CWS Market Review – September 28, 2018

“Investing without research is like playing stud poker and never looking at the cards.” – Peter Lynch

The big news this week was that the Federal Reserve raised interest rates by 0.25%. The stock market responded with a big yawn. The S&P 500 is still very close to its all-time high.

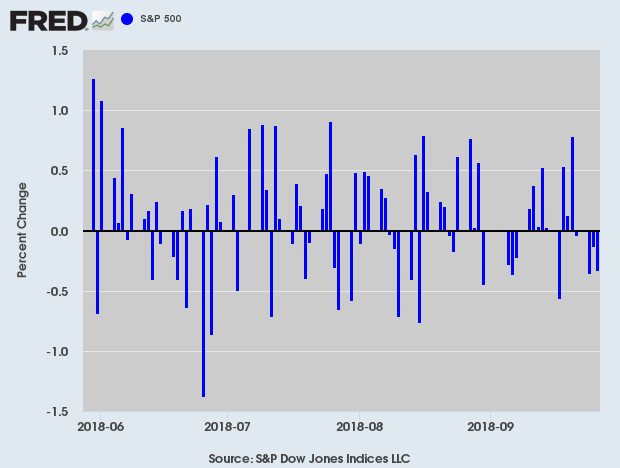

In fact, not much has bothered the S&P 500 lately. Not the Fed. Not approaching elections. Not even Elon Musk getting sued by the SEC. Ryan Detrick, one of my favorite numbers guys, recently noted that the past few months have been some of the least volatile on record. You probably wouldn’t have guessed that by looking at the headlines, but the S&P 500 has now gone 66-straight days without a daily move of more than 1% either up or down.

Will the calm market last? I think so. In this week’s CWS Market Review, we’ll take a closer look at this week’s Fed news and what it means for us. We’ll also take a look at the recent earnings report from FactSet. We’ll also preview next week’s earnings report from RPM International. First, though, let’s look at what the Fed’s game plan is.

The Federal Reserve Raised Rates—What Does It Mean for Us?

On Wednesday, the Federal Reserve raised interest rates. The move was almost universally expected. This was the Fed’s third increase this year and the eighth of the current cycle. The Fed’s target range for overnight interest rates is now 2% to 2.25%. This means that interest rates are basically in line with inflation. We haven’t had positive real rates in a decade.

The reason for the Fed hike is actually good news. It means that the economy has been improving. One bit of news was that in the Fed’s policy statement, the FOMC dropped the word “accommodative” in describing its policy stance. There are folks who pore over every letter of every Fed statement, looking for clues. Fed Chairman Jay Powell cut off any speculation. He said the new language doesn’t reflect any change in the path policy. Powell reiterated that the Fed still sees itself following the same path as before: gradual rate hikes.

Here’s the key part of the policy statement:

Information received since the Federal Open Market Committee met in August indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has stayed low. Household spending and business fixed investment have grown strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

I know it sounds dry, but that’s about as optimistic as central bankers get. Frankly, I wouldn’t read too much into the Fed’s latest move. In terms of the stock market, higher short-term rates erase some of the allure of high-dividend stocks. That’s only natural. But it’s a mistake to think that a rising rate environment is bad for all value stocks.

I suspect that the Fed’s policy will cause investors to not be as open to risk as they’ve been. When rates are low, it’s not a big deal to get in on a hi-flying stock. Other financial assets aren’t offering much competition. That’s not so true anymore. (In fact, I suspect that the lack of competition helped drive alternative assets like Bitcoin. That was the only game in town.)

Members of the Fed also updated their economic projections. This is where things get interesting, because we can assume that the cycle of rate increases is probably closer to its end than its beginning. The Fed sees one more rate hike coming this year. After that, they forecast three hikes next year, one more in 2020 and none in 2021.

