CWS Market Review – January 11, 2019

“Don’t try to buy at the bottom and sell at the top. It can’t be done, except by liars.” – Bernard Baruch

So far, Wall Street has started out 2019 on the right foot. It’s too early to celebrate, but take comfort that the S&P 500 has closed higher nine times in the last eleven sessions. This is a welcome change from December. I’ll refrain from noting that the market is rallying while the government is closed.

On Thursday, the S&P 500 finished trading 10.7% above the December 26 low (Boxing Day to our cousins). Our new Buy List is already in the black, and some stocks are doing very well. I’m glad we stuck with Ross Stores. The deep discounter is already up 9% for us this year.

So, is the bear over? In this week’s issue, we’ll take a closer look at that question, but I’ll warn you that we’re probably not in the clear just yet. I’ll also preview the Q4 earnings season, which is set to begin soon. This looks to be another good reporting season for corporate earnings.

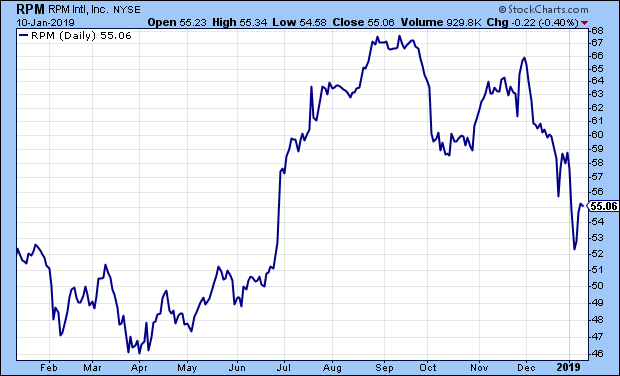

I’ll also preview two of our Buy List earnings reports that are coming next week. Later on, I’ll fill you in on last week’s soggy earnings report from RPM International. (I still like the stock.) But first, let’s see if the bulls have chased the bears away for good.

Is the Bear Market Over, or Just Hibernating?

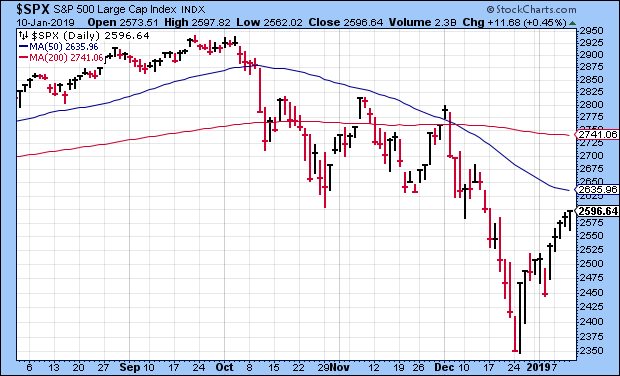

December was the worst month for the stock market in ten years. It seemed like everything went wrong. Fortunately, Wall Street has been cleaning up some of the damage this month, but are we in the clear?

The simple answer is, I don’t know. Sadly, I can’t predict the future. The more important answer is that we can try to understand the nature of the market and how it behaves in times like this. The key fact to understand is that whenever there’s a big drawdown like we saw last month, the market likes to “test” the low again. I don’t know why; it just does. In fact, sometimes, the market will test the low two or three times. If the low holds, then it often portends an upswing. If not, there can be more pain ahead. (Please note: These are all generalities.)

The day after the Christmas, the S&P 500 got as low as 2,346.58. I think it’s very likely that the market will drop back near that area soon. If the resistance holds, then it will be a shot in the arm to the bulls. While the last eleven days have been good, we always judge a bear market rally to be guilty until proven innocent. This is especially true when the bounce is as impressive as this recent one was. Remember that bear market rallies are designed to entice you back in.

Another important characteristic of investing is that the stock market tends to rise slowly and drop suddenly. Even when we dissect terrible bear markets, we often see that a large part of the damage came in a short period of time. I call this the “Panic Phase.” From December 3 to December 26, the S&P 500 plunged 15.7%. That was in just 14 trading days. Given how short and violent these periods are, I suspect that the Panic Phase of this bear market is behind us. I should stress that what I call the Panic Phase is not the bear market itself. Rather, it’s the concentrated worst part. That’s probably done for.

The public is still freaked out. On Christmas Eve, not far from the market bottom, I ran a poll on Twitter asking how much more the market had to fall. The consensus believed we had a lot more room to fall.

How much further does the S&P 500 have to fall before hitting bottom?

— Eddy Elfenbein (@EddyElfenbein) December 24, 2018

One of the curious aspects of investing is that the best time to buy is when everybody else is scared. In fact, bear markets are usually over by the time people realize they’re in a bear market.

When we look at stock charts, it’s easy to be fooled into thinking how obvious the past was. But that’s not really how things play out. If you want to see what I mean, check out this simple market-timing game. If you’re like me, after a few rounds, you see how bad you really are! That’s exactly why we favor sound, disciplined investing over trusting our gut. The good news is that for our style of investing, we don’t have to predict exact tops and bottoms. (Note Mr. Baruch’s comments in this week’s epigraph.)

