-

HP to Cut 9,000 Jobs

Posted by Eddy Elfenbein on June 1st, 2010 at 2:17 pmHere’s a post which I’d call “thinking out loud” since I can’t decide where I stand. Hewlett-Packard (HPQ) announced today that it’s cutting 9,000 jobs.

HP will take a $1 billion charge for paying severance and modernizing its data centers to provide more automated services to customers, it said today in a regulatory filing. The Palo Alto, California-based company plans to replace about 6,000 of the eliminated positions with workers in different countries.

“These sets of actions will enable HP to grow better than the market,” Ann Livermore, executive vice president for enterprise business, said today on a conference call. “This is a substantial opportunity for us and something that we think is a good opportunity for our clients as well.”

The job cuts come after HP raised its 2010 forecast last month for the third time since November as results beat analysts’ estimates on a revival in business spending. Chief Executive Officer Mark Hurd has expanded into more profitable services as the recession crimped corporate budgets for equipment. He bought Electronic Data Systems Corp. for $13.2 billion in 2008, vaulting HP to No. 2 in services behind IBM.I’m a big fan of Mark Hurd. He’s done a great job in turning HPQ around after the disastrous tenure of Carly Fiorina (who will probably win California’s GOP Senate primary one week from today). Turnarounds rarely work but this one has. HPQ earnings have grown steadily over the past few years and the stock has outperformed a dismal market.

My worry is that the company might be taking on more than it can afford. I’m not thrilled with the EDS buy and I hate (HATE) the Palm buy. Still, leadership counts and I’m leaning towards trusting that Hurd knows what he’s doing. And as today’s news shows, the company hasn’t grown complacent. -

Depressing Stat of the Day

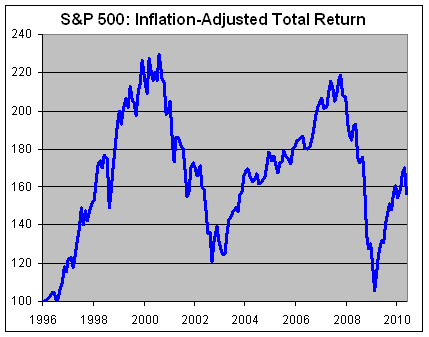

Posted by Eddy Elfenbein on June 1st, 2010 at 1:25 pmHere’s the inflation-adjusted total of the S&P 500. Even after an impressive rally, we’re still where we were more than 12 years ago.

-

ISM = 59.7

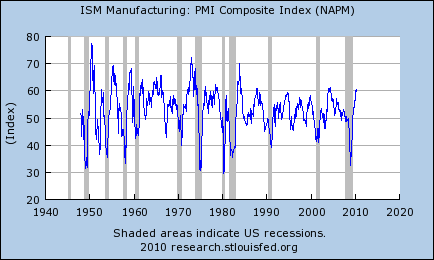

Posted by Eddy Elfenbein on June 1st, 2010 at 11:53 amThe Institute for Supply Management’s manufacturing gauge came out today and it was 59.7. Any reading above 50 indicates an improving economy. This was slightly down from the previous report of 60.4.

As I’ve written before, the ISM is one of the best reports for telling us if the economy is in a recession or not. Historically, the tipping point has been around 44-45. Reading below that have come during recessions, and above we’re in recovery. I continue to believe the Federal Reserve will raise interest rates before most people expect. -

Debtor Nation

Posted by Eddy Elfenbein on June 1st, 2010 at 11:37 amThe NYT profiles a young woman who just graduated from NYU. She’s $97,000 in debt.

This is a scandal. It’s not merely lousy finance, but it’s also wrong to pile up debt on young people who may not realize the burden they’re placing on their future selves. Here’s what I wrote last year:Much like the housing bubble, the Higher Ed bubble is being driven by cheap, government supported credit. The problem is compounded by the fact that hugely important financial decisions are placed on the backs of 19-year-olds, many of whom simply don’t have the life experience to weigh the implications of a gigantic, 20-year debt load. Heck, at least the irresponsible mortgage borrowers during the crazy days were adults (even though many acted like infants).

One report shows that students from lower-income families need to pay 40% of their family income to enroll in a public four-year college. That’s a lot of coin to have some Marxist feminist theorist tell you about atavistic nature of late-stage capitalism. Please, you can watch the Oscars to learn that. Don’t think community colleges are a bargain, either. The average tuition is up to 49% of the poorest families’ median income from 40% in 1999-2000.

The pro-college crowd likes to repeat the claim that college grads earn $1 million more, on average, over their working lifetime. Sure, this is true, but college grads start out in a big hole. On average, they don’t even catch up to high school grads until age 33.

