CWS Market Review – July 6, 2018

“Economics is extremely useful as a form of employment for economists.”

– John Kenneth Galbraith

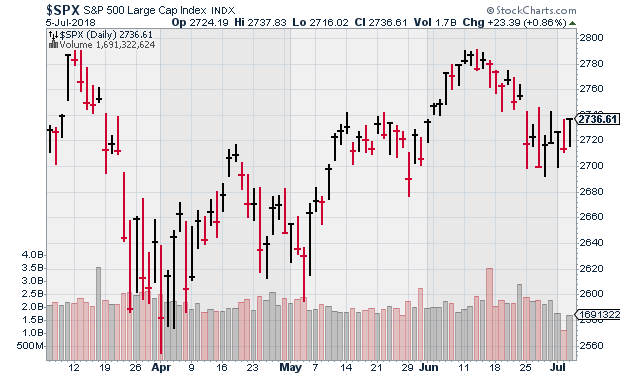

I’ll be honest: this is a slow time for the stock market. Most of the big-time money guys are chilling in the Hamptons. Trading volume has been dead. Plus, this week the stock market closed early on Tuesday and was shut all day on Wednesday.

Yep, it’s summertime on Wall Street. Soon, however, things will get a lot more interesting. Second-quarter earnings season is set to begin in a few days. Most of our Buy List earnings reports will start coming out later this month. Of the 25 stocks on our Buy List, 21 will report earnings over the next few weeks.

In this week’s issue of CWS Market Review, I want to review some of the recent economic news. The good news is that the economy is behaving pretty well. What concerns me, however, is that the Trade War is quickly moving from rhetoric to reality. This could be trouble for the economy. I’m not the only one concerned. So is the Federal Reserve. Later on, I’ll update you on some of our Buy List stocks. I’m pleased to report that our Buy List has been beating the market quite soundly over the past few weeks. Before I get to that, though, let’s focus on where the economy is headed.

The Economy Is Improving, but a Trade War Could Spoil It

The jobs report for June will come out later today. I’ll have a chance to address it later, but we do know that the report for May was very good. Unemployment fell to its lowest level since the 1960s. The jobless rate for women hasn’t been this low in 65 years. The consensus on Wall Street is for the economy to have created 190,000 net new jobs in June.

Earlier this week, we got a preview of the jobs report with the ADP private payrolls report. According to ADP, the economy added 177,00 new jobs last month. In the last reading, initial unemployment claims fell to 231,000. That’s quite strong. We’re not far from the best report since 1969.

While the labor market looks better, the overall economy is growing, but not very fast. This could change soon. We won’t get the first estimate of Q2 GDP until the end of this month, but expectations are high. Q1 GDP came in at 2.0% (that’s annualized and adjusted for inflation). The economy has pretty much stuck to 2% for the last few years. Policy makers couldn’t have done a better job if they had tried, but the Atlanta Fed now estimates that the economy grew by 4.1% in the second quarter. That would be amazing if it turned out to be right. The New York Fed’s model is less optimistic, predicting 2.8% growth for Q2.

What about earnings? There the outlook is quite good. Wall Street expects Q2 earnings of $38.65 per share for the S&P 500. (That’s the index-adjusted number. Every point in the S&P 500 represents about $8.5 billion.) If that forecast is correct, it would be an all-time record. It would also be a healthy 27% jump over last year’s Q2. Bear in mind that these forecasts are usually a bit low.

What’s notable is that the Q2 earnings forecasts have been increasing. Typically, the forecasts start out high and are pared back until they’re slightly under the actual results. (That’s right. On Wall Street, it’s expected that you’ll beat expectations.) This time, expectations are much higher thanks to tax reform. At the start of the year, the Street had been expecting Q2 earnings of $35.95 per share. The current estimate is already 7.5% above that.

It’s not just earnings. We’ve also seen good news on the dividend front. During Q2, dividends for the S&P 500 rose by 8.1% over last year. This year, the S&P 500 will probably pay out $53 per share in dividends. That works out to a yield of just under 2%. On a side note, the S&P 500 has tracked a 2% dividend yield fairly closely for 15 years. The only exception was during the financial crisis. After that blew over, we went right back to 2%. A lot of people are paid a lot of money to value the stock market. Yet simple arithmetic probably would have done a better job.

