CWS Market Review – February 17, 2017

“In finance, everything that is agreeable is unsound and everything that is sound is disagreeable.” – Winston Churchill

Recently, I’ve told you that I’ve become more bearish on the stock market in the short term, and that I expect a difficult period for February and March. So far, I’m relieved to say that I’ve been dead wrong. The stock market continues to wander higher. On Wednesday, the Dow, Nasdaq and S&P 500 all closed at all-time highs. For the first time in 25 years, the three indexes made five consecutive new highs together.

If I had told you that North Korea would launch a missile and that the National Security Advisor would resign, how would you have thought the market would behave? Now we know the answer. Wall Street continues to be as calm as could be, and quite optimistic as well.

This week, Janet Yellen went to Capitol Hill to testify on the economy and monetary policy. But that wasn’t the biggest economic news this week. Instead, we learned that in January, inflation had its biggest surge in four years. Last month, consumer prices rose at an annualized rate of 6.8%—and it wasn’t all due to gasoline. I’ll tell you what it means for us and our portfolios.

Later on, I’ll review the latest earnings report from Express Scripts. The pharmacy-benefits manager beat estimates, but guidance was a wee bit weak. I’ll go over the details. I’ll also highlight a bunch more earnings reports coming our way next week. But first, let’s take a closer look at the recent uptick in inflation.

Inflation Soars in January—What Does It Mean for Us?

On Wednesday, the Labor Department said that consumer prices rose by 0.6% last month. That’s twice what economists had been expecting. In the last year, inflation has been running at 2.5%. January’s report was the highest rate in four years. Annualized, consumer prices rose by 6.8% last month.

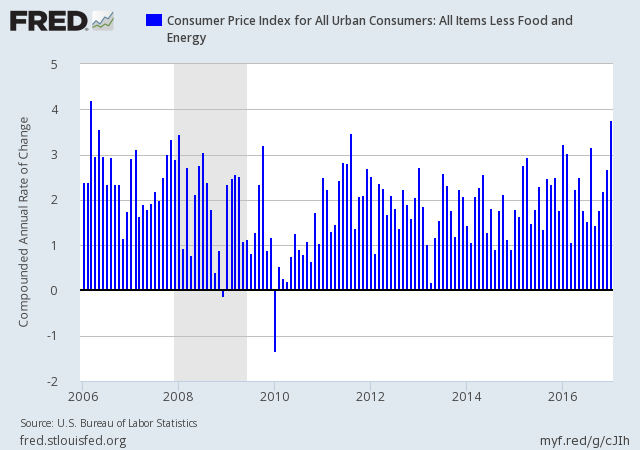

About half of the increase was due to higher gasoline prices, but there are other factors as well. Clothing prices, for example, rose strongly last month. If we look at “core inflation,” which strips away food and energy prices, then we see that inflation rose by 0.3% last month, or 3.76% annualized. Still, that’s the highest rate in more than 10 years.

Does this mean that inflation is on the upswing? Frankly, it’s too early to say. With econ numbers, we always want to look at the trend instead of single points of data. I suspect that it’s not a resurgence of inflation, but I’m open to being convinced.

More importantly, inflation is now running above the Fed’s 2% target. In fact, the increase in inflation essentially nullified the Fed’s December rate hike. I’ve said that I’ve been a doubter about the Fed’s aggressive hike-rate forecast for this year, but if inflation pressures persist, then it may come about. I would expect their next rate increase to come in June.

This week, Janet Yellen went to Capitol Hill to testify on the economy. Regarding the stock market’s recent surge, she said, “I think market participants likely are anticipating shifts in fiscal policy that will stimulate growth and perhaps raise earnings.” I have to agree, and this is important because it means the Fed is no longer pulling the market along.

Fortunately, the long-end of the bond market is still relatively calm. The yield on the 10-year Treasury climbed 2.5% after the CPI report, but that’s still pretty tame. Earlier this week, the yield on the one-month Treasury got up to 0.53%. Obviously, that’s not a lot but it’s a nine-year high. The message is clear that interest rates are on the way up, but we’re a long way from them being real competition to stocks.

Other interesting economic news this week is that small-business optimism continues to rise. We saw big jumps after the election, and it’s now at a 12-year high. Retail sales did well last month. We saw a seasonally adjusted increase of 0.4%. Interestingly, the figure for December was revised higher to 1% growth. That’s very good for one month.

