CWS Market Review – September 20, 2019

“Things are never clear until it’s too late.” – Peter Lynch

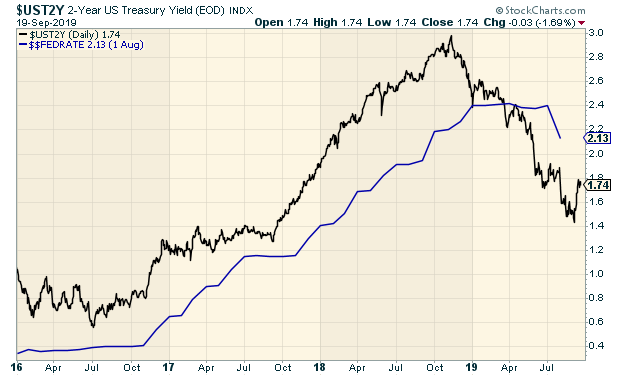

On Wednesday, the Federal Reserve voted to cut interest rates. The new target range for the Federal funds rate is 1.75% to 2.00%. This is the Fed’s second rate cut in the last seven weeks. As recently as December, the Fed had been raising interest rates.

President Trump wasn’t pleased with the move, as he wanted a larger cut. The president tweeted, “Jay Powell and the Federal Reserve Fail Again. No ‘guts,’ no sense, no vision! A terrible communicator!”

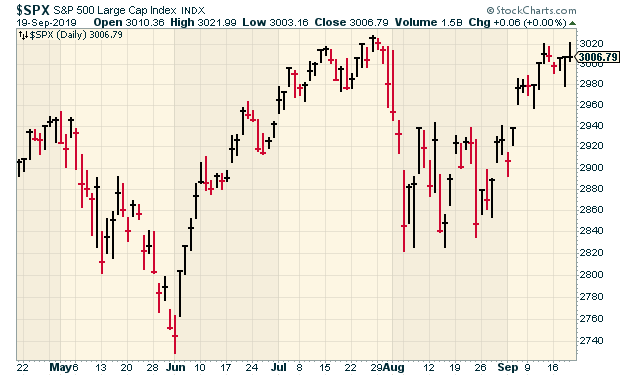

Despite the president’s criticism, the stock market has calmed down considerably. In six of the last ten trading sessions, the S&P 500 has closed up or down by less than 0.1%. The index is close to another new all-time high.

In this week’s issue, we’ll take a closer look at the Fed’s move and what it means for us. Our Buy List continues to thrive, and we touched another new high this week. Later on, I’ll preview next week’s earnings report from FactSet. We also had one of our stocks spin out an IPO. But first, let’s look at the Fed’s rate cut.

The Fed Cuts – What’s Next?

This week’s rate cut was widely expected. On Wall Street, whenever an expected thing happens, observers are quick to dismiss it as old news. However, we should bear in mind that the Fed was raising rates not that long ago. The last increase came in December. In fact, according to the Fed’s own projections, the central bank planned to continue hiking rates all year.

The story of this year is how that view of the economy fell apart. Thanks to weakness in China, there were fears of an economic slowdown in the United States. Those fears were compounded by a growing trade war between the U.S. and China.

The most visible aspect of the new world view was felt in the bond market. About this time one year ago, the yield on the 10-year Treasury got to 3.2%. Soon after, yields crashed. A few weeks ago, it dropped under 1.5%.

That caused the Federal Reserve to take notice. I’ll give you an example. As a very general rule of thumb, the yield on the two-year Treasury leads where the Fed puts interest rates. Not always, but the measure has a decent track record. In November, the two-year yield was more than 70 basis points above the Fed. Then came the recession fears, and by June, the two-year was 60 basis points below the Fed. That put a lot of pressure on the Fed to act.

At his post-meeting press conference, Fed Chairman Jay Powell said:

Since the middle of last year, the global growth outlook has weakened, notably in Europe and China. Additionally, a number of geopolitical risks, including Brexit, remain unresolved. Trade-policy tensions have waxed and waned, and elevated uncertainty is weighing on U.S. investment and exports. Our business contacts around the country have been telling us that uncertainty about trade policy has discouraged them from investing in their businesses.

Powell also reiterated that he sees this week’s action as a mid-cycle adjustment rather than the start of a long series of rate cuts prior to a recession. This is key. Historically, it’s very unusual for the Fed to be cutting rates when unemployment is below 4%. The current Fed funds target rate is basically in line with inflation, meaning the real rate is near 0%.

What does this mean for us? For the most part, lower rates are very good for the stock market. Lower rates tend to boost the market’s valuation. Of course, it also helps with borrowing costs. I think we’ll see continued improvement in the housing market.

The S&P 500 is back over 3,000. Last Thursday, the index came very close to another new high. I wouldn’t be surprised to see us hit a peak any day now. Our Buy List just recently hit a new high. We’re now up 23.8% on the year.

Will the Fed continue to cut? Eh, I’m not so sure. I think there’s a good chance the Fed will take a pause. Maybe one more cut before the end of the year. The fact is that the economy is still doing well. I’m not saying the economy is ripping higher, but the recession fears were clearly overblown.

