CWS Market Review – September 29, 2017

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” – Warren Buffett

On Thursday, the S&P 500 closed at 2,510.06, yet another all-time high. We still have one day left, but this could be the eighth-straight quarterly gain for the S&P 500. If we include dividends, it will be the 11th-straight monthly gain. Not only that, but it looks like this September could be the least volatile September on record.

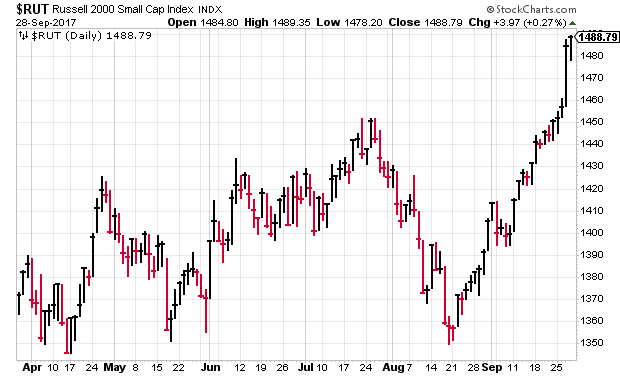

Even with as well as the big-cap indexes have been doing, the small-caps have been particularly popular lately. On Wednesday, the Russell 2000 skyrocketed 1.5% for its best day since June. (And yes, in 2017, a 1.5% counts as “skyrocketing.”) The index is up nearly 10% since mid-August.

We should be thankful for the market’s good mood, but we should always be prepared for whatever the market throws our way. In this week’s CWS Market Review, I want to focus on some recent economic news. I’ll also discuss the Buy List’s performance so far this year. Later on, I’ll have some updates on our Buy List stocks.

Expect a Good Earnings Season Next Month

On Thursday, the government updated its report for Q2 GDP growth. They now say that the economy grew, in real terms, by 3.1% during the second quarter. That makes it one of the better quarters in this cycle, but will the good news last?

I’m not so sure. We may slip back into our 2% trend line that’s been very hard to shake for several years now. The Atlanta Fed’s GDP Now forecasts Q3 growth at 2.1% (Take note of Mr. Buffett’s comments on forecasters in this week’s epigraph.)

Earnings season will soon start and then we’ll get a much better look at how the corporate world fared during Q3. Remember, of course, that profits and the broader economy don’t always need to move at the same speed, or even in the same direction.

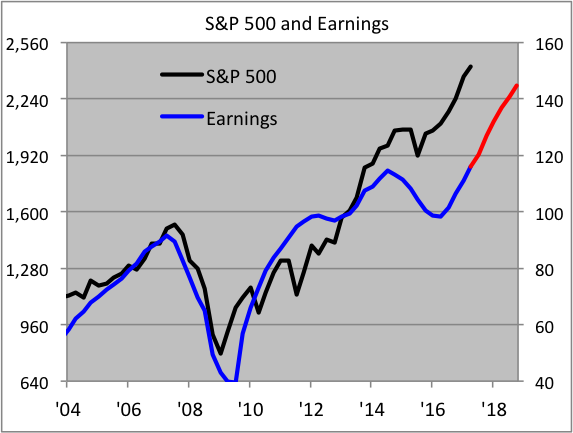

Wall Street currently expects the S&P 500 to report Q3 earnings of $32.90 per share. That’s the index-adjusted number. As is often the case, that figure has been pared back as earnings season approaches, but the estimate cuts have been less than we saw during Q2.

If the forecast of $32.90 is correct (if!), that would translate to quarterly profit growth of 14.7%. It would also be the sixth quarter in a row of profit growth for the S&P 500. Some of the previous growth has relied heavily on share buybacks. We’re seeing less of that recently. Share buybacks are down 25% since the start of 2016.

The S&P 500 is currently expected to earn $127.05 this year and $144.71 next year. That means the stock market is currently going for 17.3 times next year’s earnings. That’s elevated, but I wouldn’t say it’s an obvious bubble. Let’s also remember how low bond yields are. To give you an example, the yield for five-year TIPs (the inflation-protected securities) is just 0.16%.

The chart below shows the S&P 500 (black line, left scale) along with its trailing earnings (blue line, right scale). The two lines are scaled at a ratio of 16-to-1 so whenever the lines cross, the market’s P/E Ratio is exactly 16. The red part of the line is Wall Street’s estimate.

This should also be the 30th quarter in a row of growing dividends. As I’ve pointed out a few times, this rally has been about dividends almost as much as it’s been about share prices. For all the talk we’ve heard of a bubble, stock prices have largely kept pace with dividends.

On our own Buy List, we had recent dividend increases from Microsoft (MSFT) and Ingredion (INGR). We may get another soon from RPM International (RPM).

Some Buy List stocks that look particularly good right now include Signature Bank (SBNY), Danaher (DHR), Alliance Data Systems (ADS) and Stryker (SYK). Remember to pay attention to our Buy Below prices.

