CWS Market Review – August 3, 2018

“Paying attention to simple little things that most men neglect makes a few men rich.” – Henry Ford

I think we just set a record. Nine of our Buy List stocks reported Q2 earnings this week including seven on Thursday. I can’t remember a single day with so many reports to go through. Fortunately, this was the final batch for us this earnings season. This was an outstanding earnings season for us. Over the last two weeks, 21 out of our 25 Buy List stocks have reported earnings. All but two beat Wall Street’s estimates.

In this week’s CWS Market Review, I’ll run through all the reports. Plus, I have some new Buy Below prices for you. I promise to have more thoughts on the broader economy in upcoming issues, but this week’s issue is all about earnings. I was also happy to see how many of our companies reiterated, or even raised, their full-year guidance. That’s a very positive sign for the rest of the year.

We also had a Federal Reserve meeting on Tuesday and Wednesday. The Fed decided against raising interest rates this meeting, but they noted the recent strength in the economy. I think that means we’ll get another rate hike next month, and there’s a decent change we’ll get one more before Christmas.

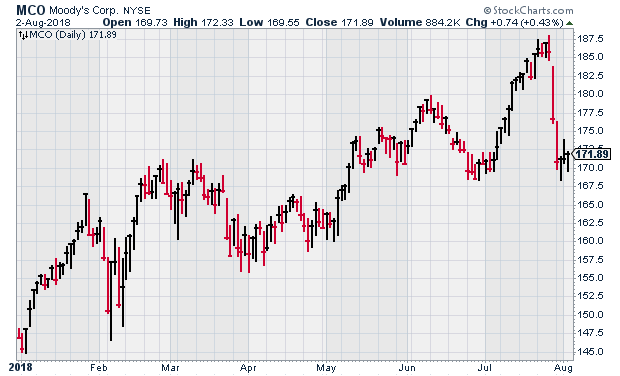

But first, we have lots of earnings to get through. Let’s start with Moody’s, which continues to be one my favorite stocks.

Moody’s Reports Strong Earnings, but the Shares Fall

Yes, I like Moody’s (MCO) a lot. It’s an excellent company. The stock is up 16% this year. Moody’s released their latest earnings report last Friday, not long after I sent you last week’s newsletter. The credit-ratings agency reported Q2 earnings of $2.04 per share. That beat Wall Street’s consensus by 15 cents per share.

This was a solid quarter for Moody’s. Quarterly revenue rose 17% over last year. I’m particularly impressed by the growth of the Moody’s Analytics business, plus Bureau van Dijk. Most importantly, Moody’s reaffirmed their full-year EPS guidance of $7.65 to $7.85. Still, traders weren’t impressed. Perhaps they were expecting higher guidance. Shares of MCO lost nearly 5% on Friday, plus another 3% on Monday.

I’m not worried at all. Moody’s will do well. I know it’s frustrating when a good company reports strong results and the stock takes a hit. Still, we know this can happen with financial markets. Don’t worry about Moody’s. The most important news is the full-year guidance. Due to the pullback, I’m dropping my Buy Below price on Moody’s down to $182 per share.

Earnings from Fiserv and Carriage Services

On Tuesday we got earnings reports from Fiserv and Carriage Services. For Q2, Fiserv (FISV) made 75 cents per share. That was one penny better than estimates. This is another rock-solid financial-services firm. Fiserv reiterated its full-year guidance of $3.02 to $3.15 per share on internal revenue growth of at least 4.5%. That’s good to hear.

Fiserv’s CEO, Jeffery Yabuki, said, “Our first-half performance has set us up for strong full-year results and additional momentum as we look into 2019.”

“Our second-quarter results were excellent and have us well-positioned to achieve our full-year objectives,” said Jeffery Yabuki, President and Chief Executive Officer of Fiserv. “We continue to focus on service quality, innovation and integration, which is reflected in both our current results and sales pipeline entering the second half of the year.”

Corporate boilerplate? Sure, but it’s still true. Since Fiserv has already made $1.51 per share for the first half, the guidance means they expect $1.51 to $1.64 per share for the second half.

