CWS Market Review – September 20, 2013

“Doubt is not a pleasant condition, but certainty is absurd.” – Voltaire

Pretty sneaky, Ben. You fooled us all. On Wednesday, the Federal Reserve announced that it’s not going to start tapering its asset purchases. At least, not yet. Wall Street celebrated as the S&P 500 and Dow both rocketed to new all-time highs.

By the closing bell on Thursday, the S&P 500 stood at 1,722.34, which is a 20.8% gain on the year. It also marks a 10.4% gain since the market’s June low. Wall Street’s about-face is staggering. The S&P 500 rallied for 11 of the first 12 days in September. I’m happy to report that our Buy List has done even better this year. We’re now sitting on a 25.8% year-to-date gain, and eight of our stocks are up 30% or more.

In this week’s CWS Market Review, I’ll break down what the Fed news means for us. We also got positive Buy List earnings reports from Oracle ($ORCL) and FactSet Research ($FDS). I’ll also discuss Microsoft’s ($MSFT) huge 22% dividend increase and $40-billion share buyback. Plus, I’ll give you a sneak peak at the upcoming Q3 earnings season. This could be the best earnings season in two years. But first, let’s look at what the Fed’s decision means for Wall Street and for us.

The Fed Says No to Tapering—For Now

On Sunday night, Larry Summers announced that he had withdrawn his name from consideration to be the next Fed chairman. Apparently, there was just too much Congressional opposition to his nomination. This almost certainly clears the way for President Obama to nominate Janet Yellen to succeed Ben Bernanke. Paul Krugman wrote that at this point, not picking Yellen “would look like spite.”

In a very simplified view, Wall Street viewed Summers as standing for less stimulus and Yellen for more. The Street, of course, is resolutely for more stimulus. With Summers out of the picture, stock prices jumped on Monday (see the chart above). That was merely a preview for what we saw on Wednesday.

On Wednesday afternoon, the Fed’s policy statement included this key line: “the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases.” That’s all it took. Within minutes, the S&P 500 vaulted 20 points. Most of Wall Street was convinced that at least some tapering was coming. After all, the Fed had spent weeks trying to prepare investors.

I had said that I thought tapering was a mistake, so I’m glad to see the Fed keep its powder dry. But I’m not pleased with the convoluted messaging coming from the central bank. In June, the Fed said that QE could be wound down by the middle of next year. Now I don’t think that will happen. There’s plenty of debate on the effectiveness of Quantitative Easing (I’m not a firm believer myself). But one thing is clear: the stock market loves QE, so that gives us one reason to be a fan.

At his press conference, Bernanke said that it’s possible the Fed will start tapering before the end of the year, but he stressed that there’s no fixed calendar schedule. The bottom line is that inflation is low and the jobs market is weak, so there’s no need to rush things. Bernanke said that the Fed funds rate will stay low as long as unemployment is above 6.5%. We’re currently at 7.3%. Most FOMC members don’t see rates going up until 2015. I wouldn’t be surprised to see some members join the 2016 camp. The Fed also lowered its growth forecasts for this year and next.

The message to investors is that the Fed isn’t going anywhere. One analyst said, “The FOMC is giving us an invitation to take on risk. There is no reason for investors not to accept the gift.” The Fed has helped the market gain 150% in four and a half years, and they still have their foot on the pedal.

Now let’s look at our recent Buy List earnings reports.

FactSet Is a Buy up to $117 per Share

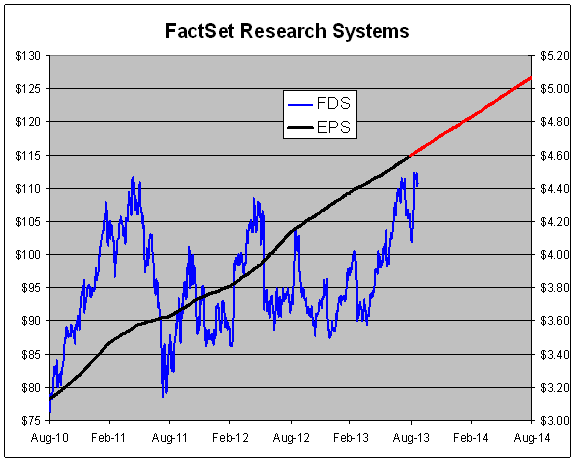

On Tuesday, FactSet Research Systems ($FDS) reported fiscal fourth-quarter earnings of $1.20 per share. Technically, that counts as a one-penny-per-share miss, since the Street was at $1.21, but FactSet’s guidance was $1.18 to $1.21 per share, so the company is hitting its own targets. The shares initially pulled back after the report, but they quickly regained most of what they had lost. Quarterly revenues rose 6% to $219.3 million, and net income was $51 million. For the year, FDS earned $4.60 per share, which is a nice increase from $4.12 last year.

The big metric for FactSet is ASV or annual subscription value. For the quarter, ASV rose by 6% to $888 million. That’s a good number, and it points towards strong revenue over the next year.

For fiscal Q1, which ends in November, FactSet expects revenues between $222 and $225 million. They see earnings coming in between $1.21 and $1.24 per share. Wall Street had been expecting $1.23 per share. The bottom line is that business continues to go well for FactSet. Their earnings-trend line is about as steady as they get (see above). I’m raising my Buy Below on FactSet to $117 per share.

