CWS Market Review – May 17, 2019

”Patterns of price movement are not random. However, they’re close enough to random.” -Jim Simons

Before I get to this week’s issue of CWS Market Review, I want to say there will be no issue next week. I’m taking my traditional break ahead of the Memorial Day weekend.

But don’t worry! I’ve scheduled a free webinar for you on Wednesday, May 22 at 4 p.m. ET. I’ll be joined by John Schindler, a national-security expert. It should be a great discussion. We’ll cover all the goings-on on Wall Street and in the world. The webinar is completely free. You can register for it here.

Now let’s look at the stock market. Wall Street has been roughed up a bit lately thanks to escalating trade tensions between President Trump and China. I still doubt that this rhetoric can do much harm to the economy. Until now, the Trade War has been a lot of sound and fury signifying not much.

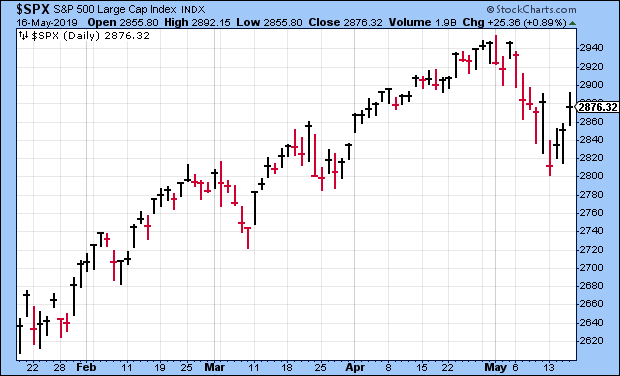

Plus, the worst may have passed. In fact, the S&P 500 is up over the last week, through Thursday, despite a nasty 2.4% drop on Monday. Now that earnings season has ended, I want to use this issue to look at some potential candidates for next year’s Buy List. Of course, we won’t make any changes to the Buy List until the end of the year, but this is a good time to look at some possible recruits.

Before we get to that, though, let’s look at some recent economic news.

We’ve Had 24 Drops of 5% in This Bull Market

The stock market’s brief hiccup was good for the relative performance of our Buy List. Since we focus on high-quality stocks, we often outperform when investors get nervous. As a very general rule, our Buy List mostly keeps up with the market during bull runs. But during bears, we tend to fall much less. That’s where most of the outperformance comes.

The S&P 500 went from an intra-day high of 2,954 on May 1 to an intra-day low of 2,801 on Monday, May 13. Charlie Bilello points out that since the current bull market started in March 2009, the stock market has had 24 separate downturns of 5% or more. All 23 of the previous ones have been turned around. I think #24 will be as well.

On Wednesday, the retail-sales report for April showed a decline of 0.2%. Taking out gasoline, the decline was 0.4%. This is often a barometer of consumer spending. What’s interesting is that this soft number comes after a very strong March. The increase for March was revised up to 1.7%.

Industrial production for April fell 0.5%. That was below expectations of a flat month. We’re now at the midpoint of Q2, and the Atlanta Fed’s GDPNow report estimates that the economy will grow at a 1.2% rate for Q2. The New York Fed’s Nowcast is expecting 2.2%.

The yield curve has again inverted, but only partially. The six-month Treasury currently yields 2.43%, while the three-year Treasury yields 2.15%. That’s unusual, but it could be a bet on a one-and-done rate cut sometime later this year.

On Thursday, the jobless-claims report came in at 212,000. That’s a pretty good number. If we do see any weakness in the labor market, it will probably show up here first. For now, the economy continues to look good, but growth may slow down later this year.

Earnings Preview for Ross Stores and Hormel Foods

We have two earnings reports coming next week. On Thursday, May 23, Ross Stores and Hormel Foods are due to report earnings. Hormel will report before the open, while Ross will report after the close.

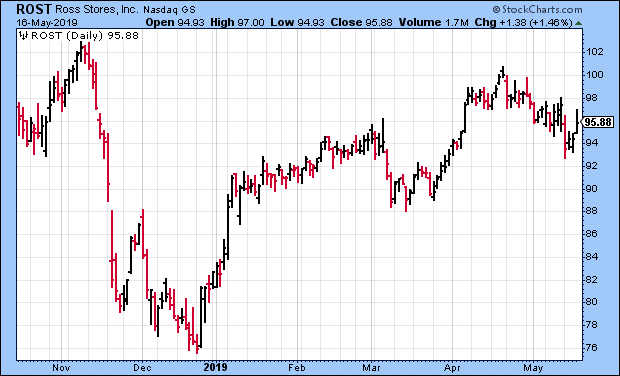

In March, Ross Stores (ROST) reported very good numbers for its fiscal Q4. The company made $1.20 per share. For context, the deep-discounter had given guidance of $1.09 to $1.14 per share. (Ross is notoriously conservative with its guidance.)

The key metric for Ross is same-store sales. For Q4, that was up 4%. Wall Street had been expecting 2.3%. As usual, the company gave weak guidance. Ross sees Q1 earnings of $1.05 to $1.11 per share. I had been expecting more. The stock is still below its high from late last year.

