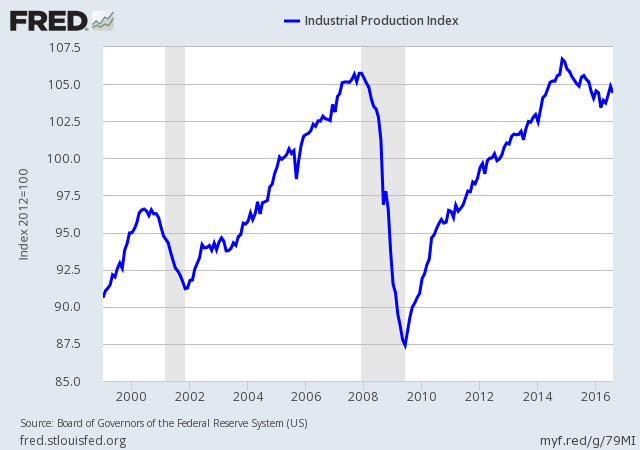

Also on Thursday, we learned that industrial production dropped 0.4% last month. Economists had been expecting a drop of 0.3%. As with retail sales, this was unwelcome news because industrial production had been recovering from a pronounced drop for much of last year (see below).

The futures market currently thinks there’s a 12% chance of a rate hike next week (take note of Jim Bianco’s words in this week’s epigraph). But for the December meeting, it’s 46.2%. The main reaction within the stock market regarding guesses as to what the Fed will do can be seen between financial stocks and higher-dividend stocks like REITs and Utilities. When the outlook is for higher interest rates, that’s good for the relative performance of financial stocks. But when the outlook is towards lower rates for longer, that helps stocks with higher dividends.

It’s interesting to note that Financial stocks (XLF) have lagged for the last four days. I also can’t ignore how strong the Tech sector (XLK) has been lately. Apple added $50 billion in market value in three days. The tech rally probably reflects the broader trend of investors being much friendlier towards riskier assets.

Assuming there will be no rate increase next week, that will draw extra attention to the Fed’s wording in their policy statement. In the Fed’s economic projections, Fed members will likely pare back their estimate for GDP growth for this year. The numbers are coming in well below the Fed’s estimate.

The Fed’s meeting will be on Tuesday and Wednesday. You can expect to see the Fed’s policy statement followed by Janet Yellen’s press conference on Wednesday afternoon. Now let’s look at the big fine leveled against Wells Fargo.

The Mess at Wells Fargo

Last week, Wells Fargo (WFC) was fined $185 million for using illegal sales practices. It’s really ugly what the bank was doing. Their salespeople were opening phony accounts for services customers hadn’t agreed to. It was so widespread that they opened two million bogus accounts. They even transferred customers’ money to new accounts, which resulted in fees for insufficient funds in the original accounts. There were instances of them opening bogus e-mail accounts to get customers into online services.

It’s easy to blame this on a few unscrupulous sales agents, but these practices were widespread throughout the bank. It all came down to incentives. The salespeople were trying to hit their sales goals.

In response, Wells has fired 5,300 employees (for context, in June, headcount stood at 268,000). While the bank agreed to pay the fine, they haven’t admitted to any wrongdoing.

What I find most troubling about this scandal is that it seems to be one centered on improper oversight. How come no one in house put a stop this sooner? The salespeople were rigging, it appears, Wells Fargo’s system as much as they were abusing their customers. This had been going on for years!

Whenever there’s a major financial merger, you’ll often hear about the magic of cross-selling as if the sum of one and one can be made to be slightly greater than two. Unfortunately, it doesn’t work this way. For the most part, people don’t use their primary bank for their mortgage.

What does this all mean for us as investors in Wells Fargo? That’s tough to say. The shares have now fallen for five-straight days, for a total loss of 7.5%. That hurts, but it’s far from dire. As part of Wells’ overall business, the fine is barely a scratch. Last year, Wells made a profit of $23 billion.

Still, it’s a black eye to a formerly respected institution. Wells can get through this, but it will take bold action. For example, CEO John Stumpf needs to go, and he needs to go now. The terrible headlines need to stop. For example, the former head of Wells’s consumer-banking division is walking away with $124 million in stock and options. That’s outrageous.

Wells needs to get ahead of the scandal. Fire some top people. Don’t be defensive. Show the public that you understand what went wrong. I’m not recommending anyone dump the shares. The shares currently yield 3.3%, which isn’t bad. Due to the scandal, however, this week I’m lowering my Buy Below price on Wells Fargo to $50 per share.

Earnings Preview for Bed Bath & Beyond

From mid-August to early October, we enter a long stretch where there are no Buy List earnings reports. The only exception is Bed Bath & Beyond (BBBY). The home-furnishing store is due to report its fiscal Q2 earnings on Wednesday, September 21.

BBBY has been a disappointing stock for us this year. The company badly missed earnings last quarter. Wall Street had been expecting 86 cents per share. Instead, Bad Bath earned 80 cents. What really struck me is that comparable-store sales fell by 0.5%. For now, the company is standing by its full-year profit range of $4.50 to $5 per share. Last year, they made $5.10 per share.

For Q2, Wall Street expects earnings of $1.17 per share. The one positive I’ll say about this stock is that its valuation is quite cheap. If BBBY hits the middle of its earnings range, the stock will still be going for about nine times earnings. That’s quite low.

That’s all for now. Next week’s news will be dominated by the Federal Reserve meeting. The Fed’s policy statement is due out at 2 p.m. on Wednesday. The Fed will also include updated economic projections from all 17 members, not just voting members. Additionally, Janet Yellen will give a press conference. Also on Wednesday, Bed Bath & Beyond will release its second-quarter earnings report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 16th, 2016 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His