Archive for 2005

-

Delta and Northwest File for Bankruptcy

Eddy Elfenbein, September 15th, 2005 at 9:20 amIt finally happened. Delta and Northwest have filed for bankruptcy. Both companies said the timing was a coincidence. Now, four of the seven largest airlines are in bankruptcy protection. In the last four years, the big airlines have lost $30 billion.

What does this mean for ticket holders? Edward Hasbrouck’s Practical Nomad blog has advice for travelers, including an “FAQ about Airline Bankruptcies.” -

Rating Brokers

Eddy Elfenbein, September 15th, 2005 at 9:03 amSmart Money recently had a review of online brokers. I use Ameritrade (soon to become TD Ameritrade) which is pretty good for my needs, although the “account” screen is a bit confusing.

For premium discounters, Smart Money likes Fidelity. Harrisdirect was their top basic discount broker. They also give high marks to OptionsXpress.

About full-service firms, Smart Money said:

Whether you are thinking about making the move to a full-service broker or are frustrated with the one you have because he doesn’t return your calls, it helps to understand the economics of the business. “If the account is not more than $250,000, it becomes difficult for the brokerage to make money,” says Brad Hintz, a brokerage analyst at Sanford C. Bernstein. Accounts below that level get “generic support” from a call center, he says. And when it comes to the big firms, say, UBS or Smith Barney, Hintz is probably lowballing that estimate. Some brokers we spoke with said their services are aimed at clients who bring half a million dollars to the table. Of course, if you want your broker to join you on the beach, it’ll take a bit more.

Of the full-service firms, Smart Money gives its highest rating to Edward Jones.

-

Banks Vs. Brokers

Eddy Elfenbein, September 14th, 2005 at 3:19 pmI thought summer was supposed to be a slow time on Wall Street. Apparently, no one told Lehman Brothers. The company reported great earnings today. Profits jumped 74%. Lehman earned $2.94 a share, well above Wall Street’s estimate of $2.37. The company sees its earnings growing 10% next year, and 8% in the year after that. With the new results, the stock is going for about 11 times earnings.

To be sure, this is the latest in a string of good quarters for Lehman, which has benefited from a robust bond environment in recent years, combined with a decision by management to further diversify its business into areas such as stock trading and investment banking. David Goldfarb, Lehman’s chief administrative officer, told analysts that the market environment was favorable in the third quarter, which helped boost the firm’s earnings.

It will be interesting to see how well the other big brokers do when they report their earnings. What I find interesting is how much better the brokers are doing than the major banks. These stocks usually track each other pretty closely, but the brokers have taken a solid lead in the past few months.

This chart shows how the brokers (the gold line) have climbed higher since May, while the banks (the black line) have barely moved.

-

Writing a Check

Eddy Elfenbein, September 14th, 2005 at 9:25 amHere’s an odd fact for you. Did you know that you can write a legal check on any old piece of paper?

According to the Uniform Commercial Code, the body of law that governs these things, all you have to include are the name of the payee, the dollar amount, the name of your bank, your signature, the date, and some suitable words of conveyance, such as “pay to the order of.” You don’t need the account number or the bank ID number you find on preprinted checks.

The trick is that you have to find somebody willing to accept such a check. Merchants and the like are free to reject any sort of payment they don’t cotton to, checks included. Needless to say, if you try to write a check on the back of an old grocery list, the average checkout clerk is going to tell you to take a hike. However, if the clerk does accept it, the bank will honor it. -

Jaffray and Goldman Rate Baidu as Underperform

Eddy Elfenbein, September 14th, 2005 at 9:13 amTwo of Baidu.com’s underwriters, Goldman Sachs and Piper Jaffray, have rated the stock as “underperform” today. Goldman even said that the company is worth just $27, which is the same as its IPO price. Yesterday, shares of Baidu closed at $113, and it’s been as high as $153. On its first day of trading, the stock jumped 345%.

Anthony Noto, the Goldman analyst, said that at the most extreme, Baidu could be worth $45 a share.