The CEO said, “While we hope to do better, we continue to take a prudent approach to forecasting our business for 2019. Although we remain favorably positioned as an off-price retailer, we face our own difficult sales and earnings comparisons, a very competitive retail landscape, and an uncertain macro-economic and political environment.”

For all of 2019, Ross sees earnings of $4.30 to $4.50 per share. The company also authorized a $2.55 billion share buyback. Ross raised its quarterly dividend by 13.3%. The payout increased from 22.5 cents to 25.5 cents per share. The company said it plans to open 100 new locations this year. Remember all the talk about the retail apocalypse? Ross is doing just fine.

Shares of Ross are currently a little bit above my Buy Below price. I want to see the earnings report before I make a change.

On February 21, Hormel Foods (HRL) said it made 44 cents per share for its first quarter. That matched Wall Street’s expectations. Sales rose 1% to $2.4 billion which was just below estimates. Operating margin came in at 13%.

Basically, the company had a solid quarter. They sold off their Muscle Milk business to Pepsi for $465 million. Importantly, Hormel reaffirmed its full-year 2019 outlook of $1.77 to $1.91 per share and sales guidance of $9.7 billion to $10.2 billion. The company said the Muscle Milk deal will add a few pennies to this year’s EPS. The current outlook doesn’t reflect the deal, but later on, Hormel will adjust for it.

The shares took a big hit during April, but seemed to have found support around $39 per share. The consensus on Wall Street is for earnings of 45 cents per share.

After that, our next earnings report will be on June 6 from JM Smucker (SJM). Shares of SJM are up 34.5% for us this year. On Thursday, the stock made a new 52-week high.

Early Buy List Candidates for 2020

Here are eleven stocks I’m keeping my eye on for 2020. Bear in mind that this is very early, and I’ll certainly change my mind over the next seven months.

3M (MMM)

Stepan (SCL)

Johnson & Johnson (JNJ)

Henry Schein (HSIC)

Silgan (SLGN)

United Technologies (UTX)

Expeditors Intl of Washington (EXPD)

Kimberly-Clark (KMB)

Waste Management (WM)

Middleby (MIDD)

Bristol-Myers Squibb (BMY)

I’ll have more to say about the stocks I like as the year goes on.

Buy List Updates

I want to make a few adjustments to some of our Buy Below prices. Shares of AFLAC (AFL) have been acting well. The duck stock had another solid earnings report last month. The company recently raised its dividend for the 36th year in a row. The shares are currently going for about 12 to 13 times this year’s earnings estimate. On Thursday, the shares hit a new all-time high. I’m lifting my Buy Below on AFLAC to $54 per share.

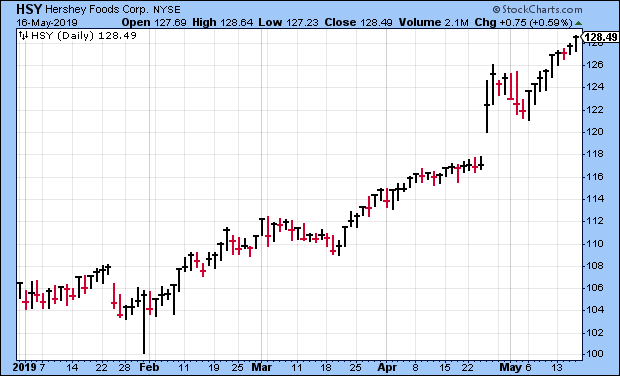

Shares of Hershey (HSY) have been performing very well for us lately. The shares got a new pop after the earnings report a few weeks ago. And thanks to Hershey’s defensive nature, traders have helped the shares in the past few days. On Thursday, HSY touched a new all-time high. Since February 1, Hershey is up more than 28% for us.

The company also announced that it’s redesigning its famed chocolate bar. Instead of the Hershey logo, the new bars will have emojis. That’s the first design change since the bars first went on sale in 1900. Fortunately, the design change isn’t permanent. In any event, I’m raising my Buy Below on Hershey to $130 per share.

Shares of RPM International (RPM) recently fell for six days in a row. The shares got off to a slow start this year, but the last earnings report was encouraging. This week, I’m dropping my Buy Below to $61 per share to reflect the down draft. RPM has increased its dividend every year for the last 45 years.

Cognizant Technology Solutions (CTSH) was our big dud this last earning season. They missed earnings and lowered guidance. In two days, the stock dropped 18%. The shares have started to stabilize around $58. I’m dropping my Buy Below on CTSH to $63 per share.

Barron’s reported that the GE/Danaher deal could be in jeopardy. The companies reached a deal where Danaher (DHR) would buy GE’s biopharma business for $20 billion. The problem is that some biopharma stocks have been reporting dismal results. This probably isn’t a dealbreaker, but it may be enough to renegotiate the price.

That’s all for now. There won’t be an issue next Friday. The following Monday, May 27, the stock market will be closed in honor of Memorial Day. Next week should be fairly quiet ahead of the three-day weekend. On Wednesday, the Fed will release the minutes from the last Fed meeting. On Tuesday, the existing-home sales report comes out. Then on Friday, the durable goods report is released. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Don’t forget to sign up for Wednesday’s webinar.

Posted by Eddy Elfenbein on May 17th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His