In my opinion, 2021 is way too far out to make a reasonable prediction. But in the near term, the Fed’s forecasts tell us that the economy is very likely on a sound footing. Earlier this week, we learned that consumer confidence is at an 18-year high. This is a very good environment in which to be a stock investor. Now let’s look at our Buy List earnings report from this week.

FactSet Earned $2.20 per Share for Its Fiscal Q4

On Tuesday, FactSet (FDS) said it earned $2.20 per share for its fiscal Q4 which ended in August. If you’re not familiar with FactSet, they help Wall Street professionals crunch all the numbers they need to make investment decisions. It’s a very profitable business.

The Q4 earnings were one penny below expectations. Personally, I had been expecting even more. In the after-hours market, FDS was down sharply. Once trading started on Wednesday, FDS was down as much as 6.2%. But as the day wore on, the shares acted better. By the closing bell, FDS had lost 1.9%.

Let’s dig into the numbers a little bit, because they’re not so bad. For the quarter, organic revenue rose 5.3% to $347.1 million. Annual Subscription Value (ASV), which is the key stat for FDS, increased to $1.39 billion. Organic ASV was up 5.7%. FDS noted that the increase for Q4 was $38.6 million which is the highest in the company’s history. Adjusted operating margin, another key stat I like to watch, inched up to 31.3% compared with 31.2% last year.

“We are proud to have reached many milestones in fiscal 2018. We celebrated 40 years as a company with 38 years of consecutive revenue growth and 22 years of consecutive adjusted EPS growth. This quarter we had the highest reported quarterly ASV in our history. We enter fiscal 2019 with strong momentum and an expanding suite of innovative workflow solutions to drive our growth plans,” said Phil Snow, FactSet CEO.

For Q4, FactSet’s effective tax rate was 18.0% compared with 25.3% a year ago. That’s largely due to the tax cuts. Their client count now stands at 5,142. That’s an increase of 167 in the past three months. User count increased by 2,391 to 91,897. Annual client retention is greater than 95% of ASV. As a percentage of clients, annual retention is 91%. Net cash provided by operating activities was $106.3 million, compared with $100.2 million a year ago. Quarterly free cash flow rose 2.1% to $91.2 million.

For the entire year, FactSet’s organic revenues rose 5.6% to $1.35 billion while ASV rose 5.7% to $1.39 billion. Earnings increased 16.7% to $8.53 per share. Previously, the company said its earnings range was $8.37 to $8.62 per share, so things seem to be working according to plan.

Annual client count increased by 8.4% or 398 during the year while users grew by 3.4% or 3,051 from the prior year. Free cash flow increased 24.1% to $352.1 million.

Now let’s look at guidance for fiscal 2019 (ending next August). FactSet expects earnings to range between $9.45 and $9.65 per share. That’s not a bad increase over this year. Wall Street had been expecting $9.61 per share. FactSet sees organic ASV rising by $75 million to $90 million in 2019, and they see operating margins between 31.5% and 32.5%. That’s pretty good.

Shares of FDS have pulled back over the last few days, but I’m not particularly concerned. The stock had a very strong rally during much of August. FactSet remains a buy up to $242 per share.

RPM International Earnings Preview

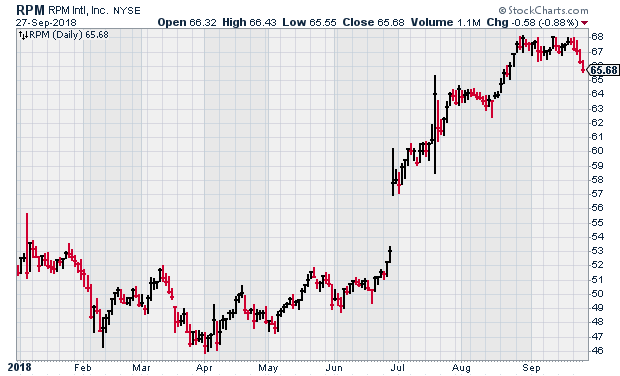

RPM International (RPM) is due to report its fiscal Q1 earnings on Wednesday, October 3 before the opening bell. Speaking of stocks giving us a head-fake after earnings, RPM was a perfect example three months ago.

