-

Morning News: June 3, 2025

Posted by Eddy Elfenbein on June 3rd, 2025 at 7:05 amGlobal Markets Mostly Lower on Continued Trade Tensions; Eurozone CPI Data In Focus

Trump Tariffs Are Hurting US and Global Economy, OECD Warns

OECD Warns That World Growth to Slow Amid Trade Turmoil

Saudi Arabia’s Hurdles at Home Are Reshaping the Mideast Financial Order

Eurozone Inflation Falls Below Target

Switzerland Records Deflation for First Time in Four Years

Switzerland Poised to Pitch Tough New Capital Rules for UBS

Bank of England to Keep Cutting Rates But How Far, Fast Is Unclear, Bailey Says

BOJ’s Ueda Says Rate Hikes Will Only Come When Economy Is Ready

India Considers Easing Bank Ownership Rules as Foreign Interest Grows

Mismanagement Is Putting Dollar’s Global Standing in Jeopardy

Sahm: Inflation Expectations Are Now Just Tariff Expectations

899 — The Three Numbers Alarming the Bond Market

Investors Say They’re Moving Away From ESG as ‘an Umbrella Concept’

Economists Question G.O.P. Bill: Why Increase the Deficit in Good Times?

Newsom, Pritzker and High Tax Blue States Offer Red States a Huge Gift

Where Do I Fall in the American Economic Class System?

Consumers Are Financing Their Groceries. What Does It Say About the Economy?

Companies Rely on Delaware Courts. Lawyers Reap Huge Fees There.

Elon Musk Returns to His Tech Empire, Facing Questions of Inattention

China’s Manus Shows the Promise of AI Agents

Trump’s Big Steel Party Exposes Japan’s Growth Conundrum

Carlos Slim Is Quietly Becoming Pemex’s Partner of Last Resort

Meta to Buy Nuclear Power From Constellation as AI Demand Soars

Viper Energy to Acquire Sitio Royalties in $4.1 Billion Stock Deal

Toyota Industries $33 Billion Buyout Faces Investor Criticism Over Discounted Price

Hims Looks to Expand to Europe With Zava Acquisition

Dollar General Shares Zip Higher After Retailer Raises Outlook

The Economic Costs of Wearing Guardian Caps In the NFL

Be sure to follow me on Twitter.

-

Morning News: June 2, 2025

Posted by Eddy Elfenbein on June 2nd, 2025 at 7:08 amAsian Manufacturing Activity Stumbles Again Under Weight of Trump Tariffs

Oil Leaps More than 3% After OPEC+ Keeps Output Increase Unchanged

U.S. Dependence on China for Rare Earth Magnets Is Causing Shortages

Valterra Platinum Shares Start Trading in London

China Rejects Trump’s Accusation That It Violated Trade Truce

As Courts Call Tariffs Into Question, Trump Again Turns to His Favorite Tool

The Imports the U.S. Relies On Most From 140 Nations, From Albania to Zimbabwe

ECB Set to Cut Rates Again and Keep Options Open

Fed’s Waller Highlights a Path to 2025 Rate Cuts

Stanley Fischer, Groundbreaking Economist and Fed Vice Chair, Dies at 81

Why the S&P 500 Is Cruising Through Policy Upheaval

Buyers’ Strike Rocks US Long Bond as DoubleLine, Pimco Stay Away

A New Ratings Game: 3,000 Deals, 20 Analysts, Lots of Questions

Senate Begins Putting Its Stamp on Giant Trump Tax, Debt Limit Bill

A Peach and Apple Farmer’s Uphill Quest to Feed Poor Families, and His Own

Trump Plans to Offload National Park Sites, But States Don’t Want Them

The Corporate Culture Wars Have a Strange New Coalition

The C.E.O. Other C.E.O.s Turn To for Advice

Wall St. Is All In on A.I. Data Centers. But Are They the Next Bubble?

Arizona’s Water Is Vanishing Before AI Gets a Crack at It

Tesla Sales Plunge 67% to an Almost Three-Year Low in France

Elon Musk’s Chatbot Can Be ‘Non-Woke’ or Truthful, Not Both

How Europe Is Losing the Global Tech Race, in Five Charts

Amazon Hit by German Warning Over Price Controls on Marketplace

Bristol to Pay BioNTech Up to $11.1 Billion in Cancer Deal

Sanofi to Buy Blueprint Medicines for Up to $9.5 Billion in Boost to Pipeline

EU Fines Delivery Hero, Glovo $373 Million in Cartel Probe

Indian Billionaire Gautam Adani Comes Under New Scrutiny from U.S. Prosecutors

Can Gen Z’s Nostalgia Save Chain Restaurants?

