CWS Market Review – August 10, 2021

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year.)

I’m often asked how investors can go about finding good investing opportunities. Last week, I mentioned one of my favorite strategies, and it’s one of the easiest. That is, find a superior company and wait for its stock to crash and burn.

In last week’s issue, I used Clorox (CLX) as an example. The bleach company has been a powerhouse for many years, but its stock hasn’t done much lately, and it got clocked after its last earnings report. That gets my attention.

Of course, that’s only the first step. We still need to discern if the problem the company is experiencing is temporary and fixable or if it’s more serious. As we know, the market likes to panic first and ask questions later. But better companies are usually better at fixing their problems.

The Trade Desk Soars 70% in Two Months

Clorox isn’t the only company like this that I’ve highlighted. In our issue from May 11, I told you about The Trade Desk (TTD). The day before, the stock got a super-atomic wedgie from traders and it plunged 26% in one day.

As I wrote, “Thanks to yesterday’s train wreck, this sounds like a good opportunity to take a closer look at this stock that’s still not very well-known.”

Nice timing. The Trade Desk is up 70% since then, including a blow-out earnings report yesterday. To be fair, I never said to expect a rally like that. Instead, I talked about the company and said that its stock is worth a look.

So what do they do? The Trade Desk markets a software platform that’s used by digital ad buyers to build data-driven advertising campaigns. In other words, they help companies get the most bang for their buck on the web.

The Trade Desk offers a real-time bidding technology platform that allows media buyers to target specific audiences with customized ads. Users can manage their digital ad campaigns in real time. They can even use third-party data to optimize their strategies. This saves a lot of time and money for companies’ media strategies.

Business has been very good. Three months ago, when the stock tanked, The Trade Desk reported an 80% earnings beat. Revenues beat as well, and the company announced a 10-for-1 stock split.

There’s been some misunderstanding about The Trade Desk’s business. That’s because some investors seem to think that it can easily be blown out by giants like Google or Facebook. That’s not true and this highlights the key difference that The Trade Desk offers. If a company wants to advertise with, say, Google, then they go to Google. If a company wants to advertise with Facebook, then they go to Facebook.

But if a company wants to use The Trade Desk, then it can tell them that the best and most cost-effective place for them is The New York Times or The Wall Street Journal or Hulu or any number of places.

The Trade Desk isn’t a direct competitor to Google or Facebook. The company can and has partnered with just about anybody. I’m amazed by how enormously profitable this business is. The Trade Desk’s gross margins are close to 80%.

That brings us up to yesterday when the Trade Desk announced earnings, and it was another massive beat. For Q2, TTD made 18 cents per share. That was nearly 40% higher than expectations. The stock jumped 7.6% today.

Sadly, the big rally means the stock isn’t quite so attractive as it was but shares of Clorox haven’t moved much after the stock’s recent tumble. Good companies fix their problems.

There Are Now 10 Million Job Openings

On Friday, the Bureau of Labor Statistics released the jobs report for July, and it was a strong one. According to report, the U.S. economy created 943,000 net new jobs last month. That’s huge. The consensus was for a gain of 870,000 jobs.

Not only that, but the numbers for May and June were revised higher. Over the last six months, the economy has added more than four million new jobs. In July, private sector payrolls rose by 703,000 while the government added 240,000 new jobs.

Among sectors, the big winner last month was leisure and hospitality which added 380,000 jobs. Of that, 253,000 came in bars and restaurants.

The unemployment rate ticked down to 5.4%. The labor force participation rate increased to 61.7%, and average hourly earnings rose by 0.4%. A key stat I like to watch is the unemployment rate for discouraged workers. Last month, that fell to 9.2% from 9.8%.

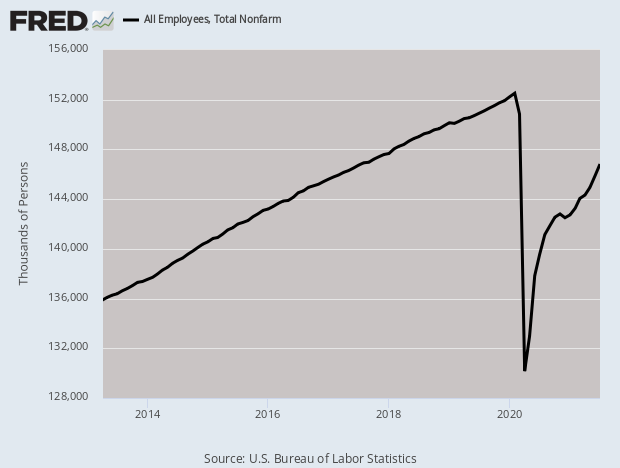

As good as these numbers are (and they are good), the larger story is the same. We have a long way to go to get back to normal. In two months last year, the economy lost 22.4 million jobs. In the 15 months since then, the economy has added 16.7 million jobs. We’re digging ourselves out of a giant hole.

