CWS Market Review – February 15, 2022

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Why You Should Avoid Market-Timing

Although the stock market will be closed this Saturday, it will mark two years since the stock market peaked before Covid-19 changed the world. On February 19, 2020, the S&P 500 closed at 3,386.15. Then all hell broke loose. The index fell for seven days in a row, and that was only the beginning.

In a dramatic stretch of 23 trading days, the S&P 500 lost 34%. Within a few days, the S&P 500 experienced its second-, fifth- and 13th-worst percentage days in history. If that’s not enough, the index also had its fourth-, 11th- and 19th-best days in history.

There has been nothing like that market in decades. On March 12, the Dow lost 2,350 points. Four days later, it fell another 3,000 points. Of the six worst daily point losses in the history of the Dow, five of them came during a nine-day period. The whole world, it seemed, was losing its mind. I remember how scary it was.

The S&P 500 eventually bottomed at 2,237.40 on March 23. Three years of gains were wiped out in a single month.

Yet, almost as remarkably, the market staged a dramatic turnaround. It turns out that magical things can happen when our friends at the Fed pull out all the stops. By June 8, the S&P 500 had rallied nearly 1,000 points, or 44%, off its low. In just 11 weeks, the market had made back 86% of what it had lost. By August, the market reached a new all-time high. It took less than five months to make back everything it had lost.

Where am I going with all of this? I can faithfully say that I didn’t see either event coming. Nor did anyone else. Yet by being fully invested, we survived the crash and the recovery. In fact, we’ve gone on to make some nice profits since then. I don’t have any profound takeaway from the events of two years ago except to say that it’s a good reminder to avoid trying to time the markets. The market can be far more temperamental than you can imagine.

I’m reminded of the words of Bernard Baruch, “Don’t try to buy at the bottom and sell at the top. It can’t be done, except by liars.”

The Fed Needs to Prove It Is Serious

Speaking of things temperamental, let’s turn to the U.S. economy. In last week’s issue, I said that if Friday’s inflation report comes in hot, then Wall Street will not take it well. Well, that’s exactly what happened. The U.S. government said that inflation had reached a 40-year high. The S&P 500 fell on Friday and again yesterday.

The real action, however, came in the futures pits. Within a few days, the odds of a 0.50% rate hike in March by the Federal Reserve went from a longshot to a very real probability. The latest prices I saw place the odds of a half-point increase at 57%. Before that happens, the Fed will need to announce that it has halted all of its bond buying. That could happen any day.

James Bullard, the top banana at the St. Louis Fed, has suggested that the Fed needs to hike by 0.5% at its next two meetings. He said that the Fed’s credibility is at stake. I’m afraid he may be too late on that. He appears to be in the minority. The odds of four rate hikes by May are currently at 10%. There’s a good chance that the Fed will target overnight rates at 1.50% to 1.75% by this summer. Even that is still well below inflation.

The Fed must do two things. First, it needs to convince Wall Street that it’s seriously committed to fighting inflation. So far, that’s not been the case. Second, it needs to prove to investors that it’s left the “transitory” language behind. That was a big mistake for the Fed and the data has proved them wrong.

Today, in fact, the government said that the Producer Prices Index rose by 1% in January. This data series is important because inflation tends to appear here before it works its way down to consumers. Over the past year, the PPI is up by 9.7%. That’s close to an all-time record. To give you an idea of how much things have changed, a year ago, the 12-month PPI rate was just 1.6%.

Before the Financial Crisis, setting interest rates for the Fed wasn’t that hard. When the economy was in rough shape, you needed to bring interest rates down to being in line with the rate of inflation. When the economy was booming, you then brought rates to about 3% above the rate of inflation. Of course, I’m oversimplifying, but not by much. That’s pretty much what the Fed did for many decades, until the crisis of 2008-09.

Right now, inflation is running much higher than interest rates. To get back to anything resembling normal would require much higher interest rates and much lower inflation. The problem with inflation is that once you see it, it’s already too late. It needs to be fought early and hard. Another issue is unanimity within the Fed. Some members appear to be unconvinced that inflation is a major problem.

