CWS Market Review – March 15, 2019

“Most investors want to do today what they should have done yesterday.”

– Larry Summers

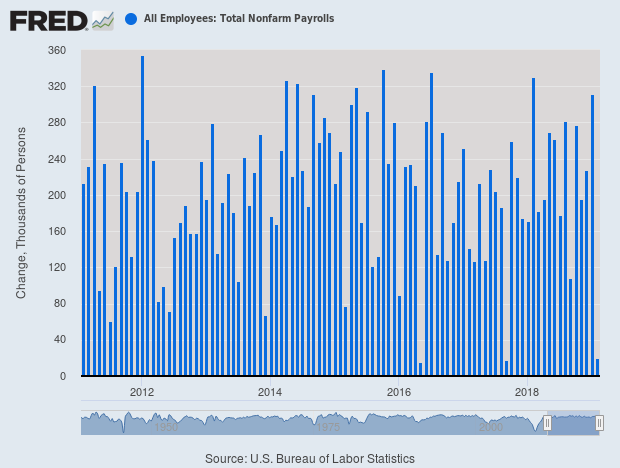

Last Friday, Wall Street got spooked by a poor jobs report. For February, the economy created just 20,000 net new jobs. Wall Street had been expecting nine times that number. Some folks are dismissing this as a one-off and not indicative of a souring economy, while others think this is the beginning of more bad news.

As for me, I take a middling view. The economy is still doing well, but as investors, we need to be prudent. The fact is that earnings growth is slowing down. We’re currently in the “lull” period between earnings seasons when there’s not a lot of financial or economic news. As such, every news item probably draws undue influence.

Every day, it seems, the market gets jostled by whatever the current headline is on China or North Korea or Brexit. These issues simply aren’t that central to the market’s long-term bearing. For investors, everything comes down to earnings and interest rates. Outside that, the rest is noise.

In this week’s issue, I want to take a closer look at where we are with the economy. There are some cracks appearing in the façade. I also want to take an early look at the Q1 earnings season, which is still a month away. This looks to be the slowest growth for earnings in quite some time. Later on, I’ll cover some news impacting our Buy List stocks. (Ross Stores has some ambitious plans for 2019.) But first, let’s take a deep dive into one of the worst jobs reports in years.

The Jobs Report Was a Bust, but Should You Be Worried?

Last Friday, the government released the jobs report for February, and the numbers weren’t good. The U.S. economy created just 20,000 net new jobs last month. That was far below expectations of 180,000. In fact, this was the third-lowest number of the past eight years. The unemployment rate ticked down to 3.8%.

A few points. One is that the jobs data is revised several times. Also, by the government’s admission, the jobs data is a rough estimate with a fairly large error margin. The problem is that this report aligns with some (note my word choice here) other economic data.

For example, I’ve previously discussed the rotten retail-sales report for December. I tend to think it’s a bad number because businesses like Walmart and Ross Stores said they’ve been doing well. This week, however, the retail-sales report for January was a bummer as well. In fact, the lousy report for December was revised downward. It’s even lousier. For Q1, the Atlanta Fed now expects GDP growth of just 0.4%. Yikes!

I’ve also noticed that some of the recent weekly jobless-claims reports have been on the soft side. That could be due to the government shutdown. That data series tends to bounce around a lot. Also, the labor markets tend to be a lagging indicator. In fact, I’ve dug through the numbers and found that high unemployment is often a very good buy signal for stocks.

As always, the housing market is crucial. This week, the new-home-sales report came in below expectations. The soggy housing market may pick up soon since mortgage rates have fallen to the lowest in over a year. Recently, economists at Goldman Sachs made the case that housing is due for a rebound. I think they’re right, and it’s another reason why a patient Fed is good news.

We’ll know more about housing when we find out the earnings report from Buy List stocks like Sherwin-Williams (SHW) and Continental Building Products (CBPX). In fact, shares of Continental have dropped lower recently. The stock had gapped up after a favorable earnings report, but it’s given back all those gains. My Buy Below for Continental is currently $31 per share, but if you’re able to get in below $26, then you got a good deal. I’ll caution you that it will take time to rally.

Not all the economic news has been bearish. This week, the Commerce Department said that orders for durable goods rose by 0.4% in January. That’s the highest in six months. Also, the jobs report showed that average hourly earnings are up 3.4% in the last year. That’s not great, but it’s the highest rate in the last ten years. That underscores an important aspect of the economic recovery: lots of jobs have been created, but wage growth has been listless. I think we’re a long way from full capacity.

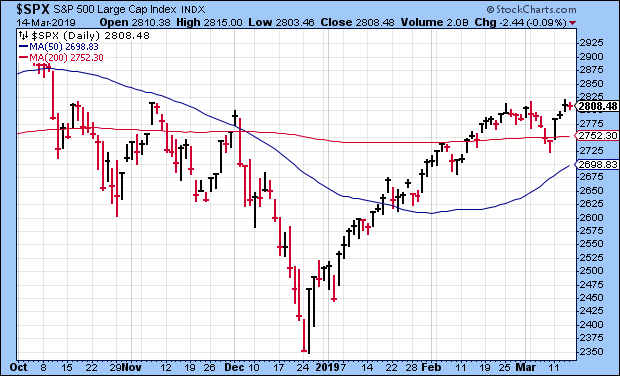

On Wednesday, the S&P 500 did something I would not have predicted. It hit its highest level since early October. This is also another reason why I don’t try to predict where the market is headed. (Once a member of the financial media asked me what my “year-end target” was. I said “December 31st.” I haven’t heard back from him.) Here’s a cool fact: Since World War II, the stock market has been up in the 12 months following the midterm election every time. That’s a perfect 18-for-18.