I will highlight two keys that often signal a better market. One is that daily volatility tends to drop off. On Wednesday, the Volatility Index (^VIX) fell below 20 for the first time in a month. We also want to keep an eye on the 200-day moving average. If the S&P 500 can clear the 200-DMA convincingly, that’s probably a signal that it’s not just another bear market rally. The index is currently a little more than 5% from its 200-DMA. Over the next four weeks, the major factor deciding the market’s fate will be the Q4 earnings season. Let’s take a closer look.

Preview of Fourth-Quarter Earnings Season

Next week, fourth-quarter earnings season gets underway. What made December’s market damage so arresting is that Wall Street expects good earnings news. The selloff would be more understandable if analysts were expecting things to get worse.

Right now, Wall Street forecasts earnings for the S&P 500 of $40.39 per share. (That’s the index-adjusted number. Each point in the S&P 500 is about $8.4 billion.) That’s up 19.3% from Q4 2017. Over the past few weeks, Wall Street has gradually pared back its forecast for Q4. At the end of Q3, the expectation was for earnings of $42.14 per share. It’s normal for analysts to start out high and lower expectations as earnings day approaches. The research folks at FactSet expect an earnings beat.

Assuming these forecasts are accurate, that means the S&P 500 earned about $157 per share in 2018. That means the index is going for 16.5 times trailing earnings. That’s hardly excessive. In 2017, the S&P 500 made $124.51 per share.

We have two Buy List earnings reports coming next week, and they’re both from our banks. Technically, only Eagle Bancorp (EGBN) has confirmed it will report, but I’m guessing Signature Bank (SBNY) will as well.

Eagle said they’ll report Q4 results after the close of business on Wednesday, January 16. In October, the bank reported Q3 earnings of $1.13 per share. That was two cents better than estimates. The bank is holding up well despite the flattening yield curve. For Q3, Eagle’s net interest margin was a healthy 4.14%. This is a solid bank, but due to its size, it doesn’t get much attention. In fact, Eagle was recently added to the S&P Small-Cap 600. Not many analysts follow EGBN, but consensus, if you can call it that, expects Q4 earnings of $1.14 per share. That sounds about right. That would bring their full-year 2018 earnings to $4.39 per share, which means Eagle is going for less than 12 times earnings.

Signature Bank usually reports on the first Thursday of earnings season (but they’re not so swift at confirming this info). Three months ago, Signature reported Q3 earnings of $2.84 per share. That was up from $2.29 per share last year. It also beat Wall Street’s estimate by one penny per share. Overall, Q3 was a solid one for SBNY. Total deposits are up 7.2% so far this year to $36.09 billion. Loans are up 12.6% to $35.13 billion. For Q3, net interest margin was 2.88%. For Q4, Wall Street expects earnings of $2.80 per share.

Buy List Updates

RPM International (RPM) reported earnings last Friday. I decided to keep RPM on this year’s Buy List, and I’m glad I did, but I recognize that business has been tough recently. I wasn’t optimistic for a good report, and we didn’t get one. For its fiscal Q2, RPM reported earnings of 52 cents per share. Sales rose 3.6% to $1.36 billion. Wall Street had been expecting 68 cents per share.

The CEO said, “Like many manufacturers, our bottom line was impacted by a continued rise in costs for raw materials, freight, labor and energy, as well as adverse foreign-exchange translation.” We already knew the company was facing these issues, but I didn’t realize the problem was so acute. For Q3, RPM expects earnings between 10 and 12 cents per share.

I’m still willing to stick with RPM even though they’re in a rough patch. All companies hit periods like this, and I want to see how well RPM manages this one. The stock had a terrible December, and the shares took another hit after the earnings report. Fortunately, RPM has come back some, and it’s higher now than it was prior to the earnings report. This week, I’m lowering my Buy Below on RPM to $60 per share.

If you’ve been a long-time subscriber, then you know that we love to add monopolies to our Buy List. Or more accurately, near-monopolies. These are companies that have dominant positions in their respective industries. A good example is Intercontinental Exchange (ICE), the owner of the NYSE.

One challenge with being a monopoly, or a near one, is that upstarts are looking to take you down. In this case, it means a group of financial heavyweights have said they’re starting up a new exchange, Members Exchange, in an attempt to dethrone the NYSE. Shares of ICE fell on the news.

Don’t worry just yet. There’s a big difference between saying you’re going to take on the NYSE and actually doing it. It will take Members Exchange at least a year just to get started. For now, I’m lowering my Buy below on ICE to $78 per share.

One last item. I’m dropping my Buy Below on FactSet (FDS) from $242 per share to $222 per share. I still like FactSet, but I want to adjust the Buy Below to reflect the market’s recent drop.

That’s all for now. I suspect that the Shutdown Battle will dominate the news next week. Also, earnings season starts next week. The banks tend to report early. JPMorgan and Wells Fargo report on Tuesday. We’ll get the December retail-sales report on Wednesday. This will tell us how strong holiday shopping was. The report on housing starts is due on Thursday. Then on Friday, we’ll get the latest report on industrial production. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on January 11th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His