CWS Market Review – December 11, 2020

“If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.” – Jack Bogle

Wall Street and the daily headlines seem to be in direct contrast. Each day, the number of new coronavirus cases ticks higher. More lockdown orders are going in place. Plus, the labor market has been sluggish of late.

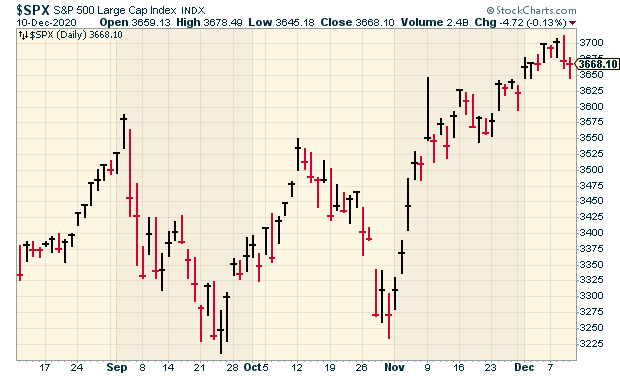

Despite this, the stock market is as festive as ever. This week, the S&P 500 peaked above 3,700 to reach a new all-time high (see below). Not only that, but cyclical stocks are leading the charge. The Nasdaq 100 just ran off a 10-day winning streak. Even the IPO market is hot again (which I’ll talk more about in a bit).

What gives? In this week’s issue, I’ll try to unravel this contradiction and show that it’s not quite the paradox that it may appear. I’ll also discuss the optimistic guidance we got this week from Fiserv. The company is about to wrap up its 35th year in a row of double-digit earnings growth. Plus, Disney has some major plans for new content in 2021.

But first, let’s look at some recent economic news, which, as I said, hasn’t been so rosy.

Stocks Versus Headlines: Who’s Right?

Last week, the government released the jobs report for November and the numbers were underwhelming. Last month, the U.S. economy created 245,000 net new jobs. That was a disappointment. Wall Street had been expecting an increase of 440,000. It’s also a big drop from the gain of 610,000 we had in October. For November, the unemployment rate dropped to 6.7%.

That miss was the latest in a series of disappointing jobs reports. It’s no secret what’s happening. The recrudescence of the lockdowns is putting the squeeze on businesses, especially small businesses. There are now 10.7 million Americans who are unemployed. That’s 4.9 million higher than in February. Normally, a gain of 245,000 jobs would be a great number, but in 2020, it’s merely trying to fill the massive hole we dug for ourselves in February and March.

Thursday’s jobless-claims report was another disappointment. A total of 853,000 Americans filed for jobless claims. That’s the highest in nearly three months. Wall Street had been expecting 730,000. It’s also an outlier to the downward trend of the last several months.

The silver lining is that the soggy economic news may help spur along negotiations for an economic stimulus. On Capitol Hill, politicians have reached the crucial “finger-pointing stage.” This boring dance will probably go on for a few days. The important fact is that a bi-partisan group of lawmakers put forth a $908 billion plan, and both House Speaker Nancy Pelosi and Senate Minority Leader Check Schumer seem to favor the bill. Given the state of the economy, I suspect that some sort of deal will be reached before the end of the year.

There’s also been more encouraging news about the vaccine. The vaccine made by Pfizer and BioNTech just won approval by an FDA advisory panel. The vote in favor was 17 to 4 with one abstention. This is a very strong signal that the FDA will soon grant its approval. After that, the shots will be moved toward states within 24 hours. The vaccine is a two-shot deal that’s been shown to be 95% effective. Next up will be Moderna’s vaccine. The advisory panel will consider that one next week.

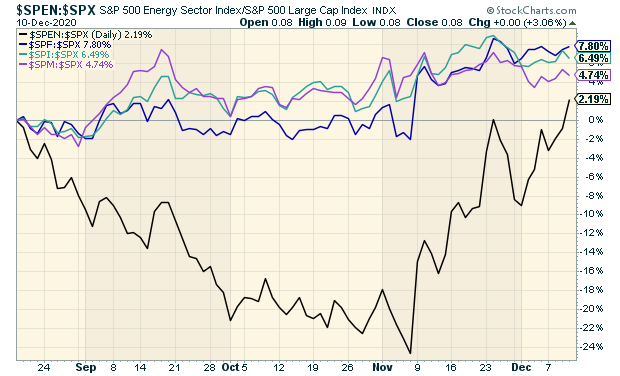

The stimulus hopes combined with optimism for the vaccines has helped push stocks higher. Not only that, but financial and energy stocks have been particularly strong lately. Both sectors have been laggards for a long time, so it’s good to see them finally take the lead.

Both financials and energy stocks are disproportionately represented in the value indexes; this has aided the market’s recent shift to value. These sectors are also cyclical indexes, which typically portend a rising economy.

Here’s an interesting chart. This is the four major cyclical sectors divided by the S&P 500. In other words, a rising line means the sector is outpacing the market. As you can see, all four have been beating the market lately. Energy stocks, the black line, are really humming along.

This trend has been mirrored in the bond market by higher interest rates. In August, the 10-year Treasury yield was near 0.5%. Lately, it’s been creeping up on 1%.