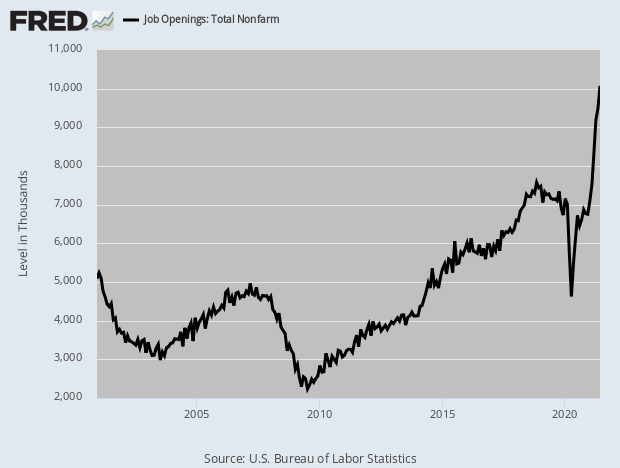

We’re at an odd point in the economy. There are tons of places looking to hire yet there are still millions of people out of work. Yesterday, the government released its monthly JOLTS report. That stands for Job Openings and Labor Turnover Summary. It said that in June, there were 10.1 million job openings. That’s an all-time record.

Wall Street was expecting 9.28 million. This was the sixth-straight monthly increase for job openings. There are now more job openings than available workers. Quits rose to 3.9 million from 3.6 million. According to Tuesday’s report on small businesses, 57% of small businesses “said they had few or no qualified applicants for open jobs in July, up one point from June.”

One stat I like to track is quits as a percentage of total separations. That includes firings, layoffs and retirements. This is known as the “take this job and shove it” indicator. In June, it got to an all-time high.

So why is there a big gap between jobs and workers? One factor is simple mismatch. The kinds of jobs being offered aren’t the kinds that people are looking for. One good factor is that more Americans were looking for work. Last April, the labor force participation rate dropped to 60.2%. For July, it’s up to 61.7%. Again, it has a long way to go. Government benefits may have also played a role in dampening hiring. Of course, many people may still be too afraid to return to the office due to Covid.

One benefit of this demand for labor is that wages have started to rise. Unfortunately, inflation has been eating up much of that increase. In fact, according to one Harvard economist, inflation has taken up all the gains for workers. (Have you noticed that the price for coffee has been rising?)

Jason Furman says that adjusting wages for the employment cost index, workers are being paid less than they were in December 2019. According to Furman, “The hot economy is heating prices more than it is heating wages.” We’ll learn more tomorrow morning when the monthly CPI report comes out. In the last four months, the CPI has increased by 3%. We’ll soon find out how transitory “transitory” truly is.

The Dow Breeches 20 Times Gold

On Monday, the Dow Jones Industrial Average crossed an important threshold. The index passed 20 times the price for an ounce of gold.

This is noteworthy for a few reasons. One is that the Dow/Gold Ratio reached its low almost exactly 10 years ago. On August 20, 2011, the Dow was going for just 5.7 times the price for gold. That means that over the last decade, the Dow has lapped gold almost four times. One prominent analyst said that the Dow and gold would eventually reach parity!

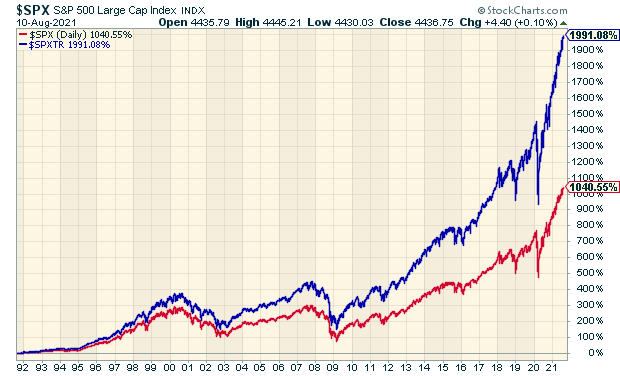

The Dow/Gold Ratio actually understates how well stocks have done because it doesn’t include dividends. Some people scoff at this, but not me. Dividends make a huge difference to long-term returns.

Over the last 30 years, the S&P 500 is up 1,040%. But the S&P 500 Total Return Index, which includes dividends, is up 1,991% over the same time. All those little payouts each quarter really do add up, especially if they’re reinvested.

Speaking of gold, next week we’ll celebrate (or commiserate, depending on your view) the 50th anniversary of President Nixon severing any link between the U.S. dollar and gold. On August 15, 1971, Nixon ditched the gold standard, boosted tariffs and announced a 90-day freeze on wages and price. We’ve been in a world of free-floating currencies for half a century. (If you’re interested, my friend Gary Alexander, has more on this episode.)

Nixon’s plan was very popular among voters and on Wall Street. Stocks rallied the next day. Using gold’s official price of $35 per ounce, that means that 50 years ago, the Dow/Gold Ratio was 24. In less than eight years, that ratio fell to 1.0.

I’m often asked my opinion on gold and I’m not much of a fan. I have nothing against it, but gold is highly volatile. The price of the gold tends to move in dramatic spikes. I’d rather own productive assets with revenue streams. Here’s more of what I’ve written on gold.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

Posted by Eddy Elfenbein on August 10th, 2021 at 7:24 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His