CWS Market Review – April 4, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Markets Are Chaos

Yesterday, the price of Dogecoin soared 30%. For the uninitiated, Dogecoin is a joke crypto currency, or, as it’s more commonly known, a “meme currency.” While it’s very much real, Dogecoin is a parody that’s one step ahead. It’s a parody that parodies attempts to parody itself. Needless to say, it has lots of fans.

For now, I’ll skip the possible benefits of Dogecoin, but one aspect I like is that it has a cartoon mascot of a dog, a Shiba Inu. You’ve probably seen it in countless memes.

So what prompted yesterday’s big rally? Well, Twitter owner Elon Musk replaced Twitter’s normal bird logo with the famous Dogecoin dog. Yes, that’s what sparked the massive rally. At last report, the doggy is still there.

Let’s be clear: At no point did Dogecoin gain any real value. Nothing was added. Nothing was taken away. It rallied solely because of attention. Traders were buying because they thought it would rally, which, in turn, caused more traders to buy, which caused it to rally even more. This was crypto meets Seinfeld. It was a rally based on nothing.

Mr. Musk has been a fan of Dogecoin for some time. Tesla even accepts Dogecoin as payment for some items. At some point, I expect it to be integrated into Twitter. One day it may even be legal currency on the moon. At this point, who knows?

On a related note, Musk is currently being sued for $258 billion. He’s accused of running a Ponzi scheme by boosting the price of Dogecoin with his tweets. I don’t expect this suit to go far. If you buy a dog-based crypto currency, then you really shouldn’t be shocked by the losses you get.

I bring up this silly story for a serious reason. That is that finance and investing is far more chaotic than most people understand. Every day on Wall Street, smart, well-dressed, serious-minded people go off to their well-paying jobs and watch something that, at root, is highly irrational.

Finance goes out of its way to cover this up. We have all sorts of models and statistics that give finance a false front of rationality. Finance has a serious case of “physics envy.” As a result, it pretends to be far more scientific than it truly is.

Why did Silicon Valley Bank go under? Because people panicked. That’s the whole story. Sure, there’s lots of blame to go around, but you can’t escape this basic fact. If people hadn’t panicked, SVB would still be in business today. Emotions matter. Any market is made up of people, and therefore, it will be driven by emotions.

Twenty-five years ago, the hedge fund Long-Term Capital Management went bust. Before LTCM went under, the fund made a lot of money by using complex models to bet on small deviations in prices. The fund used math to unlock the market, but they should have been using psychology.

This gets to the heart of the issue. No matter how much data you throw into your models, you can only use information that’s known. You can’t plug in the unknowns because … well, you don’t know them.

In the case of LTCM, all their models went down the drain when Russia defaulted on its debt. It was assumed that couldn’t happen, and it had never happened. Until it did. Before you knew it, they faced billions of dollars in losses. The models all failed.

You can look at the stock market with lots of fancy equations and Greek letters, but once the billionaire tweets the cartoon dog, then all bets are off. Isaac Newton said, “I can calculate the motion of heavenly bodies but not the madness of people.” That’s a good line to keep in mind the next time anyone talks about what the market will do.

When to Sell?

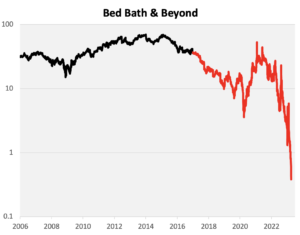

This afternoon, shares of Bed Bath & Beyond (BBBY) closed at 35.4 cents. I try not to let my emotions get in the way, but this is a sad end to what was a very good company.

I was a fan. BBBY was on our Buy List for 11 years. The problems at BBBY came about slowly. They were way behind with an internet presence. The company also overly relied on its coupons. Gradually, the numbers got worse. It was the world’s slowest-moving train wreck.

If there’s one good part of the story, it’s that we sold out long before the worst came. In fact, when we sold, we actually made a small profit in BBBY. There aren’t many people who can say that.

The black line is when we owned BBBY. The red part is after. I had to use a log chart to show how badly it’s performed.

This brings me to an important lesson, and that’s when to sell. Whenever we add a new stock, our aim is to own it as long as we can. Stocks like AFLAC (AFL) and Fiserv (FISV) have been with us since the beginning.

My basic rule for selling a stock is to do so when the thesis changes. BBBY was no longer the retail powerhouse it had been. It allowed Amazon to gain too much market share. Management was far too slow to adjust to the new reality.

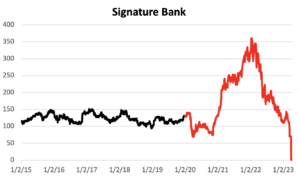

We also owned Signature Bank (SBNY) for five years which we also sold for a profit. We bought it because it was a niche bank that focused on services in New York City. The problem was that it got tied up with too many taxi medallion loans. The story had changed. Uber and Lyft killed the markets for those medallions and Signature took the blow. The bank later tried to make up ground by specializing in crypto. That didn’t go well either.

We thought we had bought one firm and we then realized that we actually owned something quite different. This was a tough one for us because selling it appeared to be a big mistake. The stock soared after we sold it, but it was caught up in crypto mania. It didn’t last.

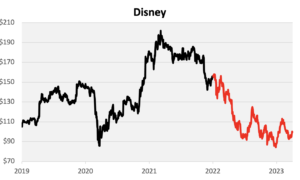

Disney (DIS) is another good example. We bought it because we thought Disney was well-positioned to profit from the shift to streaming. Initially, we were exactly right, and the stock soared. Initial success can be a dangerous thing.

Then came Covid. Again, the story changed. Disney was a company that seemed to be tailor-made to be harmed by Covid. Disney’s business is movies, sports and theme parks. If that’s not enough, they also have a cruise line. Everything Covid wrecked is where Disney stood. This is also when Bob Chapek took over as CEO.

Fortunately, we sold Disney after having it on our Buy List for three years.

Selling a stock is difficult. It’s an admission that you may have gotten it wrong. People can be very stubborn. Again, emotions get in the way.

The worst investor in the world is the man or woman who bought a stock at $80 per share. Now the company is not doing well and the stock is currently at $70 or so. The investor refuses to exit a lousy position because they “don’t want to take the loss.” Famous last words! I’ve seen it happen many times. Heck, I’ve done a few times.

Another time to sell is when a company is part of a major merger. Even if the company you own is the senior partner in a merger, the new entity will be quite different from the one you bought. Maybe the combined firm will be good, but there’s no guarantee. In fact, the research shows that most mega-mergers don’t work out for shareholders.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

Posted by Eddy Elfenbein on April 4th, 2023 at 10:46 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His