CWS Market Review – November 18, 2016

“I’m always fully invested. It’s a great feeling to be caught with your pants up.”

– Peter Lynch

Before I get to today’s CWS Market Review, I have two quick announcements. The first is that I’ll be announcing our 2017 Buy List in the December 23 newsletter. For next year, I’m going to expand our Buy List to 25 names. I wanted to add a little padding for diversification, so stay tuned for our new list.

The other announcement is that I’m taking Thanksgiving off, so there will be no CWS Market Review next week. Please do not panic. The regular newsletter will return on December 2. I’ll also be updating the blog and Twitter.

Now to Wall Street. We’re still working our way through the unexpected reaction to the unexpected election. Let me run down just a few of the milestones we saw this week. On Tuesday, the Dow rose to an all-time high. The S&P 500 is currently very close to an all-time high (see above). The U.S. dollar rose to a 14-year high. Initial jobless claims fell to a 43-year low. Housing starts are at a nine-year high. The Russell 2000 Index of small-cap stocks has rallied for 10 straight days.

Wow! That’s enough milestones for one year, but we saw all that action this week. I’ll explain what it all means for us, and for our Buy List. Speaking of which, I’ll cover the outstanding earnings report from Ross Stores. The deep discounter continues to churn out impressive earnings. Later on, I’ll preview next week’s earnings report from Hormel Foods, and I have some Buy List updates. But first, let’s look at the post-election rally.

The Trump Rally Takes over Wall Street

Goldman Sachs predicted that a Trump victory would sink the market. They later revised that to say that it would have little effect. They were wrong on both counts. The folks at Goldman probably aren’t too broken up about being wrong. In the four days following the election, the bank increased in market value by $11 billion.

The post-election rally has been pretty dramatic for two reasons. This first is obviously the size of the rally. The Dow Industrials gained 920 points in four sessions and later broke through to an all-time high. Since November 3, the S&P 500 has gained nearly 5%, and it currently stands just below its all-time from August. In fact, if you include dividends, the S&P 500 Total Return Index is already at an all-time high.

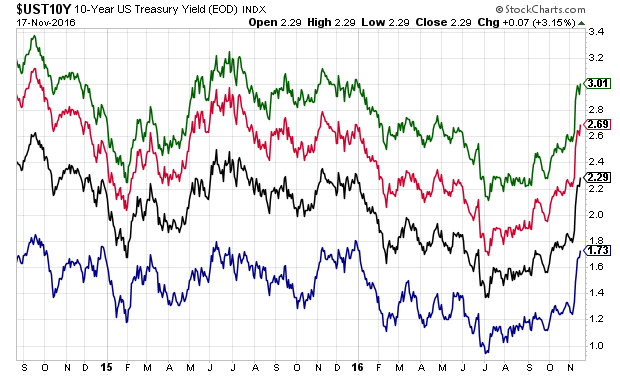

The second reason why this rally has been so dramatic has been the internal rotation we’ve seen. The most noticeable effect is the move away from bonds. Since November 4, the entire long end of the yield curve, from five year to 30 years, has seen an increase in yields of roughly 50 basis points. That’s a huge move for such a short period of time. Interestingly, the move is about the same for any point along the yield curve beyond five years out.

What does all this mean? Simple: It’s a signal from the market that it expects more economic growth and more inflation. The yield on the 10-year Treasury is now higher than the stock market’s dividend yield. CNBC asked me this week if I thought this was a danger for stocks. I said that it wasn’t. Investors aren’t dumping bonds for gold. No, they’re dumping bonds for stocks.