The debt load piled on students is scandalous. One in five students who graduated in the 1992–93 school with over $15,000 in debt defaulted on his or her loan within 10 years of graduation. We’re setting young people up for failure and ruin credit records. Thanks to the recession defaults are up 43% over the last two years. Many students go to grad school and pile on even more debt. The average law grad owes $100,000. Plus, many schools often use grad students as greatly underpaid professors in order to cut costs. Think of Lehman Brothers. Now imagine if they had a football team. -

Looking at the May Swoon

Posted by Eddy Elfenbein on June 1st, 2010 at 10:26 amThe stock market just finished its worst May since 1940. As it turns out, watching France fall to the Nazis isn’t good for stocks here. Also, watching the euro fall to reality is pretty nasty as well.

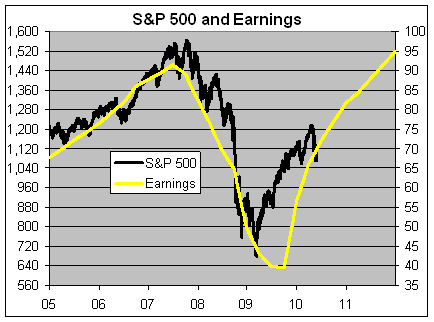

Let’s take a closer look at where the market stands today. Here’s the S&P 500 (black line, left scale) along with its earnings (gold line, right scale).

I’ve scaled the two lines at a ratio of 16 to 1 so whenever the lines cross, the market’s P/E Ratio is exactly 16.

Let me add that looking at the market’s P/E Ratio is far from perfect (the future earnings line is, of course, merely forecast), but nevertheless we can gain some insights as to what investors are thinking at the moment.

Two items stand out. The first is that the S&P 500 has fallen below a P/E Ratio of 16 which has generally been its lower bound over the past few years. The second is that the earnings forecast is still very favorable. If stocks keep pace with valuations, then the S&P 500 could easily be over 1400 within 18 months.

This is where the problems come in. It appears that investors are beginning to question the robustness of the recovery. Given the amount of aid needed, that’s certainly understandable. So if the earnings forecast turns out to be overly optimistic, then the whole bullish scenario falls apart.

My feeling is that the bearish cause has been pushed a bit too. Consider that many companies are still maintaining decent guidance. Even the bad guidance isn’t that bad. On Friday, shares of J.C. Penney (JCP) got knocked due to “poor guidance.” I’d agree that JCP is a weak buy right now, but they merely said to expect full-year EPS of $1.64 which was one penny below the Street.

I used JCP as one example, but if the future yellow line is off, then we’re going to have to see much more lower guidance announcements. That simply hasn’t come yet.

This week, we’ll get some news on our Buy List stock, Jos. A Bank Clothiers (JOSB). This company hasn’t missed an earnings forecast in four years. They haven’t given guidance for this year but they have said that they plan to open 30 to 40 new stores. Wall Street expects 71 cents per share which is a nice increase over the 62 cents per share from a year ago. My numbers say it will be close to 75 cents a share.

JOSB is a solid buy. We’ll know more on Thursday (correction: Tuesday) when the earnings report comes out. -

Happy Memorial Day

Posted by Eddy Elfenbein on May 31st, 2010 at 12:46 pm

-

Monsanto -7%

Posted by Eddy Elfenbein on May 27th, 2010 at 1:19 pmMonsanto (MON) is down 7% today on the news of sharply lower guidance. A reader writes:

I wrote you a few weeks ago about MONSANTO. And you were talking about lowered guidance, and how it’s like “cockroaches”, they keep coming out. Well, you were right. Thanks for the tip. I decided to sell shortly afterwards — it was difficult because I felt that I had spent so much time understanding their business and the prospects, but you were right, the stock has no idea I own it.

The point is that companies aren’t like sports teams that can suddenly rally. If there’s one problem you see, there are usually several more you don’t see (like cockroaches).

Just because a stock is down from its highs doesn’t mean it’s cheap. Monsanto missed its last two earnings reports and that was a tip-off to today’s news. -

The Calendar Says Buy

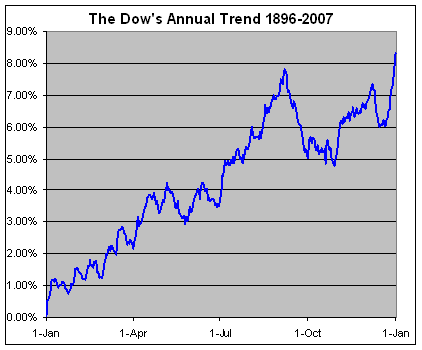

Posted by Eddy Elfenbein on May 27th, 2010 at 11:50 amA few years ago, for reasons unclear, I decided to look at the entire history of the Dow Jones to see how it performed during a typical year. Once I emerged from my dark laboratory, I was able to compile this chart.