We’re also concerned by the direction of Fed policy. The central bank has already raised interest rates twice this year. Two more hikes are probably coming. The Fed seems very likely to raise rates again in late September and possibly once more just before Christmas. Soon, this will put a squeeze on the economy.

On Thursday, the Fed released the minutes from its last meeting. This is the one where they decided to lift rates. The FOMC members were impressed by the strength of the economy. However, they said they were concerned over issues related to trade. “Most participants noted that uncertainty and risks associated with trade policy had intensified and were concerned that such uncertainty and risks eventually could have negative effects on business sentiment and investment spending.”

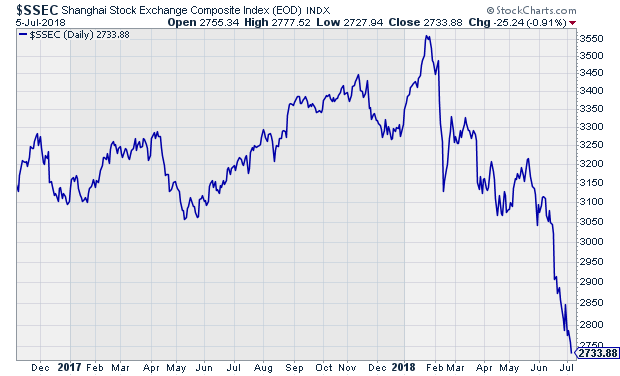

I share this concern. We’ve already seen that Harley-Davidson is looking to shift some production outside of the United States. Starting on July 6, the U.S. government will impose a 25% tariff on Chinese goods shipped to the U.S. Not surprisingly, China has said they’ll hit back. I don’t think anyone really “wins” a trade war. The Chinese stock market has been getting crushed recently. Honestly, these opening shots in the trade war probably won’t hurt the U.S. economy very much. The problem is how far this escalates. Let’s remember that China holds a cool $1.2 trillion in U.S. Treasuries, so it’s wise not to anger them too much.

Speaking of the Treasury bond market, the spread between the two- and ten-year Treasuries is now down to 29 basis points. One more hike could push it negative. The 2/10 spread hasn’t been negative in more than 11 years. This isn’t something to worry about now, but it could become a major theme in 2019. I talk about the 2/10 spread a lot, but I want to caution you not to think of it as a panic button. Since 1976, whenever the 2/10 spread has been between 0% and 0.50%, the stock market has gained an average of 13% the following year.

The proper outlook for us as investors isn’t one of fear but of prudence. This is related to a theme I’ve talked about recently, the market’s more defensive nature. Since June 6, the S&P 500 Low Vol Index is up 1.91% while the S&P 500 High Beta Index is down 4.42%. But before then, the market was all about High Beta. If we measure starting in early 2016, High Beta had a lead of more than 50%. That’s why the defensive market can last for a while.

It’s precisely this turn towards defensiveness that connects the themes of a tightening Fed and a looming trade war. Fortunately for us, the defensiveness has been a net position for our Buy List.

Buy List Updates

I want to be careful not to overstate this, but our Buy List has been acting much better than the overall market recently. As we know, the market can be very fickle, especially in the short term. This is why we’re so focused on the long term. Still, I want to highlight some of our improved performance.

Since June 1, our Buy List is up by 3.23% (not including dividends) while the S&P 500 is up a scant 0.07%. The Buy List is now up 2.82% for the year. This is the highest level for the Buy List since mid-March. Let’s look at some individual names.

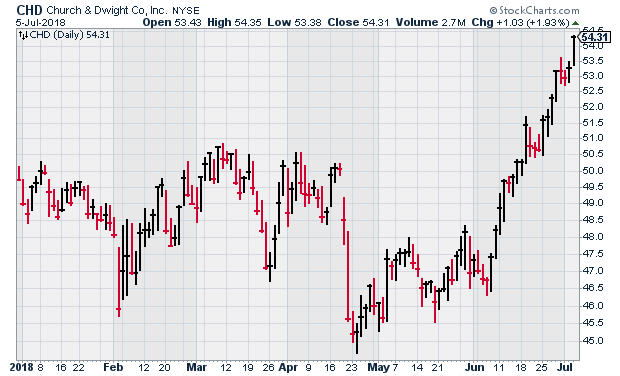

Shares of Church & Dwight (CHD) touched a new 52-week high on Thursday. The stock has rallied impressively in the last month. I think of CHD as a classic defensive stock because a recession won’t have much of an impact on their household products.

