So How Predictable Was 1987?

Twenty-five years on, any investor has to wonder, “how predictable was the market crash of 1987?” We’ve never seen anything quite like it. Following the meltdown, of course, we soon learned that lots of folks had apparently warned us. After the financial crisis of four years ago, I was surprised to hear how obvious it all was. (Unfortunately, no one ever told me.)

But what I find interesting in 1987 is seeing how arbitrary it all seemed. In 1987, there were several unusual events that all seemed to coalesce before the plunge. Southern England, for example, had one of its worst storms in centuries. The morning of the crash, the WSJ ran a chart showing the rise in the Dow compared with the rise during the 1920s. Alan Greenspan had only been on the job for two months before the crash.

On October 14th, the market was rattled by the high trade deficit report. The bond market took a big hit the next day. On Friday the 16th, the Treasury bond broke the critical 10% mark.

Over the weekend, Jim Baker, who was the Treasury Secretary, told the Germans to “either inflate your mark, or we’ll devalue the dollar.” Gary Alexander writes:

On Sunday, October 18, Baker went on the Sunday morning talk shows, where he said that the U.S. “would not accept” the recent German interest rate increase. Later, an unnamed Treasury official said we would “drive the dollar down” if necessary. These were fighting words that panicked the market.

Some said that Baker’s rash words, more than anything else, caused the Monday market crash: Jacques Delors, president of the European Commission, compared Baker’s remarks to “a pyro-manic fireman. When you’re living on the edge of the volcano, you don’t light matches.” Economist Pierre Rinfret also blamed Baker for the crash: “The Secretary of the Treasury started one of the worst panics in the history of the stock market.” Noted trader Jimmy Rogers agreed: “The crash had nothing to do with program trading or arbitrage or investment insurance. Greenspan and Baker simply panicked and blew it.”

The rest of the world crashed long before New York opened that Monday. The market day began in Asia, where Monday opened with a 33% drop in Singapore, a 17% loss in Tokyo and 11% down in Hong Kong – a market which closed for the rest of the week. Europe fared no better, with a 22% drop in London, 14% in Zurich and 13% in Frankfurt. Hearing this news over their breakfast coffee, New York traders were bearish from the start, as the market dropped 104 points in the first hour alone. By the middle of the day, the market held its losses to between 100 and 200 Dow points. But after 2:00 p.m., the market lost 100 points each half hour, reaching a 376 point drop by 3:30pm and a 508-point drop at the closing.

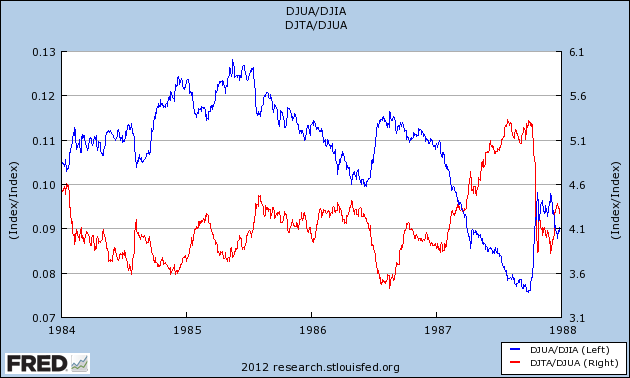

Here’s a chart showing the relative strength of utility stocks and transportation stocks in the period leading up to the crash. It’s simply the Dow Transportation Average divided by the Dow Industrials (red), and the Dow Utility Average divided by the Dow Industrials (blue). When the lines are heading up, the sectors are outperforming the market. When they’re going down, then they’re trailing the market.

In the months leading up to the crash, investors dramatically rotated out of Utilities and into Transports. In other words, they were abandoning safe sectors with high dividends and crowding into riskier cyclical sectors. This is a good way of tipping us off that the market was becoming riskier. In fact, the two lines seem to be perfectly negatively correlated.

Once the crash happened, everything shot back to normal. Still, this only tells us that investors had become more aggressive. It never told us when it would end.

The 1987 crash also showed strange numerical connections. For example, people who follow the Elliott Wave stuff which is based on Fibonacci numbers saw lots of signs. For example, the year 1987 came 55 years after the massive low in 1932, plus 21 years after the downturn of 1966, 13 years after the big low in 1974 and five years after the low in 1982. Personally, I think this is another example of people trying to find patterns in randomness, but some people take it very, very seriously.

Historically, the stock market’s one-day standard deviation is about 1%. A drop of 22% is 22 standard deviations below the mean. Statistically, that’s so rare it would take eons for it to happen. The issue, of coure, is that financial markets don’t follow normal distributions but they can appear to. With finance, as with many areas, we don’t know what we don’t know.

The case of 1987 is another reason for my investing philosophy of investing in high-quality companies and not being rattled by short-term volatility — even extreme moves. Twenty-five years on, the Dow has gained 679.2%.

Posted by Eddy Elfenbein on October 19th, 2012 at 10:02 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His