How ‘Lilo & Stitch’ Became One of the Most Profitable Movies in Years

Be sure to follow me on Twitter.

-

Morning News: May 30, 2025

Posted by Eddy Elfenbein on May 30th, 2025 at 7:03 amIndia’s Economic Growth Accelerates Despite Headwinds

Rising Inflation, Weak Production Put Bank of Japan in Tough Spot

How Russian Fortunes Stranded by US Sanctions Rocked Liechtenstein

Sliding Oil Prices Have Reopened the Door to Russian Crude

US Driving Season Starts Strongly for Oil Refiners

Twisty Path to a Deal: Is Nippon Steel Finally About to Land U.S. Steel?

Declining Inflation in Eurozone Nations Readies ECB for Rate Cut

The Swamp Wins Again, Even Against Elon Musk

Economists Cautiously Cheer Court Ruling Striking Down Trump’s Tariffs

Trump’s Tariff Options Slower, More Complex If Court Fight Fails

Trump’s Team Plots Plan B for Imposing Tariffs

Tariff Ruling Gives Businesses Hope, but They’re Soon Unmoored Again

This TACO Gives Trump Indigestion, So Watch Out

Trump Tells Powell He Is Making a Mistake by Not Cutting Interest Rates

The Bond Market’s Faith in America Is Facing a Severe Test

S.E.C. Drops Lawsuit Against Binance, a Crypto Exchange

Trump’s Tax Bill Has Nasty Surprise in SALT Fine Print for Some Rich Americans

How Trump’s Regulatory Rollbacks Are Increasing Costs on Americans

‘Bellwether of Risks’: What ‘Buy Now, Pay Later’ Defaults Say About the Consumer

Don’t Call It a Side Hustle. These Americans Are ‘Polyworking.’

Trump Taps Palantir to Compile Data on Americans

Chinese Students Ditch US Plans as Trump Vows Crackdown on Visas

Harvard’s Commencement Showcased a United University

The Judge’s Data Dilemma in the Google Search Case

Consultants are Taking Over the World’s Corner Offices

Nvidia Lays Out Worst-Case Scenario in Bid to Open China Market

Shoe Carnival Backs Guidance, Plans Focus on Premium Brands

Soaring Costs Expose a Trans-Atlantic Chocolate Divide

Celsius Looks Beyond Fitness Buffs in New Marketing Campaign

Wall Street or Vegas: Kalshi Ramps Up Battle Over Legal Gambling

Be sure to follow me on Twitter.

-

Morning News: May 29, 2025

Posted by Eddy Elfenbein on May 29th, 2025 at 7:03 amEconomic Debate Begins on Impact of ‘Military Keynesianism’

OPEC+ Prepares Third Dose of Oil Shock Therapy

UK Gas Generation Plunges as Wind Surge Turns Prices Negative

Japan’s Debt, Now Twice the Size of Its Economy, Forces Hard Choices

Bank of Korea Cuts Rates, Slashes 2025 Growth Outlook

Bank of Mexico Cuts Economic Growth Forecasts

Export Controls Are Endangering the Fragile U.S.-China Truce

Companies Turn to Private Credit During Tariff Turmoil for Loans

Trump Trade Strategy Roiled by Court Blocking Global Tariffs

Stocks Jump After Court Blocks Trump’s Tariffs

If Anything, Bond Markets Are Returning to Normal

Opposite Peter Orszag and His Opposites, Government Spending Doesn’t Cause Inflation

The Tax Bill Is Big, But Certainly Not Beautiful for Small Business

The Allure (and Complications) of Trump’s ‘Golden Shares’

DOGE Has Failed to Halt Increases in Federal Spending

A Disillusioned Musk, Distanced From Trump, Says He’s Exiting Washington

The Techno-Futuristic Philosophy Behind Elon Musk’s Mania

If America Doesn’t Want Harvard, Somebody Else Will

The AI Job Suck Is the China Shock of Today

Nvidia Eases Concerns About China With Upbeat Sales Forecast

Senators Bash Nvidia’s Plans for Facility in China

United and JetBlue Form Alliance to Sell Seats on Each Other’s Flights

Tariffs Turn Porsche’s Headwinds Into a ‘Violent Storm’

Best Buy Falls After Trimming Outlook on Hit From Tariffs

Kohl’s Beats Expectations in Wake of Dramatic CEO Firing

Foot Locker Swings to Loss Ahead of Acquisition by Dick’s

One Way to Sell Beer in Britain? Buy Into a Soccer Team.

