CWS Market Review – November 15, 2022

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The S&P 500 Breaks 4,000

The stock market continues its latest rally. Last Thursday, the S&P 500 had a better day than every single day from 1941 to 2001 except for one which was a dead cat bounce after the crash in 1987.

The buying continued today and the S&P 500 broke above 4,000 for the first time in two months. The index is now above its 50-day moving average (the blue line) and it’s getting close to its 200-DMA (green line). This is a good omen for the market. The S&P 500 hasn’t closed above its 200-day moving average since April.

This has been quite a good run. If we measure from the intra-day low from October 13 to Tuesday’s intra-day high, then the S&P 500 has gained more than 15%. Not bad for a little over one month’s work.

As always, let me caution you against getting overly optimistic. The market gods can be cruel and capricious. The last several bear-market rallies have all fizzled, but there is a case that this one may be different.

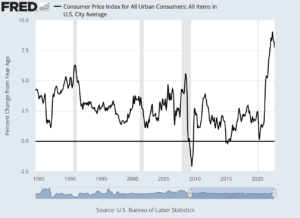

For one, the market started to move on signs that inflation could be falling. Then last week, we finally got concrete evidence that inflation, if not exactly falling, was tamer than expected. So much of Wall Street is a game of expectations.

On Tuesday, we learned that the wholesale inflation report was also lower than expected. The wholesale inflation report is particularly important because inflation often tends to appear at the wholesale before it trickles down to the consumer level.

For October, wholesale inflation was 0.2%. That was half of what was expected. A big reason for that decline was that the prices for services fell by 0.1%. That was the first decline for services in two years. Over the last year, wholesale inflation is running at 8.0%. Yes, that’s still high but it is a lot better than the 8.4% for the 12 months ending in September.

The rate of consumer inflation peaked at 9.1% in June, and it’s slowly declined — or decelerated — over the last four months. For the 12 months ending in October, consumer inflation was 7.7%.

We had more positive economic news on Tuesday when the Empire State Manufacturing Survey came in at 4.5%. The estimate was for a drop of 6%. We’ll learn even more tomorrow when we get the latest reports on retail sales and industrial production.

Walmart Beats and Raises Guidance

Speaking of retail sales, on Tuesday we got Walmart’s (WMT) earnings report which is the unofficial report on Americans’ consumer spending. In some ways, it might be an even better gauge than what the government provides. Walmart generates an average of more than $1 million in sales every minute.

For the quarter that ended on October 31, Walmart said its sales rose by 9% to $152.81 billion. E-commerce sales rose by 16%. Walmart’s earnings came in at $1.50 per share. That beat expectations by 18 cents per share.

Same-store sales excluding fuel were up 8.2%. The CFO said the holidays are “off to a pretty solid start.” Importantly, the store has been able to improve its inventory glut which has plagued so many businesses.

If you recall, Walmart lowered its outlook over the summer. The problem then was that folks were cutting back on discretionary items because they had loaded up on those things during Covid.

Walmart raised its earnings outlook. To be precise, it said the expected decrease will be less than expected. Thanks to inflation, the low-cost retailer gained market share. On Tuesday, Walmart also announced a $20 billion share buyback. The stock jumped 7% on Tuesday. Walmart isn’t alone. Home Depot (HD) also posted better-than-expected earnings.

This week, Goldman Sachs said it expects a significant decline in inflation next year. The investment house cited improved supply chains, lower wage growth and a weaker market for housing. Goldman expects core PCE to fall to 2.9% by the end of next year.

If Goldman is right, this will have a big impact on the Federal Reserve. The new slogan at the Fed may be “50-50-Pause.”

By that, I mean there’s a good chance that the central bank will raise rates by 50 basis points (or 0.5%) at its December meeting, followed by another 0.5% hike at its February meeting. After that, the Fed may take a pause for a few months. In fact, it could pause for several months. If that’s true, it means we’re not far from the end of this rate-hiking cycle. It’s those higher rate hikes that have weighed on the stock market all year.

This week, Fed Vice Chair Lael Brainard said that the Fed could slow the pace of its rate hikes. While that’s not really a radical idea, it’s interesting to hear it come from a Fed official, and from none less than the vice chair. Brainard said, “I think it will probably be appropriate soon to move to a slower pace of rate increases.”

Not only is the Fed raising rates, but it’s also been paring back on its gigantic bond holdings. So far, the Fed’s balance sheet has contracted by $235 billion. It’s now down to a mere $8.73 trillion.

Stock Focus: Rollins

Here’s a chart of the S&P 500 Value Index (blue) against the S&P 500 Growth Index (black) over the past year. Notice how much better value has done. This tells us how strongly those higher rates impact riskier areas of the market. It’s interesting that the stock market often moves before the event. The Growth/Value cycle changed last year but we didn’t get our first interest rate hike until March.

By the way, we’ve been having a good run with the stocks we’ve focused on in recent issues. In August, I told you about Polaris (PII) and the stock later jumped on a very good earnings report. Also, Ansys (ANSS) and McGrath RentCorp (MGRC) both rallied on good numbers.

The latest is Celanese (CE) which I featured for you two weeks ago. The company actually missed its earnings estimate. For Q3, Celanese made $3.94 per share. To be fair, Wall Street wasn’t expecting much this time. The company said it expected earnings at the low end of its range of $4.00 to $4.50 per share.

We also got the news that Warren Buffett added another 550,000 shares to his stake of Celanese. Last Thursday, the shares vaulted more than 13% and it added another 6% on Friday.

This week, I want to revisit Rollins (ROL) which is another stock I wrote about. I featured Rollins in February when the stock was at $31.03 per share. It’s gained 33.6% since then. For comparison, the S&P 500 is down about 12% over that time.

Rollins is in the pest control biz. It’s amazing how few people know about this stock. Rollins is the parent of Orkin. Years ago, Rollins was a diversified company with lots of holdings. They eventually spun off their oil and gas units into another company. What was left was the pest control business which is a very nice business to own.

Since 2000, shares of Rollins are up more than 6,000%. As it turns out, killing bugs is very profitable. Rollins is able to maintain gross margins in excess of 50%.

I realize that it sounds icky, and it is, but that doesn’t mean it’s a bad investment. Quite the opposite. In his book One Up on Wall Street, Peter Lynch wrote, “Better than boring alone is a stock that’s boring and disgusting at the same time. Something that makes people shrug, retch, or turn away in disgust is ideal.”

Rollins now has 2.8 million customers at 800 locations around the world. During Covid, Rollins cut its dividend by 33% which snapped an 18-year run of consecutive dividend hikes. No worries. Last month, Rollins hiked its dividend by 30%. Over the last 30 years, Rollins has split its stock 3-for-2 eight times. That’s equivalent to one split of 25.6-to-1.

With all this success, you’d think there would be a platoon of Wall Street number crunchers following Rollins. Guess again. ROL is followed by six analysts.

Last month, Rollins reported very good numbers for its Q3. Organic revenue rose 8.6% and earnings increased to 22 cents per share from 19 cents for last year’s Q3. That was a penny more than consensus. I also like that the company has a solid balance sheet. The CEO said, “We continued to see favorable demand for our services with double-digit growth across all major service lines.”

The shares jumped 10% after the earnings report and continued to rally. In three days, ROL gained 16.5%. All thanks to killing bugs.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

Posted by Eddy Elfenbein on November 15th, 2022 at 6:33 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His