Archive for 2005

-

The Market Today

Eddy Elfenbein, October 28th, 2005 at 4:58 pmThe stock market wasn’t held back by the news of the indictment of Scooter Libby, Dick Cheney’s Chief of Staff. The Dow gained 172 points, the Nasdaq was up 26 points and the S&P 500 added 19.51 points. Our Buy List edged out the broader market by gaining 1.73% to the S&P 500’s 1.65%.

The S&P 500 rose almost the exact percentage as it did on Monday. The market’s volatility recently hit some of its lowest levels in years, but that may be changing. The S&P didn’t have one daily change that was greater than 1.4% from May through September, but today was the fifth such move in October. Donald Luskin has more thoughts on volatility.

Our big winner today was Frontier Airlines (FRNT), which soared higher, but gave back some of its gains to close up 8.3%. Although Stryker (SYK) and Biomet (BMET) had good days today, some of our medical device stocks like Varian (VAR) and Respironics (RESP) were laggards. Progressive (PGR) became our latest insurance stock to hit a new 52-week high.

Outside our Buy List, Business Week looks at the growing mess at Martha Stewart Living Omnimedia (MSO). Overstock.com’s CEO takes the blame for his company’s lousy quarter. Lastly, I was struck by this line: “The economists at Merrill Lynch figure that 40 percent of after-tax personal income is now absorbed by a combination of (rising) health care, energy and interest expenses. That leaves 60 percent to make the house and car payments and pay for life’s little extras – such as groceries.” I guess consumers are becoming more and more like General Motors (GM). (H/T: The Kirk Report). -

Google Watch

Eddy Elfenbein, October 28th, 2005 at 3:02 pmThe WSJ profiles Eugene Walton, one of the few Google (GOOG) bears on Wall Street. Walton just raised his price target on Google from $200 to $225, which is about 35% below where Google’s shares are now.

The difference between Walton and others on Wall Street is that he uses discounted cash flow to value Google. Wall Street prefers to use “relative valuations,” meaning to compare Google’s valuation to similar stocks like Yahoo (YHOO).

The downside of relative valuation is that if the stocks you’re comparing to are mispriced, you still won’t know the true value of the stock you’re analyzing. All you’ll learn is that stock X is no more overpriced or underpriced than stock Y. Even though both may trade at ridiculous levels, there’s little comfort that they may do so equally.Many of Mr. Walton’s Wall Street peers expressed some reservations about Google’s future growth rate but still upgraded the stock, saying they believe the company will outperform the competition. Uncertainty about Google’s future warrants use of more conservative assumptions, says Mr. Walton. In his valuation, he assumes that Google’s long-term, or “terminal” growth rate — the rate at which cash flows are expected to grow, theoretically, in perpetuity — is 2%. Another analyst who uses discounted cash flow, Philip Remek at Guzman & Co. in Coral Gables, Fla., used a 7% rate to come up with a price target of $260.

The relative-value proponents “want to play it both ways,” says Mr. Walton. “They’re being conservative about earnings beyond 2006, but they’re also trying to justify the current share price. You can’t do that.”

Many academics contend that terminal growth rates should never be higher than the gross domestic product; otherwise, a company would eventually grow so fast that it would overtake the entire economy. Goldman Sachs estimates the GDP growth rate over time at between 3% and 3.5%.

Aswath Damodaran, a professor at New York University’s Stern School of Business who specializes in valuation, says he isn’t surprised that analysts using the relative-value method find Google to be fairly priced or undervalued. They feed into their long-term growth assumptions “whatever irrationality is driving the stock price today,” he says. -

Dell’s Descent

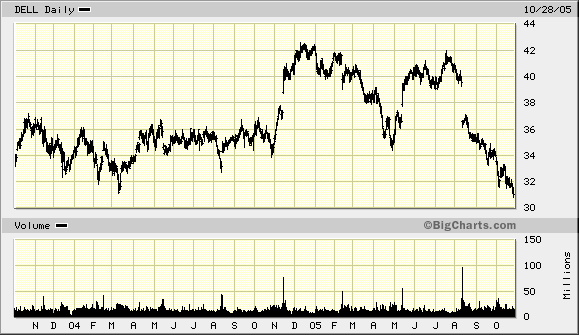

Eddy Elfenbein, October 28th, 2005 at 2:13 pmDell’s (DELL) punishment continues. The stock is close to falling below $30 a share. It looks like today will mark the lowest close in over two years. The stock first broke through $30 seven years ago (adjusted for splits).

