CWS Market Review – August 11, 2017

“The only perfect hedge is a Japanese garden.” – Eugene Rotberg

On Thursday, the S&P 500 dropped by 1.45% to close at 2,438.21. This was the index’s biggest drop in nearly three months. I should restate that—this was the biggest drop by far in the last three months. Put it this way: Since May 18, Thursday’s drop was five times greater than the damage of the sixth-largest loss.

The point is that in historical terms, Thursday’s loss really ain’t that big a deal. But in terms of 2017’s volatility, Thursday was an earthquake inside a hurricane next to shark attack.

The reason behind Wall Street’s fearfulness isn’t hard to miss. Wall Street and the world are increasingly concerned by the behavior of North Korea. The United Nations Security Council voted unanimously to impose sanctions on North Korea. Bear in mind that the UNSC is rarely unified on anything. Despite Thursday’s bout of selling, defense stocks like Lockheed Martin, Northrop Grumman and Raytheon all made new 52-week highs.

In this week’s CWS Market Review, I’ll bring you up to speed on the latest happenings on Wall Street. I’ll also cover Cinemark’s reassuring earnings report. Plus, I’ll preview next week’s earnings report from Ross Stores. We also had some good news for the Buy List. Snap-on is spending $500 million to buy back shares. But first, let’s look at how Kim Jong Un has spooked the U.S. stock market.

Should We Worry About North Korea?

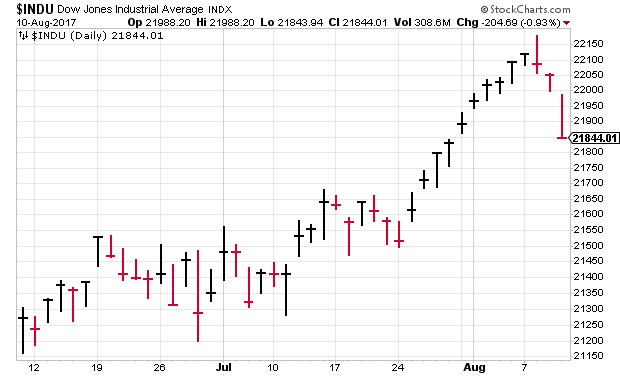

On Tuesday, the Dow snapped a 10-day winning streak. This streak got a lot of attention in the financial media, but I can’t say I was terribly impressed. For one thing, most of the increases were very small. In the history of the Dow, there have been 17 win streaks of 10 or more days. This last one has the smallest cumulative gain of all of them.

We also have to remember that the Dow is a price-weighted index. As a result, a company like Goldman Sachs has the second-highest weighting in the index even though it has the fifth-smallest market value. The S&P 500 is weighted by market value, and it barely budged during the Dow’s winning streak. In fact, the S&P 500 fell four times in those 10 days. It was precisely companies like Goldman Sachs and JP Morgan that helped power the Dow to its new highs.

With the recent war of words over North Korea, investors are starting to feel anxious. The South Korean economy punches above its weight in the world economy. There are several prominent Korean corporations like Samsung and Hyundai. But in the last two weeks, the South Korea ETF (EWY) has lost more than 7%.

Over the past several months, Wall Street has brought back its old habit of freaking out in the short-term over something that turned out to be nothing major. Remember the Brexit panic? The S&P 500 had its biggest daily drop in nearly a year. But shortly after that, cooler heads prevailed and doomsayers were yet again proven wrong.

Nearly the same thing happened after last year’s election. At one point on election night, the Dow futures were down more than 800 points. The end of the world never came, and the Dow is sitting on a nice 20% gain since the election.

My point isn’t to defend or criticize any of these political events. Rather, I’m encouraging you not be swept up by unreasonable fears. Stock prices are like a global blood-pressure machine. Historically, the U.S. stock market has been able to rally during highly-unsettling times for the country and the world. Any drop in U.S. equity prices is good for stock-pickers.

On our Buy List, there are a few stocks I like in particular. Ross Stores (ROST), which reports next week, is a good value here. I also like Danaher (DHR), which was has been quite weak lately. DHR looks particularly good below $80 per share. I also like Alliance Data Systems (ADS). The stock is currently going for a little more than 10 times the company’s estimate for next year’s earnings. ADS has also increased its buyback program by $500 million. That’s an impressive sign of confidence. Now let’s take a look at last Friday’s earnings report from Cinemark.

Cinemark Is a Buy up to $43 per Share

Last Friday, Cinemark (CNK) became our final Buy List stock to report earnings for the second-quarter earnings season. The movie-theater chain said they earned 44 cents per share last quarter. That was one penny below estimates.

