CWS Market Review – February 19, 2021

”If the job has been correctly done when a common stock is purchased, the time to sell it is—almost never.” – Philip Fisher

Thursday was the worst day this month for the S&P 500, but it was only a loss of 0.44%. The real takeaway from that fact is that the market hasn’t had many bad days this month. Volatility has been quite low. In fact, last Friday, the Volatility Index closed below 20 for the first time in more than a year.

This has been a steadily climbing market.

In this week’s CWS Market Review, I’ll go over our recent earnings reports. Moody’s became our first earnings miss this season. Despite the miss, the company offered promising guidance for this year, plus a dividend hike.

Both Zoetis and Stepan beat Wall Street’s earnings consensus. Zoetis also had an optimistic forecast for this year. Sherwin-Williams announced a 23% dividend hike, plus it will buy back 15 million shares of SHW. I’ll get to all that in a bit, but first, I want to focus on some the underlying currents driving this market.

Energy Stocks Have Been Soaring

I hope all our friends in Texas are doing well. The news reports are very troubling. The deep freeze caused mayhem for the Lone Star State, and it also had an impact on commodity markets. In certain areas, natural-gas futures soared. In Oklahoma, for example, the price for natural gas rose to $999 per million BTUs. Last week, it was at $4. Almost as quickly, prices plunged back to earth. For a moment, I thought natgas was going to displace GameStop as the hottest trade in town.

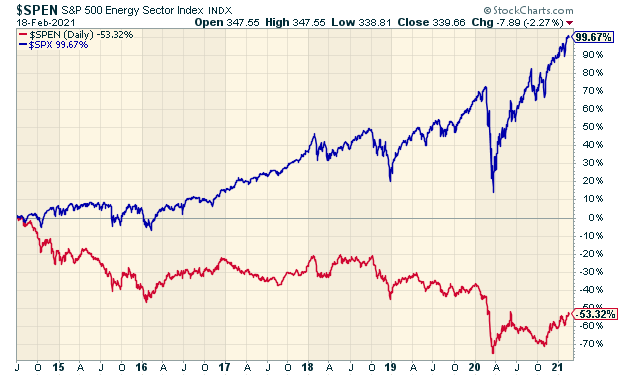

Broadly speaking, this has been a very good time for energy stocks. I say that with some hesitation, because it’s more accurate to say that energy stocks are bouncing off a very depressed low. Since late October, the S&P 500 Energy Index is up 62%. (Yes, that little red uptick in the chart below is a big gain.) While that sounds impressive, the index is still less than half its peak from seven years ago.

It’s taken a 62% rally to get up to down by half. (Old Wall Street joke. What’s a 90% loss? It’s a stock that’s down 80%, and then gets cut in half.) At the same time, the S&P 500 has doubled.

Last week, I told you how low-quality stocks were being richly rewarded by this market. A few weeks before that, I mentioned how the market has shifted from defensive stocks to offensive ones. These two trends are related, and I wanted to explain this in more detail. Higher-quality stocks tend to be more defensive in nature.

For example, Church & Dwight (CHD) is one of our worst-performing stocks this year. It’s down a little over 4%. Am I worried? Please. Not at all. C&D hasn’t done anything wrong except be a high-quality defensive stock when that’s out of favor. I’m guessing that these “quality” indexes and funds don’t have many energy stocks, which are loaded up with long-term debt.

The important point for us is that the market apparently believes that the economy is getting better. Or more precisely, it’s getting better than what was previously projected. Despite the orderly climb that the market is showing on the surface, it’s really making a very calculated, and somewhat risky, bet on the economy.

We can see supporting evidence over in the bond market. This week, the 10-year Treasury got all the way up to 1.3%. (It’s odd to describe 1.3% as “all the way,” but here we are.) Just over six months ago, the 10-year was yielding 0.5%.

In fact, the 10-year has a lot more room to climb before I would even say that it’s low. Of course, it helps that the Federal Reserve is gobbling up a billion in bonds each month. Consider that the 10-year Treasury Inflation Protected bond is now yielding -0.875%. A little over two years ago, the 10-year TIPS was going for more than 1%.

What happened is that COVID made everybody and everything more defensive, and now that’s unwinding. Defensive stocks are out, and cyclicals are in. I don’t advise on trying to capitalize on this shift. The market is very fickle. (Seen GameStop lately?). Instead, I want you to be aware of what’s happening.

Our strategy is to focus on outstanding companies going for good prices. We have lots of them on our Buy List. Now let’s look at our recent earnings reports.

