CWS Market Review – September 22, 2017

“The expectation of an event creates a much deeper impression on the exchange than the event itself.” – Jose de la Vega, 1688

First, the good news. The stock market continues its winning ways. The Dow just set nine straight daily records, and the S&P 500 is over 2,500. Not only that, but it’s been one of the calmest markets in history. Ryan Detrick notes that the Dow rose by less than 0.3% for seven straight sessions. That’s only the second time that’s happened in the Dow’s 121-year history. Volatility is low, and markets are happy.

Now the bad news. The Federal Reserve made it clear this week that they intend to keep on raising interest rates. Not just once more in December, but a few more times after that in 2018 and 2019. In my opinion, this is a big mistake.

The evidence (to me) is clear that the need for higher rates has faded. After all, inflation has cooled off. We’ve just gone through two big hurricanes. Plus, there’s been some weak economic news lately. I’m not alone in this opinion. Not too long ago, the futures market started to believe that we might not get a rate hike for the next year. But the Fed wants higher rates, and in these matters, they always get their way.

Unfortunately, as investors, we don’t get to choose the environment. We have to deal with reality as it is. In this week’s CWS Market Review, I’ll explain what the Fed said this week and what it means for us. We also got two dividend hikes from our Buy List stocks. Microsoft hiked its payout by 7.6%, and Ingredion boosted its payout by 20%. I love seeing nice dividend increases from our stocks. I’ll have more to say on these in a bit, but first, let’s look why the Fed is on the wrong course.

The Federal Reserve Holds Firm

Lately, I had been telling you that the Federal Reserve won’t be raising interest rates any time soon. Silly me. I was assuming the Fed was going off the evidence. Big mistake.

We had five very soft inflation reports in a row. Only the last one was anything close to the Fed’s target of 2%. Let’s look at some the recent data. Last Friday, the Fed said that industrial production fell by 0.9% last month, and Hurricane Harvey was responsible for 0.75% of that. We also learned that retail sales fell 0.4% in August. Take out gasoline, and retail sales still fell 0.2%. That’s not good.

The Atlanta Fed’s GDP model now sees Q3 coming in at 2.2%. The New York Fed’s model is down to 1.3%. Sure, Harvey bears some of the blame, but not all. The economy is growing, but at a tepid pace.

But the Fed is having none of this. On Wednesday, the central bank released its policy statement, along with its revised economic forecasts. I should warn you that the Fed’s track record isn’t merely bad—it’s bad for economists.

Let’s dig into the policy statement. Not surprisingly, the Fed decided against raising interest rates at this meeting. That means the target for Fed funds remains between 1% and 1.25%. In the statement, they acknowledged the damaged caused by the hurricanes, but added that “the storms are unlikely to materially alter the course of the national economy over the medium term.” This is probably true. Plus, a lot or rebuilding news to be done. Note that Continental Building Products (CBPX) had another big gap up this week while shares of Danaher (DHR) touched a new high.

The Fed also said the economy is growing moderately and the jobs market continues to get better. They also said that core inflation is low, and will probably remain so. I agree.

Now let’s turn to the Fed’s economic projections. This is often referred to as the “blue dots,” due to the dot plot in the report. The Fed now sees core inflation rising to 1.9% next year, and 2% in 2019. Mind you, the Fed has consistently overestimated future inflation. Not only that, but if anything, core inflation was been trending downward. It’ll probably something like 1.5% this year. Don’t get me wrong: I’m all for the Fed battling inflation. But I’m not wild about fighting inflation that doesn’t appear to exist.

Of the 16 members on the FOMC (not all of whom vote at policy meetings), 12 see another rate increase in December. Prior to the meeting, the futures market thought there was a 37% chance of a December hike. Now that’s up to 78%.

For 2018, the median forecast calls for three more rate hikes. That would bring the Fed funds target range to 2% to 2.25%. On a side note, if the Fed’s inflation forecast is correct, that would mean the real (or inflation-adjusted) range would finally be positive. It’s been negative for nearly a decade. In other words, you could borrow money from the Fed for free, after adjusting for inflation.

The median Fed forecast calls for one more hike in 2019, plus another one in 2020. The Fed also projects inflation and interest rates for the “long run.” (“But this long run is a misleading guide to current affairs. In the long run we are all dead.” – JM Keynes.)

Here’s an interesting nugget. The Fed members see long-run interest rates at 2.75%. Combined with the long-run inflation forecast of 2%, this implies the Fed believes the “equilibrium rate” is 0.75%. That’s the interest rate at which (theoretically) everything should come into balance (again, theoretically). I’d guess that if you polled economists on the equilibrium rate prior to the financial crisis, they probably would have pegged it around 2%. So as long as the Fed is below 0.75% in real terms, they view themselves as pumping up the economy.

