CWS Market Review – January 14, 2025

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

One hundred and fifty years ago today, Congress passed the Specie Resumption Act. This act put the country back on the gold standard. The idea of the act was to get everything back to normal following the hectic and inflationary policies of the Civil War. I can’t help but think of the similarities between that era and today.

When you’re at war, anything not directly related to the war effort gets tossed aside, and that includes fiscal discipline. For them, it was a war; for us, it was a pandemic. During the Civil War, the government stopped paying gold or silver in exchange for currency. Instead, it started printing greenbacks which weren’t backed by anything.

Now that the war was over (we won), Congress wanted to get back to exchanging gold or silver for dollars, hence the name Specie Resumption. I bring this up not to do a lesson on economic history but to show the centrality of inflation’s role in our economic life.

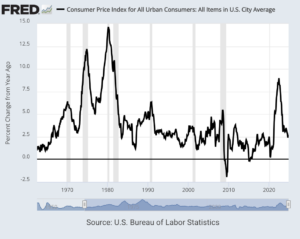

Tomorrow, the government will release the CPI report for December, and I’m concerned that it will show more evidence that inflation isn’t melting away. The consensus on Wall Street is that consumer prices rose by 0.3% last month. The Street also expects an increase of 0.3% for core prices.

The funny thing is that if any of the politicians who debated the act in 1875 were magically transported to our time, they certainly would be astounded by many things in our modern age, yet they would largely understand our current monetary predicament. They had a war. We had a pandemic. They printed greenbacks. We let inflation fly, and now we’re trying to reel it back in, and that’s proving to be more difficult than we thought.

The damage of inflation stings. Consider that over the three-year period covering 2022, 2023 and 2024, the S&P 500 gained 29.3%, not counting dividends.

Inflation, however, increased by 13.2%, and that doesn’t include the final month of 2024. We’ll get the data tomorrow. In simple terms, inflation ate up nearly half the market’s profits over the last three years. It’s like having a silent partner who takes half your winnings, before taxes.

Investors in the 1970s certainly recall how troubling inflation can be. In fact, it was 50 years ago tomorrow that President Gerald Ford began his State of the Union Address by saying, “The state of the union is not good. Millions of Americans are out of work. Recession and inflation are eroding the money of millions more. Prices are too high, and sales are too low.”

Incidentally, this is a big time of year for gold-related milestones. (Hat tip to my friend Gary Alexander who is a fountain of market history.) In January 1975, gold was finally legalized for Americans to own, and it was 45 years ago, in January 1980, that gold peaked at $850 per ounce.

In the 1964 film, Goldfinger, Auric Goldfinger planned to irradiate all the gold in Fort Knox thus increasing the value of his gold. He would have been a lot better off doing nothing since gold increased dramatically over the next 16 years.

The 1980 gold rally was extreme. Adjusted for inflation, gold was going for over $3,400 per ounce. This was the time when the Hunt Brothers tried to corner the world silver market. In real terms, gold has lost more than 20% of its value over the last 40 years. If you had paid $25 for an ounce of gold instead of $850, you still would have lost to the dividend-adjusted S&P 500.

Twenty-five years ago, the Dow peaked at 11,723. It wouldn’t top that for another seven years. Still, the market is up fourfold in 25 years. Gold has endless appeal for some investors, but for the long run, I’m on the side of stocks.

Strong Jobs Report

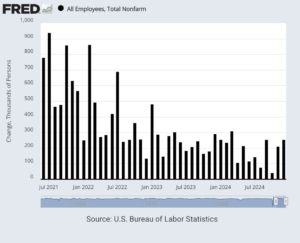

On Friday, the Bureau of Labor Statistics said that the U.S. economy created 256,000 nonfarm payrolls last month. That was well above Wall Street’s forecast for a gain of 155,000 jobs.

The unemployment rate fell by 0.1% to 4.1%. The jobless rate has been below 4.3% for the last 38 months in a row. The economy also added 212,000 net new jobs in November. Last year, the U.S. economy added over 2.2 million jobs. The broader U-6 measure of joblessness fell by 0.2% to 7.5%.

Here are some details from the report.

Job growth came from the familiar sources of health care (up 46,000), leisure and hospitality (43,000), and government (33,000).

Retail also saw a sizeable gain, up 43,000 after losing 29,000 in November heading into the holiday shopping season. The sector saw payroll growth of 2.2 million for the full year, down sharply from the 3 million gain in 2023.

Revisions for prior months were less substantial than has been the recent trend. The October count saw an upward change of 7,000 to 43,000, while the November number was cut by 15,000 from the prior estimate.

The household report showed that full-time jobs increased by 87,000, and part-time jobs rose by 247,000.

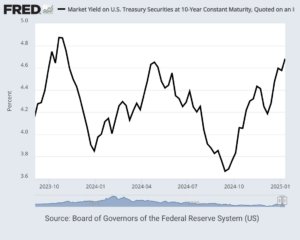

Thanks to the strong jobs report, the bond market got knocked down. In two days, the yield on the two-year Treasury rose 13 basis points. The yield on the 10-year Treasury is up over 100 basis points in four months, and it’s at its highest yield since late 2023. The 2/10 Spread just hit a 2.5-year high.

On Tuesday, we learned that producer prices rose 3.3% over the last year. That’s the steepest increase in nearly two years.

You can expect the Fed to take a breather later this month. The odds for another rate cut are now around 2%, and for March, the odds are at about 22%.

The jobs report was a classic good news/bad market event. Higher jobs growth means there’s no need to cut rates, and stocks don’t like that.

Thanks to a late-day rally, the S&P 500 closed higher today, but earlier in the day, the index was on pace for its lowest close in over two months. The S&P 500 recently dipped below its 100-day moving average, and since the end of the third quarter, the stock market has gained just 1.4%.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. I was recently on the “We Study Billionaires” podcast with Clay Finck. I had a lot of fun. Check it out.

Posted by Eddy Elfenbein on January 14th, 2025 at 6:22 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His