CWS Market Review – May 18, 2018

“Don’t gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don’t go up, don’t buy it.” – Will Rogers

I wish I could say the stock market has been interesting lately, but it hasn’t. The market’s been pretty dull, which doesn’t bother me. For a while, the Dow looked like it was getting exciting as it had an eight-day winning streak, but that came to an end on Tuesday. The market took a mild dip on Tuesday, and things haven’t moved much since then.

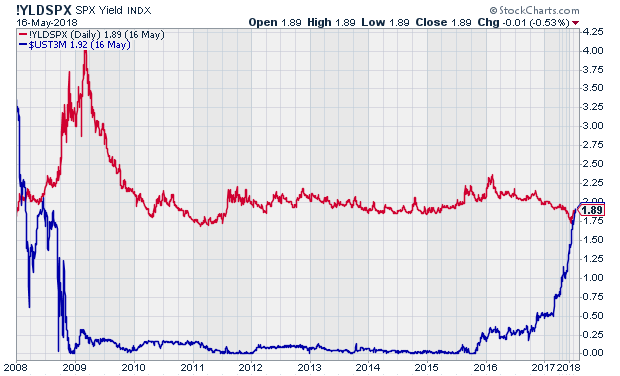

The bond market has been a little more interesting. The yield on the 10-year closed Thursday at 3.11%; that’s a seven-year high. This is all part of the larger trend that’s been going on for some time. Rates are going up all across the yield curve. In fact, the yield on the three-month Treasury bill recently crossed 1.9%, and it may soon hit 2%, which it hasn’t seen in a decade. The yield on the three-month is now higher than the yield on the S&P 500. The financial crisis happened 10 years ago, and things are still getting back to normal.

In this week’s CWS Market Review, I’ll describe some of the market’s recent action. Even though it appears boring on the outside, there are some interesting stirrings just beneath the surface. I’ll explain more in a bit. I’ll also preview two of our Buy List earnings reports coming next week. Ross Stores loves to play the game of telling us that earnings for the coming quarter will be blah. But then on earnings day, they give us good news. Before we get to that, let’s look at the market’s hidden bear.

The Hidden Bear Market

Around here, we’re not much for market-timing. If I could do it well, and consistently, then I’d be all for it. The problem I’ve found is that being a market timer forces your mind to be a bear-market predictor which is a bit different. It’s pretty simple, really. If you’re looking for signs of trouble, you’ll soon start seeing them everywhere (Korea! Tariff! The Fed!), and that’s not good for your portfolio.

We just came through a good earnings season. Across the board, we’ve seen good earnings reports plus optimistic forecasts for the coming year. At the same time, the stock market peaked in late January. After the initial tumble, the bears haven’t been able to move the dial much. Don’t be fooled: they’re not done trying.

But as stock prices are down from their highs, and earnings have improved, valuations are also lower. We assume that a bear market must be a sudden and ugly drop. But what if, instead of a big plunge, the market just rolled along for several months, maybe even more than a year, and all the while earnings improved? The flat P and higher E would depress P/E Ratios, and that’s the same net effect as a bear market. Happening in this way, it almost goes unnoticed.

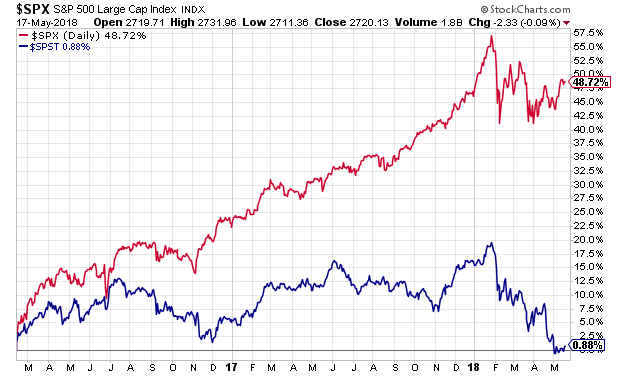

Related to a shift toward lower valuations, we’ve seen a pronounced rotation on Wall Street. As I mentioned in last week’s issue, energy stocks have been performing much better. They continued to get even stronger this week. This is most likely tied to an improving economy and higher long-term yields.

The tech sector, which has been creaming the market almost nonstop for five straight years, is starting to look weak. I should note we’ve seen more than one head fake from Tech in the past year. But the prospects for tech are important because they tell us how much investors are willing to shoulder risk.

When the Dow was at 15,000, loading up on FAANG stocks wasn’t too scary. Nowadays, the market is more discerning, plus the indexes are heavily dependent on large-cap names. Here’s a good example: Before it got dinged on Thursday, Cisco accounted for 6% of the entire gain for the S&P 500 this year.