Sports Stadiums Are Monuments to the Poverty of Our Ambitions

The Rise of the Japanese Toilet

Be sure to follow me on Twitter.

-

Morning News: May 28, 2025

Posted by Eddy Elfenbein on May 28th, 2025 at 7:05 amDoing Business in China Is Getting Harder, but Its Exports Are Hard to Resist

Japan Bonds Draw Weak Demand as Rise in Superlong Yields Sparks Concern

Now Is the Moment to Pressure Putin, Not Appease Him

Russian Central Bank Warns of Oil Price Risks as it Defends High Rates

Alberta Wildfires Threaten an Oil Industry Working to Refill Dry Tanks

Central Bankers Bow to Political Winds When It Comes to Climate, Study Shows

Germany’s Jobless Numbers Tick Higher

ECB Says Lagarde ‘Determined’ to Complete Her Term

UniCredit to Double Stake in Greece’s Alpha Bank to Around 20%

US Banks Tiptoe Toward Crypto, Awaiting More Green Lights from Regulators

The GOP’s Budget Bill Will Pass in Spite of Itself

Musk Says He’s ‘Disappointed’ That Trump Tax Bill Raises Deficit

Income Taxation: TheTap Root of Collectivism

Fisher: On the Big Beautiful Bill

Why You Don’t Lose Money in Bonds (If You Wait Long Enough)

Wall Street’s Rush to Launch Vanguard-Style Funds Draws Warnings

Boston Pushes Harvard, Other Colleges for Money Even as Trump Steps Up Attacks

US Home-Refinancing Gauge Falls to Three-Month Low as Rates Near 7%

‘We’re In a Holding Pattern’: Home Sales and Building Slump in the Face of Uncertainty

EU Aims to Cut Red Tape, Boost Funding to Lure Tech Startups

DeepSeek Unveils Update to R1 Model as AI Race Heats Up

Watchdog Probes Illegal Use of Starlink Service in South Africa

Droga Steps Down as CEO of Accenture Song, the Marketing Unit He Helped Build at Consulting Giant

Honeywell Enters Cooperation Pact With Elliott Before Breakup

Brazil Sues EV Giant BYD Over ‘Slavery’ Conditions at Plant

Jeep Maker Stellantis Names Americas Boss as CEO

GM’s Mary Barra on the Auto Giant’s EV Strategy

Macy’s Cuts Profit Outlook Despite Solid Spring-Season Sales

Luxury Brands Are Paying for Over-the-Top Price Hikes

Be sure to follow me on Twitter.

-

CWS Market Review – May 27, 2025

Posted by Eddy Elfenbein on May 27th, 2025 at 5:51 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The stock market got a nice bounce today after President Trump said he’s going to delay the 50% tariffs on the EU.

It’s interesting how any news of a tariff pause sends the bulls charging but any warning of tariffs to come brings out the bears. It’s clear that Wall Street doesn’t like tariffs.

