CWS Market Review – August 14, 2020

“Big Stock Market Numbers!” – President Donald Trump

So tweeted the president, and he’s right. The stock market has been bigly strong recently. On Wednesday, the S&P 500 closed at its second-highest level ever. The index came close to marking a new all-time high on Wednesday and again on Thursday, but finished just shy of that record at the time the closing bell rang.

I’m pleased to report that our Buy List is doing well. In fact, we’re doing even better than the rest of the market. Through Thursday, our Buy List is up 6.63% on the year (not including dividends). That’s ahead of the S&P 500, which is up 4.42% on the year. It’s still close, so I’m not ready to declare victory just yet. But it does show you how much you can do by not doing anything except buy and hold good stocks.

We just wrapped up a very good earnings season. All of our stocks but one beat expectations, and the lone exception merely met expectations. In this week’s CWS Market Review, I’ll cover our final earnings report, which was from Broadridge Financial Solutions. The company beat earnings and raised its dividend, and the shares rallied to a new all-time high. Big numbers indeed. I’ll have all the details in a bit.

While the president might be pleased with the market, the overall U.S. economy is still in a difficult spot. In this issue, I’ll discuss the recent jobs report. This week, we saw the highest report for core consumer inflation in nearly 30 years. We also saw jobless claims finally fall below one million. That had not happened for 20 consecutive weeks. I’ll also preview next week’s earnings report from Ross Stores. But first, let’s take a closer look at the jobs report.

The Economy Created 1.8 Million New Jobs — and We Need More

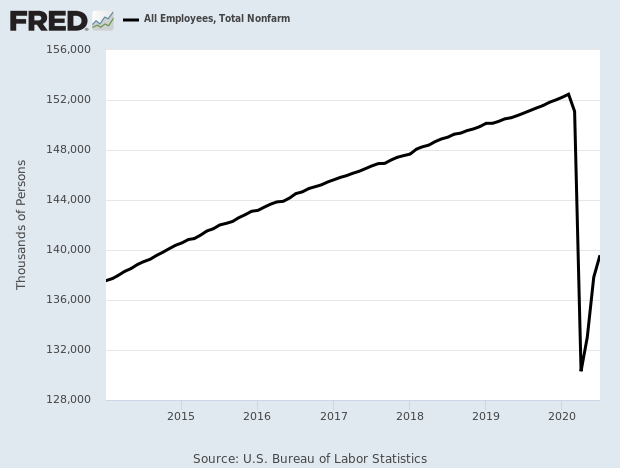

Shortly after I sent you last week’s issue, the government reported that the U.S. economy created 1.763 million new jobs last month. The expectations had been for 1.48 million. More accurately, many folks were returning to their own jobs that got axed during the lockdown. Still, it’s good to see the numbers going in the right direction.

These are huge gains in employment, but it comes after even larger losses. To be sure, the economy is a long way from where it was just six months ago. The unemployment rate is down to 10.2%. We’ve had recessions that peaked with lower unemployment rates. The number of unemployed people dropped by 1.4 million to 16.3 million.

The labor-force participation rate is 61.4%, which isn’t as bad as I had expected. Average hourly earnings rose by 0.2%. Here’s a look at nonfarm payrolls:

I’ll be frank: these numbers really aren’t about economics. They’re about the coronavirus. Where the economy is allowed to work, it can. In areas that are still locked down, it can’t.

I’m far from an immunologist, but the trends appear to be favorable. In Florida, for example, which saw a big run-up of new cases in June and July, the numbers are clearly trending downward.

For example, let’s look at leisure and hospitality, which is a crucial sector for the economy. Leisure and hospitality added 592,000 jobs in July. In May and June, the sector added 3.4 million jobs. That sounds impressive, but leisure and hospitality lost over 8.3 million jobs in March and April.

We had more good news for the jobs market on Thursday when the jobless-claims report finally fell below one million. The number of folks filing for jobless benefits fell to 963,000. That’s the first time in 20 weeks it came in under one million. Economists had been expecting 1.1 million.

While the jobs market is better, there’s still a long, long way to go.

I was most surprised this week by the strong CPI report. On Wednesday, the government reported that consumer prices rose by 0.59% in July. That was the largest monthly increase in 11 years. Wall Street had been expecting an increase of 0.3%.

This comes after a 0.57% increase in June. Before that, we had three straight months of lower prices, better known as deflation.

Wednesday’s report also showed that “core” consumer prices, which exclude volatile food and energy prices, rose by 0.62%. That’s the largest increase since January 1991. The core rate had also dropped in March, April and May, so this could be simple mean reversion.