Before this week, the S&P 500 fell eight times in nine sessions. Monday, Tuesday and Wednesday of this week were all strong up days. The index is currently above its 50- and 200-day moving averages. However, I want to stress caution. Within the stock market, the industrial sector has been badly lagging. Coupled with this, small-caps issues have lagged while the biggest stocks have enjoyed the best gains.

This is a good time to be conservative. Look for solid dividend stocks (SJM at 3.3%!), and stay away from any shaky high-fliers. As always, pay attention to our Buy Below prices. They’re here for your protection. Now let’s take a look at what we can expect when first-quarter earnings season begins in a few weeks.

This Could Be the Worst Earnings Season in Three Years

March is already halfway over, and soon Q1 earnings season will be upon us. This will be an interesting season for Wall Street because the earnings got a big boost in 2018 thanks to the corporate tax cut. That story has run its course. For Q4, the S&P 500 had the highest number of earnings misses since Q4 of 2013.

Currently, Wall Street expects Q1 earnings from the S&P 500 of $37.12 per share. That’s the index-adjusted number. Every one point in the index is worth roughly $8.4 billion. Over the last six months, the Q1 estimate has been revised lower by nearly 10%. If that estimate is correct, it would represent growth of just 1.6% over last year. That would be the weakest growth in some time. In fact, there’s a good shot that Q1 growth won’t be growth at all but instead will show an earnings decrease.

The big weak spot is Energy. Oil prices still haven’t done much. We don’t own any energy stocks on the Buy List. That’s not a bold prediction on energy prices. I just haven’t seen anything that caught my eye. Consider that ExxonMobil (XOM) is expected to earn $4.32 per share this year. That’s down from $4.88 per share last year. In 2011, the company made $8.37 per share.

The other earnings weak spots are in Materials (-11%) and Consumer Discretionary (-11%). This certainly reflects the housing slowdown. On the plus side, earnings for Financials are expected to be up 14%, and Healthcare is expected to be up 30%. Quiz: What are the best-performing sectors over the past year? Answer: REITs and Utilities. Yep, the boring stuff has been working.

Interestingly, the Financial sector has the lowest aggregate Price/Earnings Ratio. We can see that on our Buy List. All three of our major financial stocks, AFLAC (AFL), Eagle Bancorp (EGBN) and Signature Bank (SBNY), are going for less than 12 times this year’s earnings.

Buy List Updates

I usually don’t pay much attention to ratings changes from Wall Street firms on our Buy List stocks, but I wanted to pass along two items this week. RBC Capital Markets lifted its price target on Stryker (SYK) from $184 to $204. They have an “outperform” rating on the stock. Stryker continues to be a very good stock. Also, Raymond James upgraded Broadridge Financial Solutions (BR) to “outperform” and set a price target at $118 per share.

Let me reiterate that I’m not a fan of price targets. It’s a silly concept. If a stock is good, then it’s good. There’s no set line that it needs to cross. Our Buy Below prices aren’t targets, and you’ll notice how often we change them.

Ross Stores (ROST) says it plans to open 100 new stores this year. In February and March, Ross opened 22 stores, plus six dd’s Discount stores. For 2019, the company plans to open 75 Ross Stores and 22 dd’s.

“These recent openings reflect our ongoing plans to continue building our presence in both existing and newer markets, including the Midwest for Ross, and expansion of dd’s DISCOUNTS into Oklahoma and Illinois,” said Jim Fassio, President and Chief Development Officer. “We now operate a total of 1,745 Ross Dress for Less and dd’s DISCOUNTS locations across 38 states, the District of Columbia, and Guam. As we look out over the long-term, we remain confident that Ross can grow to 2,400 locations and dd’s DISCOUNTS can become a chain of 600 stores given consumers’ ongoing focus on value.”

Ross now runs 1,500 Ross Stores. The stock recently beat earnings, raised its dividend and announced a big share buyback.

We have two Buy List earnings reports between now and Q1 earnings season. FactSet (FDS) is due to report on March 26. The stock is currently above my Buy Below price. Hold off on buying it for now. I may change our Buy Below, but I want to see the earnings report first. I’ll have more details next week. RPM International (RPM) is due to report its fiscal Q3 earnings on Thursday, April 4. Wall Street expects earnings of 12 cents per share.

That’s all for now. The Federal Reserve meets again on Tuesday and Wednesday. The policy statement will come out on Wednesday afternoon. Don’t expect any change to interest rates. The Fed will also update its economic projections for the next few years. The factory-orders report is on Tuesday. Then on Friday, the existing-home-sales report is due out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on March 15th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His