Oracle Earns 59 Cents per Share

On Wednesday, Oracle ($ORCL) reported fiscal Q3 earnings of 59 cents per share, which beats estimates by three cents per share. Total revenue rose 2% to $8.37 billion, which was $10 million below the Street’s view. Overall, I was pleased by these results. In June, the company had given us an earnings range of 56 to 59 cents per share, which was probably a bit of low-balling. Actually, the earnings would have been even better this time if it weren’t for those meddling currency effects. Not counting the strong dollar, earnings were up 14% last quarter.

I called this a make-or-break earnings report for Oracle, and I’m glad to see that they did well. The financial details are pretty impressive. Oracle had free cash flow of $6 billion, and half of that went to share buybacks.

For fiscal Q2, which ends in November, Oracle sees earnings coming in between 64 and 69 cents per share. Frankly, that’s on the light side. The consensus on Wall Street was for 69 cents per share. I suspect the company is being extra-conservative these days with guidance.

For Q2, Oracle said that sales of new software and subscriptions would be between -4% and +6%. By contrast, their estimates for Q1 were between 0% and 8% (the actual results came in at 4%, the dead center of the range). The problem for Oracle is that they’ve been squeezed by a tough environment for tech and a new product cycle. I think they will come of out this strong, but it will take more time.

The shares initially gapped up in the after-hours market, then they dropped sharply on the tepid guidance. By the end of the day on Thursday, ORCL finished higher by two cents to reach its highest close in three months. I should note that Larry Ellison couldn’t make the conference call because he was at an America’s Cup race in San Francisco. That’s not reassuring to me. Still, Oracle remains a very good buy up to $35 per share.

Third-Quarter Earnings Preview

The third quarter is almost over, and soon the third-quarter earnings season will be upon us. This is a crucial time. Between mid-October and early November, 15 of our Buy List stocks are due to report their results.

This is also a big earnings season for Wall Street. Earnings growth was rather sluggish for the first half of the year, but most analysts expected that. For months we’ve been hearing that growth will ramp up later this year. Well, later this year is now, and investors want to see hard evidence.

Fifteen months ago, analysts on Wall Street were projecting that the S&P 500 would earn $30 per share (that’s the index-adjusted figure; $1 equals about $9 billion). That forecast has been cut down almost continuously, and it now stands at $27. Some folks have noted the incongruity of rising stock prices and falling estimates. This has led to lots of renewed bubble talk. Personally, I think the bubble talk is itself a bubble.

My take: We’re not seeing a bubble in stocks right now. In fact, it’s the opposite. The reason stocks have rallied with lower estimates is that the tremendous fear bubble from last summer has gradually been deflated. If you recall, we heard constant worries that what was happening in Greece, or Portugal, or Spain, or Italy was about to sink the U.S. market. The euro was toast, and so were we. It didn’t happen, and investors returned to their senses. That’s really been the story of the latest phase of the rally.

Currently, Wall Street expects Q3 earnings to rise 12.4% over last year’s Q3. That would be the best growth rate in two years. They see another 25.4% coming for Q4. The S&P 500 is on track to earn $108.12 this year, and $122.34 for 2014. I’m wary of estimates that go too far into the future, but if the forecast for next year is accurate, the market is currently going for a little more than 14 times next year’s earnings. That’s hardly a bubble.

We have one more Buy List earnings report left for September. Bed Bath & Beyond ($BBBY) reports on Wednesday, September 25th. Three months ago, they gave us a range of $1.11 to $1.16 per share. BBBY is a solid buy up to $79 per share.

Microsoft Raises Its Dividend by 22%

In last week’s CWS Market Review, I made an optimistic forecast. I said I was expecting Microsoft ($MSFT) to raise its quarterly dividend from 23 cents to 26 cents per share. Funny, I thought I was being bold, but it turns out that I wasn’t optimistic enough.

On Tuesday, Microsoft announced that it’s raising its quarterly dividend by five cents to 28 cents per share. That’s a 22% increase. The dividend is payable on December 12th to shareholders of record on November 21st. The software giant also announced a $40-billion buyback program which is equal to 15% of their market cap. The new buyback program will replace another $40-billion program that’s due to expire at the end of September. The new program doesn’t have an expiration date.

Microsoft’s new dividend translates to $1.12 per share for the year. Going by Thursday’s closing price, MSFT yields 3.33%, which is more than a 10-year Treasury. This week, I’m raising my Buy Below on Microsoft to $35 per share.

One quick note on JPMorgan Chase ($JPM). The company has admitted wrong-doing on its London Whale Trade fiasco and agreed to pay fines of $920 million. JPM is a good stock, but it would be a lot better without Jamie Dimon. JPM is still a buy up to $56 per share.

That’s all for now. Next week is the last full week of the third quarter. On Thursday, the government will offer its final revision to Q2 GDP. In August, you may recall that Q2 GDP was revised substantially higher from the initial report, from 1.7% to 2.5%. It will be interesting to see if that’s revised any higher. We also have the earnings report from Bed Bath & Beyond on Wednesday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 20th, 2013 at 7:06 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His