There appears to be some nascent optimism for the U.S. economy. The housing market, for example, appears to be doing well. Also, bond yields are creeping higher. On August 4, the 10-year Treasury yield got down to 0.52%. Deutsche Bank said that Treasury yields were at a 234-year low. On Thursday, the 10-year yield got to 0.71%.

We’re also seeing another move towards cyclical stocks. By this, I mean stocks whose fortunes are closely tied to the broader economy. When cyclicals do well, that’s often—though not always—a harbinger of an improving economy.

A few weeks ago, there was a similar turn to cyclicals, but it didn’t last (see our June 5 issue). Alas, head fakes are common on Wall Street. We’re seeing another one. In fact, Industrials have actually outperformed Tech over the last three months. I would not have guessed that. Perhaps Wall Street is sensing that the economy will reopen sooner than expected.

Earlier I mentioned that the S&P 500 is up 4.42% this year. As it turns out, that’s nearly the exact long-term average for this point in the year. We’ve seen typical returns for this most atypical year.

Now let’s look at our last earnings report for the Q2 earning season.

Broadridge Beats Earnings, Raises Dividend and Hits New High

On Tuesday morning, Broadridge Financial Solutions (BR) became our final stock to report this earnings season. I had been a little nervous because Broadridge’s last earnings report was somewhat mediocre, and the one prior to that was a dud. The company missed earnings three times in a row.

I was relieved to see that this report was a good one. For its fiscal Q4, BR’s earnings rose 25% to $2.15 per share, which beat estimates by six cents per share. Recurring revenue, which is a key stat for them, rose 14% to $930 million.

Broadridge also offered guidance. For the new fiscal year, which ends on June 30, Broadridge expects earnings growth of 4% to 10%. Since the company made $5.03 per share last year, breaking out the math, that implies earnings this year between $5.23 and $5.53 per share. Wall Street had been expecting $5.44 per share.

The company also increased its quarterly dividend from 54 cents to 57.5 cents per share. That’s a 6.5% increase. This is BR’s 14th consecutive annual dividend increase. It’s not a big dividend. Based on Thursday’s close, the dividend yields 1.66%. Still, it’s better than most anything you can find in fixed income.

The shares jumped nearly 6% during the day on Tuesday and got to a new 52-week high. This week, I’m raising my Buy Below on Broadridge to $150 per share.

Earnings Preview for Ross Stores

That’s it for Q2 earnings, but we’ll soon get the earnings reports for companies with reporting quarters ending in July. We only have two such stocks on our Buy List. Hormel Foods (HRL) will report on August 25. The other, Ross Stores, will report next Thursday, August 20.

Ross Stores (ROST) is in a difficult situation. Fundamentally, it’s a sound company. However, the economic lockdown has been hard on them. Some of our Buy List stocks have been able to muddle through, but Ross has had many of its stores shut down. In fact, one of Ross’s competitors, Stein Mart, just went bankrupt.

At one point, Ross had shut all of its stores. For fiscal Q1, which ended on May 2, Ross reported a loss of 87 cents per share. Sales fell by half. The deep-discounter halted its dividend and share buybacks. None of this, however, is a reflection on the business.

The same factors hold sway over the upcoming earnings report. For its part, Wall Street expects a loss of 30 cents per share. The good news is that Ross has the money to ride this out. The company drew on its $800 million revolving-credit facility. Ross also completed a $2 billion bond offering. I’m confident Ross Stores will make a nice profit once it’s allowed to make one.

Buy List Updates

Good news from AFLAC (AFL). The duck stock said it’s going to increase its buyback authorization by 100 million shares. The current authorization is down to 21.9 million shares.

AFLAC is one of the few companies that actually reduces its share count. Many other companies buy back stock but then give executive stock options at the same time, so the funds bypass the shareholders. I’m lifting our Buy Below on AFLAC to $40 per share.

Last week, Intercontinental Exchange (ICE) said that it will buy Ellie Mae, a mortgage-services provider, for $11 billion.

ICE is buying Ellie Mae from Thoma Bravo, a private company. This is a nice pay day for them since they bought Ellie Mae last year for $3.7 billion. The deal will mostly be in cash and some will be in ICE stock.

Bloomberg had an interesting article on Bob Chapek, Disney’s (DIS) new CEO. Bloomberg describes Chapek as “using the Covid-19 crisis to transform Disney much faster than expected, all with an eye toward making the company an online juggernaut that reaches far more people worldwide.” Check it out.

That’s all for now. There’s not much in the way of economic news next week. On Tuesday, the report on housing starts is released. This is usually a good indicator of the housing market. On Wednesday, the Fed will release the minutes of its last meeting. The Fed members appear to be united in their current approach. On Thursday, we’ll get another jobless-claims report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on August 14th, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His