Earnings from Moody’s, Zoetis and Stepan

We had two more Buy List earnings reports this week, plus Moody’s came out late last week. Here’s our updated Earnings Calendar:

| Stock | Ticker | Date | Estimate | Result |

| Silgan | SLGN | 26-Jan | $0.53 | $0.60 |

| Abbott Labs | ABT | 27-Jan | $1.35 | $1.45 |

| Stryker | SYK | 27-Jan | $2.55 | $2.81 |

| Danaher | DHR | 28-Jan | $1.87 | $2.08 |

| Sherwin-Williams | SHW | 28-Jan | $4.85 | $5.09 |

| Church & Dwight | CHD | 29-Jan | $0.52 | $0.53 |

| Thermo Fisher | TMO | 1-Feb | $6.56 | $7.09 |

| Broadridge Financial Sol | BR | 2-Feb | $0.70 | $0.73 |

| AFLAC | AFL | 3-Feb | $1.05 | $1.07 |

| Check Point Software | CHKP | 3-Feb | $2.11 | $2.17 |

| Hershey | HSY | 4-Feb | $1.43 | $1.49 |

| Intercontinental Exchange | ICE | 4-Feb | $1.08 | $1.13 |

| Fiserv | FISV | 9-Feb | $1.29 | $1.30 |

| Cerner | CERN | 10-Feb | $0.78 | $0.78 |

| Disney | DIS | 11-Feb | -$0.42 | $0.32 |

| Moody’s | MCO | 12-Feb | $1.97 | $1.91 |

| Zoetis | ZTS | 16-Feb | $0.87 | $0.91 |

| Stepan | SCL | 18-Feb | $1.08 | $1.42 |

| Trex | TREX | 22-Feb | $0.36 | |

| Ansys | ANSS | 24-Feb | $2.54 | Middleby | MIDD | 24-Feb | $1.40 |

| Miller Industries | MLR | TBA | n/a |

Let’s start with Moody’s (MCO). The credit-ratings agency reported on Friday morning. For Q4, Moody’s made $1.91 per share. That was six cents below consensus. This is our first and only earnings miss this season. For Q4, revenues rose 4.6% to $1.29 billion. Wall Street had been looking for $1.22 billion.

Robert Fauber, the President and CEO, said, “MIS had another strong quarter with a favorable issuance mix from leveraged loans and infrequent bank issuers. Our MA team delivered growth by staying close to the customer, driving subscription sales and high retention.”

Moody’s provided an upbeat forecast for this year. The company sees 2021 earnings ranging between $10.30 and $10.70 per share. Wall Street had been expecting $10.34 per share. The company said it sees revenue growth in the “mid-single-digit percent range.”

Moody’s also raised its quarterly dividend by 11% to 62 cents per share. Moody’s remains a buy up to $290 per share.

On Tuesday, Zoetis (ZTS), one of our newbies this year, reported Q4 earnings of 91 cents per share. That topped Wall Street’s estimate of 87 cents per share. Quarterly net revenue rose by 8% to 1.8 billion. For the full year, Zoetis made $3.85 per share.

CEO Kristin Peck said, “We grew revenue 9% operationally, which is once again above market growth in a competitive, global sector. We also grew our adjusted net income faster than revenue, at 10% operationally.”

Once again, we got an optimistic forecast for this year. Zoetis sees 2021 revenues between $7.40 billion and $7.55 billion, and EPS between $4.36 and $4.46. Wall Street had been expecting earnings of $4.26 per share on revenues of $7.11 billion.

Shares of ZTS got a nice bump after the report. Zoetis is a buy up to $180 per share.

Finally, we had earnings for Stepan (SCL). On Thursday, the chemical company reported Q4 earnings of $1.42 per share. That creamed Wall Street’s estimate of $1.08 per share. For last year’s Q4, Stepan made $1.10 per share. Sales volume increased by 7%.

For all of 2020, Stepan made $5.68 per share. That’s up from $5.12 per share in 2019. Sales rose 3%. This is a very solid company. Don’t let its apparent dullness fool you. It just had a record year. Also, Stepan had negative net debt at the end of the year. The company’s cash balance of $349.9 million exceeds its total debt of $198.7 million.

CEO F. Quinn Stepan, Jr. said:

“Despite significant challenges during the year, inclusive of the global pandemic and the first-quarter 2020 power-plant outage at our Millsdale, IL facility, the Company delivered record fourth-quarter and full-year earnings. Both full-year adjusted net income and adjusted EPS were up 11% versus the prior year. Surfactant fourth-quarter operating income was up 28% on the strength of 8% volume growth, which was mostly attributable to strong demand in consumer-product end markets driven by the fight against the COVID-19 virus. Our polymer business was up significantly during the quarter due to the Millsdale insurance recovery. Excluding the insurance recovery, our polymer business was up 12% due to strong European rigid polyol growth. Our specialty-product-business results were up slightly in the fourth quarter.”