Express Scripts Is A Buy Up To $74 Per Share

After the closing bell on Tuesday, Express Scripts (ESRX) reported their Q4 earnings. This was a closely-watched report for people following the issue of drug pricing. There’s been a growing war of words between drug makers and pharmacy-benefits managers about who’s really responsible for the increase in drug prices. ESRX’s CEO, Tim Wentworth, has recently pushed back at criticism of PBMs, and I think he’s right to do so.

Now to the earnings report. For Q4, Express Scripts earned $1.88 per share. That beat estimates by one penny per share. For the year, Express earned $6.39 per share, which was a nice 16% increase over 2015. Earlier, Express had said that its full-year total would range between $6.36 and $6.42 per share. Overall, this was a solid year for the company.

“We delivered another year of successful performance, not only through financial results, but by providing innovative solutions to help our patients and clients drive healthier outcomes and lower drug trends,” said Tim Wentworth, CEO and President. “In a year when the focus on drug pricing has never been greater, Express Scripts has held the 2016 growth rate in drug unit costs to 2.5% and lowered the patients’ share of total drug costs per prescription. The fundamentals of our business remain strong as our clinical focus and unwavering alignment with clients enables us to lead the industry in developing innovative value-based solutions that our country needs.”

Quarterly revenue came in at $24.86 billion, which was below estimates. For Q1, Express said it expects earnings between $1.30 and $1.34 per share. The Street had been expecting $1.35 per share. For the whole year, they see EPS ranging between $6.82 and $7.02 per share. That means the stock is going for about 10 times this year’s earnings. Express Scripts remains a buy up to $74 per share.

Four Buy Earnings Reports Next Week

I’m writing this early on Friday. Later today Moody’s (MCO) and Smucker (SJM) are due to report. Moody’s is our #2 performing stock for the year, with a YTD gain of 16.9%. On a side note, I always find it interesting that I never know what the top performers will be, and it’s usually a big surprise. Wall Street expects earnings of $1.24 per share. I’ll probably raise my Buy Below on Moody’s, but I want to see the earnings report first.

Also, Smucker will be reporting. However, their earnings reporting period ended in January. The company estimates full-year earnings (ending in April) coming in between $7.60 and $7.75 per share, “with a bias toward the middle to high end of the range.”

On Tuesday, February 21, Wabtec (WAB) is scheduled to report Q4 earnings. The rail-services company had a weak Q3 report. They also lowered full-year guidance. I think 2017 will be a much better year for them. Wall Street expects earnings of 93 cents per share.

Then on Thursday, February 23, we’ll get our final two earnings reports for this cycle as Cinemark (CNK) and Continental Building Products (CBPX) are due to report. The movie-theater chain has been doing a brisk business lately. Wall Street expects earnings of 43 cents per share. Three months ago, Continental missed earnings, but I expect a rebound. Wall Street is looking for Q4 earnings of 27 cents per share.

Also on Thursday, Hormel Foods (HRL) will report earnings, but they’re another stock on the January cycle. The Spam stock has delivered 14 record quarters in a row, and I expect to see #15. Wall Street expects Q1 earnings of 45 cents per share. Hormel gave 2017 guidance of $1.68 to $1.74 per share. The company also recently raised its dividend for the 51st year in a row.

Buy List Updates

Before I go, let me add a quick note on Cerner (CERN). In last week’s issue, I mentioned that their earnings report matched expectations. In Friday’s trading, just after I sent the newsletter, the stock got punished by traders. The market then had second thoughts, and Cerner rallied this week, and it made back everything it lost. The lesson here is not to worry too much over the stock market’s initial reaction to things. Traders prefer to sell first and ask questions later. This actually works to the advantage of those like us who are in it for the long haul.

Also, Sherwin-Williams (SHW) raised their dividend by one whole penny! The quarterly dividend went from 84 to 85 cents per share. Obviously, that’s not a big increase but this is Sherwin’s 38th straight year of raising its dividend. That’s a streak I like. The stock is up 15.8% on the year for us.

That’s all for now. The stock market will be closed on Monday in honor of George Washington’s birthday. The NYSE is a bit old school on such matters. They make it clear that it’s Washington’s Birthday, not President’s Day. There’s not much in the way of economic news next week. The existing home-sales report is on Wednesday. Then on Friday, the new homes sales report comes out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on February 17th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His