CWS Market Review – August 28, 2020

“There is a danger of expecting the results of the future to be predicted from the past.” – John Maynard Keynes

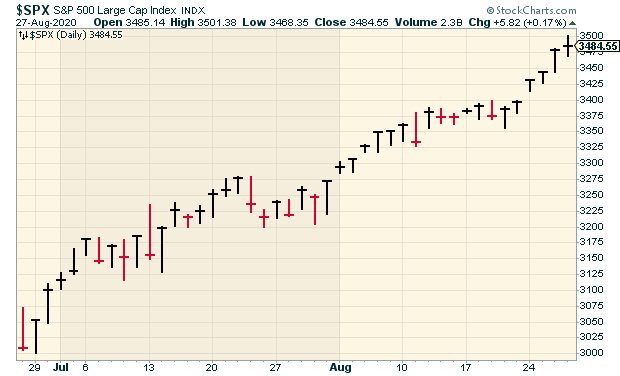

On Thursday, the stock market closed higher for the sixth day in a row, and it was the fifth all-time high close in a row. This has been an incredible run for the stock market. Over the last two months, the S&P 500 has gained nearly 16%.

This is quickly becoming the Honey Badger market—it simply doesn’t care about anything. Lockdowns, no problem. Social unrest, who cares? Mass unemployment, hold my beer. No matter what comes our way, the market just keeps going and going.

In this week’s issue, I want to discuss a recent speech by Federal Reserve Poobah Jerome Powell. Normally, I try not to pay too much attention to what the Fed says, but this time, it’s worth some closer inspection. I’ll break it all down for you.

We also had a good earnings report from Hormel Foods. The Spam folks beat expectations. I’ll have a summary. I also have some new Buy Below prices for you.

The Fed Ditches Its 2% Inflation Target

The Federal Reserve is holding its annual shindig in Jackson Hole, Wyoming. This event is sponsored by the Kansas City Fed, and it’s notable because the Fed has historically used the late-summer conference to announce important policy changes.

The theme this year is “Navigating the Decade Ahead: Implications for Monetary Policy.” I know, it sounds kind of dry, but this year’s conference is worth some attention. More specifically, I’m referring to Powell’s speech on Thursday, which was entitled “New Economic Challenges and the Fed’s Monetary Policy Review.”

Let me pause for a moment to warn you that central bankers are bred to speak in convoluted jargon. Some of this is by design. It’s a nice advantage to have when no one understands what the heck you’re talking about. Former Fed Chairman Alan Greenspan once said, “If I’ve made myself too clear, you must have misunderstood me.”

Fortunately, your humble newsletter writer is well versed in the arcane dialect of Fedspeak, so I can translate it for you. In his remarks, Powell said that the Fed will shift its emphasis when deciding to adjust interest rates. Previously, the Fed stressed the need to raise interest rates early in an effort to combat inflation. The feeling was that inflation needed to be fought before it showed up.

Powell now says that’s no longer needed. The battle against inflation is over. Just looking at recent history, the threats to the U.S. economy have been a pandemic and a financial crisis. For the most part, inflation has been safely bottled up. With this, the Fed is ditching its 2% inflation target.

In 2012, the Federal Reserve adopted a policy of targeting inflation at 2%. They weren’t alone. Many central banks around the world adopted similar policies. The benefit of targeting inflation is that it gave the public a clear view of what the Fed was trying to do. With this, the Fed got better (much better) at communication, and the Fed also has improved its transparency.

The Fed has undershot 2% inflation so consistently that no one bats an eye anymore. At root, Powell is officially adopting a policy that’s already existed. The Fed’s just admitting it. Powell cited four major changes in the Fed’s understanding of the economy. One is that normal economic growth is now assumed to be much less than what it had been. During latter third of the 20th century, the U.S. economy routinely grew by 3% per year in real terms. Not anymore. Now we’re lucky if we can get 2%.

The Fed also assumes that interest rates now need to be much lower than they have been. Under the old playbook, during an expansion, the Fed would raise interest rates to 2% or 3% above inflation. During a recession, it would cut rates to about the level of inflation. That hasn’t been the case in over 10 years.

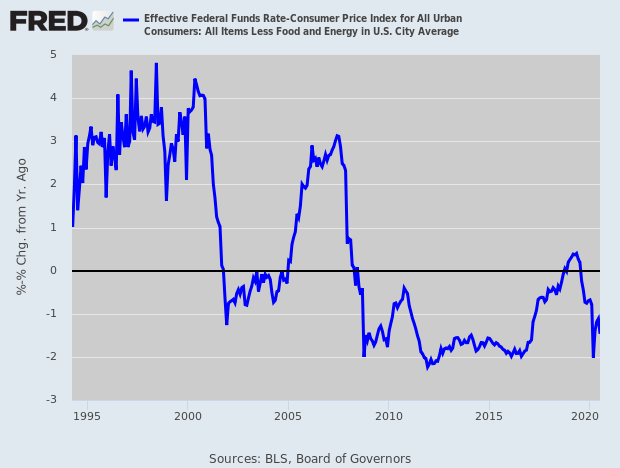

Here’s a look at real short-term interest rates. Notice how much lower they are than in years past.

Economists speak of the natural rate of inflation. This is the rate at which everything comes into balance. No one knows exactly what the natural rate is, but it’s widely understood that whatever it is, it’s much lower than where it used to be.

Powell also noted that before Covid-19, the labor market was doing quite well. The unemployment rate dropped to a 50-year low. Even when the labor-force participation rate started to rise, it did absolutely nothing to spark inflation. How times have changed. In the 1980s, bond investors would have totally freaked out.

