CWS Market Review – October 29, 2024

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

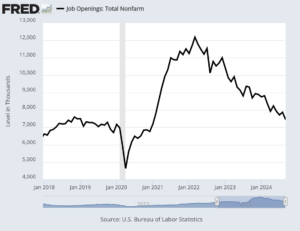

Job Openings Plunge by 400,000

We’re now in the heart of earnings season, and that’s dominating the news on Wall Street. We’re about one-third of the way through earnings season, and this will be an especially busy week. Companies that make up 42% of the S&P 500’s market value are due to report this week.

Many tech stocks are faring well. In fact, the Nasdaq rallied to a new high today. Alphabet, Google’s parent, reported very good results after the closing bell. Several other tech giants are due to report soon.

It’s hard to draw an overall theme for this earnings season just yet. Some stocks are doing quite well. Royal Caribbean raised its guidance for the fourth time this year, but Ford said that earnings will be at the low end of expectations.

It’s still early, but the beat rate for this earnings season is low. So far, 78% of companies that have reported earnings have beaten expectations. If that trend holds up, this will be the lowest beat rate since Q4 of 2022. That includes the fact that estimates were lowered—sometimes by a lot—as earnings season approached.

The S&P 500 is poised for its sixth positive month in a row, but the market hasn’t moved much in either direction for the past two weeks. That’s usually a bearish sign, but that can change on a dime.

Americans appear to be in an optimistic mood, at least according to the Conference Board. Earlier today, the group said that’s its reading for consumer confidence jumped 11% in October to 138. That’s the largest monthly increase in over three years. The Conference Board also has an “expectations” index, and that rose 8% to 89.1.

The bad news is that the number of job openings for September plunged to 7.44 million. That’s a drop of more than 400,000, and the prior month was also revised lower. Job openings are now at the lowest level since January 2021. The ratio of vacancies to available workers is down to 1.1. Not too long ago, the ratio was more than 2.0.

Layoffs are now at their highest since early 2023. We’re also seeing fewer quits. That’s usually a sign that the labor market is getting weaker. If that’s true, it’s very much different from the data we got in the last jobs report.

We’ll soon learn more. The October jobs report is due out this Friday. Wall Street is looking for a gain of 110,000 new jobs. That’s a low bar, and if that comes in weak, the entire view of the economy could change.

Unfortunately, it’s not going to be easy to divine a trend from these numbers. The problem is that the job numbers could be skewed due to the Boeing strike and the recent hurricanes. In other words, things could be worse than the official numbers say. Also, the job openings data tends to be very volatile.

To add more to the mix, the Federal Reserve meets next week, November 6 and 7. That’s after the election, but it may not be before we know who won. Despite all the hoopla in recent weeks, the expectation on Wall Street is that the Fed will again lower interest rates, this time by 0.25%. The futures market thinks the rate cut has a probability of 99%. I don’t see the Fed altering from its path anytime soon.

The real action lately hasn’t been in the stock market but in the bond market. Treasuries are supposed to be safe and sound but they’re looking at their worst month in two years. That’s probably because traders have realized the economy is better than they thought. Again, it’s not so much that the economy is soaring ahead, but it’s hanging in better than expected.

The yield on the 10-year Treasury rose to 4.28% today. That’s up 55 basis points since October 1. So the Fed lowers rates and the long-terms start to rise? That wasn’t supposed to happen, but Wall Street doesn’t always like to do what it’s told. It’s like a four-year old in that regard, and many others.

Much of the outlook for the market depends on how well the economy fares. Tomorrow morning we’ll get our first look at how the economy did during Q3. Wall Street is optimistic. The consensus is for growth 3.1%.

S&P 500 Calendar Effects

I’ve been working on a project that I thought I’d share with you. I’ve been knee-deep in market data for the last few days.

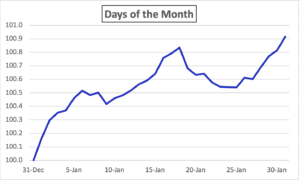

I took all the data for the S&P 500 going back to 1957. This is how the average month has performed for the index:

I used 1957 because that’s when the index was expanded from 90 to 500 stocks. As you can see, the stock market does much better near the start and end of each month (I used January as a stand-in). From the 6th to the 25th of each month has only been a little positive. The rest of the time accounts for the most growth.

Obviously, I don’t favor a strategy of going in and out of the market that quickly. I’m a confirmed buy-and-hold guy, but I find market patterns like this fascinating.

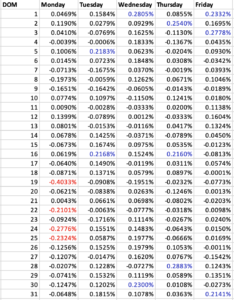

Here’s a look at how the S&P 500 has performed on each day and date of the month:

I’ve highlighted the best days in blue and the worst days in red. Again, I find this interesting, and it took me a long time to compile. Interestingly, Friday the 13th hasn’t been that bad for investors. Sorry, Jason.

By the way, today is the 95th anniversary of Black Tuesday, also a Tuesday the 29th.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on October 29th, 2024 at 6:31 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His