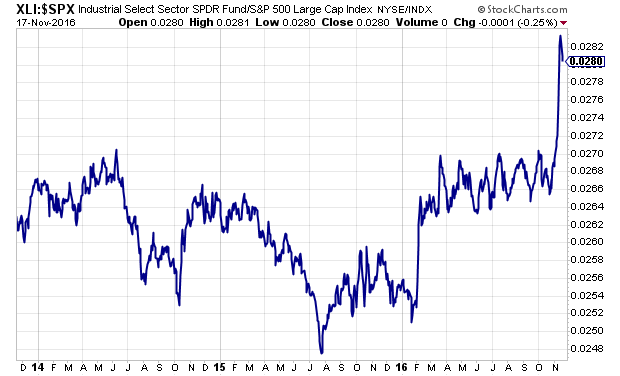

But importantly, what kind of stocks? It’s chiefly banking (like Goldman) and heavy-industry sectors. Anything with a smokestack and guys with hardhats. Wabtec (WAB) would be a good example. Put it this way: If it figures in a Bruce Springsteen song, then it’s probably been rallying like crazy this week. The Industrials ETF (XLI) gained 9% in just seven days. By its nature, that sector usually doesn’t stray far from what everyone else is doing. Not lately. XLI has been en fuego. This is the XLI divided by the S&P 500.

That’s also why the Dow has been charging higher than the S&P 500. We forget that the Dow 30 is officially the Dow Jones Industrial Average. Most of the time, the difference is too small to notice. Not now.

Many small-cap indexes are skewed towards domestic manufacturers. Obviously, the mega-cap stocks are more likely to be sprawling multinationals. As a result, the small-cap Russell 2000 has been on a blistering rally. It’s the same effect going on with higher bond yields and higher industrials. The Russell 2000 is now up 10 days in a row for a total gain of 13.3%.

For the past few months, I’ve talked about how investors have been willing to migrate to riskier assets. What we’re seeing is a continuation of that trend. For example, utilities and REITs have been going nowhere lately. If you recall, utes were King of the Mountain late last year when everyone wanted safety. Or more precisely, what some people thought was safe. Now what’s risky is not having exposure to the economic cycle. Funny how that changes.

The wider the yield curve, the greater the expectation the market has for future growth (generally). The yield spread is getting wider as investors load up on financials. Remember that a bank is nothing more than the yield curve with incorporation papers. The wider yield spread is also helping industrials, and that helps industrial metals. Copper recently rallied 14 days in a row. (Fun fact: An average single-family home uses 439 pounds of copper.)

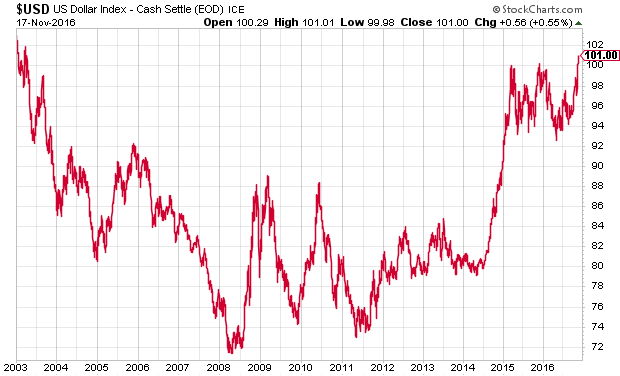

This has also caused investors around the world to flock to the U.S. dollar. The greenback has suddenly become the belle of the ball. The U.S. Dollar Index (DXY) just touched a 14-year high (see below). The Federal Reserve almost seems certain to raise interest rates next month, but I don’t believe investors need to be fearful of the Fed. At some point, a strong dollar will weigh heavily on our exports, but we’re not quite there yet.

To be fair, the pieces for the Trump rally had been building for several weeks. The election brought them all together at once. The Atlanta Fed now sees Q4 GDP coming in at 3.6%! This is an excellent time to be an investor. Investors should continue to be focused on a core group of high-quality stocks such as our Buy List. And with that, let’s look at the very good earnings report from Ross Stores.

Ross Stores Earned 62 Cents per Share

After the closing bell on Thursday, Ross Stores (ROST) reported fiscal Q3 earnings of 62 cents per share. That was six cents more than Wall Street had been expecting. It was also well above the company’s own guidance range of 52 to 55 cents per share.