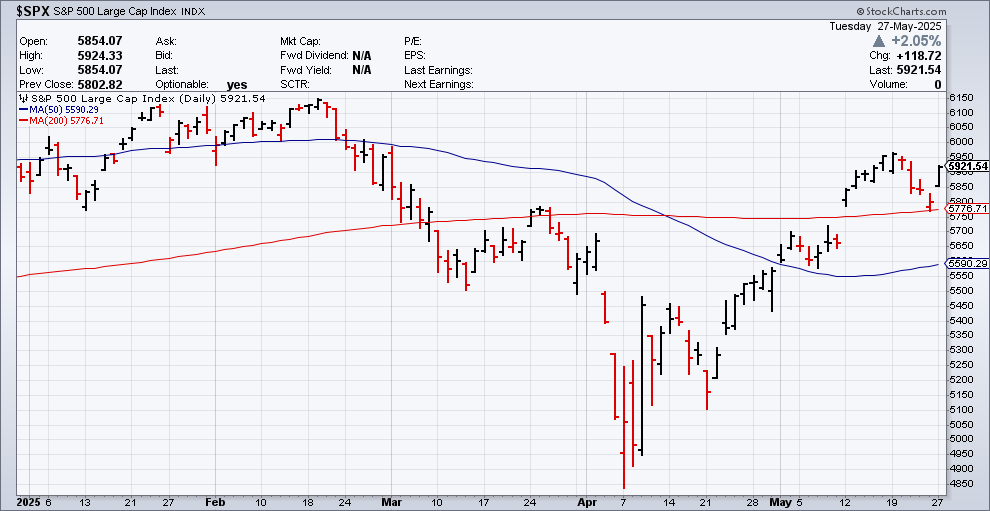

At one point, the Dow was up more than 740 points today. The S&P 500 was up by 2.0% while the Nasdaq was up by 2.5%. I talk a lot about the 200-day moving average. This is a good example of why. The S&P 500 bounced almost perfectly off its 200-DMA. The Russell 2000 was particularly strong today.

President Trump said he’ll push the EU tariffs back to July 9. He’s making the move as part of a request from Ursula von der Leyen who is the president of the European Commission. The original date for the tariffs was for June 1.

President Trump took to Truth Social: “This is a positive event, and I hope that they will, FINALLY, like my same demand to China, open up the European Nations for Trade with the United States of America.” The EU said it will fast-track trade talks with the U.S.

Through May 19, the S&P 500 had put together a very nice run of 17 up days in 20 sessions. That came to an end last week as the index fell on Tuesday, Wednesday, Thursday and Friday. Today’s rally is walking back most of last week’s damage.

The 30-year Treasury yield fell back below 5%. There were some concerns last week when a Treasury auction showed unusually light interest. This was particularly worrying to some because it shortly followed the credit downgrade from Moody’s.

Interestingly, shares of Tesla (TSLA) got a nice boost today after Elon Musk said he’s going to pull back on his political endeavors. Tesla sold only 7,261 cars in Europe in April. That’s down 49% from last year. The overall EV market saw an increase of 34.1%. Shares of Tesla have lagged the market for more than three years.

When a stock goes up, shareholders will forgive most anything. But when a stock starts to slide, their patience wears thin. All things being equal, I prefer to invest in a company whose CEO keeps a low profile.

We’re not quite done with earnings season, but we’re getting very close. So far, 95% of the companies in the S&P 500 have reported results. Of those, 78% have topped estimates. This week, we’re getting Nvidia’s (NVDA) earnings report which will be very closely watched. The report is due out after tomorrow’s closing bell. Wall Street expects earnings of 75 cents per share. That’s up from 61 cents per share for last year’s fiscal Q1.

The other earnings report to look out for will come from Costco (COST). I highlighted the company last week and explained why I’ve been such a big fan over the years. Last time, Costco had a rare earnings miss ($4.02 versus $4.10 per share). This time, Wall Street expects earnings of $4.23 per share. Costco’s earnings report is due out after the closing bell on Thursday.

We also had good economic news this morning. It seems that consumers are in a much better mood. This morning, the Conference Board’s Consumer Confidence Index came in much stronger than expected. For May, Consumer Confidence was 98.0. That’s an increase of 12.3 points over April. For May, Wall Street had been expecting 86.0.

This snaps a streak of five straight monthly declines. What caused the surge? It seems that President Trump’s decision on May 12 to hold back on the most severe tariffs certainly played a role.

The present situation index increased to 135.9, up 4.8 points, and the expectations index posted a major surge to 72.8, a 17.4-point gain. Investors also showed more optimism, with 44% now expecting stocks to be higher over the next 12 months, up 6.4 percentage points from April.

Views on the labor market also improved, with 19.2% of respondents expecting more jobs to be available in the next six months, compared with 13.9% in April. At the same time, 26.6% expect fewer jobs, down from 32.4%. However, the level of respondents saying jobs were “plentiful” edged higher to just 31.8%, while those saying employment was “hard to get” increased to 18.6%, up 1.1 percentage points.

Consumer confidence was higher for every income bracket. Consumer confidence is an interesting metric to watch because it’s not visible and it’s hard to measure, but if you don’t have it, it can be terrible.