I try not to be surprised by what I see on the market, but the falloff in Dell’s stock is pretty stunning. Put it this way: Dell and GE (GE) are now trading at roughly 16.5 times next year’s earnings. Does anybody really that think these stocks have equal growth prospects? Dell’s earnings multiple is now less than Coca-Cola’s (KO).

The earnings report is due on November 10. To be conservative, Dell’s sales should grow around 14% or so. If Dell posts earnings of 42 cents a share or more, the stock could easily run to $40.

-

The Morning Market

Eddy Elfenbein, October 28th, 2005 at 11:14 amThe markets are reacting somewhat favorably to this morning’s GDP report. Stocks and bonds are up; gold and oil are down. Thanks to Frontier Airlines (FRNT), our Buy List is on its way to another strong day. Frontier opened at $9.50 a share this morning, although it has slipped some since then. The stock was upgraded today by Calyon Securities. Shares of Frontier are currently up 10% today.

The theme this quarter seems to be strong earnings and weak forecasts. That’s what we heard from Microsoft (MSFT) yesterday and Bristol-Myers (BMY) today. Another good example is the orthopedics business. Melissa Davis at TheStreet.com looks at the pricing pressures facing Zimmer Holdings (ZMH).Anticipating future price cuts, Zimmer went ahead and scaled back expectations for revenue and profit growth next year. The company now hopes to grow revenue by 8% to 9% and profits by about twice that much in 2006.

I think it’s clear that Wall Street doesn’t pay enough attention to good small-cap stocks. At the Motley Fool, Rich Smith pointed out that Quality Systems (QSII) is followed by just four analysts. Wall Street is still ignoring it even though its shares are up 15-fold in the last five years.

The China Construction Bank just went public on the Hong Kong exchange. This is one the largest IPOs in years. To continue to grow economically, China will have to modernize its banking sector. The China Construction Bank has a market value of $70 billion, which is more than Morgan Stanley (MWD). Also from China, China National Petroleum has completed its acquisition of PetroKazakhstan (PKZ).

Authorities in Beijing have allowed the yuan to climb 0.32% since it was “floated.” That may not seem like a big deal, but at the time of the announcement Beijing said it would keep the yuan to a strict 0.3% trading range. The yuan is supposed to be tied to a basket of currencies, but only two major currencies are rallying–the yuan and the dollar. I think the dollar must feel pretty lonely in that basket.

And finally, Hershey (HSY) is suing a California company called Milkdudz over patent infringement. The company makes clothing to make breast-feeding easier. -

Today’s GDP Report

Eddy Elfenbein, October 28th, 2005 at 9:27 amThe government reported that GDP grew by 3.8% during the third quarter. Economists were expecting a growth rate of 3.6%. The economy has now grown by over 3.3% for ten straight quarters. In real terms, the economy has expanded by 13.4% over the last four year. The GDP report will be updated two more times, and I still think the third-quarter growth rate could be revised to over 4%.

-

Frontier’s Earnings

Eddy Elfenbein, October 28th, 2005 at 6:56 amAt 8:27 last night, it finally came….

Frontier Airlines (FRNT) had to wait until prime time to deliver its earnings report. I won’t lie. This one had me nervous. I kept thinking of all the horrible things they could announce. They’re already an airline. Is it even possible to get worse?

But we all knew that Frontier had to stand tall. The Evil Sith Knights over at Love Field (LUV) had invaded their turf. This could not stand.

Congratulations Potter & Co., the earnings were out-freakin-standing. The analysts were expecting two cents a share. Frontier made 18 cents a share. Read that again: 18 cents a share. They didn’t just beat the Street—Frontier steamrolled estimates. (Note: Yes, I realize I’m mixing my metaphors, airplanes don’t steamroll, but you get the drift.)

But then Jeff Potter, Frontier’s CEO had to drop this on us:Although a quarter as strong as this is certainly cause to celebrate and for our employees to congratulate each other on a job well done, we recognize that the ills that continue to plague this industry haven’t disappeared. Fuel remains at historic highs and the market still suffers from overcapacity leading to general weakness in fares. We don’t anticipate a solution to these issues in the coming quarter, and we expect that high fuel costs and weak fares will adversely affect earnings for our fiscal third quarter 2006.

