CWS Market Review – December 9, 2016

“Investment success does not require glamour stocks or bull markets.” – John Neff

The Trump Rally keeps on trumping. Since Election Day, the Dow has set 13 new highs. Remarkably, just one stock—Goldman Sachs—is responsible for 31.2% of the Dow’s entire advance.

Remember how the start of 2016 was one of the worst market starts in Wall Street history? Howard Silverblatt noted this stat: At the market’s February low, the S&P 500 was down 10.5% YTD, yet the Financials were down 17.7%. Since then, the S&P 500 has rallied 21.5%, while the Financials are up 45.6%. It’s as if the entire market were the dog being wagged by the banking sector’s tail.

I’ve been pleased to see the Trump Rally broaden out recently. On Wednesday, one-quarter of the stocks in the S&P 500 closed at a new 52-week high. That’s the most in two years.

In this week’s CWS Market Review, we’ll take a look at the recent jobs report, plus we’ll preview next week’s Federal Reserve meeting. For the second time in a decade, the Fed looks set to raise interest rates. I’ll also preview the upcoming earnings report from HEICO. This quiet stock is now a 50% winner for us this year. We also got a nice 12% dividend increase from Stryker. The stock has increased its dividend every year for more than 20 years. But first, let’s see if the Fed has plans to kill the Trump Rally.

The Federal Reserve Will Finally Raise Interest Rates

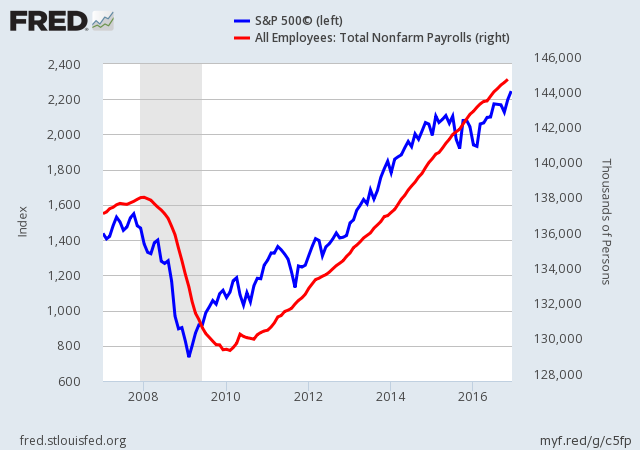

Last Friday, the government reported that the U.S. economy created 178,000 net new jobs for the month of November. I try to take the government stats with a very big grain of salt. Instead, I prefer to zero in on the overall trend, which, as it turns out, has been very close to 178,000 new jobs each month.

The unemployment rate dropped down to 4.6%, which is the lowest in nine years. The workforce participation rate is still too low, and I’d like to see that come up some. Still, the overall trend has been slow improvement in the labor market.

All this sets us up for next week’s two-day meeting of the Federal Open Market Committee. I’m afraid I’m going to ruin the suspense for you—the Fed’s going to raise rates. This will be the second December in a row in which the Fed has hiked interest rates.

So will the Fed’s move be a rally killer? Not at all. For one, interest rates are still very low. As low as they are, they’re actually positive, which we can’t say for much of the world. Even after the rate increase, the Fed funds rate will be below the rate of inflation. To be blunt, this is less a rate increase than it is fine tuning from the Fed.

To be sure, the Fed usually kills rallies in their sleep, but that would require a lot more action than what we’re seeing. Interest rates would have to be 2% or 3% more than inflation. That’s hardly a fear at the moment.

It also appears that the economy is gaining a little momentum. Q3 was pretty good for the economy, and the earnings recession ended for Corporate America. This week, we learned that the ISM Non-Manufacturing Index rose to 57.2 for November. That’s very good.

The market this year has been very difficult for a lot of Wall Street bigwigs. The Financial Times notes that more hedge funds will shut down this year than in any year since 2008. This market has thrown us a couple false starts, quiet reversals and head fakes.

For example, stocks are becoming much more correlated with each other. In previous years, when the S&P 500 rose, say, 1%, you could pretty much guess that most stocks would be near 1%. Now that’s not so true. In fact, even the Dow and S&P 500 have parted ways. Since the Dow is loaded with more heavy-industry industrial stocks, it’s enjoyed the Trump Rally far more than the broader S&P 500.

This has been a great time for U.S. stocks. Since Donald Trump got elected, about $2 trillion has rotated out of bonds and into stocks. On Thursday, the S&P 500 set another record closing high of 2,246.19. At some point, this surge will come to a halt, but don’t try to guess when. For now, we should enjoy the ride. Our Buy List stocks are doing very well. Now let’s take a look at the smallest stock on our Buy List, which just so happened to close Thursday at a fresh 52-week high.