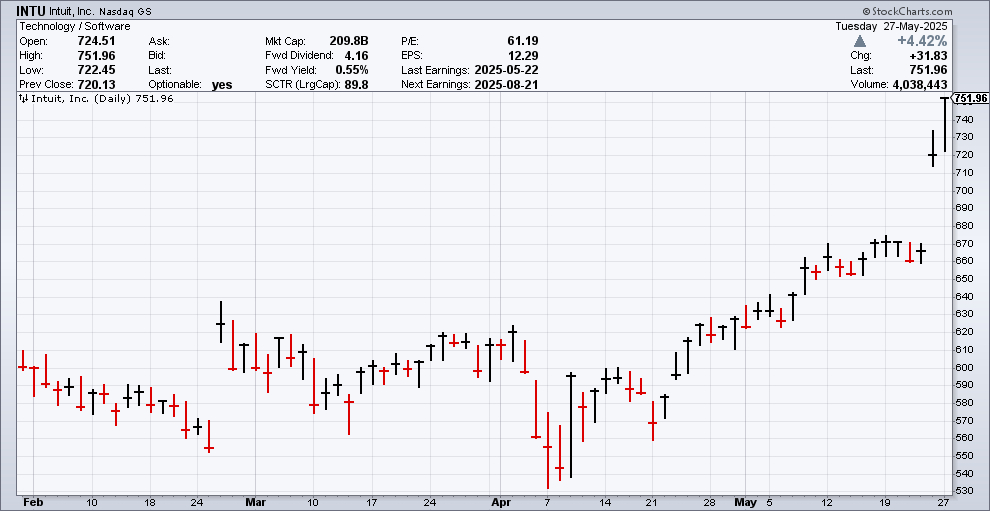

Last week, we had a great earnings report from one our Buy List stocks. Intuit (INTU), the TurboTax people, reported earnings of $11.65 per share. That was up 18% over last year, and it beat Wall Street’s consensus of $10.91 per share.

The CEO said Intuit is “becoming a one-stop shop of AI-agents and AI-enabled human experts to fuel the success of consumers and small and mid-market businesses.”

But the best news is that Intuit raised its full-year guidance. Intuit now see its profits ranging between $20.07 and $20.12 per share. That’s a growth rate of 18% to 19%. The previous guidance had been for 13% to 14%.

Shares of Intuit jumped 8.1% on Friday, and another 3.4% today. The shares hit a new 52-week high today. I won’t give you the “hard sell,” but you can sign up for our premium newsletter here. This is where we discuss our Buy List in greater detail.

The Federal Reserve doesn’t meet for another three weeks, but tomorrow the Fed will release the minutes of its last FOMC meeting. At that meeting, the Fed decided against raising interest rates, which was widely expected, but I’ll be curious to see what the reasoning was inside the Fed.

Over the last few weeks, the market has gradually changed its outlook for the Fed. Wall Street no longer sees the Fed as being willing to lower rates so aggressively.

Futures traders currently see the Fed lowering interest rates in September, but even that’s not an overwhelming proposition. The current probability of a September rate cut is 62%. The market only expects two rate cuts for the rest of this year.

Also today, the Atlanta Fed’s GDPNow model sees Q2 growth of 2.2%. That’s down a little from the prior forecast of 2.4%. The estimate for real gross private domestic investment growth fell from +0.7% to -0.2%. Today’s Case-Shiller Index on home prices showed the first monthly decline in home prices since 2023. The data is seasonally adjusted.

On Thursday, the government will update its report on Q1 GDP growth. The initial report said that the economy grew by only 0.3% for the first three months of this year. I don’t expect to see much of a change.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: May 27, 2025

Posted by Eddy Elfenbein on May 27th, 2025 at 7:04 amJapan Will Spend $6.3 Billion to Shield Its Economy From Trump’s Tariffs

Global Bonds Rally as Japan Looks to Stabilize Its Debt Market

China’s Industrial Profit Growth Accelerated in April

Toy Company Still In Crisis Despite Reduced Tariffs on China

China Turns to Consumers to Boost Growth, but Households Are Wary

China’s Soft Spot in Trade War With Trump: Risk of Huge Job Loss

German Consumer Confidence Edges Higher Despite Tariff Uncertainty

Eurozone’s Economic Outlook Picks Up After Tariff Turmoil Abates

French Inflation Declines, Opening Door to ECB Rate Cut

Swiss Watch Exports Jump in April Boosted by U.S. Frontloading

Buying 100% Made in America Is Really, Really Hard. These People Are Trying.

