CWS Market Review – June 28, 2019

“A good decision is based on knowledge and not on numbers.” – Plato

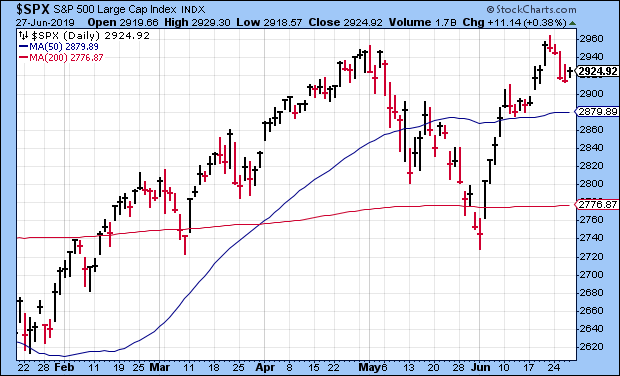

Today is the last day of trading for the first half of 2019. This has been a pretty good start to the year. The S&P 500 is up 16.68%. Including dividends, the index is up 17.85%. It looks like the Dow is about to close out its best June in 81 years.

Our Buy List, I’m happy to report, is beating the market again this year. Through Thursday, we’re up 19.30% for the year. I’ll have more details on our performance in upcoming issues. Best of all, we haven’t made one single trade all year.

This week, our #1 performer proved why it got that title. FactSet beat Wall Street’s earnings estimate by 26 cents per share! The company also raised its full-year earnings guidance.

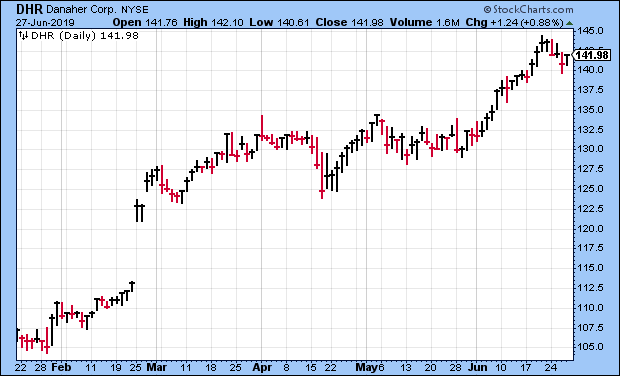

This week, we also learned the name of Danaher’s dental spinoff. The new company will be called Envista. (Yuck!) Anyway, DHR shareholders will get shares of it later this year.

I’ll get to all that, but first, let’s look at some recent economic news and what to expect when Q2 earnings season begins.

Earnings Growth Looks to Decline in Q2 and Q3

I was a bit surprised on Tuesday by the weak consumer-confidence report. This was the lowest report since September 2017. Some of that is clearly related to trade tensions, but it could have a wider impact.

As is often the case, this is a game of expectations. Relatively speaking, consumer confidence is quite high. It’s just lower than people had expected. This could wane soon if a trade deal is reached between the U.S. and China at the upcoming G-20 meeting.

That’s not all. Also this week, the Census Bureau reported that new-home sales fell in May to 626,000. That’s an annualized figure. The three previous months were revised down as well. We’ll probably see some improvement in these figures since mortgage rates have come down. In fact, Freddie Mac just reported that mortgage rates are at a 31-month low.

It’s been eleven years since the housing sector went kablooey. Adjusted for inflation, home prices are still below peak.

The second-quarter earnings season is set to begin in two weeks. Overall, the numbers will be so-so. Nothing terrible, but nothing great either. According to FactSet (not only a great stock, but a great source of data as well), earnings are expected to decline by 2.6% for Q2. Not only that, but estimates for Q3 have just turned negative as well, but only barely. At the start of the year, Wall Street had been expecting Q3 earnings growth of 3.4%. Now that’s down to -0.3%. Earnings in the tech sector are expected to fall by 9.3%.

There’s a direct relationship between short-term interest rates and stock valuations. So we’ve seen share prices rise as earnings have flatlined. But at the same time, short-term rates are expected to fall soon. In other words, the valuations can mask the weakness in the market.

There’s nothing wrong with a rise in valuations, but you have to keep in mind that it can be fleeting. I love seeing valuations rise for our stocks, but I’d much rather see stronger earnings growth.

As we’re entering a period of meager earnings growth, it’s important for us to focus on high-quality stocks. If investors know they can count on steady earnings growth from companies like AFLAC (AFL) or Hershey (HSY), they’ll migrate to them.

I also want to address an issue that’s gotten a lot of attention.