Don’t toy with my feelings like that. Later on, the company says that this quarter’s loss will “likely” exceed last quarter’s gain. The more I think about it, it appears that Frontier is keeping expectations low. The quarter isn’t even one-third over. Plus, fuel costs have been falling. This isn’t good news, but it’s not necessarily bad news.

Let’s look at the positives. Frontier has been able to keep operational costs low. This airline can compete with any low-cost carrier. Total revenues for the quarter increased by over 20%. Also, the company was hampered by a 38% jump in fuel prices. Total fuel costs jumped nearly 60%, yet they still had a great quarter. Fuel makes up nearly 30% of their total costs. If the price for jet fuel falls, Frontier could soar. Let’s hold on and watch how the shares react this morning.

In other news, Southwest came out with its plans for Denver. -

The Market Today

Eddy Elfenbein, October 27th, 2005 at 6:51 pmI’m not pleased with the market today. Two of our stocks reported earnings that were inline with expectations, but they gave modest outlooks for next quarter. So both stocks got nailed for big losses. I don’t know what to say. This market wants results right now, and anything less gets punished. This was not a fun day. Every single sector was down. Today was the peak day for earnings. Tomorrow the market will focus on the GDP report.

Our Buy List lost 1.69%, and the S&P 500 fell 1.05%. Our big loser was CACI International (CAI), which dropped $8.29 or 13.7%. If you’re not familiar with the company, it’s a major defense contractor based in Virginia. The company reported earnings that we inline with expectations, but it guided lower going forward. The company sees earnings next quarter of 69 to 72 cents a share. The Street was looking for 72 cents. That doesn’t seem so bad, but the market will hear none of it. Just so we have this right, the company’s low end is three cents below expectations, and we drop 829 cents. The market is giving these “missed profits” an earnings multiple of 275, and they’re not even missing yet! If you’ve been a long-time owner of CACI, you might have a sense of deja vu. Solid profits and the stock get slammed–that’s exactly what happened nine months ago.

With Respironics (RESP), we have almost the same story. The company makes those weird mask things that help with sleep apnea. RESP reported earnings of 28 cents a share. Again, this was inline with forecasts, but the stock took a 5.4% hit due to a tepid outlook. The company sees earnings of 35 to 36 cents a share for this quarter, while the Street was looking for 36 cents a share. The stock dropped $2.05.

One of the bright spots is Frontier Airlines (FRNT), which seems to be showing some strength lately. I think the main trends will continue. The economy is getting stronger, interest rates are going higher, and oil is going lower.

Outside our Buy List, Aladdin Knowledge Systems Ltd. (ALDN) reported earnings of 24 cents a share, one penny above expectations. I had discussed this stock two weeks ago. I was happy to see their margins continue to expand. For this quarter, Aladdin’s operating margins reached 18.6%, up from 16% last year. The company sees earnings of 24 to 26 cents a share for next quarter. The stock rose 34 cents today. -

AT&T Brand Lives On

Eddy Elfenbein, October 27th, 2005 at 3:40 pmI have to say that I like this news. SBC Communications (SBC) is buying AT&T, and it will adopt its name. AT&T was originally formed 120 years ago. It’s a classic name that deserves to live on. I’ve already discussed how much I hate the names of telecom stocks.

The Baby Bells are almost gone now. SBC has already bought two if its siblings, Ameritech and Pacific Telesis. Two others, Bell Atlantic and Nynex, merged to form Verizon. US West was bought out by Qwest (Q). BellSouth (BLS) is the only one left as originally conceived. Perhaps it will be bought by Starbucks (SBUX). -

Don’t deficits matter?

Eddy Elfenbein, October 27th, 2005 at 1:06 pm“Don’t deficits matter?” asks Buttonwood at the Economist. She’s not happy that the dollar continues to rally:

The currency has gained more than 10% this year, hitting a two-year high against the yen last week and a three-month peak against the euro. This is despite an American current-account deficit even wider than last year’s and apparently reduced enthusiasm among Asian central banks for dollar-denominated assets. Buttonwood was among those early in the year who expected the dollar to go every which way but up. How wrong can a columnista be? Why didn’t the currency behave as she told it to? Don’t deficits matter?

I hate it when currencies don’t do what columnists say. Here’s the awful admission:

Despite hurricanes, higher oil prices and indeed higher interest rates, America’s economy has grown more strongly than most people expected.

