CWS Market Review – March 8, 2022

(You can sign up for our premium newsletter for $20 per month or $200 per year. Sign up here.)

The Markets React to War

The war in Ukraine is about to enter its third week, and the economic ramifications are starting to be felt. Not just in Russia but all over the world. In December, the price for oil was below $70. This week, it cracked $130.

AAA reported that gasoline prices are the highest on record (not adjusted for inflation). On Tuesday, the average price at the pump reached $4.17 per gallon. Last week, it was $3.60. The increases ain’t over.

The war has wreaked havoc in world markets. JPMorgan said that oil could hit $185 per barrel before the end of this year. Here’s a handy stat: Every $10 increase in the price for oil adds 0.2% to the rate of inflation. The Russian Deputy Prime Minister said that oil could hit $300 per barrel if Europe bans energy imports.

That’s just oil. All sorts of commodities are rallying. For example, Russia is the world’s leading producer of palladium. That’s a metal few people ever think about but it’s very important if you have a catalytic converter. Palladium is more expensive than gold, and it’s been soaring recently.

Wheat shot up to an all-time high and then it plunged. In the futures pits, wheat trading has hit the daily limit for the last six days in a row. Corn has rallied as well. These price increases will fall particularly hard on the world’s developing nations. They could even lead to social and political chaos.

But those rallies are nothing compared with nickel. In two days, nickel gained more than 250%. That’s the largest move ever on the London Metal Exchange. Apparently, a Chinese billionaire shorted nickel and now faces huge losses. It’s an old story. After nickel broke above $100,000 per metric ton, the LME suspended trading and it doesn’t see nickel trading resuming before March 11.

What’s the impact? There could be several. For example, nickel goes into lithium-ion cells that many electric cars use. One analyst said that Monday’s increase alone added $1,000 to the input cost of an average electric vehicle. I can’t help but think of the Butterfly Effect.

Stocks Are at a Nine-Month Low

The reaction from the stock market continues to be one of fear. Stocks have become a lot more volatile. Yesterday, the S&P 500 had its biggest one-day loss since October 2020. Today, the index closed at a nine-month low. Measuring to today’s close, the index is down 13% from its all-time high close which came on the first trading day of this year.

Today was an unusual day of trading. While there were 75 new 52-week lows in the S&P 500, there were also 19 new 52-week highs. The explanation is that many energy stocks did well, while many consumer staples did not.

It’s noteworthy to see what’s happening within the market. I’ve talked about this a lot, but the key trend continues to be low volatility stocks holding firm while high beta stocks are getting pummeled.

This trend has been very beneficial for our Buy List. Since our portfolio is very high-quality, it tends to outperform during scary markets.

So far this year, energy stocks have done very well. The S&P 500 Energy Index is currently up 39% YTD. Banks started off the year well but have lagged badly since the war started. We’re also seeing a lot of weakness in consumer non-discretionaries. In plain English, those are big-ticket items like cars and houses.

Could the bottom be in? I won’t venture a prediction, but I’ll add that as long as the S&P 500 is below its 50- and 200-day moving averages, as it is now, that’s usually a sign of more trouble ahead.

On an historical note, this is a popular time of year for market inflection points. The Nasdaq peaked on March 9, 2000. Three years later, the S&P 500’s closing low came on March 11, 2003. After the financial crisis, the market bottomed on March 9, 2009. The Covid low came on March 23, 2020.

If you’re of a particular historical bent, I’d add that today, March 8th, is also the anniversary of the start of the Russian Revolution, the “February Revolution” (1917), the USSR confirming it had the atomic bomb (1950) and Ronald Reagan giving his Evil Empire speech (1983).

Expect the Fed to Hike Next Week

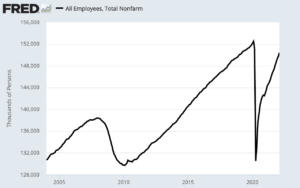

On Friday, the Bureau of Labor Statistics released the February jobs report, and it was good news. Last month, the U.S. economy created 678,000 net new jobs. That easily beat expectations of 440,000. We’ve nearly made back everything we lost (see chart below). The unemployment rate ticked down to 3.8%. The revisions for the previous two months added 92,000 jobs. The broader U-6 rate was 7.2%.

The surprise is that the average hourly earnings figure was unchanged. Over the last year, average hourly earnings are up 5.1%. Private payrolls increased by 654,000. Expectations were for 400,000. Manufacturing added 36,000 jobs. The labor force participation rate was 62.3%. That’s a post-Covid high.

The Federal Reserve meets next week, on Wednesday and Thursday. The war does not seem to have altered the Fed’s policy. It seems virtually certain that the Fed will raise rates next week. The futures market now places the odds of a rate increase at 96%. That seems about 3.999% too low, but that’s just me. It seems increasingly likely that the Fed will hike rates by 0.25% at each of its next four to five meetings, perhaps more.

The key test for the economy is how much more inflation we’ll see. Inflation is a cruel tax, and it takes a heavy toll on lower-income folks. The next CPI report is due out on Thursday. The last report showed year-over-year inflation of 7.5%. That’s the highest in 40 years.

I expect to see similar numbers for this week. Wall Street expects core and headline inflation of 0.6% for February. If that turns out to be accurate, it will slightly increase the year-over-year figure. I had expected to see inflation cool off later this year, but the war has changed my outlook. We may be seeing only the start of high inflation, especially for key commodities.

Simulations Plus Revisit

Last year, I told you about Simulations Plus (SLP). I said I liked the stock but that it was way too expensive. At the time, SLP was going for $57 per share. But I added that I would like it if SLP fell below $40 per share. That seemed a long way away.

Well, that day came. In fact, the shares recently fell below $37 and SLP closed today at $41.43 per share. That has my attention.

So what do they do? Simulations Plus makes software that lets drug companies simulate tests of their products in the virtual world before using any human or animal test subjects.

That’s a big cost-saver for drug companies. Simulations Plus helps streamline the R&D process by making it faster and more efficient. Not only is this cost effective, but it also helps drug companies in dealing with time-consuming regulatory hurdles.

In fact, there are times when the results from SLP’s products have allowed companies to waive clinical studies. The cost savings are substantial. This means drug companies don’t have to deal with the time and expense of recruiting test subjects and analyzing test results.

By using SLP’s software, drug companies can experiment with many variables like fine tuning dosage amounts. Companies can also see potential harmful side effects. Another important factor is that companies can identify treatments that have no benefits.

In healthcare, cost control is a major issue. That’s why SLP’s products are in such heavy demand. A great business to buy is one that helps other companies control their costs.

In many ways, I think what Simulations Plus does for pharmaceutical researchers is closely akin to what Ansys (ANSS) does for engineers. By sitting at a computer, an employee can efficiently iron out a lot of kinks before experimenting in the real world. Simulations Plus is also branching out from their core customer base of drug companies. They work with consumer products companies to see the side effects of things like pesticides.

In January, Simulations Plus reported fiscal Q1 earnings of 15 cents per share. That beat Wall Street’s forecast of nine cents per share. Total revenue rose 16% to $12.4 million. The CEO said, “we remain confident in achieving our 10-15% total revenue guidance for fiscal 2022.”

I’m not adding SLP to our Buy List. I don’t many any changes until December. But I rate the stock a “buy” for aggressive investors. I’ll warn you, SLP moves a lot but they have a winning business.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

Posted by Eddy Elfenbein on March 8th, 2022 at 7:41 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His