CWS Market Review – May 5, 2017

“Get out when you can, not when you have to.” – Jesse Livermore

Here are the last eight daily closes for the S&P 500:

2388.61

2387.45

2388.77

2384.20

2388.33

2391.17

2388.13

2389.52

Exciting, right? I have to wonder: if the index had stayed at 2388 the whole time, would anyone have noticed? This is about as flat as a market can get. This week, the Volatility Index (VIX) dropped below 10 for the first time in more than a decade.

Despite the market’s equipoise (look it up), there was a fair bit of news this week. At the top of the list was another Federal Reserve meeting. As expected, the Fed didn’t raise interest rates. However, their policy statement hinted that a rate hike is coming, possibly as early as next month. Honestly, this would be a mistake. I simply don’t see the need for another rate hike. I’ll lay out my case in a bit.

We also had four more Buy List earnings reports, and I’m happy to say that all four beat expectations. This keeps our streak alive. So far, all 18 of our Buy List stocks that have reported so far have beaten Wall Street’s expectations. For the broader market, the “beat rate” usually runs around 70% so this has been a very good earnings season for us. We now have four Buy List stocks that are up over 25% for the year!

But before we get to that, let’s look at this week’s Fed meeting and what it means for us.

The Fed Should Not Raise Rates in June

So far, the Federal Reserve has raised interest rates three times this cycle: this past March, this past December and again in the December prior to that. The current range for the Federal funds rate is 0.75% to 1%. Obviously, that’s quite low, and it continues to be below inflation.

The Federal Reserve got together again this week on Tuesday and Wednesday. Wall Street was almost certain that the central bank would forego a rate increase this month, and they were right on that.

But in the Fed’s policy statement, the central bank dropped several hints that a rate hike is on the way. I had no objections to the Fed’s first three rate increases, but I just don’t see the need for another. At least, not yet. Let’s remember that the jobs report for March was pretty much a dud. Just 98,000 net new jobs. And what about inflation? Please. The last core CPI report was the weakest in 35 years. We actually had a bit of de-flation.

I could go on. The first-quarter GDP report fell flat on its face. We had growth of just 0.7%, the slowest in three years. We also learned this week that worker productivity fell by 0.6% during Q1. For some context, the long-run average is 2.1%. The latest construction-spending report showed a decline of 0.2% for March.

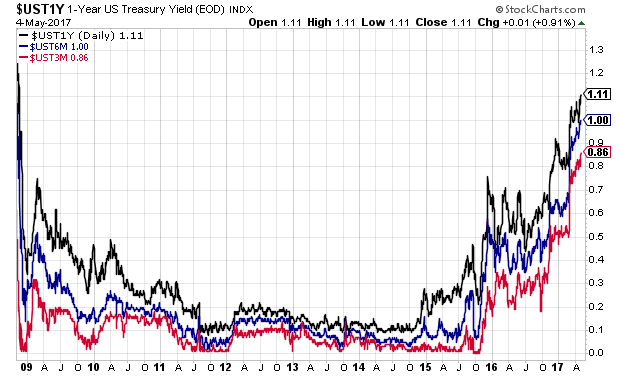

Check out the commodity pits. You may also have noticed that oil is falling again. West Texas Crude closed Thursday at $45.52 per barrel. That’s the lowest close for the year. Oil was over $53 just a few weeks ago. I don’t know if the trend will continue, but it’s hard to say that inflation is heating up when oil is going down fast. Still, the bond market is getting ready for higher rates. The short end of the bond market is seeing the highest yields in more than eight years.

This hypnotically colorful graph below shows the three-month (red), six-month (blue) and one-year (black) Treasury yields.

To be fair, there’s been some decent news on the jobs front. Initial jobless claims have been under 300,000 for 114 weeks in a row. That’s the longest such streak since 1970. Job growth has been steady, but the problem is that wage growth has been, at best, tepid.

The latest numbers from the futures market show that traders believe there’s a 76% chance that the Fed will raise rates again in June. On top of that, there’s a 51% chance of another rate hike in December.

In the Fed’s policy statement, they acknowledged the recent weakness, “The Committee views the slowing in growth during the first quarter as likely to be transitory and continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2 percent over the medium term.” It’s as if they’re saying, “Here are the reasons not to raise rates. But we’re going to anyway.”

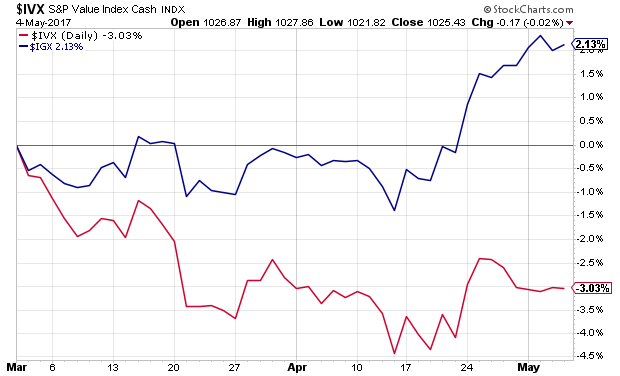

We can also see some interesting trends when we look at the stock market. While the overall market has been calm, we’ve been seeing a growing divergence just below the surface. Growth stocks are going higher, while value stocks are mostly going nowhere.