U.S. Ships Championed by Trump Cost 5 Times as Much as Asian Ones

Trump’s China Tariffs Are Having a ‘Massive Impact’ on Small Business

HSBC Cuts Dozens of Analyst Jobs in Investment Banking Overhaul

US Fund Managers Put on Notice by $65 Billion Dutch Investor

The US Is About to Discover if Deficits Don’t Matter

The Silver Tsunami Is Keeping the US Economy on Track

There’s No Such Thing As ‘Exorbitant Privilege,’ There’s Just Production

Stablecoin Issuer Circle, Shareholders Seek $624 Million in IPO

Private Equity Fundraising Plunges Amid Struggle to Return Cash

The Economic Consequences of Destroying Harvard

Singapore’s AI Push Charts Path Toward Localized Models

Tech’s Trump Whisperer, Tim Cook, Goes Quiet as His Influence Fades

Mark Zuckerberg Loves MAGA Now. Will MAGA Ever Love Him Back?

The Republican Assault on EVs Is Almost Complete

Tesla’s Europe Sales Nearly Halve In April

Yes, That 18-Wheeler on a Texas Highway Is Driving Itself

Salesforce Nears $8 Billion Deal for Informatica

Temu Owner PDD’s Profit Nearly Halves as Revenue Growth Slows to Three-Year Low

Retailers Pummeled by Trump’s Trade War Entertain More ‘Take-Private’ Offers

Inside the Test Kitchens Helping Restaurants Navigate the Trade War

The N.B.A.’s Age of Dynasties Is Over. Will That Hurt Its Business?

Be sure to follow me on Twitter.

-

Morning News: May 26, 2025

Posted by Eddy Elfenbein on May 26th, 2025 at 7:14 amGlobal Central Banks Talk Harsh New Economic Realities in Tokyo

Moody’s Rethinks Its Rating Spectrum on the G-7

Trump’s Tariffs: Where Things Stand

The 90-Day Rush to Get Goods Out of China

Your Patio Furniture Set Is Going to Cost a Lot More This Summer

China Has Special Access to Rare Earths — From Myanmar

Big Miners Want New Blood to Tackle an Old Problem

Trump’s Tariffs and Tax Bill May Derail U.S. Battery Industry

Moderate House Republicans Did What They Do Best: They Caved

Chinese Auto Stocks Fall on Fears of Fresh Price War

Xi Mulls New Made-in-China Plan Despite US Call to Rebalance

Chinese, EU Trade Heads to Meet as Trump Tariff Tensions Rise

Trade Between the U.S. and EU Is Massive. We Break It Down.

Trump Delays E.U. Tariffs Until July 9

Ring-Fencing Was a Good Idea That UK Banking No Longer Needs

If They’re Telling You Why Treasury Yields Are Up, They Don’t Know Why

Kashkari Says ‘Not Sure’ on Interest Rate Moves by September

How Student-Loan Crisis Will Show Up in the Economy

Trump Allies Look to Benefit From Pro Bono Promises by Elite Law Firms

Trump Backing for a Nippon Steel Deal Leaves Big Questions

Electric Vehicles Died a Century Ago. Could That Happen Again?

Chinese EV Trucks Will Build the Cities of the Future

Volvo Car to Cut Around 3,000 Jobs

Malaysia, Singapore Explore Importing Wind Energy from Vietnam

Jony Ive’s OpenAI Deal Puts Pressure on Apple to Find Next Big Thing

ChatGPT’s Improved Memory Points Toward a More Personal AI

At Amazon, Some Coders Say Their Jobs Have Begun to Resemble Warehouse Work

Meituan Profit Soars as Revenue Beats Estimates Despite Rising Competition

‘Lilo & Stitch’ and Tom Cruise Add to a Box Office Boomlet

Be sure to follow me on Twitter.

