CWS Market Review – September 13, 2013

“If you have more than 120 or 130 I.Q. points, you can afford to give the rest away. You don’t need extraordinary intelligence to succeed as an investor.” – Warren Buffett

That’s so true, Warren. In fact, over-thinking things can be a problem for a lot of investors. Lately, for example, Wall Street has been dramatically over-thinking its own prospective reaction to any tapering plans from the Federal Reserve. Next week, we’ll finally learn what the Fed has up its sleeve. Hold on to your seats, because this is one of the most-anticipated meetings in years.

After an August slump, Wall Street’s mood has improved considerably this month. Good economic news out of Asia, plus the emerging outlines of a diplomatic solution to the Syria problem have helped calm investors’ nerves. The S&P 500 rallied for the first seven days of September. Remarkably, this was our fourth seven-day winning streak this year. Bespoke Investment Group notes that that hasn’t happened since 1980. The S&P 500 also broke above its 50-day moving average (see chart below) and has gained back most of what it lost during September’s slide.

In this week’s issue of CWS Market Review, we’ll focus on upcoming earnings reports from Oracle ($ORCL), FactSet Research Systems ($FDS) and Bed Bath & Beyond ($BBBY). I also want to highlight some of the strong performers on our Buy List, like Cognizant Technology ($CTSH), which has been red hot lately. But first, let’s look at why we shouldn’t get too worked up over whatever the Fed does next week.

The Tapering Is Here—Perhaps

Wall Street has finally reconciled itself to the fact that the Federal Reserve will start to taper its bond purchases. The FOMC meets again on Tuesday and Wednesday, and the consensus on Wall Street is that the Fed will reduce its monthly bond purchases by $10 billion. That sounds about right. Officials inside the Fed have worked hard to convey any policy hints to investors.

In an argument between the two options, more bond buying or less, the stock market clearly favors more. But I also think the market realizes that this policy wasn’t going to last forever. Plus, there seems to be disagreement within the Fed as to how effective Quantitative Easing truly is. I don’t have any hard proof, but I have the feeling that the Fed has been institutionally uncomfortable with any QE plans.

What will the market’s reaction be? Impossible to say. Plus, it depends on various details in the Fed’s policy statement. I suspect that Wall Street is setting itself up to be disappointed, yet I doubt any strong negative reaction will last long. The fundamentals of the market continue to be very much in favor of the bulls.

I also suspect the Fed will be at pains to stress that tapering is not tightening. This important fact seems to get lost in the discussion. The Fed is merely reducing the amount of monetary stimulus. Ben Bernanke is still fully committed to helping the economy. The larger trend since the start of this month has been a relaxation of investors’ worries. The yield on the 10-year Treasury is back to 2.91%. The Volatility Index ($VIX), which is often referred to as the “fear index,” is down as well, and gold just fell below its 50-DMA. I should add that lots of high-quality stocks yield more than the 10-year, like Microsoft ($MSFT), CA Technology ($CA) and Nicholas Financial ($NICK).

Once the Fed’s decision has passed, traders will start focusing on Q3 earnings season. We have two more weeks left in the third quarter, and earnings season will start in another month. The consensus on Wall Street is that the S&P 500 will earn $27 per share. (That’s an index-adjusted number. Each point in the S&P 500 works out to about $9 billion.) That represents a 12.7% increase over last year’s third quarter. If that’s right, it would be our strongest growth rate in two years. Wall Street expects earnings growth of 25% for Q4. This is probably part of the reason why the Fed thinks it’s safe to start tapering now.

My advice is to avoid any overreaction to next week’s Fed announcement. The market may see some volatility for a bit. As we know, Traders aren’t happy unless they’re unhappy, and they’ll look for any bad news they can find. The case for high-quality stocks remains strong, and we’ve profited from that. Our Buy List is on its way to beating the market for the seventh year in a row. Now let’s look at some of our upcoming earnings reports.

FactSet Research Systems: 16 Straight Record Years

FactSet Research Systems ($FDS) is one of my favorite stocks. The data-service company churns out earnings increase after earnings increase. They’ve increased their profits for 16 straight years. After a while, it gets boring, but this is the kind of boring that investors should find exciting. FactSet is due to report its fiscal Q4 earnings on Tuesday, September 17th.

Three months ago, FDS reported Q3 earnings of $1.15 per share, which matched Wall Street’s estimate. But traders, being traders, hated the report. The shares tumbled 6% that morning. Fortunately, cooler heads prevailed, and the stock has since rallied. On Wednesday, in fact, FDS finally took out its old all-time high, set more than two years ago. I wonder what those traders thought who had panicked and sold 16% ago.

When the June earnings report came out, FactSet said that it sees fiscal Q4 earnings ranging between $1.18 and $1.21 per share and revenue coming in at $218 million and $221 million. That sounds about right. For now, I’m holding our Buy Below at $112 per share, but if the results are good, I’ll raise our Buy Below. FactSet is an excellent stock.

Oracle’s Make-or-Break Earnings Report

Oracle ($ORCL) is due to report its fiscal first-quarter earnings the day after FactSet, on Wednesday, September 18th. Three months ago, Oracle gave us a range for Q1 of 56 to 59 cents per share. For comparison, ORCL earned 53 cents per share in last year’s Q1. Their last two earnings reports were, frankly, unimpressive. Larry Ellison & Co. has promised us that we would see improvements later this year, so I’m holding them to that forecast.