Apple, Google and Amazon are all up over 20% this year, and Facebook is up more than 30%, while the S&P 500 is up 6.7%. Take away a few high-profile names, and the market is basically flat. Now let’s look at some of our Buy List earnings reports from this week.

Earnings from CNK, INGR and ICE

On Wednesday morning, three of our Buy List stocks reported earnings, and all of them beat estimates.

Cinemark (CNK) reported Q1 earnings of 68 cents per share, seven cents more than estimates. Revenues rose 10.6% to $779.6 million. I like to joke that CNK is really a popcorn company more than a movie chain, but that’s not so outlandish.

For Q1, Cinemark’s concession revenue rose by 12.8%, while their admissions revenue rose by 9.3%. Quarterly attendance increased by 2.5%, but the average ticket price rose by 6.7% to $6.41. Concession revenue per person rose 10.1% to $3.61.

Cinemark now runs 525 theaters (aka, popcorn distribution centers) with 5,894 screens. They’re looking to open another seven theaters this year. After the earnings report, shares of CNK gapped up on Wednesday but gave much of it back on Thursday. Cinemark remains a buy up to $46 per share.

Ingredion (INGR), the plant food people, had another solid earnings report. For Q1, Ingredion made $1.88 per share. That was 12 cents more than estimates.

The company also raised the low end of its full-year guidance by 10 cents per share. They now see 2017 EPS ranging between $7.50 and $7.80. Last year, Ingredion made $7.13 per share.

“Our solid first-quarter results reflect the overall positive trajectory of our business,” said Ilene Gordon, chairman, president and chief executive officer. “Higher core and specialty volumes, good operating efficiency, and the impact of acquisitions, more than offset headwinds in South America. Year-over-year operating income improved in North America, EMEA, and Asia Pacific.

“Our growth strategy continues to drive robust results, and we remain confident in our 2017 outlook. Volume growth and improved specialty mix are expected to be driven by the startup of our recently completed specialty investments in North America and Asia Pacific. The integration of the Sun Flour Industry rice business and Shandong Huanong Specialty Corn further broaden our specialty portfolio and capacity, while the integration of TIC Gums further expands our texture capabilities and enables us to deliver custom solutions faster. We have taken additional restructuring actions to right size our South American business. and we will continue our disciplined approach to cost management. Our current expectation for adjusted EPS for the year is $7.50-$7.80.” Gordon highlighted.

Ingredion said that for 2017, cash generated by operations is expected to be in the range of $800 to $850 million, while capital expenditures are estimated to be between $300 and $325 million. The shares dropped a bit after the earnings report. Ingredion remains a buy up to $122 per share.

Intercontinental Exchange (ICE), the stock-exchange business, said they earned 74 cents per share for Q1. That beat the Street by a penny.

From MarketWatch:

In its first quarter, trading- and clearing-segment revenues, less transaction-based expenses, fell 6% to $538 million in the quarter. Such fees rise and fall with trading volume. Data-services revenue increased 9% to $520 million, and listing revenue increased 2.9% to $106 million. The closely watched initial public offering of Snap Inc. was on NYSE in March, in a win for the company.

(…)

In all, ICE earned $502 million, or 84 cents a share, up from $369 million, or 62 cents a share, a year prior. Excluding certain expenses, its per-share profit was flat at 74 cents a share.

Frankly, I was expecting a little more from ICE, but the nature of their business can be fickle. If trading volume is light, there’s not a whole lot you can do. Overall, it’s a very good business to be in. ICE is still a buy up to $61 per share.

After the closing bell on Thursday, Continental Building Products (CBPX) reported Q1 earnings of 32 cents per share which was five cents above consensus. For Q1, the wallboard maker had revenue of $120.6 million, an 8.2% increase over last year. Cash flow from operations rose by 10%.

This is a classic boring business where few people realize how profitable it is. CBPX provides guidance on several performance metrics, but not on EPS. I think CBPX can earn as much as $1.35 per share this year. That’s up from $1.08 last year. CBPX is a buy up to $26 per share.

Cognizant Technology Solutions (CTSH) and Moody’s (MCO) are due to report later today. I’ll have more to say about them in next week’s issue.

That’s all for now. Next week should be fairly quiet for economic news. I’ll be curious to see the next CPI report, which comes out on Friday. As I mentioned before, the inflation report for March was unusually low. This could be an outlier or maybe the start of a trend. If inflation was elevated last month, that would give the Fed more ammo to proceed with a rate increase. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on May 5th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His