Stepan has increased its dividend for 53 years in a row, and it looks like we’ll see #54 later this year. Stepan is a buy up to $134 per share.

Four Buy List Earnings Next Week

We have four more Buy List earnings reports next week. Three are in the normal Q4 earnings season, but also have HEICO, whose Q1 ended on January 31.

Let’s start with Trex (TREX), which is due to report on Monday. Not only was Trex our best-performing stock last year, but the deck company is off to a strong start this year as well (+22.25%).

Trex didn’t provide guidance for Q4, but it said it sees sales ranging between $210 million and $220 million. At the midpoint, that’s a 30% increase. Excluding some charges, Trex’s gross margins are running close to 40%. That’s very good. For Q4, wall Street expects earnings of 30 cents per share. My magic crystal ball says it will be closer to 35 cents per share.

For 2021, Trex expects double-digit sales growth (btw, they’re low-balling). The company also reinstated its share-buyback program. The stock is currently above our Buy Below price. I may raise it next week, but I want to see the earnings report first.

HEICO (HEI) is one of our new stocks this year. It’s actually returning to our Buy List after a three-year absence. The company is due to report earnings on Tuesday.

HEICO is the kind of niche business I love. The company makes replacement parts for the airline industry. Sexy, right? Well, not exactly, but let’s consider a few things. If a commercial aircraft needs some obscure new part, the airline can’t run down to the local hardware store. Instead, it needs to special-order it. Moreover, there’s a great deal of cost pressure on the airlines to keep the older planes serviceable.

Also, the aircraft parts often need to meet strict regulatory guidelines. The part maker really has to know what it’s doing. That’s where HEICO comes in. The business is lean and well run.

The aviation sector was hit hard by COVID. HEICO managed itself well. The company made $2.29 per share for its last fiscal year, which is down a bit from the $2.39 per share it made the year before. For Tuesday, Wall Street expects HEICO to report earnings of 48 cents per share.

Ansys (ANSS) is another nice winner for us this year (+7.15%). Three months ago, Ansys reported earnings of $1.36 per share. That beat the Street by 10 cents per share.

For Q4, Ansys expects revenues between $542.3 million and $582.3 million and earnings between $2.36 and $2.67 per share. That’s a pretty wide range. For all of 2020, Ansys sees revenues between $1,610.0 million and $1,650.0 million, and earnings between $6.09 and $6.40 per share.

Business is going well for Ansys. I expect to see more good numbers from them. The company is due to report on Wednesday.

Technically, I don’t know when Middleby (MIDD) is due to report, but I’ve seen some sources say it will be on Wednesday. (The company’s calendar of events is still blank. As I often say, some companies are better at shareholder communication than others.)

Middleby had a very strong Q3 earnings report in November. Wall Street had been expecting $1.04 per share and Middleby beat that by 30 cents per share. Traders loved the news. The stock jumped 17% in one day.

If you’re not familiar with Middleby, the company makes kitchen equipment for hotels and restaurants. Think big ovens and grills, and stuff with conveyer belts.

The stock got demolished last year during the market wipeout in February and March. The stock has more than tripled from its 52-week low. CEO Tim FitzGerald said, “We delivered record cash flows, improved profitability, and enhanced our capital structure for the long-term.” For Q4, Wall Street expects $1.09 per share.

Sherwin-Williams Hikes Dividend by 23%

More good news from Sherwin-Williams (SHW). Three weeks ago, the paint people gave us a very solid Q4 earnings report. Sherwin also announced a 3-for-1 stock split.

This week, Sherwin announced a 23.1% dividend hike. The quarterly payout will rise from $1.34 per share to $1.65 per share. That’s a hefty increase, and its SHW’s 43rd annual hike in a row. The new dividend is payable on March 12 to shareholders of record on March 1, 2021.

If that’s not enough, Sherwin’s board approved another 15 million shares to be bought back by the company. This week, I’m lifting our Buy Below to $750 per share. Our Buy Below price will split along with the stock.

That’s all for now. We’re headed into the last part of earnings season. There will be a few key economic reports next week. The consumer-confidence report comes out on Tuesday, followed by the new-home sales report on Wednesday. On Wednesday, we’ll get another jobless-claims report. The last one was for 861,000. That was the highest in a month. Also on Thursday, the government will revise its Q4 GDP report. The initial report showed economic growth of 4%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on February 19th, 2021 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His