I like Oracle a lot, but I’m afraid they’re swimming against a strong current. Europe has been quite weak this year, and that’s impacted a lot of tech companies. Lately, there’s been some evidence that Europe has turned a corner, so it will be interesting to see if that’s reflected in Oracle’s results. Also, Oracle is facing more competition from Internet-based cloud systems. It’s simply been a tough environment for tech.

I should mention that Oracle’s fiscal Q1 typically has the smallest profit by far, compared with the other quarters. The earnings-per-share figure is usually about 30% less than the preceding fourth-quarter result. Three months ago, Oracle reported earnings of 87 cents per share. For Q4, new software sales rose by just 1%. For Q1, the company said to expect new software sales growth between 0% and 8%.

My take: If Oracle has indeed turned the corner, then it’s a $40 stock. That’s not an exaggeration. I’ve learned never to count Larry Ellison out. Just when you think they’re out of the race, ORCL impresses you. For now, I rate Oracle a buy up to $35 per share.

The Most Financially Conservative Big Retailer in the U.S.

Bed Bath & Beyond ($BBBY), our home furnishings powerhouse, is due to report on Wednesday, September 25th. This will be for the company’s fiscal second quarter. I don’t want to minimize this report, but for BBBY, the Q4 report is the big one. About 35% of their full-year profit comes during the holiday quarter.

BBBY is a very well-run outfit. I’ve been consistently impressed with how they do things. Barron’s said they “could be the most financially conservative big retailer in the U.S.” The firm has a rock-solid balance sheet—no debt and lots of cash. The last two earnings reports were good, but not great. But “good” by BBBY’s standards is still vastly better than it is with most companies.

Bed Bath & Beyond had some short-term problems, which they’ve worked to fix. I think they relied too much on coupons for too long in order to get feet in the door. That was smart during the recession, but they’re not a discount retailer. Traders might be a bit nervous going into this earnings report. BBBY ran up to $78.25 five weeks ago but has gradually pulled back since then. Even the broader market’s rally since the start of the month has failed to lift BBBY.

For Q2, Bed Bath & Beyond sees earnings ranging between $1.11 and $1.16 per share. That’s a nice profit. For the entire year, BBBY sees earnings between $4.84 and $5.01 per share (they made $4.56 per share last year). Personally, I think that figure for the low end is way too low. If the company can make $5 per share this year, which is quite reasonable, the stock is going for 14.4 times earnings.

Thanks to buybacks, BBBY’s share count has dropped from 326 million in 2004 to 226 million today. I’m not a fan of buybacks, but at least they’re actually reducing the amount of shares. Bed Bath & Beyond remains a steady buy up to $79 per share.

Updates on Buy List Stocks

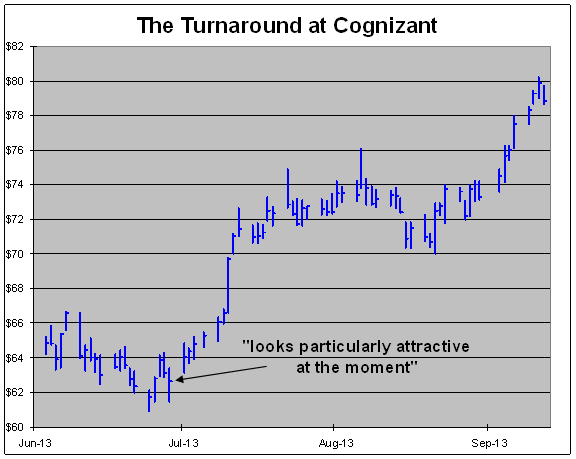

Before I go, I wanted to add a few words on some of our other Buy List stocks. In the CWS Market Review from June 28th, I said that Cognizant Technology Solutions ($CTSH) “looks particularly attractive at the moment.” Well, we nailed that one perfectly (see below). At the time, shares of CTSH were going for $62.64. This week, it broke $80 per share.

Last month, Cognizant had an excellent earnings report and offered strong guidance. The company sees full-year earnings of at least $4.32 per share on revenue of $8.74 billion. That translates to revenue growth of 19%. For Q3, CTSH sees earnings of $1.09 per share. This week, I’m raising Cognizant’s Buy Below to $84. CTSH remains a very good buy.

A quick word about Microsoft ($MSFT). The stock has rebounded recently, along with the rest of the stock market. Look for a dividend increase soon. I think the company will raise their quarterly dividend from 23 cents to 26 cents per share. That would give the software giant a yield of 3.18% based on Thursday’s close. I also think a higher dividend will help calm some investors’ nerves. Microsoft remains a cautious buy up to $34 per share.

Last week, I raised our Buy Below on CR Bard ($BCR), and the stock rallied to another 52-week high this week. The stock came within a penny of $120 per share. Don’t chase it. Bard remains an excellent buy up to $119 per share.

Harris Corp. ($HRS) continues its impressive rally. HRS touched $58.72 on Thursday, which is another 52-week high. The stock is good buy up to $62 per share. Last week, I also raised our Buy Below on Ross Stores ($ROST), and the shares keep powering ahead. On Wednesday, the stock got as high as $70.86. ROST is now a 30% winner for us on the year. Ross continues to be an excellent buy up to $71 per share. Also this week, Ford Motor ($F) reached its highest close in more than two years. I should warn you that Ford can be volatile, but it’s a solid buy up to $18 per share.

That’s all for now. Next week is the big Fed meeting. The FOMC will get together on Tuesday and Wednesday. Look for their policy statement on Wednesday. Everyone on Wall Street will be paying close attention to this one. Also, Ben Bernanke will hold a post-meeting press conference on Wednesday. Finally, we also have earnings reports from Oracle and FactSet. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 13th, 2013 at 7:04 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His