CWS Market Review – May 7, 2024

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

It’s still early, but so far, May is looking a lot better than April. The S&P 500 has rallied for the last four days in a row. On Tuesday, the index briefly stuck its head above 5,200. More importantly, the S&P 500 has overtaken its 50-day moving average. That comes after 15 straight days of closing below it. Still, I’m not convinced that the coast is clear.

What makes me say that? On Friday, the government reported that the U.S. economy created 175,000 net new jobs last month. That’s a decent figure but it was well below expectations. Economists had been expecting a gain of 240,000. Also, the unemployment rate ticked up to 3.9%. That’s still low, but it’s the highest in over two years.

Oddly enough, the immediate impact of the jobs report has been positive—not because it’s good news itself but because it could push forward the Fed’s plans to cut rates, and that would be good for the market.

In other words, bad news is good news because it may spur the Fed to action. I realize that may sound odd, but welcome to Planet Wall Street.

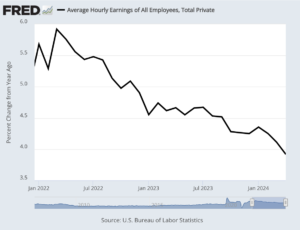

In the jobs report, I was particularly disappointed to see that average hourly earnings increased by only 0.2% for April. That needs to improve. Over the past year, average hourly earnings are up 3.9%. Both numbers were 0.1% below expectations. These are crucial numbers for Wall Street because it may signal that consumers are close to being tapped out.

Here’s a look at the year-over-year increase in average hourly earnings. Notice how it’s increased but the rate of increase has consistently fallen.

The government also calculates a broader unemployment rate, called the U-6 rate, which includes “discouraged” workers. For April, the U-6 rate rose to 7.4% which is the highest since November 2021. The labor force participation rate stayed the same at 62.7%.

We’re also seeing more part-time workers shift to fulltime. Last month, the number of fulltime workers increased by 949,000 while part-time workers dropped by 914,000.

Here are some details about jobs growth in different sectors:

Consistent with recent trends, health care led job creation, with a 56,000 increase.

Other sectors showing significant rises included social assistance (31,000), transportation and warehousing (22,000), and retail (20,000). Construction added 9,000 positions while government, which had shown solid gains in recent months, was up just 8,000 after averaging 55,000 over the previous 12 months.

The recent gains had been heavily tilted to government and healthcare jobs. I’d like to see those gains broaden out.

Moses Sternstein points out that the jobs market isn’t so much growing as it’s “closing in the gaps.” The number of jobs that need to be done has stayed roughly the same but the number of people available to fill those jobs has been fewer than expected. As a result, job gains are modest while the unemployment rate is low. One effect of this has been higher wages for low-end workers.

That’s part of the reason why we’ve seen an imbalance in inflation. Services like haircuts have been hit hard by inflation while goods like new TVs haven’t moved that much. It all comes down to how much the product is dependent on labor costs.

So where does this put the Fed? That’s hard to say, but the futures market now thinks the first Fed rate cut will come in September. Prior to the jobs report, we were looking at a cut in November. There’s also a slight chance of another rate cut before the end of the year. Any rate cuts are good for stocks and that’s probably why the market has rallied the last few days.

We’re still in Q1 earnings season. Overall, the results have been quite good but only relative to expectations. Q1 earnings growth is currently tracking at 5.31%. That’s up from 2.99% one month ago.

So far, 77.4% of companies have beaten Wall Street’s earnings estimates while 59.1% have beaten on sales. A little more than half have beaten on both.

Stay tuned for next Wednesday, May 15. That’s when we’ll get the CPI report for April. There hasn’t been much improvement here in several months.

Apple’s Massive $110 Billion Share Buyback

Last week, Apple’s (AAPL) board of directors made news by announcing a new $110 billion share buyback plan. That’s an astounding amount of money. Of the ten largest share buyback announcements of all time, Apple owns six of them.

The plans also raised some questions about how a company ought to use its excess cash. Is a buyback plan the best thing to do with shareholders’ money? Is Apple no longer an innovation giant, or has it become a high-cash-flow value stock?

I have some thoughts about this. Ideally, I’d prefer to see a company pay out cash dividends. Apple increased its dividend by one penny to 25 cents per share. The best thing about this is that it gives shareholders the option of using their dividend payment to buy more shares, which is effectively what the buyback does automatically.

I also fear when a company holds too much cash. This often leads to unwise acquisitions. This is known as the Bladder Theory of Corporate Finance.

I have no problem with the idea of share buybacks, but I think they’re often abused. For example, too often share buybacks merely use shareholder money to buy an overpriced stock. This is what happened at Cisco (CSCO) for many years.

I also don’t like it when companies offer large stock options to their senior executives but share buybacks tend to mask how much money is at stake.

Here I have to give Apple credit. The company has gradually reduced the number of shares outstanding. In fact, over the past year, Apple’s profit declined but its earnings-per-share increased slightly thanks to fewer outstanding shares. According to MarketWatch, over the last 10 years, Apple has reduced its share count by 37%.

If you’re going to do a buyback, that’s the way to do it.

IES Holdings Revisit

Three weeks ago, I told you about IES Holdings (IESC). This is one of those great companies with an impressive track record that’s virtually ignored by Wall Street. Since 2012, it’s up 90-fold. Literally, IESC isn’t followed by a single analyst on Wall Street.

The company “provides infrastructure services including electrical, communications, low-voltage, network, AV, and security alarm systems to the residential, industrial and commercial markets.”

In the newsletter, I wrote: IESC’s next earnings report will probably be out in early May, but I can’t say what Wall Street’s consensus is since there isn’t one.” Well, on Friday, IESC released its earnings report, and it was a good one.

For its fiscal Q2, IESC’s revenues rose by 24% and its operating income was up 146%. Q2 earnings rose from $1.07 per share last year to $2.29 per share for this year. IESC has $106 million in cash and not a dime of debt. During Friday’s trading, shares of IESC jumped 18%. In two weeks, IESC gained 50%.

I certainly can’t take credit for predicting that would happen, but it does show you that there are plenty of good stocks to own that aren’t part of the Magnificent Seven.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

Posted by Eddy Elfenbein on May 7th, 2024 at 8:19 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His