We’ve just entered one of the best times for the market. From May 25 to June 12, the Dow has gained an average of 1.27%. From May 25 to September 6, the Dow has gained an average of 4.72%. That’s more than half of the Dow’s entire historic capital gain coming in a little over three months.

On top of that, all of the market’s gains have come on the last four trading days of the month plus the first three of the following month. Outside that, the market is down. -

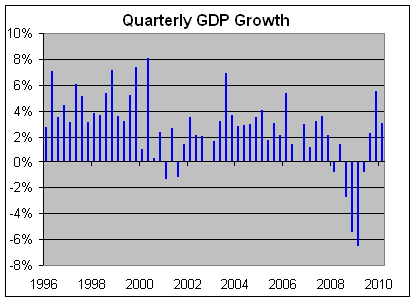

Q1 GDP Growth Revised Lower

Posted by Eddy Elfenbein on May 27th, 2010 at 10:45 amThe government pared back its estimate of first-quarter GDP growth. The original report said the economy grew by 3.2% for the firth three months of the year but now the Feds say it was 3.0%. That’s not a big change but it highlights the issue that the economy isn’t growing nearly fast enough to pull us from the recession.

Compare the last bar on this chart to the long stretch of GDP growth in the late 1990s.

As an investor, this caught my eye:The latest report showed consumers increased their spending by 3.5%. That was below the previously estimated 3.6% gain but more than double the 1.6% increase of the fourth quarter.

That’s a good sign. Sure enough, this comes out today: Tiffany raises outlook as profit, sales soar. As always, company guidance is key. If you’re a publicly traded company, you don’t want to shout out good news unless you can back it up. If Tiffany (TIF) is doing well, that means the high-end market is recovering.

Excluding one time items, Tiffany earned 48 cents per share, beating Wall Street forecast of 37 cents, according to Thomson Reuters I/B/E/S.

Sales at its stores open at least a year, or same-store sales rose 10 percent, lifted by growing international sales.

In Asia, sales rose 50 percent, while at its flagship store on Manhattan’s Fifth Avenue, sales were up 26 percent.

Overall sales rose 22 percent to $633.6 million during the quarter.

Tiffany raised its full year profit forecast to a range of $2.55 to $2.60 per share, above the average Wall Street estimate of $2.51. Tiffany expects sales to be up 11 percent this year and to open 16 stores.So they beat estimates by nearly 30% and raised their full-year. I’m not suggesting TIF is a buy, the stock is a bit pricey, but it gives us a clue where business is strong.

The advantage of looking at Tiffany is that its fiscal cycle is slightly off most other companies. Their fiscal calendar ends at the end of January instead of the beginning. This makes sense because they want any lingering Christmas sales in the same reporting period. As a result, today’s report covers February, March and April — whereas the last earnings season for most stocks was for January, February and March. This off-cycle report could mean that consumers are in a better mood than Wall Street thinks. -

100 Years Ago — King Edward’s Funeral

Posted by Eddy Elfenbein on May 26th, 2010 at 11:12 pmThis week marks the 100th anniversary of the funeral of King Edward VII. This was an interesting event in world history since it was the last great gathering of European monarchs.

Just about every king or crown prince was invited (see a listing here). In fact, many of them were related to the late king. The soon-to-hated Kaiser was Edward’s nephew. You’d hardly know that in just a few years the whole world these people knew was to be blown apart by the Great War.

King Edward’s funeral is also used as an entry point in George Dangerfield’s book “The Strange Death of Liberal England.” For a student of history, the ceremony serves as a good dividing line between two periods. Two worlds, really. If you want to read really good writing, check out pages 18 and 19 here.

The Library of Congress has some footage of the funeral which I’ve embedded below. Everyone is marching by rank so in the very back of the line is a commoner—the representative of a still-strange form of government—Former President Teddy Roosevelt. This is oddly symbolic because even though the U.S. was at the back of the line, it was about to become the world’s most powerful nation.

I’ve watched this a few times. I can’t be sure but I think TR appears at 4:53 in the lower right part of the screen. Here’s the NYT‘s coverage and it confirms that TR is carrying his overcoat.

- Tweets by @EddyElfenbein

-

-

Archives

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His