CWS Market Review – November 1, 2019

”Time is on your side when you own shares of superior companies.” – Peter Lynch

What an action-packed week this has been! Not only is it earnings season (we had six Buy List reports this week), but we also had the first report on third-quarter GDP, the October jobs report and a Federal Reserve meeting.

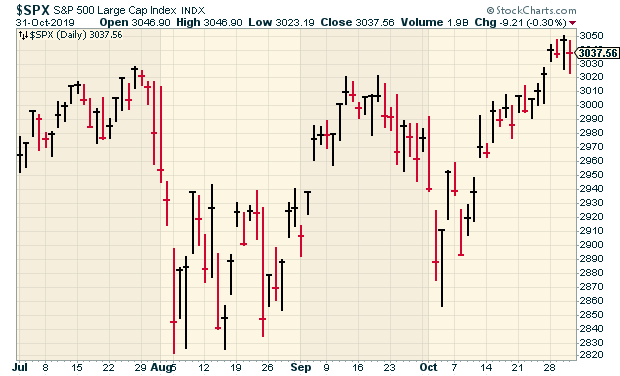

On top of that, on Wednesday, the S&P 500 closed at a new all-time high. Since the bull market began more than 10 years ago, there have been 25 breaks of 5% or more. Every single one has been turned back. Every. Single. One.

Our Buy List also hit a new high. I’m happy to see so many good earnings reports this week. In this week’s issue, I’ll go through them all. But first, I want to touch on the Fed’s news from earlier in the week.

What the Fed’s Rate Cut Means for Us

On Wednesday, the Federal Reserve decided to cut interest rates for the third time in three months. It wasn’t that long ago that the Fed was hiking rates. But what comes next?

Well, that’s not so easy to say, but the Fed gave us some clues. In its previous statement, the Fed said it “will act as appropriate” to keep the economy going. This time around, those words were missing. Instead, the Fed said it will “monitor the implications of incoming information for the economic outlook as it assesses the appropriate path.”

I happen to be fully fluent in the arcane and bizarre language of Fedspeak, so allow me to translate. The Fed said, “we’re going to chill out for a bit and watch what happens.” That makes sense. The central bank has already brought rates pretty low. In response, mortgage rates have fallen, and I think we’ll see a pick-up in housing and construction. In his post-meeting press conference, Fed Chair Jay Powell said, “We believe that monetary policy is in a good place.”

Overall, this is very good for the market and for us. Low real rates (meaning after inflation) are usually very good for stocks. Despite repeated predictions, there’s still no sign of broad-based inflation.

On Wednesday, ADP said the economy created 125,000 private-sector jobs last month. That was 5,000 more than expectations. The government’s jobs report for October will come out later today. Last month’s report had the unemployment rate at a 50-year low. Also on Wednesday, the government said that the economy grew at a 1.9% real annualized rate in the third quarter. That’s OK, but not great. It’s basically in line with the current expansion. Simply put, there’s no imminent threat of a recession.

Now let’s get to this week’s earnings reports. You can also see our earnings calendar.

Six Buy List Earnings Reports This Week

On Monday, Check Point Software (CHKP) said it made $1.44 per share for Q3. That was four cents better than estimates, Previously, the cyber-security firm had told us to expect Q3 earnings between $1.36 and $1.44 per share on revenue of $480 to $500 million. Total revenue was $491 million.

The business is going as expected. Gil Shwed, the CEO, said, “our security subscriptions continued to drive results, with 13% growth. This was underscored by expanded customer adoption of our cloud solutions.” I’m very pleased with these results.

For Q4, Check Point sees earnings ranging between $1.93 and $2.04, and revenue between $527 million and $557 million. The company reiterated its previous full-year guidance of earnings between $5.85 per share and $6.25 per share and revenue between $1.94 million and $2.04 billion. The shares jumped 3.8% on Tuesday and hit a three-month high. Check Point remains a buy up to $120 per share.

After the bell on Tuesday, Stryker (SYK) reported Q3 earnings of $1.91 per share. That beat by a penny. This was a good quarter for Stryker. Organic sales were up 8.6% to $3.6 billion.

Stryker said it now expects full-year results to be at the high end of its previous guidance. For Q4, Stryker sees earnings of $2.43 to $2.48 per share. For all of 2019, Stryker projects earnings between $8.20 and $8.25 per share. That’s an increase of five cents to the low end.

Shares of SYK rallied 3% on the news. This is one of the most dependable stocks on our Buy List. Stryker remains a buy up to $223 per share.

On Wednesday morning, Moody’s (MCO) said it made $2.15 per share for Q3. That was 15 cents more than expectations. The ratings agency has been a big winner for us this year (+57%). The key to Moody’s success is its Moody’s Analytics segment. Revenue there was up 13% last quarter.

The results were so good that Moody’s raised its full-year EPS guidance to $8.05 – $8.20. The previous guidance was $7.95 per share to $8.15 per share. The stock initially dropped on Wednesday, but it gradually made back much of the loss. This week, the stock came very close to hitting a new high. Moody’s is a very good buy up to $225 per share.

