CWS Market Review – November 8, 2022

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Some Cautious Reasons for Optimism

For the first time in a long time, I would call myself an optimist on the stock market. Not that we’re out of the woods just yet, but I sense that the recent selling pressure is overdone.

The market has already thrown several false rallies our way, but the current uptrend may last. The S&P 500 is already up close to 10% since its intra-day low from October 13. The index is also above its 50-day moving average (the blue line in the chart below) which has often been an omen for good returns. Interestingly, the market has historically made several important lows during October.

I don’t want to overstate the case. Of course, we should always be prudent, but there are concrete reasons to be optimistic. For example, the Federal Reserve is probably getting near the end of its rate hikes. In fact, I think rates may be held steady for most of 2023.

Also, the stock market is reasonably priced. It’s been a good thing for disciplined investors to see so many “lockdown darlings” get punished harshly this year. From peak to trough, Peloton lost more than 96% of its value. Stocks like Facebook and Netflix have also been hammered.

Meanwhile, to take an example from our Buy List, Silgan Holdings (SLGN), just hit a new 52-week high. Silgan is going for about 12 times next year’s earnings. The shares are quietly up more than 15% this year. It seems like the more attention a stock usually gets in the media, the worse it’s done this year.

While I think the economy will be in a recession next year, it will probably be a shallow one. Inflation is still a serious problem, but it finally has the attention of people who were quick to dismiss it.

We don’t have all the numbers in yet, but it looks like the S&P 500 will post minor earnings growth compared with last year’s Q3 (though not as much as inflation). This is a very different market than we had only a few months ago. The New York Times quoted Patrick Fruzzetti: “The main thing to remember is that the markets tend to rally post election only because markets don’t like uncertainty.” I have to agree.

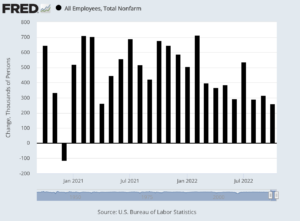

On Friday, the government released the jobs report for October, and it wasn’t bad. Last month, the U.S, economy created 261,000 net new jobs. While that’s a decent number, it’s the smallest monthly increase since December 2020.

I don’t mean to dismiss the report. It beat Wall Street’s forecast of 205,000. The stock market opened higher on Friday but then zig-zagged for a bit before closing higher by 1.4%. Not that long ago, a report like that probably would have tanked the market.

The details of the report were somewhat mixed. The unemployment rate rose 0.2% to 3.7%. The labor force participation rate declined for the second month in a row to 62.25%.

The labor force participation rate can be easily influenced by demographic factors such as more retirees. If we look at just the labor force participation rate for prime working age people (ages 25 to 54), that’s 82.5%. That’s not far from where it was pre-Covid.

The frustrating part continues to be wages. For October, average hourly earnings rose by 0.4%. In the last year, average hourly earnings are up 4.7%. That’s the smallest increase in over a year. We need to see this number improve. While many workers are seeing their pay go up, they’re seeing prices go up even more.

The government also tracks a broader measure of unemployment, the U-6 rate. For October, that increased to 6.8%. Here are some more details:

Health care led job gains, adding 53,000 positions, while professional and technical services contributed 43,000, and manufacturing grew by 32,000.

Leisure and hospitality also posted solid growth, up 35,000 jobs, though the pace of increases has slowed considerably from the gains posted in 2021. The group, which includes hotel, restaurant and bar jobs along with related sectors, is averaging gains of 78,000 a month this year, compared with 196,000 last year.

Heading into the holiday shopping season, retail posted only a modest gain of 7,200 jobs. Wholesale trade added 15,000, while transportation and warehousing was up 8,000.

After last Wednesday’s Fed meeting, Fed Chairman Jerome Powell gave a press conference that sounded noticeably more hawkish than the policy statement let on. The financial markets took the cue and sold off. That has passed and the market has gained ground for three days in a row.

For the December 13-14 Fed meeting, futures traders continue to be evenly divided. Half think there will be a 0.5% increase. The other half expects a 0.75% increase. Personally, I’m leaning towards another 0.75% hike. In total, we’re probably looking at another 100 to 125 basis points in further rate increases. After that, I suspect the Fed will pause for several months.

Of course, much of this hinges on the incoming data. The next big test for Wall Street will come Thursday morning when the CPI report for October comes out. The last report showed inflation running at 8.2% over the last 12 months. That’s very high but it’s still below the peak of 9.1% in June.

In the last CPI report, the big problem was that the core rate increased by 6.6% over the last 12 months. That was the fastest pace since August 1982. That’s when the stock market reached rock bottom after a nasty 16-year bear market. Even if headline inflation has already peaked, we may be facing a slow decline.

Ansys and McGrath Rally After Big Earnings Beats

I recently highlighted two stocks for you and both have been doing quite well. This week, I want to bring you updates on both stocks.

In our issue from four weeks ago, I focused on Ansys (ANSS). I’ve always been a big fan of this stock but last year, I thought it got way too pricey. We cut the stock from the Buy List at the end of last year, and I’m glad we did. The stock has had a rough year in 2023. Ansys is down more than 45% this year.

Despite the falling share price, business at Ansys has been doing very well. As we know, a strong business can be a very different animal from a strong stock. In August, Ansys had an earnings report that was very good. Last Wednesday, the company released its Q3 earnings report and it smashed expectations.

For Q3, Ansys said it expected Q3 earnings between $1.56 and $1.70 per share. It turns out that they made $1.77 per share. The CEO said Ansys beat its “financial guidance across all key metrics.” What impressed me is that it’s able to maintain an operating profit margin close to 40%. This is such a good business.

For Q4, Ansys now sees earnings ranging between $2.58 and $2.90 per share. That works out to full-year earnings of $7.48 to $7.90 per share. Wall Street liked what it saw. In the four trading days since the report, Ansys has rallied 9.1%. I haven’t made our Buy List decisions yet for next year, but I’m considering adding Ansys back to our Buy List.

Two months ago, I told you about little McGrath RentCorp (MGRC). The company is in the unusual business of renting relocatable modular buildings, portable storage containers, electronic test equipment and liquid containment tanks. This means things like modular classrooms. Or imagine a construction site in the middle of nowhere. McGrath can rent the foremen an instant office. These things are more common than you might expect. I always like small niche businesses like this.

The odd thing about McGrath is that almost no one follows it, but the company has raised its dividend for 31 years in a row. Earlier this year, the company solidly beat earnings for Q1 and Q2, but I wanted to bring you up to speed on the latest earnings report.

On October 27, McGrath reported very strong numbers for Q3. Sales rose 16% to $200.5 million, and earnings increased to $1.25 per share. That beat by eight cents per share. The stock jumped 11.6% on the news. The shares reached a new all-time high today. In the last 30 years, the stock is up 100-fold.

Here’s a stat that tells you so much about Wall Street. Sixty analysts currently follow currently Meta Platforms. Most have it rated as a buy or a strong buy. Only two analysts follow McGrath.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

Posted by Eddy Elfenbein on November 8th, 2022 at 8:17 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His