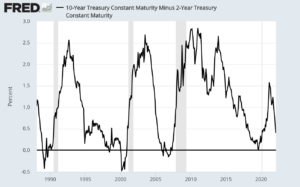

The five-year “breakeven” rate, which is basically the market’s guess as to what the annual inflation figure will be over the next five years, is currently a tad below 3%. If you’ve been reading me for some time, you’ll know that I’m a fan of watching the spread between the two- and the 10-year Treasuries. That has had a better track record of predicting the economy than a roomful of Nobel laureates. Notice how the spread has gone negative just before each of the last four recessions (the shaded areas).

The 2/10 Spread has dropped down to 40 basis points. This is very unusual and it’s the kind of thing you’d see late in a business cycle. Does this mean that the Fed is close to pushing the yield curve negative? For now, we can’t say for certain, but it is cause for concern.

Either way, this calls for two things. One is that the Fed needs to be clear about its intentions to fight inflation. The other is for investors to adopt a defensive posture. This has already been a tough year for many growth stocks, and it could soon get worse. Speaking of high-quality defensive stocks…

Zoetis Is a Buy up to $210 per Share

We’ve had a very good Q4 earnings season for our Buy List, and that continued today with a nice earnings report from Zoetis (ZTS).

If you’re not familiar with Zoetis, it’s the world’s leading animal health company. Zoetis was spun off from Pfizer a few years ago. Today, the company has more than 12,000 employees and last year had revenues of $7.8 billion. Here’s a recent interview the CEO did with Jim Cramer.

Zoetis is also an excellent example of our style of investing. We added the company to last year’s Buy List, and it was an immediate flop. By March, we had a 12% loss in Zoetis. Still, business was doing well. As we know, stock traders can be a fickle bunch, so I wasn’t too worried about the poor share performance. This is the business we’ve chosen. ZTS then turned around and rallied strongly. By the end of the year, ZTS had made a 47% gain for us. (By the way, have I mentioned that we have a premium newsletter? You can sign up for it here.)

Once again, business is looking good, and the stock has been lousy so far in 2022. For Q4, the company said it made $1 per share. That was four cents better than Wall Street’s consensus. Quarterly revenue rose 9% to $2 billion. For the whole year, Zoetis made $4.70 per share. That’s an increase of 25% over 2020.

“In 2021, Zoetis delivered its strongest performance ever, thanks to our innovative, diverse and durable portfolio, and the talent and commitment of our colleagues,” said Kristin Peck, Chief Executive Officer of Zoetis. “We grew revenue 15% operationally, which is once again above the expected market growth rate in the $45 billion animal health market. We also grew our adjusted net income faster than revenue, at 19% operationally, while continuing to support investments in our latest product launches and future pipeline of innovations.”

“Looking forward, we believe this momentum sets us up for a strong 2022. We expect to continue growing revenue faster than the market in the coming year, driven by continued strength in petcare; expansion of our diagnostics portfolio internationally; and significant growth in both livestock and companion animal product sales in emerging markets, including China and Brazil. As a result, we are guiding to full-year operational growth of 9% to 11% in revenue,” said Peck.

For Q4, sales in its U.S. business were up 9% to $1.04 billion. Sales in the international segment were up 8% to $902 million.

Zoetis recently received approval in the U.S. for Solensia, the first injectable mAb for the control of pain associated with osteoarthritis in cats. It’s also approved in the European Union, the U.K., Canada and Switzerland. Kristin Peck noted that spending on pets has increased and spending per visit to the vet has increased.

Now let’s look at guidance. For 2022, Zoetis sees revenues ranging between $8.325 billion and $8.475 billion. The company also sees earnings ranging between $5.09 and $5.19 per share. That’s earnings growth of roughly 8% to 10%. (In last week’s premium issue, I predicted $5.05 to $5.20 per share.)

That’s a bold forecast and it tells me that we don’t have to worry about the stock’s downturn in January and February. This week, I’m lowering our buy below price on Zoetis to $210 per share.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

Posted by Eddy Elfenbein on February 15th, 2022 at 5:57 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His