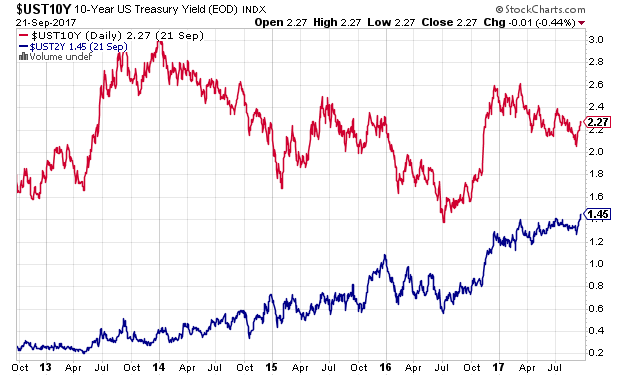

Remember that for much of 2017, long-term interest rates have been falling. Lots of other people were betting that the Fed would take a breather. But in the last two weeks, a lot has changed. The yield on the 10-year bounced from 1.88% on September 7, to 2.11% on Thursday.

That’s not all. The yield on the two-year Treasury is now up to 1.45%. That’s the highest in nearly nine years. The two-year is a good maturity to watch, because it’s usually very sensitive to interest-rate expectations. For some context, six years ago, the two-year was yielding as low as 0.16%.

What does all this mean? A December rate hike from the Fed won’t be a disaster. The problem is that it gives the Fed less room to operate if and when things get bad. There’s also no reason to worry about the stock market. The market can rally along with higher rates. That’s what happened from 2004 to 2006.

In last week’s issue, I talked about the impact of the weak dollar on the stock market. If the dollar gains strength, this means that the nature of what’s rallying could change. For example, bank stocks tend to perform when short-term rates rise. That’s how they make their money. On our Buy List, I still like Signature Bank (SBNY), especially below $125.

This is a boring market, and boring markets are usually good markets.

Investors should continue to focus on high-quality names. In addition to Signature, two other Buy List stocks I particularly like are Ross Stores (ROST) and Intercontinental Exchange (ICE). As always, please watch my Buy Below prices. There’s no need to chase after good stocks.

Dividend Hikes from Microsoft and Ingredion

We recently got two dividend increases for our Buy List stocks. Last Friday, Ingredion (INGR) announced a 20% dividend increase. INGR’s payout will rise from 50 to 60 cents per share. Business has been good. Last month, Ingredion reported earnings above expectations.

“We are proud of our record of delivering consistent shareholder value. From dividends and share repurchases to capital investments and acquisitions, we are committed to a balanced deployment of cash consistent with our strategic blueprint,” said Ilene Gordon, chairman, president and CEO.

The new dividend is payable on October 25 to stockholders of record at the close of business on October 2. Based on Thursday’s close, INGR yields 2%.

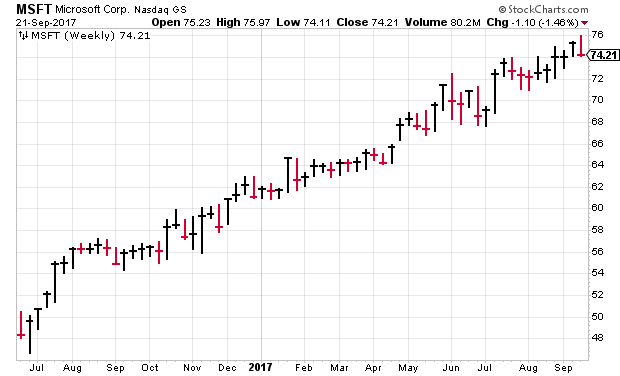

Then on Tuesday, Microsoft (MSFT) announced a 7.6% increase to its dividend. The quarterly payout will rise from 39 to 42 cents per share. In last week’s CWS Market Review, I said, “I’m expecting 42 cents, maybe 43 cents per share.” Close enough.

The dividend is payable December 14 to shareholders of record on November 16. The ex-dividend date will be November 15. By the way, too many investors ignore the importance of dividends. Remember that those dividend increases can add up. Microsoft is now yielding 11.3% based on its 2009 low. Even in today’s terms, MSFT yields 2.26%. That’s only two basis points below a 10-year Treasury. I like Microsoft a lot.

That’s all for now. We’re going to get some key economic reports next week. On Tuesday, we’ll get reports on consumer confidence and new-home sales. Then on Wednesday, the durable-goods report comes out. On Thursday, the government will have its second revision of Q2 GDP growth. Last month, the estimate for Q2 growth was revised to 3.0% from the initial estimate of 2.8%. Friday will be the last trading day of the third quarter. We’re also get the income and spending reports for August. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 22nd, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His