I was especially pleased to see Fiserv’s operating margin expand by 0.4% to 32.4% for Q2. That’s often a sign that business is going well. The shares pulled back a little after the earnings report, but it’s nothing too serious. I’m keeping my Buy Below on Fiserv at $81 per share.

Carriage Services (CSV) was our big disappointment this earnings season. This was one of the two that missed Wall Street’s consensus (RPM was the other). Actually, that phrase really doesn’t apply much to Carriage since only two analysts follow the stock. The average of the two was for 37 cents per share, and Carriage earned just 22 cents per share last quarter.

The company blamed the poor showing on two factors: “broadly lower volumes and average revenue due to a spike in cremation rates in both our Same Store and Acquisition Funeral Portfolios, and higher interest costs and an increase in outstanding common shares after our recent balance-sheet recapitalization.”

I should note that the company remains optimistic for the coming quarters. They said they forecast earnings of $1.35 to $1.40 per share for the coming four quarters. The stock dropped for a 4.3% loss on Wednesday. I was afraid it was going to be a lot more. The fall isn’t so bad considering the stock rallied 3.7% on Tuesday. Still, I’m lowering our Buy Below price to $26 per share. I want to see improvement here.

Seven Buy List Earnings Reports on Thursday

Thursday was a very busy day for us. Seven of our Buy List stocks reported. Five were before the opening bell, and two came after after the close.

Let’s start with Cognizant Technology Solutions (CTSH). The IT-outsourcer earned $1.19 for Q2. That was nine cents better than estimates. Quarterly revenue rose 9.2% to $4.01 billion. Very good quarter.

For Q3, CTSH expects earnings of at least $1.13 per share. That was a penny less than where Wall Street was. Also, the revenue guidance was a bit light. For all of this year, Cognizant now expects earnings of at least $4.50 per share. This is notable because three months ago, Cognizant lowered its full-year EPS guidance from $4.53 to $4.47. So they’ve reclaimed some of that lost ground.

Despite the higher earnings guidance, traders focused on the weak revenue outlook. Cognizant lost over 6% on Thursday. I’m not too worried. This probably reflects a temporary slowdown in the financial-services sector rather than deeper business issues. I’m keeping our Buy Below at $81 per share.

Becton, Dickinson (BDX) reported earnings of $2.91 for Q2. That beat the Street by three cents, and it was up 18.3% over last year. Becton also raised its revenue guidance for this year. Plus, they bumped up the low end of their full-year forecast. Becton now sees full-year EPS of $10.95 to $11.05 from a previous range of $10.90 to $11.05. Granted, that’s not a big change, but it’s good to see. Becton is quietly becoming a nice winner for us. I’m keeping our Buy Below at $250 per share.

There’s no way to sugarcoat the problems at Ingredion (INGR). The stock has been a very poor performer for us this year. Ingredion warned that its Q2 results would be between $1.63 and $1.68 per share. That was well below Wall Street’s consensus of $1.92 per share. On Thursday, we got the results. For Q2, Ingredion made $1.66 per share. They stood by their full-year guidance of $7.50 to $7.80 per share. Perhaps the worst is over.

The stock rallied a bit after the earnings, probably in relief that there wasn’t any more bad news. At least we can say that Ingredion is going for a decent valuation. Going by the current guidance, INGR is trading at 12.5 to 13 times earnings. Not much else to say, but I’m not pleased with Ingredion’s performance this year.

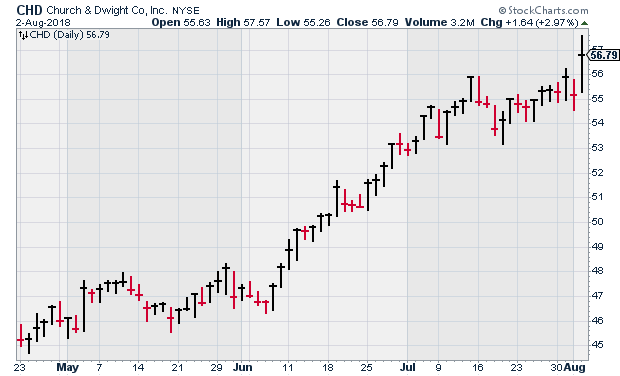

Church & Dwight (CHD) is quickly becoming a favorite around here. The stock is up more than 25% since last April. The company had been expecting Q2 earnings of 46 cents per share. Last week, I said they should beat that, and I was right. CHD made 49 cents for Q2. Net sales grew 14.5% to $1.03 billion. Church & Dwight raised the low end of its guidance. CHD now expects EPS of $2.26 to $2.28 (previously, it was $2.24 to $2.28). For Q3, they’re looking for 53 cents per share. I’m raising my Buy Below to $60 per share.