Noto’s forecasting growth rates of 35% for revenue and 40% for earnings per share between 2006 and 2009. In 2006 alone, the Goldman Sachs analyst estimates Baidu.com will see earnings-per-share growth of 106% on a 71% jump in revenue.

Noto bases his forecast on the company’s solid results to date and on an exploding Chinese market.

“By 2008, the number of Internet users in China should reach 252 million, surpassing that of the U.S. despite only representing 19% of the expected population at that time vs. 71% for the U.S,” said Noto. “These strong secular growth trends provide a positive backdrop for Baidu.”Baidu’s stock is currently down about 24% in pre-market trading.

-

The S&P Since 2004

Eddy Elfenbein, September 13th, 2005 at 5:21 pmThis has not been an equal-opportunity market. Since the beginning of 2004, the S&P 500 is up 10.73%. However, it’s been largely led by two sectors–the Energy Sector is up 72.8% and the Utilities Sector is up 41.06%. The rest of the market has been pretty much flat.

Energy 72.80%

Utilities 41.06%

Industrials 11.75%

Telecom 7.28%

Staples 6.35%

Discretionary 6.07%

Healthcare 5.58%

Financials 4.79%

Materials 2.91%

Tech 2.59% -

Reuters: Northwest shares plunge as bankruptcy looms

Eddy Elfenbein, September 13th, 2005 at 4:02 pmThe end may be near for Northwest.

Shares of Northwest Airlines plunged 58 percent on Tuesday following a press report that the No. 4 U.S. carrier could file for Chapter 11 bankruptcy protection as early as Wednesday.

The New York Times, citing anonymous sources, said both Northwest and No. 3 carrier Delta Air Lines were very close to filing.

“The shares are down obviously on the New York Times article. That’s the only news that came out before the stock before the stock began to fall,” said Helane Becker, an analyst at Benchmark Cos.

“I think that they will file before October 17 for sure. With oil prices where they are and big pension contributions due, and without higher airfares, Northwest had no choice,” Becker said.

Shares of Northwest were down 57.7 percent, or $1.91, to $1.40 in afternoon trade on Nasdaq. -

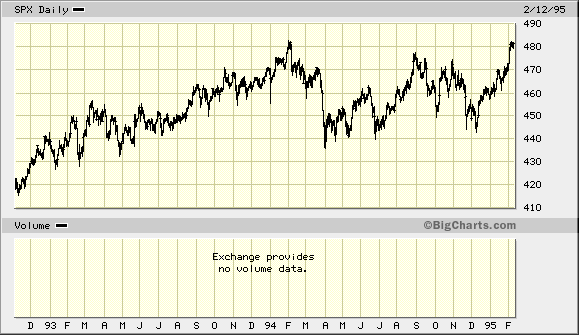

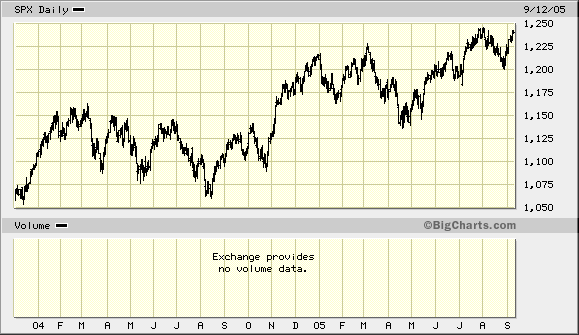

Replay of 10 Years Ago?

Eddy Elfenbein, September 13th, 2005 at 3:48 pmI normally don’t pay attention to these kinds of historical parallels, but there’s a strong similarity between today’s market and the market of 10 years ago. Both markets are stuck in trading ranges and both have very low volatilities.

Here’s the S&P 500 from November 1992 to February 1995:

And here’s the S&P 500 since December 2003:

I keep thinking that the market will break out of its trading range, but it never seems to. Each time we get close to a new high, the market backs off. What turned the market around in 1995 was a rally in the bond market. I don’t think we’ll get that again, but stranger things have happened.

-

Get into Google before Wednesday, Ski Daddy!

Eddy Elfenbein, September 13th, 2005 at 3:11 pmJim Cramer is telling you to “get into Google before Wednesday.”