Three months ago, CHD reported Q1 earnings of 63 cents per share. That was two cents better than estimates. The company also reaffirmed full-year guidance of $2.24 to $2.28 per share. CHD increased its expected sales growth to 9%. For Q2, they expect earnings of 46 cents per share. This week, I’m lifting my Buy Below on Church & Dwight to $57 per share.

Becton, Dickinson (BDX) is quietly turning into a nice winner for us this year. Through Thursday, shares of BDX are up 13.1%. With the last earnings report, Becton raised its full-year guidance by five cents per share at both ends. The company sees 2018 coming in between $10.90 and $11.05 per share. I’m raising our Buy Below to $250 per share.

Cerner (CERN) was our big disappointment last earnings season, as the company lowered guidance. At one point, CERN got down to $52 per share. Lately, however, the stock has acted much better. On Thursday, the shares closed at a three-month high. I hope to see improvement in the next earnings report. This week, I’m raising our Buy Below on CERN to $65 per share.

Sherwin-Williams (SHW) is another stock that’s turned a corner for us. The company started off the year on the wrong foot. Two months ago, SHW got down to $362 per share. The company now expects full-year EPS of $18.35 to $18.95. On Thursday, it broke $410. I’m lifting our Buy Below on SHW to $414 per share.

That’s all for now. We’ll start getting some early earnings reports next week. There’s not much in the way of economic reports although I’ll be on the lookout for Tuesday’s Small Business Optimism report. Also, the CPI report will come out on Thursday. So far, inflation has been fairly well contained. Typically, when unemployment gets this low, pricing pressures increase. We haven’t seen much of that yet. Let’s hope it continues. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

3 High Yield Stocks for Bottom Fishers

Dividend investors face an extra challenge of timing stock purchases. No dividends will be earned until shares are bought. There are several techniques on when to buy that I use and recommend to investors who follow my Dividend Hunter system. For more aggressive income stock investors, jumping into out-of-favor high yield stocks can produce excellent returns.

In my previous article, I discussed three stocks that have done well so far in 2018 (all up over 20% YTD) and which I expect to continue to post gains for the rest of the year. Buying stocks in an uptrend is the safer strategy. If the moves are driven by underlying fundamentals, you can expect the trend to continue if the fundamentals remain positive. The trade off is that rising stocks have been discovered, and usually carry lower yields. The three that I highlighted on Monday have an average current yield of 5.4%.

For investors searching for higher yields, there is the challenge in analyzing whether dividends are secure or in danger of reduction or elimination. These are often stocks that have dropped significantly in value, and most investors get scared or nervous about jumping on shares where the price has recently gone through a steep decline. Bottom fishing for high-yield stocks is a more aggressive strategy. The investor must be able to determine if the company can continue to pay dividends, and there is a need for patience. It can take months or even years for a stock to recover to pre-crash levels. The good part is that these stocks can pay double-digit yields, which is a nice wage to earn while you wait. Here are three high yield stocks that illustrate the strategy.

What Does This Huge Options Trade Mean For Oil?

When I write about large options block trades, it’s generally for one of two reasons. First, a lot of smart money is active in the options market. If a very big (i.e. capital intensive) trade occurs with options, it can often be a signal that there’s going to be action in the underlying asset.

Second, sometimes I just find an options trade very interesting and worth discussing. It could be because it’s an unusual trade or is an original way to handle risk management. Of course there are times when I write about a large trade because it’s interesting and may provide meaningful insight into the underlying asset.

A trade last week I came across meets both of those criteria. More specifically, I noticed a massive covered call trade in United States Oil (NYSE: USO).

USO is the most active oil ETF. While it has its flaws, trading USO is probably the easiest way for the average trader/investor to trade oil. Beyond trading oil futures themselves, USO is likely the most direct way to trade oil as well.

Covered calls can be intriguing to analyze because they can be successful in many different types of market conditions. However, one of the few situations which are “bad” for covered calls are when the underlying asset price blows through the short call strike. (It’s not entirely bad since you are still making money, but you could have made more money by just being long the asset.)

So, is this covered call trade suggesting there’s a limit on how far oil prices are going to rise? Let’s take a closer look at the position.

Posted by Eddy Elfenbein on July 6th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His