Imagine that! But don’t worry; here’s the mandatory “dark-clouds-on-the-horizon” ending. The dollar is about to crash. It has to crash. It must crash. Run! Hide!!

Yet if all this sounds too Goldilocks to be true, it probably is, for a couple of reasons. Any big upward movement in the dollar’s exchange rate is probably limited by the perception that there are sellers of dollars out there waiting for right price (central banks, especially). “Non-commercial traders” have longer net positions in dollar futures than almost ever before, on figures from the Commodity Futures Trading Commission—always a bad sign. As the dollar strengthens, American investors themselves are pouring money into foreign markets, which in time could blunt the greenback’s rise. Some of Japan’s normally risk-averse investors are stripping off their currency hedges to capture higher yields in America; they could flee at the slightest sign that the dollar is in trouble or Japan’s economic recovery is finally starting to lift the yen. And the euro has lost 12% in value since the beginning of the year. If the ECB starts raising interest rates in the first half of next year just as the Fed stops, it might gain it back.

Or it might not.

-

Business Week Takes another Shot at Dell

Eddy Elfenbein, October 27th, 2005 at 12:43 pmYou can tell Dell’s (DELL) earnings announcement is coming soon when Business Week starts publishing its anti-Dell articles. You can almost set your clock by them. This time, Business Week tells us that Dell is floundering in China.

You couldn’t blame Michael S. Dell for sounding a little bit smug about his company’s prospects in China during a cocktail party for analysts in Austin, Tex., last April. Dell’s market share in Asia was growing fast, and it looked as if its formula of selling PCs directly to customers over the Internet and phone was catching on just as it had in the U.S.

“Demand for our products and services in China is tremendous,” he said, adding that “99% of the economic value in China is in the large metro areas” where Dell (DELL) was concentrating its efforts.

All of a sudden, Dell’s strategy in Asia is looking a little shaky. Third-quarter numbers released by tech market researcher IDC show Dell’s market share for Asia, excluding mature Japan, dropped by a full point, to 7.8%. Then, on Oct. 25, the company announced that the co-president of its Chinese operations, Foo Piau Phang, had “chosen to retire.”Please. Dell has an incredibly strong business in China. Four years ago, Dell held just 5% of the Chinese market. Today, the company has 4,500 employees there and it announced plans to build a second plant in China. Japan is Dell’s third-largest market. China is fourth.

RURAL FREEZE. What’s happening to Dell’s march on Asia? The company won’t talk — it’s in the quiet period before its Nov. 10 third-quarter earnings announcement. But there’s plenty of evidence suggesting it’s out of sync with shifting market conditions in fast-growing China. While Dell has focused on large business and government customers in the country’s major cities, demand is emerging elsewhere — in hundreds of smaller cities, where Dell doesn’t sell as effectively as its rivals and where even some business customers want to see products before they buy.

That’s where competitors Lenovo, Hewlett-Packard (HPQ), and Founder have been selling briskly through retail shops. Says HP Executive Vice-President Ann Livermore: “You have to wonder, how well does the direct model work in the hinterland?” HP has invested heavily in hiring staffers and recruiting retailers in secondary Chinese and Indian cities.

The China setback is just the latest in a string of recent disappointments for Dell. Since the Round Rock (Tex.) company missed its second-quarter revenue target, its stock price, which peaked at $42 a share in July, has sunk to less than $32. A survey by the University of Michigan recently showed a decline in Dell’s customer-satisfaction rating. Also, the company was embarrassed in China in May after the publication of an e-mail from a Dell salesman criticizing the Chinese government — a key Dell customer.An HP executive questioning Dell’s business model? I’m sorry, but which company is laying off 15,000 employees? Does anyone know? Bueller? Anyone?

As far as its revenue miss, Dell barely missed. The stock hasn’t done well lately (and that’s why I think it’s a great buy), but it’s still well ahead of the market over the last four years. The customer satisfaction issue is important, but the survey made it clear that customers are upset with Dell’s customer service, not the products. In other words, this is a problem that can be fixed.

The article is cobbling together negative and slightly negative news and making it appear that there’s some large trend in play. The moral of the story is always the same. Dell can’t maintain its margins. Lower-cost competitors are under-pricing it, and Dell is losing market share. Just last week, we learned that Dell is still #1 and it’s slightly increasing its market share.

We’ll find out more on November 10.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His