-

Morning News: May 23, 2025

Posted by Eddy Elfenbein on May 23rd, 2025 at 7:03 amEU Agrees to Reinstate Trade Quotas on Ukraine as War Drags on

Sorry, Donald Trump, But Ukraine Is Your War

How Middle East Oil Giants Are Building Soft Power

Big Gas Cheered by Evidence Chinese Demand Remains Strong

China’s Lithium City Is a Front Line of the Battery Trade War

Japan Consumer Inflation Picks Up on Higher Energy, Food Prices

Eurozone Wages Slowed Sharply Ahead of Tariff Blow

Germany Upgrades First-Quarter Growth on Manufacturing Strength Ahead of Tariffs

U.K. Retail Sales Rise for Fourth-Straight Month, Boosted by Warm Weather

U.K. Consumer Sentiment Edges Up From Low Mood as Tariff Turmoil Eases

Trump Threatens a 50% Tariff on EU Goods Starting in June

Bond Market to Washington: We’ll Make You Pay

Republicans Harness Tax Code to Punish Trump’s Political Nemeses

The Republican Tax Bill Could Sharply Slow E.V. Sales

US Debt Limit Nail-Biter Looms as Senate Ponders Trump Tax Bill

Treasury Sounds Death Knell for Penny Production

US Firms Face Biggest Hit on Trump Tariffs, HSBC Survey Says

Under Trump, a Mainstay for Small Businesses Clamps Down

CEOs Can Stop White House Attacks — If They Act Now

Empathy and Ethics Needed In the C-Suite

The FTC’s Fruitless Search for ‘Relevant Markets’

Harvard’s Foreign Students Are Stunned and Devastated by Trump’s Ban

Booz Allen Hamilton Revenue, Outlook Below Estimates

Dillard’s Sues Wells Fargo for Allegedly Abandoning Co-Branded Card Relationship

Trump Threatens 25% Tariffs on Apple If iPhones Not US Made

Surge of Successful Tech IPOs Gives Hope to Silicon Valley Startups

AI ‘Washers’ Can’t Exaggerate Their Way Out of This One

The Obesity-Drug Battle Is Heating Up After Novo’s CEO Ouster

OnlyFans Owner in Talks to Sell to Investor Group at About $8 Billion Value

Why Is IMAX Suddenly Everywhere?

Are You Smarter Than a Billionaire?

Be sure to follow me on Twitter.

-

Morning News: May 22, 2025

Posted by Eddy Elfenbein on May 22nd, 2025 at 7:05 amMetal Traders Are Beginning to Look Past China’s Economic Woes

India’s Central Bank Cautiously Upbeat on Economy Despite Trade Risks

BOJ Board Member Noguchi Calls for ‘Measured, Step-By-Step Approach’ to Rate Hikes

From Wealth Management to Tourism, the Gulf Reimagines Its Role

OPEC+ Discusses Another Super-Sized Output Hike for July

Barbarism Against Israelis Is Bigger Than Hamas

France and Saudi Arabia Aim to Disarm Hamas in New Peace Push

Eurozone Business Activity Declines Despite Tariff Respite

EU to Delay Bank Rules as It Waits for Trump’s Deregulation Moves

U.S. Trade Deals With Allies ‘Suboptimal’ Solution to Tariff Drag, EU’s Dombrovskis Says

It’s ‘Crunch Time’ for US Importers Facing Tariff Deadlines, Customs Audits

Trump Tax Bill Narrowly Passes House, Overcoming Infighting

The House Passed Trump’s Megabill. Bond Investors Are Worried.

Bond Market Warns Trump, Congress on Dangers of Swelling Deficit

Dimon Warns of US Stagflation Risk, Says Fed Right to Hold

Deutsche Bank CEO Calls 2025 a ‘Year of Reckoning’

Canada’s TD Bank Tops Profit Estimates, Announces Job Cuts

Crypto Crime Is the Future. Bank Heists Are History.

The Trump Family’s Money-Making Machine

Elon Musk on Political Spending: ‘I Think I’ve Done Enough’

Musk’s Political Backpedal Leaves X Searching for Relevance

Meet the IT Companies That Say DOGE Is Good for Business

What Trump’s Apple Threat Means for India’s Tariff Negotiations

Jony Ive and OpenAI Make a Long-Shot Bet to Kill the iPhone

Facebook Is Powerful Evidence That Meta Is Not a Monopoly

Deepfake Laws Bring Prosecution and Penalties, but Also Pushback

Why Bureaucrats Are Bad for Businesses and Brands

Trump’s Funding Threats Build a Case for Private High-Speed Rail

Nike to Sell Products on Amazon Following Five-Year Absence

Wes Anderson, De Niro Push Back Against Trump Tariffs in Cannes

Be sure to follow me on Twitter.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His