CWS Market Review – August 2, 2019

“There seems to be some perverse human characteristic that likes to make easy things difficult.” – Warren Buffett

There was a lot of news this week. Let me give you the highlights up front:

1. On Wednesday, the Federal Reserve cut interest rates by 0.25%. This was the first cut since 2008. However, the Fed signaled that this was a “mid-cycle” cut, not the start of a rate-cutting cycle.

2. On Monday, Fiserv officially merged with First Data. This was a $22 billion deal.

3. Church & Dwight reported Q2 earnings of 57 cents per share, five cents more than expectations. CHD also ditched the low end of its full-year guidance.

4. Cognizant Technology Solutions made 94 cents per share, two cents more than expectations. The stock rallied 3.8% on Thursday.

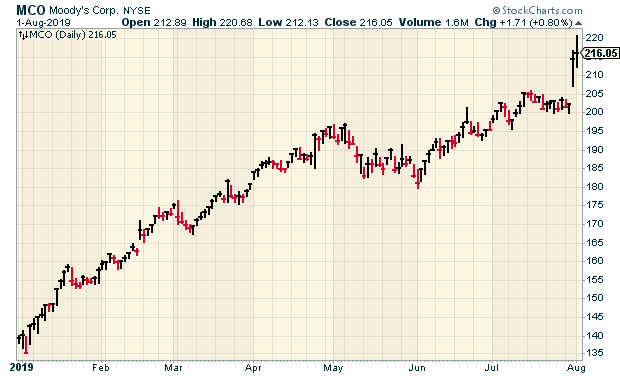

5. Moody’s earned $2.07 per share. Wall Street had been expecting $2.00 per share. The stock gained 6% on Wednesday. MCO also raised full-year guidance.

6. Broadridge Financial earned $1.72 per share, one penny more than expectations. The company raised its dividend by 11%. BR sees growth of 8% to 12% next year.

7. Intercontinental Exchange said it made 94 cents per share. That was two cents more than expectations.

8. Continental Building Products earned 43 cents per share for Q2. That was four cents below estimates.

The Federal Reserve Cut Interest Rates by 0.25%

On Wednesday, the Federal Reserve cut interest rates for the first time since George W. Bush was president. The new range for the Fed funds rate is 2.00% to 2.25%. The Fed last raised rates just over seven months ago.

It may sound odd that the Fed is cutting rates. The economy is mostly fine. The unemployment rate is low, and the stock market has done quite well. I wasn’t a big fan of the Fed’s last increases in December, but I didn’t think they’d cut rates so soon. I was wrong on that.

The bond market clearly led the Fed to make its move now. The two-year yield has been falling for the last several months. As a very general rule of the thumb, the Fed doesn’t get very far from where the two-year yield is. There were even some folks who thought the Fed would jump in and cut by 0.50%.

Fed Chairman Jerome Powell listed three reasons for this recent move: “to insure against downside risks from weak global growth and trade policy uncertainty; to help offset the effects these factors are currently having on the economy; and to promote a faster return of inflation to our symmetric two percent objective.”

Powell also said that “we’re thinking of it as essentially in the nature of a mid-cycle adjustment to policy.” In other words, the Fed doesn’t see this move as the first in a long series of rate cuts going into a recession. Instead, they see a few cuts to help the economy during an expansion. That statement disappointed investors and caused the market to drift lower on Wednesday.

Powell also said, “After simmering early in the year, trade-policy tensions nearly boiled over in May and June, but now appear to have returned to a simmer.” Well, that simmer didn’t last long. On Thursday, President Trump tweeted that the U.S. will impose a whole slew of new tariffs on Chinese goods starting in September.

The market didn’t like that, and I’m sure Powell was probably less than pleased as well. On Thursday, the S&P 500 dropped immediately after the tweet (see below) and closed the day at its lowest level in one month. The damage was mostly done among “high beta” and cyclical stocks. Our Buy List is skewed away from those areas, so we didn’t fall nearly as much.

What happens from here? I think there’s a good chance that the Fed will cut rates again at its meeting next month. After that, it gets a little murky. It really depends on how well the economy does.

For now, the rate cut is good for investors, but the trade war stuff is not. The good news is that this has been a good earnings season for us (besides Eagle, of course). Over the last six trading days, the S&P 500 has lost 2.19% while our Buy List is down just 0.17%. Investors should continue to focus on high-quality stocks. You also want to make sure you have some nice dividend yields in your portfolio. That’s the best defense against an easing Fed.

Let’s look at our Buy List earnings reports from this week:

Six Buy List Earnings Reports this Week

It was another busy week for us. We had three reports on Wednesday and another three on Thursday.

Let’s start with Church & Dwight (CHD). On Wednesday morning, the company reported Q2 earnings of 57 cents per share. That was five cents better than Wall Street’s forecast. That was also up 16.3% over last year. Gross margins rose to 44.6%, and organic sales rose by 4.9% (9.1% internationally).

The CEO said it was CHD’s fifth quarter in a row of organic sales growth in excess of 4%. The company now sees full-year earnings of $2.47 per share and 60 cents per share for Q3. The previous EPS guidance was for $2.43 to $2.47.

This was a good quarter for the company. Church & Dwight remains a buy up to $82 per share.

Also on Wednesday morning, Moody’s (MCO) reported Q2 earnings of $2.07 per share. That beat the Street by seven cents per share.

I like to see how Moody’s Analytics performs. That’s the gem of the company. For Q2, revenues were up 12% to $475.2 million. Moody’s Analytics makes up about 40% of revenues for the entire company.

