CWS Market Review – September 13, 2022

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Stock Market Suffers Its Worst Day Since 2020

This morning, the government released its report on inflation for August. Wall Street had been eagerly anticipating this report. Last month inflation was unchanged, and it was hoped that we would see more good news on the inflation front.

The equation is simple: If inflation backs off, then the Federal Reserve may back off with its rate hikes as well. After all, gasoline prices have fallen for over 90 days in a row. Up and down Wall Street, all eyes were hoping for good news.

Well, we didn’t get it.

Instead, inflation is alive and well. According to the Bureau of Labor Statistics, the U.S. economy had inflation of 0.1% last month. That beat expectations of -0.1%.

Over the last year, inflation is running at 8.3%. Wall Street had been expecting 8%. At that rate, that means if you’re paid a salary at a constant rate for one full year, then you work one month for free.

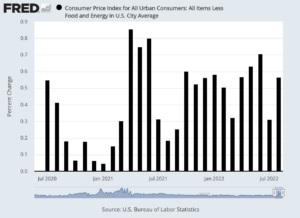

We know that falling energy costs have had a major impact on the overall inflation rate, so let’s also look at core inflation which excludes food and energy prices.

Eh, not much good news. For August, core inflation was up 0.6% (see chart below). That doubled Wall Street’s forecast of 0.3%. I think this is the stat that really stung people. Over the last year, core inflation is now running at 6.3%.

Here are some details:

Energy prices fell 5% for the month, led by a 10.6% slide in the gasoline index. However, those declines were offset by increases elsewhere.

The food index increased 0.8% in August and shelter costs, which make up about one-third of the weighting in the CPI, jumped 0.7% and are up 6.2% from a year ago.

Medical care services also showed a big gain, rising 0.8% on the month and up 5.6% from August 2021. New vehicle prices also climbed, increasing 0.8% though used vehicles fell 0.1%.

This bout of inflation is unusual in that it appears to be hitting regular consumers harder than the overall numbers suggest. It’s one thing to say that inflation has increased by 8.3% over the last year, but that’s just the average. For example, the index for food is up by 11.4% over the last 12 months. That’s the highest rate since 1979. The price for electricity is up nearly 16% in the past year.

Larry Summers, the former Treasury Secretary, tweeted:

Today’s CPI report confirms that the US has a serious inflation problem.

Core inflation is higher this month than for the quarter, higher this quarter than last quarter, higher this half of the year than the previous one, and higher last year than the previous one.— Lawrence H. Summers (@LHSummers) September 13, 2022

Traders hated the report. I mean, they hated this report. Prior to the report coming, the futures indicated that the stock market was ready to open higher. Today could have been the market’s fifth up day in a row.

But as soon as the report came out, so did the bears. They loved the lousy inflation news. This was the stock market’s worst day since 2020. The S&P 500 lost 4.32% and the Dow gave up more than 1,200 points. The Nasdaq Composite lost more than 5% on the day. Today was just ugly.

The strong inflation news gives political cover to Jerome Powell and his friends at the Fed to continue hiking interest rates. When the Fed hikes rates, risky stocks suffer the most and conservative stocks provide much greater protection. I feel like a broken record on this point, but we saw it so clearly today.

Here are some numbers from today that make the story clear. The S&P 500 High Beta Index lost 5.16% today while the S&P 500 Low Volatility Index fell “only” 2.89%. It’s a similar story with growth and value. The S&P 500 Growth Index lost 5.19% while the S&P 500 Value lost 3.49%.

Amazon and Netflix were both off by more than 7%. Facebook was down more than 9%.

On our Buy List, Hershey (HSY) is probably one of the best examples of a conservative, defensive stock. It’s our top-performing stock this year. Not surprisingly, it was among our top-performing stock today. In fact, today really was a microcosm for the whole year so far. Our Buy List outperformed the S&P 500 today by more than 1% today.

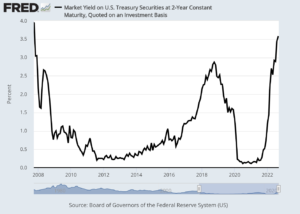

Where do we go from here? The Federal Reserve meets again next week. We can almost certainly expect another 0.75% rate increase. This would be its third 0.75% rate hike in a row. There’s even a decent chance (around 33%) that we’ll see a full 1% increase, but I doubt that will happen. Six months ago, the Fed’s range for short-term interest rates was 0% to 0.25%. After next week, it will be 3% to 3.25%.

The meeting after next week will be on November 2, just before Election Day. Yesterday, the futures market was indicating only a 14% chance of a 0.75% rate hike. Thanks to today’s inflation report, that’s up to 53.5%. That would bring the upper range to 4%.

