CWS Market Review – February 15, 2019

“Panics do not destroy capital—they merely reveal the extent to which it has previously been destroyed by its betrayal in hopelessly unproductive works.”

– John Stuart Mill

Before I get to today’s newsletter, please join me for an after-market conference call at 4 p.m. ET on Wednesday, February 20. Morgan Housel, one of my favorite financial writers, will be joining me. This should be a great discussion. To join us, you can register here.

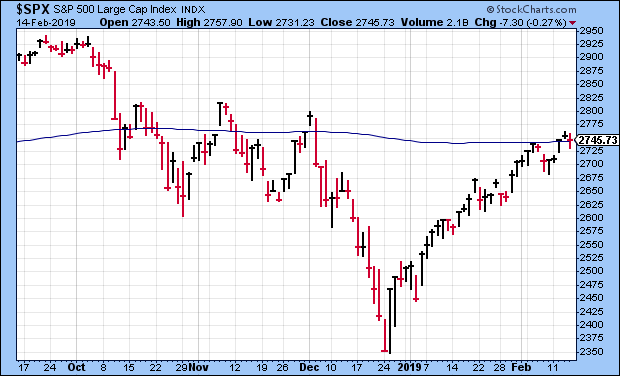

Now to the stock market. The Great 2019 Bounce Back continued this week. On Tuesday, the S&P 500 closed above its 200-day moving average for the first time in ten weeks. Historically, the stock market performs much better above its 200-DMA than below it.

I’ve been surprised by how smartly the stock market has rebounded since the start of this year. In fact, our Buy List briefly broke the +10% YTD barrier this week. Earnings-wise, this was a subdued week for us, especially compared with the earnings blizzard of the previous two weeks. We didn’t have any Buy List earnings reports this week, although Moody’s is due to report later today (check the blog for updates).

Given this brief lull for us, in this week’s issue, I want to go back and cover some of our stocks in more detail. For example, Sherwin-Williams just raised its dividend by 31%. This is their 41st annual dividend increase in a row. Before I get to that, let’s look at the surprising retail-sales report we got on Thursday.

Don’t Believe All the Government’s Data

On Thursday, the government released the retail-sales report for December. It was a complete dud. Wall Street had been expecting an increase of 0.2%. Instead, the report showed a drop of 1.2%. In the world of retail sales, that’s a gigantic miss. In fact, it was the worst retail-sales report in nine years!

What happened? That’s not an easy question to answer. The reason is that this report had been delayed for a few weeks thanks to the government shutdown. As such, I’m inclined to think the numbers are just plain wrong.

As always, I keep an open mind about these things, but as investors, we always want to see confirmation of trends from other areas. The report said that sales dropped sharply at gas stations. Sure, no surprise there. Gasoline prices are down.

But the report also said that sales were down nearly 4% at Internet retailers. Say what? That doesn’t sound right. Many companies in that sector like eBay and Amazon said they did just swimmingly in December.

Here’s where it gets odd. Those numbers will be plugged into the government’s numbers for Q4 GDP. As a result, most folks had been expecting a Q4 number around 2.5%. Now, I’m not so sure. Wall Street now expects something closer to 2%. Bad data begets more bad data. Either the economy suddenly got weaker late last year and no one noticed, or the government’s number crunchers are off base.

Still, the retail-sales report helped push Ross Stores to a 1.4% loss on Thursday. This makes little sense to me. The results at Ross have been pretty good. The deep-discounter will soon report earnings for the holiday shopping quarter. I highly doubt Ross experienced any of kind of slowdown. Ross has a very good eye on the price-conscious shopper.

Speaking of consumer prices, we got yet another tame inflation report this week. I’ve been told many times that hyperinflation is about to reappear. Maybe, but it’s sure taking its sweet time. According to CPI data, consumer prices were unchanged last month. To be precise, it’s the third month in a row of a teeny, tiny decline. Over the last year, inflation has been running at just 1.55%.