Looking through the numbers, it’s clear Ross had a very solid quarter. EPS rose 17% from a year ago. Quarterly sales rose 11% to $3.1 billion. I was especially impressed with their comparable-store sales growth of 7%. That’s outstanding.

Barbara Rentler, Chief Executive Officer, commented, “We are very pleased with our better-than-expected sales and earnings growth in the third quarter as customers responded favorably to the compelling values we offered throughout our stores. Operating margin of 12.6% was ahead of plan, increasing 55 basis points mainly from a higher merchandise margin.”

Ross’s guidance, however, was a bit conservative. To be fair, the company often gives subdued forecasts. Perhaps they like to impress later by beating expectations. This is what the company had to say:

Ms. Rentler continued, “As we enter this year’s holiday season, we face our most challenging multi-year sales comparisons. In addition, the ongoing uncertainty in the macro-economic, political, and retail environment could, once again, lead to a very promotional fourth quarter.”

For Q4, Ross sees comparable-store sales growth of just 1% to 2%, and earnings per share ranging between 72 and 75 cents per share. Since Ross has already made $2.06 per share for the first three quarters, that works out to full-year earnings of $2.78 to $2.81 per share. That would be an increase of 11% to 12% over last year’s profit of $2.51 per share.

I’m not at all worried about the conservative guidance. Even if they hit it, Ross has still had a great year. This week, I’m raising my Buy Below on Ross Stores to $70 per share.

Hormel Foods Earnings Preview

Hormel Foods (HRL) will release its third-quarter earnings before the market opens on Tuesday, November 22. Wall Street expects earnings of 45 cents per share. I also expect the Spam maker to increase its dividend. This will be its 51st consecutive annual dividend increase. Not too shabby.

Three months ago, Hormel reported earnings of 36 cents per share which beat consensus by a penny. Quarterly revenues rose by 5.2% to $2.3 billion, which was a little better than expectations. That was Hormel’s 13th quarter in a row of record earnings.

Hormel had solid results across the board. Thanks to the inclusion of Applegate, Hormel’s refrigerated-foods segment saw its profits rise by 24%. Their Jenny-O Turkey biz had a profit increase of 59%. Last year’s profits were impacted by the avian flu, so it’s nice to see a big increase here.

I was especially pleased to see Hormel raise its full-year guidance. The old range was $1.56 to $1.60 per share. The new range is $1.60 to $1.64 per share. Look for another good earnings report on Tuesday.

Buy List Updates

The unexpected, but pleasant, rally pushed several Buy List stocks beyond their Buy Below prices. I was surprised by the post-election reaction. I want to take this opportunity to adjust a few of our Buy Below prices. Starting with our bank stocks, I’m lifting the Buy Below on Wells Fargo (WFC) to $52 per share, and on Signature Bank (SBNY) to $150 per share. The turnaround in SBNY has been remarkable.

Shares of Cerner (CERN) have been plunging. The company just announced a $500 million share-repurchase program. That works out to 3.1% of their outstanding shares. I’m lowering my Buy Below on Cerner to $55 per share.

I also want to lift the Buy Below price on Biogen (BIIB) to $320 per share, and on Wabtec (WAB) to $85 per share. Can you believe that WAB is now our third-best performer this year, with a 21.2% gain? Only four months ago, it was -7% for the year. How quickly things can change. After the poor July earnings report, I wrote, “This is a disappointing report from Wabtec, but I’m not ready to throw in the towel. This is a solid company.” I’m glad we stuck with them.

Before I go, a quick update on Fiserv (FISV). The company’s board of directors announced an expansion to its share-buyback program of 15 million shares. That’s 6.9% of the outstanding shares. This is an outstanding company.

That’s all for now. The stock market will be closed on Thursday, November 24 for Thanksgiving. The market will close at 1 p.m. on Friday. The Friday after Thanksgiving is often the lightest trading day of the year. There’s not much in the way of news next week, but I’ll be curious to see the minutes of the Fed’s last meeting. Those will come out on Wednesday at 2 p.m. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on November 18th, 2016 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His