One of the reasons why I like to track the two-year Treasury yield is that it serves as an unofficial estimate for what the Fed will eventually do. It’s not perfect, but it’s a decent proxy for what Wall Street is thinking. Today the two-year yield got as high as 3.75%. That’s a 14-year high (see chart below). More importantly, it’s much higher than you see in most stocks. The yield on the 30-year Treasury topped 3.5% today. Eighteen months ago, during Covid, it was at 1%.

Today’s message is clear. The Fed still does not have a handle on inflation. Despite assurance that inflation is merely transitory, inflation is becoming annoyingly persistent. The Fed now realizes that it will have to take bold action to defeat inflation. Christopher Waller, a Fed governor, said, “This is a fight we cannot, and will not, walk away from.”

As long as the Fed is determined to raise interest rates, then the stock market will be soggy. I’m not predicting a crash, or even a downward market, but bulls will find it difficult to get a sustained rally going. As fun as this summer’s rally was, it’s come to an end.

The other important takeaway is that holding risky assets right now is dangerous. I’m mostly speaking of high-volatility stocks, but this spills into NFT and crypto as well. With higher rates on the way, conservative stocks will fare much better. That’s been consistent for the last 10 months. These stocks aren’t nearly as impacted by the Fed’s inflation battle as is the rest of Wall Street.

BofA’s Investor Survey

Bank of America recently conducted a survey of major investors. I’m brining this to your attention because I was struck by the level of fear it revealed. Personally, I like to keep an attitude of reasonable optimism. In most cases, it’s too easy to let fear overtake what should be a sober process.

According to the survey, 52% of investors are underweighted in stocks, and another 62% are overweight in cash. I would not have guessed it’s that high.

As concerns over the economy escalate, the number of investors expecting a recession has reached the highest since May 2020, strategists led by Michael Hartnett wrote in a note on Tuesday. Sentiment is “super bearish,” with the energy crisis further weighing on risk appetite, they said. A net 42% of global investors are underweight European equities, the largest such position on record.

What also stood out to me is that a new 92% of the respondents expect profits to fall next year. Investors are clearly shying away from risk.

Persistently high inflation is seen as the biggest tail risk, followed by hawkish central banks, geopolitics and a global recession. Only 1% of participants see a resurgence in the Covid-19 pandemic as a tail risk.

Unfortunately, investors see more problems in Europe. According to the survey, 70% of respondents think Europe’s energy crisis will push the continent into a recession.

One positive note is that 79% of investors expect to see inflation calm down in the U.S. over the next year, and 36% see the Fed ending rate hikes by Q3 of next year.

Stock Focus: McGrath RentCorp

One of my hobbies is finding interesting (and hopefully profitable) businesses that few on Wall Street know about. I’ve featured many of them in these pages. This week, I want to introduce you to McGrath RentCorp (MGRC). This is a fascinating and little-known stock. The company is involved with business-to-business renting.

McGrath rents relocatable modular buildings, portable storage containers, electronic test equipment and liquid containment tanks. This means things like modular classrooms. Or imagine a construction site in the middle of nowhere. McGrath can rent the foremen an instant office. These things are more common than you might expect.

But McGrath does more than that. They also rent test equipment and storage tanks. The company currently operates through four segments: Mobile Modular, TRS-RenTelco, Adler Tanks and Enviroplex.

Only two Wall Street analysts currently follow the stock, but despite being almost completely ignored by Wall Street, this is a very sound company. McGrath has raised its dividend for 31 years in a row. Earlier this year, they bumped up the quarterly dividend from 43.5 to 45.5 cents per share.

The company was founded by Bob McGrath in March 1979 in a small two-acre inventory center in San Leandro, California. McGrath was quickly successful and by 1984, the stock IPO’d on the Nasdaq at $6 per share.

Since then, McGrath has split 2-for-1 three times which comes to 8-to-1. That means that McGrath’s split-adjusted IPO price was 75 cents per share. Today it’s at $85.37 per share.

Check out this chart:

And it’s only gotten the attention of two analysts!

McGrath was hurt during Covid but it still managed itself well. The company’s EPS dropped from $4.16 in 2020 to $3.66 in 2021. I think the company has a good shot this year of topping its all-time EPS high from 2020.

During Q1 of this year, the company made 77 cents per share which beat by five cents. For Q2, McGrath made $1.07 per share which beat consensus by 17 cents per share. (Please bear in mind that with so few analysts following it, that’s a stretch to call it a “consensus.”)

The current market cap is a little over $2 billion. McGrath runs a very strong business and the shares are going for a very good price. That may not last long.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

Posted by Eddy Elfenbein on September 13th, 2022 at 7:40 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His