After the last earnings report, RPM opened down 4%. This is why we eschew trading. It’s too irrational. Fortunately, the market came to its senses, and RPM closed higher by 5.3%. The difference between the daily high and low price was nearly 12%.

For fiscal Q4, RPM earned $1.05 per share which was 13 cents below Wall Street’s consensus. The company blamed “higher raw-material costs and extended winter weather.” Rust-Oleum had to shutter two manufacturing facilities. RPM’s consumer segment was especially weak, while the industrial unit fared better.

As part of the deal with Elliott Management, RPM is going to unveil a comprehensive business plan later this year. I think that may involve major divestments. Because of this, the company will forgo any EPS guidance. Sales-wise, for 2019, RPM expects a mid-single-digits sales increase for its industrials unit. For the consumer unit, they see an increase of mid- to upper-single digits.

The consensus on Wall Street expects Q1 earnings of 88 cents per share which is a slight increase over the 86 cents per share they earned in last year’s Q1.

One last note. I’m dropping the Buy Below on Carriage Services (CSV) down to $24 per share. This move reflects the stock’s recent weakness.

That’s all for now. The fourth quarter kicks off next week. With the start of the new month, we’ll get some key economic reports. On Monday, the ISM report comes out. The last ISM was the strongest in 12 years. Then on Wednesday, ADP will release its report on private payrolls. Then on Friday we’ll get the September jobs report. The unemployment rate is close to a multi-decade low. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Buy These 3 High Yield Clean Energy Stocks While They’re Still Cheap

Renewable energy sources are a growing part of the total energy sector assets. In the first half of 2018 solar and wind projects accounted for 42% of new power capacity in the U.S. Overall, solar and wind have grown to provide 10% of the total U.S. electric power generation. The power industry uses high yield investment vehicles as one funding source for the growth in renewable energy. These stocks can put a solar powered lift in your dividend income.

A type of income stock often called a Yieldco has been widely used to own renewable power producing assets. These companies have been formed by energy project developers and electricity utilities to help fund development.

The system roughly works like this. A company constructs a new wind power windmill project or solar array. Once it is near completion the development company will sell the projects future power production on a long term contract with a utility company or other energy user. Once its up and operating, with power contracted to an end user, the new project will be sold to a Yieldco that is affiliated with the developer. The Yieldco gets an asset with a long term revenue stream to support dividend payments. The developer gets paid back for the development and can put the capital to work developing another project.

The result is that Yieldco stocks are steady dividend payers with good prospects for dividend growth.

Here are three to consider for your income portfolio.

Are Charismatic Founders a Curse or a Blessing For Investors?

Throughout U.S. corporate history, there have been some very memorable company founders such as JP Morgan and Henry Ford. Fast forward a few decades and we have Bill Gates and Steve Jobs.

I suspect though that history will less kindly remember the current batch of founders including the likes of Travis Kalarick of Uber, John Schnatter of Papa John’s and Elon Musk of Tesla. These entrepreneurs succeeded initially, but failed to come up with a succession plan to transition to a professional management. And worse, they’ve stayed on too long, becoming both an embarrassment and a hindrance to their respective companies.

In the case of Musk and Tesla, he may have let his strong dislike of people pointing out the flaws in his company’s finances go so far that he may have committed a crime with his “funding secured” tweet. The U.S. government has launched a criminal investigation into Tesla.

All of the above examples are companies that failed at the very important task of planning for the replacement of an executive who serves not only as the company’s manager but also as its pitchman and inspiration. These companies should all have planned for a staged withdrawal with the elevation of several key executives to key positions. But Tesla for example, cannot seem to keep an executive for more than a few months.

However, there are companies that have done things right. Here are two examples.

Posted by Eddy Elfenbein on September 28th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His