President Trump has continued to rip Fed Chairman Jay Powell. I’ll skip the politics, but it’s quite clear that the president can’t fire Powell based on policy differences. Moreover, the FOMC is a committee. The president even said he wanted ECB President Mario Draghi as Fed chairman. (The ECB is expected to cut rates soon to -0.5%.)

There’s a reason why the Fed members have 14-year terms, and Powell is hardly a rogue member. The recent policy statement to leave rates unchanged was supported by a margin of nine to one.

I don’t believe the Fed will be swayed by any empty threats from the White House. In fact, fights between the Fed and the White House are nothing new. Lyndon Johnson wanted to fire William McChesney Martin. in the 19th century, Andrew Jackson and Nicholas Biddle fought constantly. The period is even known as the “Bank War.” I actually think Powell could be an ally to Trump if negative effects of the trade war become evident.

If you had paid attention to the talking heads, you probably would have been scared out of this market by any of the following: Iran, Russia, Trump, China, the Democrats, the Fed or half a dozen other boogeymen (boogeypeople?). Yet here we are at the halfway mark and our strategy is doing just fine. Good investing is boring. Now let’s look at a solid earnings report from our biggest winner this year.

FactSet Beats Earnings by 26 Cents per Share

Before the opening bell on Tuesday, FactSet (FDS) reported fiscal Q3 earnings of $2.62 per share. That creamed estimates by 26 cents per share. Compared with last year, it’s an increase of 20.2%. Organic revenue grew 7.3% to $366.3 million. FactSet’s operating margin increased to 34%.

A key stat for FDS is Annual Subscription Value or ASV. Last quarter, that rose to $1.45 billion. The organic growth rate, which excludes the effects of acquisitions, dispositions, and foreign currency, was 5.6%.

Also, the Board of Directors approved a $210 million increase to the existing share-repurchase program.

“FactSet’s ability to perform well this year amid sector and industry headwinds serves as a proof point that our long-term strategy is working,” said Phil Snow, FactSet CEO. “We are encouraged that our smarter, connected data and technology solutions continue to resonate with clients as we help them drive efficiency and increase value in an ever-changing environment.”

FactSet also updated its guidance for 2019. The company expects revenue between $1.42 and $1.44 billion, and operating margin between 32.5% and 33.0%. FactSet sees their earnings-per-share ranging between $9.80 and $9.90. That’s an increase to the previous guidance of $9.50 to $9.65 per share.

The stock pulled back a little after the earnings report, but it was nothing too serious. This has still been a very big winner for us this year. Through Thursday, FDS is up 42.6%. This week, I’m raising my Buy Below on FactSet to $298 per share.

Buy List Updates

This week, Danaher (DHR) announced that its dental spinoff will be called Envista Holdings Corporation. Sometime in the second half of 2019, shareholders of Danaher will get shares of Envista.

I’m not a fan of most modern corporate names. This one requires some explanation:

Mr. Aghdaei stated, “Envista’s name is a combination of two Latin root words: ‘en’, a prefix meaning to be within, and ‘vista’, meaning a view. Our logo of concentric circles represents our ability to collaboratively achieve endless possibilities ahead. The Envista brand reflects the forward-looking energy that embodies our company culture.”

As far as the Buy List goes, the spinoff shares will join the Buy List as our 26th member. That’s what we’ve done with previous spinoffs. I’ll decide whether we’ll keep it or not at the end of the year.

Danaher will report earnings again on July 18. For Q2, Danaher expects earnings to range between $1.13 and $1.16 per share. For all of 2019, Danaher sees earnings coming in between $4.72 and $4.80 per share. Danaher is a buy up to $150 per share.

Becton, Dickinson (BDX) got clobbered in April, and the earnings report wasn’t that good. In May I decided to lower our Buy Below price. Strong companies tend to manage their way through weak stretches. Sure enough, shares of BDX have rallied 12% since mid-April. I’m raising my Buy Below to $255 per share. Becton sees full-year earnings ranging from $11.65 to $11.75.

Shares of Ross Stores (ROST) got pinged this week. The deep-discounter was downgraded by Goldman Sachs. I’m not too worried. The analyst downgraded Nordstrom as well. At one point, ROST was down 3.5% on Thursday. The last earnings report was quite good. As usual, the outlook was cautious. Ross Stores is a buy up to $106 per share.

That’s all for now. The stock market will close at 1 p.m. on Wednesday, July 3. The market will be closed all day on Thursday, July 4 in honor of Independence Day. We’re open for business again on July 5. The ISM Manufacturing Index will come out on Monday. The ADP payroll report is on Wednesday. Then on Friday, we’ll get the big June jobs report. The jobless rate for April and May was 3.6%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on June 28th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His