As I touched on before, some of this is due to lower gasoline prices. The “core rate,” which excludes food and energy, rose by 0.24% in January. In the last year, core inflation is up by 2.15%. This is important because thanks to the falling inflation, the real Fed funds rate (meaning, after inflation) has continued to rise. If rates stay the same while inflation decelerates, that means the Fed is de facto tightening. This is another reason why I think the Fed is going to chill out for most of this year, and that’s good news for us. Now let’s look at some of our Buy List stocks.

Buy List Updates

We had such a flurry of Buy List earnings news over the last two weeks that I’m afraid I didn’t have the chance to highlight some key facts for us.

Let me first start with Sherwin-Williams (SHW). This week, the paint people raised their dividend by 31%. The quarterly dividend is rising from 86 cents to $1.13 per share. The new dividend is payable on March 8 to shareholders of record on February 25. This is Sherwin’s 41st consecutive annual dividend increase. Based on Thursday’s closing price, the new dividend yields just over 1%. This week, I’m raising my Buy Below price on Sherwin to $441 per share.

Earlier this week, shares of AFLAC (AFL) broke $49 per share to hit a new all-time high. I mention this not just because the duck stock has done well for us but also because Wall Street briefly panicked over AFLAC a little over a year ago.

In January 2018, a magazine ran a series of articles that accused AFLAC of unsavory business practices. I wasn’t impressed by the reporting, but it was enough to knock shares of AFL for an 8.7% loss. I told investors not to panic.

Since then, AFL has made back everything it lost, raised its dividend and gotten to a new all-time high. So much of investing boils down to knowing what to ignore.

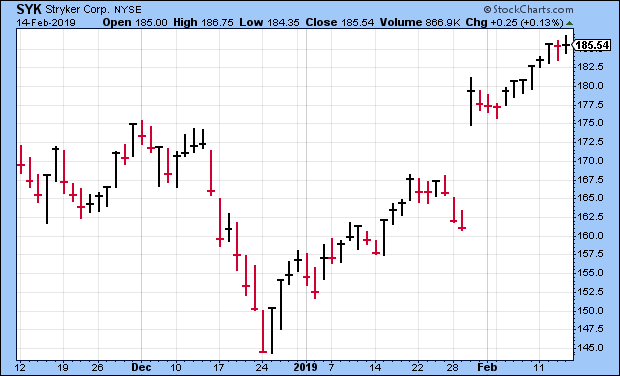

I’ve already talked about the earnings report for Stryker (SYK), but I wanted to highlight what an outstanding year the company had. Let’s run through the timeline. (Warning: Lots of numbers ahead.)

For 2017, Stryker made $6.49 per share. In January 2018, Stryker forecasted Q1 earnings between $1.57 and $1.62 per share. For full year 2018, Stryker expected earnings of $7.07 to $7.17 per share.

Now let’s jump to April when they reported $1.68 per share for Q1. Stryker also raised full-year estimates to $7.18 – $7.25 per share and gave Q2 guidance of $1.70 to $1.75 per share.

In July, Stryker said they made $1.76 per share for Q2, again exceeding their range. For Q3, they forecasted earnings between $1.65 and $1.70 per share. Again they raised full-year guidance, this time to $7.22 – $7.27 per share.

In October, Stryker said they made $1.69 per share for Q3 (Wall Street’s original forecast). For Q4, Stryker said they expected $2.13 to $2.18 per share. Again, they raised full-year guidance. This time to $7.25 – $7.30 per share. That’s three increases.

So what happened in December? The shares dropped 16% in seven trading days.

Then in January, Stryker reported $2.18 per share for Q4. For 2018, they earned $7.31 per share, which beat the top end of their guidance. That’s an increase of 12.6% over the $6.49 per share they made last year. That’s three increases to their full-year guidance, which they still beat.

Stryker is now 28% above its December low. On Thursday, the shares hit another all-time high. We’re up 18.4% YTD. I’m lifting my Buy Below on Stryker to $192 per share.

In last week’s CWS Market Review, I mentioned that Becton, Dickinson (BDX) sees 2019 earnings ranging between $12.05 and $12.15 per share. On the earnings call, BDX added that Q1 earnings should range between $2.50 and $2.60 per share.