Earnings Preview for HEICO

Who would have guess that little HEICO (HEI) would turn out to be our top-performing stock this year? Through Thursday’s close, shares of HEI have gained more than 50% this year.

If you’re not familiar with HEICO, the company makes replacement parts for the aircraft industry. They’ve raised their earnings guidance three times this year.

HEICO is due to report their Q4 earnings next Tuesday, December 13, after the closing bell. Earnings for the first three quarters of this year are up 18%, while sales are up 19%. The company only provides guidance for net income, instead of EPS. In the Q3 earnings report, they said they forecast net income to rise by 13% to 15%.

Let’s bust out some math. Last year, HEICO earned $1.97 per share. That means an increase of 13% to 15% works out to a range of $2.23 to $2.27 per share. However, HEICO’s shares outstanding are 0.4% higher this year, so that will dilute that range by about one penny per share. Since the company has already made $1.64 per share so far this year, we can expect 58 to 62 cents per share for Q4. Wall Street’s consensus is for 62 cents per share.

The stock is currently well above our $76 Buy Below price, but I want to hold off increasing that price until we see the Q4 earnings report. I like HEICO a lot.

Stryker Raises Dividend by 12%

We got very good news this week from Stryker (SYK). The orthopedic company announced a 12% dividend increase. Stryker’s quarterly payout will rise from 38 cents to 42.5 cents per share. The company has increased its dividend every year since 1993.

“Our 12% increase in the dividend for 2017 reflects the strength of our balance sheet and our consistent capital-allocation approach, which uses acquisitions, dividends and share repurchases to drive shareholder value,” said Kevin A. Lobo, Chairman and Chief Executive Officer. “Our continued strong performance should enable us to continue to drive future dividend increases roughly at or above our earnings growth.”

The annualized dividend is $1.70 per share, which comes to 1.5% based on Thursday’s closing price. The dividend is payable on January 31, 2017 to shareholders of record at the close of business on December 30, 2016. Stryker remains a buy up to $119 per share.

Express Scripts Drops on Short-Seller’s Tweet

I’ve been getting more impressed with Express Scripts (ESRX), although the stock hasn’t done particularly well this year. ESRX was starting to recover until Thursday, when a prominent short-seller dinged the stock with a pair of tweets.

On Thursday afternoon, Andrew Left of Citron Research had two tweets:

$ESRX is Philidor of the pharma industry. @therealdonaldtrump promises to fix drug pricing? Two words: EXPRESS SCRIPTS

— Citron Research (@CitronResearch) December 8, 2016

When @realdonaldtrump tells $ESRX “ you’re fired” heads will roll. The culprit behind pharmaceutical price gouging. Price Target $45

— Citron Research (@CitronResearch) December 8, 2016

I’m not sure if the president-elect read Left’s tweets, but enough traders did. The stock reacted immediately. Within minutes, shares of ESRX fell from $74 to about $68. The stock recovered a bit later in the day and closed at $70.75.

I’m always a bit reluctant to comment on other people’s research. I still like Express a lot and see no reason to worry. The problem is that drug companies are pushing back against the flap about high drug prices by shifting the blame to companies like Express Scripts. It might be good PR, but it’s bad economics.

From the last earnings report, Express said they expect full-year earnings of $6.36 to $6.42 per share. That means the stock is currently going for about 11 times earnings. That’s quite cheap.

Three New Buy Below Prices

Thanks to the post-election rally, a few of our stocks have jumped well above their Buy Below prices. I suppose that’s a good problem to have. I wanted to adjust a few of our Buy Belows before the end of the year. In this week’s issue, I’m raising our Buy Below on Alliance Data Systems (ADS) to $250 per share. The stock has rallied impressively over the last month.

Another big winner recently has been Snap-on (SNA). SNA had a great earnings report in October. The stock has rallied more than 18% in the last two months. This week, I’m raising our Buy Below on Snap-on to $181 per share.

But Signature Bank (SBNY) has been our biggest winner lately. The stock is up close to 40% from its September low. After the October earnings report, I lowered our Buy Below on SBNY to $125 per share. The stock quickly blew past that, so three weeks ago, I raised the Buy Below to $150. SBNY is still climbing, so now I’m raising our Buy Below to $165 per share.

That’s all for now. A reminder that I’ll unveil the 2017 Buy List in the CWS Market Review two weeks from today. Next year’s Buy List will be expanded to 25 names. The big news next week will be the Federal Reserve’s meeting on Tuesday and Wednesday. The Fed will almost certainly raise interest rates for just the second time in the last decade. I suspect that the Fed will lean towards doing very little over the first six months of 2017. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on December 9th, 2016 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His