CWS Market Review – September 21, 2018

“Investing is the intersection of economics and psychology.” – Seth Klarman

On Thursday, the S&P 500 closed at 2,930.75, another record high. In the last 31 months, the index is up over 60%. But here’s an interesting fact about this rally. Despite steadily rising share prices, the bull market hasn’t had much impact on public opinion. My friend Gary Alexander recently noted:

A survey by Betterment Research from July 31 to August 6, 2018 polled 2,000 Americans over age 18 and found that 48% believed that stocks had been flat (had gained nothing) over the past 10 years. Another 18% believed stocks had declined. The truth? The S&P and the Dow are both up over 120% from July 31, 2008 to July 31, 2018, and the Nasdaq is up 230%.

That’s amazing. How can so many people be so wrong? I honestly don’t know, but my hunch is that the public is still turned off by Wall Street. I can certainly understand why. The financial crisis was bitter and painful. I also think the media shares in the blame. Unfortunately, fear and alarmism sell.

As disciplined investors with a long-term focus, we should always maintain a healthy skepticism of the market, but that can’t lead us to ignore basic facts: this is a very good time to be a patient investor. The economy is improving. Jobless claims just fell to another 49-year low, and our world-famous Buy List is up over 10% YTD. Our strategy is working.

In this week’s CWS Market Review, I want to help you sort out this mess and give you a plan for the rest of the year. First, we’ll focus on next week’s Fed meeting. The central bank will almost certainly raise interest rates. I’ll tell you what to expect and what it all means. I’ll also preview next week’s earnings report from FactSet. FDS is a 21% winner for us this year. Plus, I’ll update you on Wabtec’s dramatic week. But first, let’s see what Jay Powell and his friends at the Fed have in store for us.

What to Expect at Next Week’s Fed Meeting

The Federal Reserve meets again next week, on Tuesday and Wednesday, and this will be a biggie. This will be one of the Fed’s two-meetings, which means it will be followed by a press conference from Jay Powell, the Fed Chair. The Fed participants will also update their economic projections.

The Fed is widely expected to raise interest rates. This will be their eighth rate hike in the last three years. It will bring the Fed funds target range up to 2% – 2.25%. There are a few important points here. The first is that this rate hike will bring the real Fed funds rate (meaning after inflation) to 0%. Real Fed funds have been consistently negative since the economy went kablooey ten years ago. In fact, real Fed funds have been negative almost non-stop since 9/11 except for a three-year period before the financial crisis.

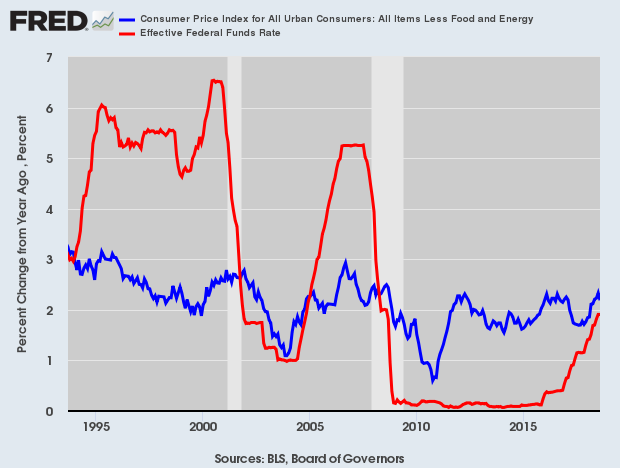

Here’s the Fed funds rate (in red) along with the core inflation rate (in blue):

The equation is very simple: when real short-term rates are low, especially negative, it’s very good news for stocks. And they have been. That won’t magically change next week, but the free-money window is beginning to close. We can also see the effect by looking at the yield curve. The spread between the two- and ten-year Treasury yields is now down to 26 basis points. In other words, about one more Fed rate hike. This week, the two-year Treasury yield got as high as 2.81%. It hasn’t been that high in more than a decade. For some context, at one point in 2011, the two-year was yielding just 0.16%. The world has come back to normal.

I want to be careful in how I word this. A negative yield curve is on balance bad for stocks and the economy, but it’s not a tripwire. Instead, it’s a warning sign. For example, the 2/10 spread went negative in late 2005. The stock market and economy chugged along for two more years. They key with a flat yield curve is to be more cautious but not run away at the first signs of trouble.

The other important aspect of this meeting will be the Fed’s economic projections. Let me preface by saying that the Fed’s predictions are notoriously bad. I mean, even for economists. Still, it’s important to know what the Fed is thinking.

In the last projections, a narrow majority at the Fed saw the need for two more rate hikes this year (meaning one in September and another in December). Frankly, I’ve been a doubter on a December hike, but it looks like I’ve been outvoted. The futures market places the odds at 90% for a December hike.

But what about 2019? Well, here’s where it gets a little tricky. The Fed sees three more hikes next year, but the futures market isn’t so sure, and I share their skepticism. The futures see a March hike, and maaaaybe another one before the end of the year. At next week’s meeting, it’s very possible that the Fed might pare back its forecasts for 2019. The distribution of the Fed’s projections are fairly dispersed, so it wouldn’t take a lot to bring the median vote down to two hikes for 2019. If that happens, it would be a good signal for the market.