After the bell on Thursday, Cognizant Technology Solutions (CTSH) reported Q3 earnings of $1.08 per share. That was three cents more than estimates. Revenues rose 4.2% to $4.25 billion. In constant currency, that’s an increase of 5.1%, which is above Cognizant’s previous guidance of 3.8% to 4.8%.

Cognizant also said it plans to cut costs. I’m always skeptical of announcements of plans to cut costs. (Shouldn’t they always be doing that?)

“Over the past few months, we’ve sharpened Cognizant’s strategic posture and begun executing plans aimed at improving our competitive positioning,” said Brian Humphries, Chief Executive Officer. “Today we are announcing a simplification of our operating model and a cost-reduction program, which will allow us to fund investments in growth. Looking ahead, we see a clear path to unlock the organization’s full growth potential, win in our key digital battlegrounds, and return Cognizant to its historical position of being the bellwether of the IT services industry.”

For Q4, Cognizant sees revenue growth of 2.1% to 3.1% in constant currency. For the full year, CTSH sees earnings between $3.95 and $3.98 per share. That’s an increase of three cents per share to the low end. The guidance implies a Q4 range of $1.02 to $1.05 per share.

This is better news from CTSH, but remember this is after the company pared back guidance significantly earlier this year. Cognizant remains a buy up to $64 per share.

We had two earnings reports on Thursday. Let’s start with Intercontinental Exchange (ICE). The exchange owner earned $1.06 per share, which was 10 cents more than expectations. I really like this stock. For the quarter, ICE’s adjusted operating margin was 59%.

One sticking point is that the government is not pleased with the pricing power that exchanges have for their data services. That’s a big money maker for them. I don’t think this issue can be solved easily or quickly, and it will probably get settled by the courts. For Q4, ICE expects data revenue to be between $555 million and $560 million.

This week, I’m lifting our Buy Below on ICE to $100 per share.

Every earnings season, there’s a dud, and this time, that looks to be Church & Dwight (CHD). For Q3, the company made 66 cents per share. That was six cents more than the company’s own guidance. Despite the earnings beat, the shares lost 7.25% in Thursday trading.

What made traders sour on CHD? For one, the revenue figure wasn’t that good. Sales volume actually dropped a bit, but thanks to price increases, sales in dollars rose. The company expects sales growth of 5%, which is below consensus.

Church & Dwight also kept its full-year guidance at $2.47 per share. You’d think that they’d raise that after a six-cent beat. I’m lowering my Buy Below on Church & Dwight to $73 per share.

Next Week’s Buy List Earnings Reports

We have a few more earnings reports due next week.

Let’s start with Becton, Dickinson (BDX), which is due to report earnings on Tuesday, November 5. The medical-devices company gave us a scare in Ma, when it lowered its full-year guidance by 40 cents at each end to $11.65 – $11.75 per share.

Becton blamed currency exchanges plus “recent regulatory and market pressures related to paclitaxel-coated devices.” Fortunately, the last report was pretty good, and the company stood by the lower range. For next week, which is BDX’s fiscal Q4, Wall Street expects $3.30 per share. BDX should be able to beat that. Later this month, I expect Becton to raise its dividend for the 47th year in a row.

Three months ago, Broadridge Financial (BR) raised its full-year dividend from $1.94 to $2.16 per share. This was the eighth-straight year that BR has raised its dividend by double-digit percentages.

Broadridge’s fiscal year ended in June. For 2020, the company sees earnings growth of 8% to 12%. That implies a range of $5.03 to $5.22 per share. BR sees recurring-fee growth of 8% to 10% and operating margins around 18%. The earnings report is due out on Wednesday. For the fiscal first quarter, Wall Street expects 71 cents per share.

In August, Fiserv (FISV) completed its merger with First Data. In July, the company beat earnings by a penny per share. For 2019, Fiserv expects earnings to range between $3.39 and $3.52 per share. Earnings are also scheduled for Wednesday. Wall Street expects Q3 earnings of $1 per share.

Last is Disney (DIS), which is scheduled for Thursday. The company is having a great year. Not just at the box office, but on Wall Street as well. The Mouse House is about to become a giant in the world of streaming. The cord-cutting movement has morphed into the Streaming War. Disney+ will be a content powerhouse. The Street’s estimates for Q3 is 95 cents per share.

Continental Building Products (CBPX) hasn’t said yet when it’s going to report earnings. In previous years, the wallboard company has reported right about now. Just in case CBPX reports next week, Wall Street is looking for 41 cents per share.

That’s all for now. There aren’t many economic reports next week, but there will be a lot more earnings. The factory-orders report is due out on Monday. On Tuesday, the ISM non-manufacturing index is due out. Then on Wednesday, the productivity report comes out. On Thursday, the jobless-claims report comes out. The reports have come in at 250,000 or fewer for 108 straight weeks. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I was recently a guest on the Animal Spirits podcast.

Posted by Eddy Elfenbein on November 1st, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His