Meanwhile, the defensive sectors have gotten some relief. Consumer Staples have been getting lapped by the market for more than two years. In fact, you can spot some pretty general yields among blue-chip consumer stocks. Both Smucker and Hormel yield over 2%, and Church & Dwight isn’t far behind.

Some Healthcare names have been improving as well. For example, Stryker came very close to touching a new high this week. As a technical note, I think of Healthcare as a defensive sector, but it’s not as purely defensive as Utility stocks or Consumer Staples. Still, the improvement in these sectors, combined with the weakness in Tech, leads me to think that the market is becoming more conservative and less tolerant of risk. Tesla, for example, is more than 26% off its high.

A few names on the Buy List that look particularly good at the moment include Check Point Software (CHKP), Danaher (DHR) and Cognizant Technology Solutions (CTSH). Now let’s look at two “April Cycle” Buy List stocks due to report earnings next week.

Earnings Reports Next Week from Ross Stores and Hormel Foods

We have two Buy List earnings reports next week. Both Ross Stores and Hormel Foods are due to report on May 24. Hormel reports before the market opens. Ross’s report will come after the close.

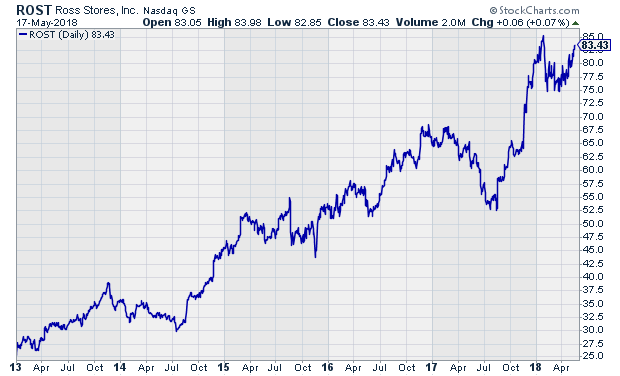

In March, Ross Stores (ROST) released a very good fiscal-Q3 earnings report, but the shares dipped due to poor guidance. Or what was perceived by others as poor guidance. Let’s run through the numbers. For Q4, the deep-discounter earned 99 cents per share. That beat its own guidance of 88 to 92 cents per share. Sales for Q4 rose 16% to $4.1 billion. The key metric to watch is same-store sales which rose 5% versus a 4% gain last year. I was particularly impressed by Ross’s operating margins.

Ross also raised its dividend by 41% from 16 to 21.5 cents per share. Ross has raised its dividend every year since 1994. The company also added $200 million to its buyback program. The authorization is now up to $1.075 billion. This is the sixth year in a row that Ross has been on our Buy List, and it’s been a big winner for us.

Now let’s turn to guidance. Barbara Rentler, the CEO, said they’re taking a “prudent approach to forecasting.” Well, they often do that. Ross projects earnings this year to range between $3.86 and $4.03 per share. Ross also said it expects same-store sales growth of 1% to 2%. Sorry, but they’re low-balling us again.

For Q1, Ross projects earnings between $1.03 and $1.07 per share. That’s up from 82 cents per share last year. Ross expects same-store sales growth of 1% to 2% for the first quarter. Again, that’s too low.

There are a few key facts to remember. For one, Ross plans to open another 100 stores this year. The company is also raising its minimum wage to $11 per hour. TJX, their main rival, has not made that pledge. Higher wages can save money in the long run since you have lower turnover and a happier workforce.

Fortunately, the shares have made back a lot of what they lost after the Q4 earnings report in March. That’s one of the benefits of our long-term approach. We don’t dump a stock just because traders get nervous.

Hormel Foods (HRL) has been one of our disappointing stocks so far this year. I don’t think the blame lies with them. Most everything in the Consumer Staples group has been treated unkindly this year. Actually, Hormel has been behaving better in recent weeks.

Three months ago, Hormel Foods reported fiscal Q1 earnings of 56 cents per share. Of that, 12 cents was due to tax reform, so on a practical level, they made 44 cents per share in terms of continuing operations. That matched Wall Street’s consensus.

Hormel raised its FY 2018 guidance to a range of $1.81 to $1.95 per share. The previous range was $1.62 to $1.72 per share. The company also raised its starting wage from $13 to $14 per hour. In November, Hormel increased its dividend from 17 cents to 18.75 cents per share. That marked its 52nd annual dividend increase.

For Q2, Wall Street’s consensus is for 45 cents per share. That may be a bit too high, but I don’t see Hormel adjusting its full-year guidance.