Also in last week’s issue, I said that Cognizant Technology Solutions (CTSH) expects full-year earnings of at least $4.40 per share. I should add that the company has altered its accounting definitions. The earnings figures will no longer exclude stock-based compensation expenses and acquisition-related expenses. This means that the estimate of $4.40 per share represents a 10% increase over last year’s profit. We have a 15% gain this year in CTSH.

Last week, Broadridge Financial (BR) said they see earnings growth of 9% to 13% for this fiscal year, which is already half over. Since they made $4.19 per share last year, the guidance works out to $4.57 – $4.73 per share this year. Wall Street expects $4.66 per share. Broadridge has already made $1.35 per share for the first half of this fiscal year.

Earnings Preview for Hormel and CBPX

There are three Buy List stocks with quarters that ended in January. Hormel Foods (HRL) will report this Thursday, February 21. JM Smucker (SJM) is due to report on February 26. Ross Stores (ROST) hasn’t announced an earnings date yet, but it should report in early March.

In November, Hormel Foods reported fiscal Q4 earnings of 51 cents per share. That was two cents above estimates. Unfortunately, their revenues were pretty weak. Organic sales fell 1%, and operating margin slipped to 12.6%. For the year, the Spam folks made $1.57 per share. The company also raised its dividend for the 53rd year in a row.

For 2019, Hormel sees revenue ranging between $9.7 and $10.2 billion and EPS between $1.77 and $1.91. That’s not bad. The shares initially got dinged after the report but have since recovered. Wall Street expects Q1 earnings of 44 cents per share.

Continental Building Products (CBPX) will also be reporting on Thursday. That will be our final earnings report for stocks reporting on the December cycle. The wallboard stock got clobbered in October, along with just about everything related to building and construction, but the November earnings report was pretty good. CBPX beat by three cents per share. Next week’s report will be for their fiscal Q4. Wall Street expects 56 cents per share. I think they can beat that. (The company gives guidance on several metrics but not on EPS.) Thanks to the selloff, Continental is going from 12 times forward earnings.

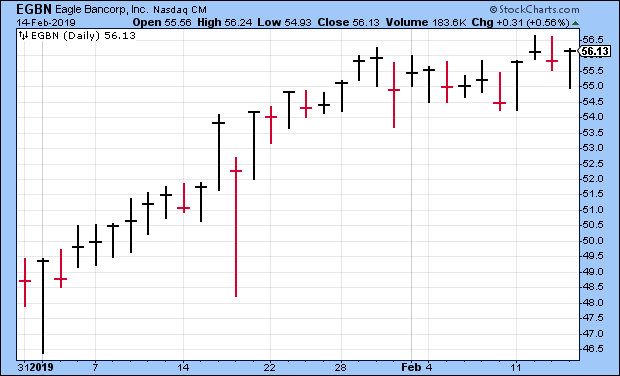

Our two bank stocks, Signature Bank (SBNY) and Eagle Bancorp (EGBN) have done very well for us so far this year. Signature is up 29% for us, while Eagle is up over 15% (see below). This week, I’m lifting the Buy Belows on both; Signature is now a buy up to $140, and Eagle is a buy up to $60.

Raytheon (RTN) is another new stock that’s done very well for us. We have a nice 18.1% gain so far this year. Once again, this was a stock that got hit for a 4% loss after a perfectly fine earnings report. For the second time this year, I’m raising my buy price on RTN. Raytheon is a buy up to $190 per share.

That’s all for now. The stock market will be closed on Monday in honor of George Washington’s Birthday. Earnings season will start to trail off next week, but there are still big reports due. On Wednesday, the Fed will release the minutes from its last meeting. This is the meeting when the language about being “patient” was added. On Thursday, we’ll get the latest report on existing-home sales. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Join me for a conference call on Wednesday, February 20 at 4 pm ET. Morgan Housel and I will talk about all things stock market including the ETF, which was been rallying very well lately. I’m looking forward to this. You can register here.

Posted by Eddy Elfenbein on February 15th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His