What happens when the best story on earth goes on the road to tell itself to dozens of the largest accounts in the world?

I think it goes higher, especially when it dawns on people that there may not be enough Google to go around.

All last week I watched in amazement as Google acted terrifically in the face of a mountain of supply. I know, from my sources, that much of this massive secondary offering deal is already taken.

But now the company is going on the road to tell its story, including a boffo Wednesday lunch in New York. Can you imagine? It’s like spraying lighter fluid on general alarm fire! I mean, this thing might be priced at a premium to where it is right now.Google lacks in many things, but outstanding shares is certainly not one. This is the same company that forgot to register nearly 30 million shares and options it had issued before it went public. There are now nearly 280 million shares of Google. If you want one, just buy it. You don’t have to be on the “in” of its next offering. Boffo lunches don’t drive the market, earning do.

We’re now a little more than a month away from Google’s next earnings announcement. Wall Street’s current estimate is for $1.35 a share, however there’s a pretty wide spread among the forecasts. Current projections range from $1.14 to $1.44 a share.

The best thing about a Google income statement is that if you don’t like one result, you can simply choose another number. There are several to chose from. When, say, GE reports its bottom line number, investors are basically stuck with it. Not so for Google. Take last quarter. Google earned $476 million. Easy, right? But that includes the “non-cash, stock-based compensation charge” of $47 million. You don’t want that, do you? And don’t forget traffic acquisition costs (or TAC if you’re cool) of $494 million. So Google’s bottom line was $1.19 a share. Or if you go by diluted shares, it’s $1.27. Or you can include the “non-cash, stock-based compensation charge” and get $1.36. Take your pick, it’s all good.

For next year, Wall Street expects at least one earnings result of $7.33 a share. This means that Google is worth about 43 times next year’s earnings. A bargain, right? Not exactly. A better estimate was recently done by Professor Aswath Damodaran of NYU. His research shows a valuation for Google at $110.13 a share. Click here for details. (Warning: link contains math).

However, I’m assuming Dr. Damodaran wasn’t invited to the boffo lunch.

-

Today’s Market

Eddy Elfenbein, September 13th, 2005 at 10:37 amFor a very brief period last week, traders weren’t sure if the Federal Reserve was going to raise rates at its next meeting. The futures market was split 50/50, but now the market is pretty much convinced that the Fed will raise the Fed Funds rate for an 11th straight time.

Today, the government reported that producer prices rose 0.6% in August, which is slightly less than what economists were expecting. The core rate, which excludes volatile food and energy prices, was unchanged, however this data does not include the effects of Hurricane Katrina. We’ll have to wait until next month to see how broad an impact the hurricane had on prices.

The Commerce Department reported that the trade deficit narrowed to $57.9 billion in July. I doubt that trend will last very long. The reason is oil. As oil heads higher, Americans send more money overseas. For the year, the trade deficit will probably be close to $700 billion, which is a big increase over last year’s record of $617 billion.

This is also the time when companies guide their earnings higher or lower in time for earnings season which kicks off next month. Nokia, the world’s largest cell phone company, raised its earnings estimate today. Nokia is a great company, but I’m a little suspicious of this earnings guidance. Not that Nokia won’t make it, but because Nokia was so gloomy beforehand. In July, Nokia shocked Wall Street when it missed its earnings then it said that third-quarter earnings will be no higher than 21 cents a share. Now it sees profits coming in at 22 or 23 cents a share. Still, Nokia is an excellent company and I expect it will rally over the next few months.

Shares of Best Buy are taking a big hit today on the company’s lower guidance for next quarter. Best Buy reported earnings of 37 cents a share, which is one penny below estimates. However, the electronics chain sees earnings of just 28 to 32 cents a share for next quarter, where Wall Street was expecting earnings of 34 cents a share. I would never count Best Buy out. The company is still very strong and it had an amazing May quarter when it topped Wall Street’s estimates by 70%. For this quarter, sales were up 10% and profits were up 25%. The stock is trading for about 20 times this year’s earnings.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His