The reason this is important is that an overly-vigilant Fed has historically been a big threat to bull markets. The Fed also always overdoes it. Once the yield curve goes negative, then we want to start paying close attention to knock-on effects. At the top of the list is the housing market. To reiterate, we’re in a good spot right now, but mistakes from the Fed could lead to unpleasantness in 2019. Now let’s take a look at our one Buy List earnings report for next week.

Preview of FactSet’s Earnings Report

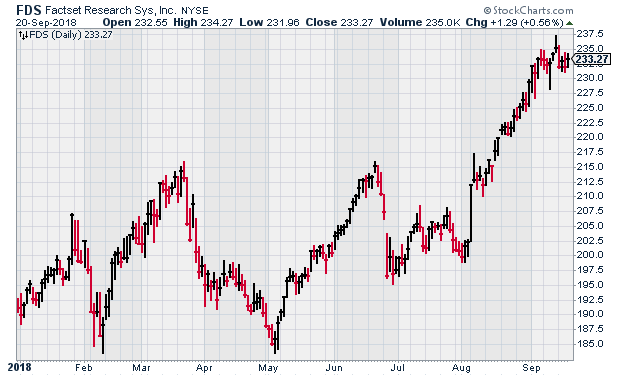

FactSet (FDS) has been a nice 21% winner for us this year (see below). Because the company follows an off-cycle reporting schedule (its fiscal year ends in August), it’s due to report its fiscal Q4 earnings on Tuesday, September 25.

I’m expecting more good news from FactSet. In June, they reported fiscal Q3 earnings of $2.18 per share, which beat Wall Street’s estimate by five cents per share. Q3 was a solid quarter for them. Revenues increased 8.9% to $339.9 million compared.

Thanks to those good numbers, FactSet also bumped up its full-year earnings forecast. The old range was $8.35 to $8.55 per share. The new range is $8.37 to $8.62 per share.

FactSet’s CEO said, “We are making progress integrating and cross selling our acquisitions resulting in important wins this quarter, particularly within Analytics. We continue to innovate with the launch of the Open:FactSet marketplace and enhancing our risk offering. We believe we have a solid pipeline for the fourth quarter and expect to finish fiscal 2018 in our guidance range.”

With FactSet, the key stat to watch is Annual Subscription Value or ASV. For Q3, ASV rose 5.3% to $1.36 billion. At the end of the quarter, FactSet had 4,975 clients. That’s an increase of 80 clients. User count rose by 860 to 89,506.

One weak spot is operating margin. For Q3, their operating margin fell to 31.0% compared with 31.9% a year ago. The company blamed the fall on restructuring actions and certain one-time administrative expenses.

The CEO said, “We made good progress on our annual and medium term goals this quarter. The restructuring actions we initiated this quarter help us to optimize costs and benefit margins in the future. With our balanced capital allocation framework including our robust share buyback program and an increase in dividends, we continued to return value to shareholders.”

Let’s run some math. For the first nine months of the fiscal year, FDS has earned $6.34 per share. The current outlook implies Q4 earnings of $2.03 to $2.28 per share. Wall Street had been expecting $2.19 per share, but they’ve now raised their expectations to $2.21 per share. I’m expecting something closer to $2.25 per share. I’ll be curious to hear what they have to say for Q1 guidance. FactSet remains a very solid stock.

Update on Wabtec

Shares of Wabtec (WAB) got slammed for a 12.4% loss last Friday after an analyst at JP Morgan questioned whether the math adds up on WAB’s merger deal with GE.

The company played it smart. They shot back with a press release on Friday stating that the merger deal “continues to make progress,” and that they expect it to be complete by early 2019.

Then on Monday, WAB amended their proxy which noted that they expect to see a “minor” (their word) $63 million adjustment in revenue and EBIT for next year. Bear in mind, WAB expects free cash flow of $6 billion from 2019 to 2022. They also said that adjustment will have “no material effect in future years.” They stood by their other financial targets for the deal. The stock rallied 7% on Monday.

Barron’s quoted two analysts who are optimistic on Wabtec. Both of them noted that the freight-rail business has been above expectations. I’m still a fan of this company. Wabtec remains a buy up to $111 per share.

One final note. Sherwin-Williams (SHW) keeps busting through our Buy Below prices. At the start of July, our Buy Below on SHW was $400. The stock ran straight through that, so I raised it to $414. Soon it crashed through that. I then raised our Buy Below to $460 per share. I thought that would give us some breathing room. Not quite. Here we are a few weeks later, and SHW is at $478. It’s not a bad problem to have. SHW is up $100 in four months. This week, I’m lifting my Buy Below on Sherwin-Williams to $498 per share.

That’s all for now. The third quarter comes to a close next week. The big story will be the Fed meeting. Look for the latest policy statement on Wednesday afternoon. We’ll also get updated economic projections. Then on Thursday, we’ll get the latest report on durable goods. Also on Thursday, the government will update the Q2 GDP report. The initial report showed growth of 4.1% which was later revised to 4.2%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Join me for next week’s “Alpha Call.” On Wednesday, September 26 at 4 pm ET, I’ll be talking markets with market veteran Louie Navellier. Follow this link to register.

Posted by Eddy Elfenbein on September 21st, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His