For example, this week we learned that housing starts are at a 12-year high. Monday’s industrial production was also quite good. The IP reports have been pretty weak this year. Over the weekend, the price of oil spiked after an attack on Saudi oil-production facilities. It’s still early, but the impact appears to be muted. There’s a lot of incentive to get production back to normal.

I thought it was interesting that there were three dissensions in this week’s Fed statement. Dissenting votes are rare but not unheard of. Two Fed members voted for no change to interest rates, while a third wanted to see a 50-basis-point cut.

In this meeting, the Fed also updated its economic projections. If the median vote gets its way, that means the Fed won’t be touching rates for the rest of this year and all of 2020. I can’t say how long that view will last, but that’s why I took notice of the dissenting votes. At some point, the dissenters could become a majority.

Last week, we saw a major rotation from growth to value. This got a lot of attention, but I think the story was a little different than what was commonly discussed. I believe it was more of a shift from defensive stocks to cyclical stocks. Of course, there’s a lot of overlap between those categories, but the defensive-to-cyclical was, in my view, the dominant theme.

In essence, this was the stock market violently pushing back against the view that the economy is getting weak. It’s not. If the market is right, then the Fed may back off on rates. We’ll learn a lot more in a few weeks when the third-quarter earnings season gets going.

According to the latest figures, Wall Street expects the S&P 500 to report earnings of $40.98 per share for Q3 (that’s the index-adjusted number). That figure has come down about 7.5% since the start of the year. It’s typical for earnings estimates to be pared back as earnings season approaches.

But if Wall Street’s estimate is correct, then it would be about 1% below the earnings results for last year’s Q3 and the first quarter of negative earnings growth in three years. Bear in mind that after being pared down, earnings usually beat expectations by about 3% to 5%. It’s a $30 trillion game of “lower the bar to the point where you can easily step over it and declare yourself the winner.”

All told, earnings growth for the year is expected to be up by 6.6%. We’re still a long way from a bubble. The S&P 500 is currently going for 16.6 times the earnings estimate for 2020. Speaking of earnings, let’s take a look at our Buy List earnings report for next week.

Preview of FactSet’s Earnings

FactSet (FDS) is scheduled to report its fiscal Q4 earnings before the market opens on September 26. Their fiscal year ends on August 31. FDS has been a big winner for us this year. In May, FactSet raised its dividend by 12.5%. The quarterly payout increased from 64 to 72 cents per share.

For Q3, FactSet had a blow-out earnings report. The company earned $2.62 per share, which topped estimates by 26 cents per share. The result was a 20% increase over the same quarter from last year. Organic revenue grew 7.3% to $366.3 million. FactSet’s operating margin increased to 34%.

The key stat for FDS is Annual Subscription Value, or ASV. Last quarter, that rose to $1.45 billion. The organic growth rate, which excludes the effects of acquisitions, dispositions, and foreign currency, was 5.6%. The Board of Directors approved a $210 million increase to the existing share-repurchase program.

In June, FactSet updated its guidance for 2019. The company expects revenue between $1.42 and $1.44 billion, and operating margin between 32.5% and 33.0%. FactSet sees its earnings per share ranging between $9.80 and $9.90. That’s an increase to the previous guidance of $9.50 to $9.65 per share.

Since FactSet has earned $7.39 per share for the first three quarters, that implies an earnings range for Q4 of $2.41 to $2.51 per share. The consensus on Wall Street is for earnings of $2.47 per share. In June, shares of FDS briefly broke above $300, but the stock has since pulled back. Another strong earnings report could push FDS back above $300.

We’re in the slow period for Buy List earnings reports. The next Buy List earnings report will be RPM International (RPM) on October 2. After that, we’ll have to wait until the Q3 earnings season starts in mid-October.

Buy List Updates

On Wednesday, Danaher (DHR) had an initial public offering for Envista (NVST), Danaher’s dental business. This is not a spin-off; it’s an IPO. Danaher still holds a large stake in the company.

Envista priced at $22 per share. Danaher sold 26.8 million shares at that price. The shares opened at $25.65 per share and got as high as $28.92. Danaher still owns around 83% of the voting power in Envista. Danaher remains a buy up to $150 per share.

I also want to raise the Buy Below prices for two of our Buy List stocks. Globe Life (GL), the new name for Torchmark, has been quietly gaining steam lately. The shares are up about 10% in the last month.

In July, GL beat earnings by two cents. The company projects net operating income per share will be between $6.67 and $6.77. I’m raising our Buy Below to $100 per share.

Raytheon (RTN) had an interesting week. One day it was upgraded by an analyst at JP Morgan, and the next day it was downgraded by an analyst at Sanford Bernstein. Shareholders of RTN will, at some point, get 2.3348 shares of the new combined company with United Technologies (UTX). The combined company, however, will not include the spinoffs of Otis and Carrier.

Shares of RTN have been rallying lately, possibly due to increased international tensions. This week, I’m raising our Buy Below on Raytheon to $210 per share.

That’s all for now. There’s not much in the way of economic news next week. On Tuesday, the consumer confidence report comes out. Then on Thursday, we’ll get another revision to the Q2 GDP report. The initial report showed real annualized growth of 2.1% in the second quarter. Last month, that was revised down to 2.0%. On Friday, we’ll get data on personal income and spending in addition to the durable-goods report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 20th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His