What’s even more interesting is inflation expectations. We can see this by comparing the 10-year yield with the 10-year TIPs, the inflation-protected bonds. The 10-year “breakeven” is now higher than it was since before the pandemic. In fact, it’s at a two-and-a-half year high. Inflation expectations are closing in on 2%, which is the Fed’s target (LOL).

I’ve been beating on this value/growth divide for several weeks so I may sound like a broken record (Google it, kids), but the trend persists. This could be a major theme for Wall Street as we head into 2021. Now let’s take a look at some recent action in the market for IPOs.

The IPO Market Heats Up

With the advent of the coronavirus and the subsequent lockdown, the market for Initial Public Offerings (IPOs) dried up. Now that Wall Street is in its happy place, there’s been a backlog of stocks waiting to hit the market.

This week, there were two major IPOS, from DoorDash (DASH) and Airbnb (ABNB). Not only were they looking to IPO at the same time, but both are fair representations of the new economy. The IPO market is interesting to watch because it can be a good gauge of investor sentiment. It can also be a warning when you see a lot of D-list stocks flooding the market. Remember 1999?

The interest in both DASH and ABNB was intense. In fact, the underwriters had to raise the price range prior to the IPO. That didn’t slow down the appeal. Both stocks priced above their range—and once trading started, the shares soared.

DoorDash’s pre-IPO price went from a range of $75 to $85 per share up to $90 to $95 per share. The stock was eventually priced at $102 per share. On Wednesday, the first trade was at $182 per share. At one point, DASH hit $195.50 per share.

Airbnb had been looking at a price range of $44 to $50 per share. That was increased to $56 to $60 per share. Then it was priced at $68 per share. The opening trade was $146 per share. That’s more than double the underwriting price.

Both of these offerings tell me that investors are optimistic and that they’re no longer running for cover like they had been a few months ago. There are more IPOs due over the next few weeks. This could be a good omen for 2021.

Investor Day for Fiserv and Disney

This is a popular time of year for investor days. This is when companies discuss their recent results and announce their plans for next year. I’ll be honest—a lot of it is corporate spin and PR. I get that, so I don’t get too worked up about investor day. Still, sometimes you can glean useful tidbits of actual news.

On Tuesday, Fiserv (FISV) held its investor day, and it had some good news to share. I like Fiserv a lot, but it’s had a tough 2020. That’s unusual for Fiserv. The stock trailed in the bear market and trailed in the rally. Lately, however, the shares have started to perk up.

Now let’s look at the guidance they offered. For 2020, Fiserv expects to see its EPS grow by 11% over last year. That would make it Fiserv’s 35th year in a row of double-digit growth.

Let’s do some math. Last year, Fiserv made $4.00 per share, so 11% from there comes to $4.44 per share. The company has raked in $3.12 per share over the first three quarters, so that implies Q4 earnings of $1.32 per share. Sure enough, Wall Street had been expecting $1.30 per share. That’s pretty good.

For next year, Fiserv expects internal revenue growth of 7% to 12% and EPS growth of 20% to 25%. Fiserv also expects internal revenue growth of 7% to 9% annually for 2022 and 2023, and EPS growth of 15% to 20%. I like those numbers, and I’m glad to see Fiserv’s optimism after a tough year.

Fiserv and AFLAC are our only two Buy List stocks that have been members all 15 years. Fiserv is a buy up to $120 per share.

The other big investor day this week was Disney’s (DIS) on Thursday. Actually, Disney is known for making a big deal out of its investor day, and 2020 was no exception.

Not surprisingly, Disney talked a lot about its streaming service, which continues to gain subscribers at a fantastic rate. CEO Bob Iger said that Disney+ now has 86.8 million subscribers. At the end of last quarter, they were at 73 million. Disney also owns Hulu and ESPN.com.

The lineup of new content is truly impressive:

Kareem Daniel, head of the company’s new media and entertainment distribution group, revealed that Disney+ will become home to 10 Marvel series, 10 Star Wars series, 15 Disney live-action, Disney Animation, and Pixar series and 15 Disney live action, Disney Animation, and Pixar films.

Dave Filoni and Jon Favreau, the masterminds behind “The Mandalorian,” are co-producing two additional series exclusively for Disney+ — “The Rangers of the New Republic” and “Ahsoka.”

As previously announced, “Andor” is coming to Disney+ in 2022. The 12-episode show follows K-2SO and Cassian Andor from “Rogue One” and has been called a spy thriller.

The company announced a new Star Wars movie coming in 2023 called “Rogue Squadron.” Disney knows exactly what to tell its fans.

There is a lingering question for Disney and the entire industry, and that is, “how exactly will all this content be distributed?” Will folks still be going to the movie theaters, or will it all be streamed? Also, what will the price structure be? It’s kind of odd that all movies at the theater cost the same, except for a matinee. Why should that be the case? Disney already experimented with that with Mulan.

I suspect the industry was already headed this way but that it was five to seven years off. Then came the coronavirus, and by necessity, the future got here quicker than we thought. Apparently, the mouse’s investor day was a hit. Shares of Disney were up over 3% in the after-hours market. The shares made a new high this week.

That’s all for now. There’s another Fed meeting next week. Don’t expect much in the way of new policies, but it will be interesting to hear what the central bank has to say. The policy statement is due out on Wednesday, and it will be followed by a J-Pow press conference. That morning, we’ll get the latest report on retail sales. On Thursday, we’ll get another jobless-claims report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on December 11th, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His