The Buy List’s Performance So Far

We still have one day left in the third quarter, but I wanted to give you an update on how the Buy List is doing so far this year. Through Thursday, our Buy List is up 11.09%. That trails the S&P 500, which is up 12.11%.

Neither figure includes dividends. I didn’t have enough time to calculate the dividend-adjusted returns, but our Buy List yields a little bit less than the market as a whole. I hope to post all those numbers soon.

While we’re trailing the market at the moment, I think we have a very good shot at once again beating it for the year. Our difficult period came in late July and early August, during Q2 earnings season, when a few bad earnings reports caused our Buy List to lose its lead. That was a tough time for us, but we’ve gotten back on track. Lately, in fact, our Buy List has been beating the overall market.

Also, we shouldn’t lose sight of the fact that the Buy List is making money for us this year. What works against us is that the market’s rally has been skewed to a small number of stocks that have performed very well.

Through Thursday, four of our Buy List stocks are up more than 40%. The big winners are CR Bard (BCR), HEICO (HEI), Moody’s (MCO) and Cerner (CERN). Remember that sometime in Q4, CR Bard will become Becton, Dickinson.

Our biggest loser this year is Smucker (SJM), which is down nearly 19% YTD. The next biggest loser is Signature Bank, which I think looks especially tempting below $130 per share. It’s interesting how often one year’s biggest losers becomes the next year’s biggest winners.

Preview of RPM International’s Earnings Report

We haven’t had many Buy List earnings reports lately, but we’ll get another one next week. RPM International (RPM) is due to report before the market opens on Wednesday, October 4. This will be for RPM’s fiscal first quarter, which ended on August 31. The consensus on Wall Street is for earnings of 84 cents per share. That’s an increase of one penny over last year’s result.

This will be an interesting report because RPM has missed Wall Street’s consensus for the last three quarters. The shares dropped 7% after the last earnings report came out in July. I want to see signs of improvement here. RPM makes building materials and adhesives.

In July, RPM said they see Q1 earnings ranging between 83 and 85 cents per share and between $2.85 and $2.95 per share for the fiscal year. That disappointed investors. Wall Street had been expecting 89 cents per share for Q1 and $3 per share for the fiscal year.

The company blamed a rainy spring for poor results at their Kirker nail-enamel business. I’m usually suspicious when the weather is used as an excuse. A higher tax rate last quarter ate up 12 cents per share.

I also expect to see a modest dividend increase from RPM. They currently pay out 30 cents per share. The company has raised its dividend every year since 1973. I don’t think they’ll go very high, but they’ll do enough to keep the streak alive.

Buy List Updates

This has been a rough year for Ross Stores (ROST), but the shares have improved recently, plus they got a nice upgrade this week. I think the deep discounter got tossed in with many other retailers that were being done in by Amazon, but investors should understand that Ross competes for a different market segment.

Late last year, ROST got close to $70 per share, but by July, it was trading below $52. This week, an analyst at JP Morgan upgraded Ross to “outperform” from “market perform.” That was the latest catalyst in a nice rally over the past month. The stock closed Thursday at $64.80 per share. Notice how often good stocks take their lumps but then come charging back.

Hormel Foods (HRL) announced the resignation of their chairman, Jeffrey Ettinger. He was the CEO until last year. Lately, HRL has been struggling along with many other food stocks. The shares seem to have found a floor around $31 per share.

Axalta Coating Systems (AXTA) said it was shutting down operations in Venezuela. I’m surprised it’s taken this long. It’s sad what’s happening in Venezuela. I hope the country can emerge from this crisis successfully.

Sherwin-Williams (SHW) updated its Q3 guidance to reflect the disruptions caused by the recent hurricanes. The company now expects core sales to rise for Q3 in the low single digits. Previously, Sherwin gave Q3 earnings guidance of $3.70 to $4.10 per share. The company has now lowered that range to $3.40 to $3.70 per share. Actually, that’s not as bad as some were expecting. The shares rallied 2% on Thursday on the news. The CEO said, “”While we are still assessing the longer-term impact of these tragic events on our business, the sales momentum we are seeing across most geographies—particularly in our company-operated stores in the unaffected regions of the U.S. and Canada—should enable us to recover some of the third-quarter earnings shortfall over the balance of the year.”

The Financial Times notes that investors are expecting the Bank of England to raise interest rates soon. That’s caused trading volume for Intercontinental Exchange (ICE) to surge to its highest level in four years.

That’s all for now. Q4 begins next week. On Monday, we’ll get the September ISM report. On Wednesday, Janet Yellen will be speaking. Also, the ADP payroll report will come out. On Friday morning, the September jobs report comes out. The unemployment rate for August was 4.4%, which is close to a 16-year low. There’s a good chance we’ll make a new low. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 29th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His