Buy List Updates

Cerner (CERN) has been in the news lately due to a lot of headaches involving its new digital health program from the VA. Actually, this isn’t a new story, but the new development is a report that blasted the program. The story is also getting extra attention because the project has been supported by Jared Kushner.

The project’s price tag and political sensitivity — it was designed to address nagging problems with military and veteran health care at a cost of about $20 billion over the next decade — means it is “just another ‘too big to fail’ program,” the tester said. “The end result everyone is familiar with — years and years of delays and many billions spent trying to fix the mess.”

The unclassified findings could further delay a related VA contract with Cerner Corp., the digital health-records company that began installing the military’s system in February 2017. The VA last year chose Cerner as its vendor, with the belief that sharing the same system would facilitate the exchange of health records when troops left the service. The military program, called MHS Genesis, was approved in 2015 under President Barack Obama.

In a briefing with reporters late Friday, Pentagon officials said they had made many improvements to the pilot at four bases in the Pacific Northwest since the study team ended its review in November.

To be fair, the problems don’t appear to originate with Cerner but rather with an antiquated government system. Fixing this turns out to be a bigger issue than people expected. I want to make it clear that there’s no allegation of wrongdoing on Cerner’s part. Cerner is a buy up to $61 per share.

I also want to make adjustments to two of our Buy Below prices. Before I do that, let me remind you that our Buy Below prices are not price targets. I change them pretty frequently. The Buy Below prices are merely guidance for current entry into a stock.

I often get emails asking me if stock A, which is 15% below its Buy Below, is better than stock B, which is only 5% below its Buy Below. The answer is no. As long as a stock is below its Buy Below price, I like it. We try to keep things as simple as we can around here.

This week, I’m lifting our Buy Below on Stryker (SYK) to $176 per share. I’m also raising Wabtec (WAB) to $97 per share.

That’s all for now. There will be no newsletter next week. The stock market will be closed on Monday, May 28 for Memorial Day. Next week’s market will probably be fairly tame as we head into the three-day weekend. On Wednesday, the Fed will release the minutes from its last meeting. Then on Thursday, we’ll get a look at existing-home sales. On Friday, the durable-goods report comes out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Dividend Investors are Happier People and How You Can Be One of Them

This week I have been giving presentations to investors attending the Las Vegas MoneyShow. One of the great parts of what I do at the show is meeting subscribers to my newsletter. My first presentation was a joint discussion of dividend investment strategies with Kelley Wright. Further below I’ll share some of rights top stock picks based in his investment strategy.

Wright is the managing editor of Investment Quality Trends. The IQT service provides buy/hold/sell recommendations on a group of about 350 blue chip stocks. To be included in the database, a company must have paid dividends for at least 25 consecutive years with histories of dividend growth. The service rates stocks based on the current yield in relation to the historic yield range. For example, if a stock’s yield is near the low end of the range it is a sell candidate. When a stock gets to the high end of the range, it would be time to buy. Total returns are generated when the share price cycle upward from a low yield to a high yield.

The IQT method is not so much about high yield stocks as a method to buy stocks when they are undervalued. The stocks in Wright’s watch list will have their highest yields when they are out of favor with the investing public. This is very much of a value strategy, and the analysis will recommend buying out of favor share of long-term high-quality companies.

Here are four stocks from Wright’s presentation that his method separates out currently as good value buys. He used the term “ridiculous values” several times.

How To Generate Safe Income From High Yield Bonds

High yield bonds, often known as junk bonds, have been very popular investments since the financial crisis of 2008. The high yield market took a nosedive around the time of the crisis, but bounced back pretty quickly, and has been stable ever since.

As interest rates have started going higher, so too have the yields on high yield bonds. For the general high yield market, yields have gone from about 5% to 6% over roughly the last year. For reference, true junk (CCC rated bonds) has a much higher yield at around 10%.

On one hand, 6% is a solid yield in this day and age. For the most part, credit risk is not something you have to worry about all that much, even with so-called junk bonds. On the other hand, a lot of highly rated stuff got crushed in 2009, when almost no one had any concerns over credit risk.

Of course, high yield investors don’t have to worry about credit risk if they use ETFs instead of the bonds themselves. It’s also much easier (and more affordable) to use a high yield bond ETF instead of buying individual high yield bonds.

The most popular high yield ETF is iShares iBoxx High Yield Corporate Bond ETF (NYSE: HYG). It’s currently got a dividend yield of 5.1% and trades over 15 million shares a day on average. The options market is also very active, with over 130,000 options trading on an average daily basis.

Speaking of options, they are a great way to generate even more income on high yield bonds or high yield ETFs. In fact, I just came across an interesting trade this week which involved writing puts on HYG.

Posted by Eddy Elfenbein on May 18th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His