Intercontinental Exchange (ICE) had Q2 earnings of 90 cents per share. That’s an 18% increase over last year, and it beat the Street by one penny. ICE expects Q3 data revenue between $530 million and $532 million, and for Q4, it’s expected to be between $538 million and $542 million. The CFO said, “In the first half of 2018, we grew revenues, expanded margins and generated over $1.2 billion of operating cash flow.” This is a solid company. Buy up to $79 per share.

Cerner (CERN) reported after the closing bell on Thursday. The company made 62 cents per share which was two cents ahead of estimates. Revenue for Q2 was up 6% to $1.368 billion. For Q3, Cerner expects revenue between $1.335 billion and $1.385 billion and earnings between 62 and 64 cents per share. Wall Street had been expecting 65 cents per share. Cerner also stood by its full-year EPS range of $2.45 to $2.55.

“I am pleased with our second-quarter results, which included all key metrics being at or above expected levels,” said Zane Burke, President. “Our results were solid across all of our major solution and services categories and included good contributions from U.S. and non-U.S. regions. Looking ahead, we believe our solutions and tech-enabled services are well aligned with the challenges providers and other healthcare stakeholders are facing, and we have a significant opportunity to grow as we help them with their transition to value-based care in coming years.”

This was a good report. I’m going to bump up my Buy Below price on Cerner to $67 per share.

Continental Building Products (CBPX) had a blow-out earnings report. The wallboard outfit made 59 cents per share, which was 14 cents more than estimates. The details of the report are quite good. Net sales were up 15.5%, while EBITDA rose more than 21%. Gross margins improved to 29.4% from 25.5%. It’s not just about price increases; wallboard sales volume rose from 647 million square feet last year to 722 million square feet this year.

Continental doesn’t provide EPS guidance, but they do give expected ranges for some internal budget numbers. They pared back some of those by a little bit in this latest report. For now, I’m keeping our Buy Below at $34 per share, but I may raise it soon depending on how the market reacts.

That’s all for now. With earnings out of the way, next week should be a lot calmer. Later today, we’ll get the jobs report for July and it could be another big one. There’s not much in the way of economic reports next week. However, I will be curious to see next Friday’s CPI report. I suspect that some inflation may slowly be brewing, but I want to see hard data first. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Buy These 3 High-Yield Stocks with Positive Earnings Surprises

Earnings season is in full swing, with a large portion of the high yield stock universe reporting in the first half of August. Predicting what will happen with individual company earnings is a tough sport and guessing how share prices will react is more like wagering on sports events. However, earnings is the time when a company can show that the market price of a stock is far out of line with the business fundamentals.

I seem to always have a handful of companies on my watch list where I believe the underlying business fundamentals are much stronger than the current stock market value indicates. These stocks may be down for a variety of reasons such as a one time bad earnings report, or a misperception of the company’s growth potential. Here are three stocks that could move up nicely after hopefully positive earnings reports.

Is It Time to Bail on the FAANGs?

In recent months, it has gotten harder to separate the performance of the U.S. stock market from the performance of the FAANG stocks (Facebook, Amazon, Apple, Netflix and Google).

Despite Facebook’s face-plant, after its earnings announcement led to the worst one-day loss ever for any stock, the overall performance of the market year-to-date has been supported by the FAANG group. While they’re only a 13.6% weight in the S&P 500’s market cap, they’re driving the market up to the tune of almost half of its year-to-date gains. Impressive stuff for just 5 stocks on their own.

The question facing investors is, of course, whether the FAANG stocks will continue carrying the market or if their leadership is beginning to fade.

Posted by Eddy Elfenbein on August 3rd, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His