The best news is that Moody’s raised its full-year guidance. The company had been expecting earnings to range between $7.85 and $8.10 per share. Now Moody’s 2019 earnings range is between $7.95 and $8.15 per share.

The stock jumped 6% on Wednesday and rallied some more on Thursday. Moody’s is now a 54% winner for us this year. It’s our #1 performer. This week, I’m lifting our Buy Below on Moody’s to $225 per share.

After the close on Wednesday, Cognizant Technology Solutions (CTSH) reported Q2 earnings of 94 cents per share. That was two cents above estimates. If you recall, I was concerned about CTSH because the last earnings report was a dud. I’m relieved by these latest numbers.

Quarterly revenue rose 3.4% to $4.14 billion. In constant currency, that’s up 4.7%. Cognizant said they expect full-year earnings between $3.92 and $3.98 per share. That’s an increase from the previous range which was $3.87 to $3.95 per share. However, that was a big cut from the initial guidance of at least $4.40 per share.

These are encouraging signs, but CTSH has more work to do. Simply put, they need to cut costs. The market was relieved. CTSH gained 2% in Thursday’s trading. After the May earnings report, CTSH lost 18% in two days. The shares are up 12.5% since then. I’m cautiously raising my Buy Below on Cognizant to $70 per share.

On Thursday morning, Broadridge Financial Solutions (BR) reported earnings of $1.72 per share which was one penny more than expectations. The company is also raising its full-year dividend from $1.94 to $2.16 per share. This is the eighth-straight year that BR has raised its dividend by double-digit percentages.

This was BR’s fiscal fourth quarter. The company made $4.66 per share for the year. For 2020, the company sees earnings growth of 8% to 12%. That implies a range of $5.03 to $5.22 per share. Wall Street had been expecting $5.14 per share. BR sees recurring-fee growth of 8% to 10% and operating margins around 18%.

I like these numbers. The shares started dropping a few days ago. I think some folks were expecting a miss. The report halted that. I’m raising my Buy Below on Broadridge to $137 per share.

Intercontinental Exchange (ICE) also reported on Thursday morning. For Q2, ICE made 94 cents per share which was two cents better than estimates (exact same as CTSH).

Revenues rose 4% to $1.3 billion. Adjusted operating margin came in at 58%. ICE said that through June 30, it has returned over $1 billion to shareholders.

ICE didn’t offer EPS guidance but it did for a few other metrics. What stood out to me was the ranges for data revenue. ICE said Q3 data revenues are expected to be in a range of $550 million to $555 million. For all of 2019, they see data revenues in a range of $2.19 billion to $2.24 billion. I’m lifting my Buy Below on ICE to $95 per share.

Finally, there’s Continental Buildings Products (CBPX). After the close on Thursday, the company reported sluggish numbers for Q3. CBPX earned 43 cents per share which was four cents below Wall Street’s forecast.

The problem isn’t with Continental; it’s the housing market. For the quarter, net sales fell 10.8% to $124.2 million. Wallboard sales fell 6.1% to 678 million square feet. Mortgage rates have come down a lot, and that should help CBPX.

Wall Street is very down on this stock, but I like what I see. On Thursday, shares closed at their lowest point in six weeks. If you’re patient, this could be a worthwhile investment. CBPX remains a buy up to $28 per share.

Earnings Next Week from Disney and Becton, Dickinson

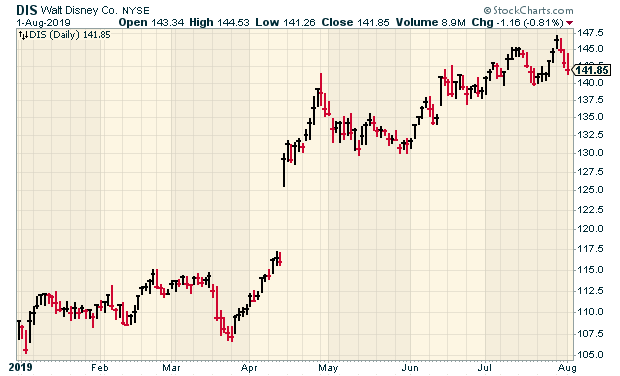

Earnings season is just about over. We have two more Buy List reports next week. On Tuesday, August 6, Disney (DIS) and Becton, Dickinson (BDX) are due to report earnings.

I feel like I’m running out of adjectives for Disney. Their business has been astounding this year. The Lion King is another monster hit for them. Disney owns five of the ten highest grossing movies this year.

Disney said it expects Disney+, its new streaming service, to be profitable by 2024. The theme parks had a very good Q1. Net income for the parks totaled $1.5 billion for Q1. Wall Street expects earnings of $1.75 per share.

In May, Becton, Dickinson had decent earnings, but the company lowered guidance. Becton now sees full-year earnings ranging from $11.65 to $11.75. The company blamed currency exchanges plus “recent regulatory and market pressures related to paclitaxel-coated devices.” The previous range was $12.05 to $12.15 per share.

BDX also lowered its full-year revenue guidance of growth of 8.5% – 9.5% down to 8.0% – 9.0%. The company blamed the negative impact of currency exchange. BDX didn’t change its currency-neutral forecast of revenue growth of 4% to 6%.

The stock has been impressively resilient. Wall Street expects Q3 earnings of $3.05 per share.

That’s all for now. The big jobs report comes out later this morning. For June, the unemployment rate was 3.7%. The economic news will be a little slower next week. On Monday, we’ll get the ISM Non-Manufacturing Index. Yesterday we learned that the ISM Manufacturing Index was the lowest in three years. On Wednesday, we’ll get the report on consumer credit. Then on Friday, we’ll see the report on wholesale inflation. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on August 2nd, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His