One problem with lower inflation is that the Fed has had less room to boost the economy with rate cuts. That explains why the Fed has embarked on some non-traditional policies.

To be blunt, the Fed needs some inflation. Powell said:

“Our new statement indicates that we will seek to achieve inflation that averages 2 percent over time. Therefore, following periods when inflation has been running below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

To be clear, the Fed wants inflation to average 2%, but it’s not going to worry if it rises above 2%.

What does this mean for us? It’s good news. For one, I don’t like to see central bankers wedded to outmoded ways of thinking. Theories should fit the facts, not the other way around.

It’s also good to keep interest rates low. The Fed has killed many stock rallies with overly aggressive rate hikes.

Most importantly, stocks have performed well under modest inflation. I’ve run the numbers and found that inflation doesn’t became a problem for stocks until it hits 5.7%, and we’re a long way from there.

The story out of Jackson Hole simply confirms what we all knew. The Fed was never going to sacrifice the health of the U.S. economy in order to preserve some random inflation target.

Now let’s look at our one Buy List earnings report from this week.

Hormel Foods Beats Earnings

On Tuesday, Hormel Foods (HRL) reported fiscal Q3 earnings of 37 cents per share. That beat Wall Street’s estimate of 34 cents per share. This was for the quarter that ended on July 31.

Looking at the numbers, this was a solid quarter for Hormel. Overall sales rose 4% to $2.4 billion. Sales volume also rose by 4%. That’s important, because you don’t want to rely overly on price increases. Hormel’s operating free-cash flow rose 72% to $242 million. That’s a good sign.

“We had an excellent third quarter with strength across our retail and deli businesses, along with a rebound in our foodservice business,” said Jim Snee, chairman of the board, president and chief executive officer. “The intentional balance we have built across our portfolio has once again enabled us to generate stable cash flows in a very dynamic time period, even as we absorbed significant incremental costs in our supply chain due to the COVID-19 pandemic.”

Here’s how the quarter broke down by Hormel’s different business units:

Refrigerated Foods

Volume up 8%; organic volume up 7%

Net sales up 5%; organic net sales up 2%

Segment profit down 11%

Grocery Products

Volume up 6%

Net sales up 7%

Segment profit up 36%

Jennie-O Turkey Store

Volume down 9%

Net sales down 4%

Segment profit down 67%

International & Other

Volume down 5%

Net sales up 2%

Segment profit up 26%

I also like that Hormel has a solid balance sheet. Its cash on hand is now $1.7 billion. That’s up from $0.7 billion a year ago. The big gain is due to the bond offering and also halting share buybacks. Total debt is up to $1.3 billion from $0.3 billion a year ago.

For Hormel’s outlook, Snee said he expects to see the current quarter mirror the strength of Q3, but he was cautious to add that it’s an uncertain environment. He also said he expects the food service to post a year-over-year decrease for Q4.

HRL pulled back, but that’s after a pretty nice run. Hormel remains a buy up to $53 per share.

That’s it for our Buy List earnings report. The next stock to report is FactSet (FDS), and it won’t report until September 24. RPM International (RPM) will probably report in early October. Things won’t get busy again until the Q3 earning season heats up in mid-October. Now let’s look at some updates to our Buy Below prices.

Buy List Updates

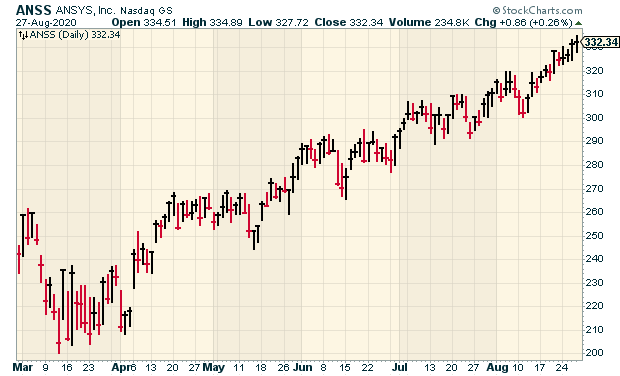

Shares of Ansys (ANSS) got to another new high on Thursday. We now have a 29.1% gain in ANSS this year. This week, I’m raising our Buy Below on Ansys to $340 per share.

Shares of Globe Life (GL) have been trending higher recently. The insurance company recently resumed its share repurchases. GL’s last earnings report was pretty good, and the stock is only going for about 12 times estimates earnings. I’m raising my Buy Below on Globe Life to $90 per share.

I covered the recent earnings report from Ross Stores (ROST) in last week’s issue. The deep-discounter surprised us by reporting a small profit. Ross was widely expected to report a loss. I held off on changing our Buy Below price. Now that I’ve had more time to consider it, I’m going to lift our Buy Below on Ross Stores to $98 per share.

That’s all for now. There are some important economic reports due out next week. On Tuesday, the ISM Manufacturing Index comes out. It will be interesting to see if the economy is still rebounding. On Wednesday, the ADP releases its payroll report. On Thursday, we’ll get to see another initial-jobless-claims report. Then on Friday, the August jobs report comes out. For July, the unemployment rate was 10.2%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Please join me for a webinar this Tuesday, September 1 at 4 p.m. ET. Noah Hamman, the CEO of AdvisorShares, will be joining me. Noah is an expert on all things ETF. You can register here.

Posted by Eddy Elfenbein on August 28th, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His