What’s interesting is that shares of CNK dropped sharply going into Friday’s earnings report. That’s largely because a competitor, namely AMC, completely bombed its earnings report. Traders naturally think that whatever’s hurting one company in a sector must necessarily be hurting its competitors as well.

For Cinemark, that’s not the case. So even though they missed earnings by a penny per share, last Friday’s results relieved investors who feared the worst. Looking at the details, Cinemark´s quarterly sales rose by 0.9%. Concession revenue per person, which is the real moneymaker for CNK, rose by 8.9%.

“We continue to be pleased with the consistency of our financial performance, including our second quarter’s global revenue growth, record food and beverage per caps, and year-over-year box-office results that again exceeded the North American industry,” stated Mark Zoradi, Cinemark’s CEO. “We remain optimistic about film content for the remainder of the year, as well as the future growth potential that our strong foundation and strategic initiatives provide for our Company.”

Cinemark’s screen count is up to 5,926. I’m keeping CNK’s Buy Below at $43 per share.

Earnings Preview for Ross Stores

Ross Stores (ROST) will report its fiscal Q2 earnings after the closing bell on Thursday, August 17. Ross is one of my favorite retailers, but the shares have been struggling this year. It’s actually our single-worst performer YTD, with a loss of 14%. Part of the reason isn’t so much about Ross but the impact of online shopping on the entire retail sector. There have been countless stories this year about how Amazon is devouring the retail world. In fact, others retailers like Macy’s and Target have been hit worse than Ross.

Still, I’m an optimist on Ross. If you understand Ross’s business model, you see that Amazon isn’t much of a direct competitor. For their Q2 report, which ended on July 29, Ross sees earnings ranging between 73 and 76 cents per share. That’s compared with 71 cents per share for last year’s Q2. That sounds about right. For comparable-store sales growth, Ross sees an increase of 1% to 2%.

I’ve been particularly impressed with Ross’s operating margins. Retail is all about keeping control of costs, especially for a deep discounter like Ross. In May, Ross raised its full-year earnings forecast. The company now projects 2017 earnings between $3.07 and $3.17 per share. The previous range was $3.02 to $3.15 per share. For context, Ross made $2.83 per share last year; however, this year will include an extra business week. Ross estimates that will add eight cents per share.

I’ll be paying close attention to Ross’s guidance for Q3. I’m expecting something around 65 to 68 cents per share. There’s a good chance I’ll raise my Buy Below on Ross, but I want to see their guidance first. Don’t give up on Ross!

I wanted to follow up on Continental Building Products (CBPX). Last week, the wallboard folks missed on their earnings report by three cents. The stock, however, reacted rather dramatically. Last Friday, CBPX jumped 8.4%. Then on Monday, it dropped by 5.4%. This is unusual but not unheard of. The stock seems have to calmed down lately. This week, I’m dropping my Buy Below on CBPX down to $23 per share.

A few weeks ago, Snap-on (SNA) beat earnings, yet the stock fell after the report. The earnings looked fine to me. Apparently, the company is trying to take advantage of the reduced share price. This week, Snap-on announced a new buyback plan worth $500 million. That’s worth about 5.6% of the SNA’s current market value.

Good news for CR Bard (BCR). This week, shareholders voted to approve Bard’s merger with Becton Dickinson (BDX). According to Bard, “approximately 99%” of the vote was in favor of the merger. There wasn’t much doubt about the outcome, but it’s nice to see such a strong vote.

As a reminder, the deal calls for BCR shareholders to get $222.93 per share in cash plus 0.5077 shares of BDX. That currently values BCR at $323.57 per share. The stock is currently going for a slight discount (about 1.4%) relative to the deal’s price. That’s common because there’s always a chance that the deal could fall apart. It’s highly unlikely but not impossible. The discount has gradually diminished since the deal was announced in April. Bard said the merger will officially take place sometime in Q4.

HEICO (HEI) has been very strong recently. Over the last six weeks, the shares are up 21%. If you recall, HEICO had a very good earnings report in May. The company has already raised guidance twice this year. I’m raising my Buy Below on HEICO to $90 per share.

That’s all for now. We’ll get some key economic reports next week. On Tuesday, the July retail-sales report comes out. The June report was not very good, so I’ll be curious to see if there’s been any improvement. On Wednesday, we’ll get the minutes from the last Federal Reserve meeting. Then on Thursday, the next industrial-production report comes out. This data series has been improving in recent months. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on August 11th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His