Archive for January, 2006

-

MLK Day

Eddy Elfenbein, January 16th, 2006 at 12:22 pmThe stock market is closed today on honor of Dr. Martin Luther King. He would have turned 77 yesterday.

Here’s his “Letter from a Birmingham Jail.” To quote Keith Burgess-Jackson, “If this letter doesn’t move you to tears, you aren’t wired properly.”

I found a copy of the letter via Wikipedia. If you’re not familiar with Wikpedia, it’s an open source Web encyclopedia. Anyone can jump in and edit it. Recently, The New York Times reported that the entry for John Seigenthaler Sr., a former aide to Robert Kennedy, contained “defamatory content.” The entry was fixed, but on Wikipedia, you never know what you’re going to see.

Here’s part of the Wiki entry for Martin Luther King:The March on Washington

King and SCLC, in partial collaboration with SNCC, then attempted to organize a march from Selma to the state capital of Montgomery, for March 25, 1963. The first attempt to march on March 7, was aborted due to mob and police violence against the demonstrators. This day since has become known as Bloody Sunday. Bloody Sunday was a major turning point in the effort to gain public support for the Civil Rights Movement, the clearest demonstration up to that time of the dramatic potential of King’s nonviolence strategy. King, however, was not present. After meeting with President Lyndon B. Johnson, he had attempted to delay the march until March 8, but the march was carried out against his wishes and without his presence by local civil rights workers. The footage of the police brutality against the protestors was broadcast extensively across the nation and aroused a national sense of public outrage.

The second attempt at the march on March 9 was ended when King stopped the procession at the Edmund Pettus Bridge on the outskirts of Selma, an action which he seemed to have negotiated with city leaders beforehand. This unexpected action aroused the surprise and anger of many within the local movement. The march finally went ahead fully on March 25, with the agreement and support of President Johnson, and it was during this march that Willie Ricks coined the phrase “Black Power” (widely credited to Stokely Carmichael).

King, representing SCLC, was among the leaders of the so-called “Big Six” civil rights organizations who were instrumental in the organization of the March on Washington for Jobs and Freedom in 1963. The other leaders and organizations comprising the Big Six were: Roy Wilkins, NAACP; Whitney Young, Jr., Urban League; A. Philip Randolph, Brotherhood of Sleeping Car Porters; John Lewis, SNCC; and James Farmer of the Congress of Racial Equality (CORE). For King, this role was another which courted controversy, as he was one of the key figures who acceded to the wishes of President John F. Kennedy in changing the focus of the march. Kennedy initially opposed the march outright, because he was concerned it would negatively impact the drive for passage of civil rights legislation, but the organizers were firm that the march would proceed.

The march originally was conceived as an event to dramatize the desperate condition of blacks in the South and a very public opportunity to place organizers’ concerns and grievances squarely before the seat of power in the nation’s capital. Organizers intended to excoriate and then challenge the federal government for its failure to safeguard the civil rights and physical safety of civil rights workers and blacks, generally, in the South. However, the group acquiesced to presidential pressure and influence, and the event ultimately took on a far less strident tone.That’s not correct. The march from Selma to Montgomery happened in 1965, not 1963. The text refers to Lyndon Johnson as being president, but that didn’t happen until that November.

I like Wikipedia, but it’s always good to remember that you can trust everything you see on the Web. -

World to End Tomorrow; Republicans, Christians Suffer Most

Eddy Elfenbein, January 14th, 2006 at 6:06 pmThese are heady days for the Apocalypse biz. The latest offering in the “we’re all doomed” genre is The Long Emergency: Surviving the Converging Catastrophes of the Twenty-First Century by James Howard Kunstler.

Yikes! Even the title scares me. I thought I was pretty immune to this stuff, but Kunstler takes his end-is-nigh riff to another level. His outlook is so bleak, he makes Thomas Malthus look like Barney the Dinosaur. This is Joe Kaplinsky‘s review:The picture of the future put forward in The Long Emergency is truly grim. The best-case scenario is a mass die-off followed by a forced move back to the land, complete with associated feudal relations. As the title implies, this is to be an ongoing state rather than a crisis to be overcome – a sentiment that the US critic Susan Sontag described as ‘apocalypse from now on’. How bad will it be? ‘The prospect will be so grim that some individuals and perhaps even groups (as in nations) may develop all the symptoms of suicidal depression.’

By going extinct, Barney’s pals may have gotten off light. But before you go snapping up shares of Soylent Green Ltd. (PEPL), it’s worth remembering that these books often tell us less about the future, and more about the present.

Apparently, those who will suffer most terribly in the long emergency are the US Republican states whose culture is built on violence and fundamentalist Christianity. Neighbourhoods with spacious housing (‘McMansions’) and ‘poor street detailing’, a particular insult to Kunstler, are singled out for destruction. Europeans, by contrast, may pull through in better shape. There is an uncanny alignment between the supposedly objective, inevitable laws of nature and Kunstler’s prejudices. Perhaps the best summary of his views is found in the book’s epigraph: ‘I don’t know if the Gods exist, but they sure act as if they do.’

These Apocalypse books seem to be cyclical. Every few years, we’re about to hit a new calamity; global warming, famine, oil depletion, obesity, global cooling, Barbara Walters. It’s hard to keep it all straight.

The Stalwart points to a NYT article highlighting the fact that sometime this October, the U.S. population will pass the 300 million mark. The article notes that in 1967, when we topped 200 million, David E. Lilienthal, the former chairman of the Atomic Energy Commission, said, “a population of at least 300 million by 2000 will, I now believe, threaten the very quality of life of individual Americans.”

I’m not so sure he got that one right. But hey, it’s not the end of world.

A more responsible view is offered by Alfred Crosby. His book, “Children of the Sun: A History of Humanity’s Unappeasable Appetite for Energy,” manages to look at our energy problems without scare-mongering. Peter Pettus reviews the book in the New York Sun:As “Children of the Sun” begins to address this daunting issue, we are grateful to find ourselves in the company of grown-ups. This is our crunch time, and what we need is rational and realistic discussion instead of hysteria and panic. It is true that the fossil-fuel game is winding down. There may still be a lot of oil and natural gas in the ground; the problem is that the amount of energy expended to procure it is creeping up to the amount of energy gained. What are our other options?

Hydrogen fuel cell technology looks terrific, but the problem here is the energy cost of procuring the hydrogen in the first place. “In order to provide the electricity needed to pry loose enough hydrogen to meet its full requirements, the United States would need 400 gigawatts (400 billion watts) of electricity in addition to what it already generates. “This is a virtual impossibility. “The alternative is to utilize a new and very powerful prime mover that doesn’t pollute,” Mr. Crosby tells us. “It already exists: the nuclear reactor waits at our elbow like a superb butler.”

This may be true, but many people, especially here in the United States, are fearful. After Three Mile Island and Chernobyl, the domestic nuclear power plant was practically finished. Whereas France obtains around 80% of its power from nukes, we get only 20%. “This subject,” Mr. Crosby reminds us, “which arouses fear, anger and panic, requires cool and careful analysis.” This he provides with a calm assessment of both the real dangers of nuclear plants (highly exaggerated), as well as the costs of decommissioning plants and storing wastes. It is increasingly clear that in spite of the drawbacks of fission reactors, they must now be built because no feasible alternative exists. -

Good Riddance to Traditional Pensions

Eddy Elfenbein, January 14th, 2006 at 11:10 amIn the wake of IBM (IBM) doing away with its pension plan, James Glassman says, “good riddance.”

Lee Conrad, a labor organizer, said after the IBM news: “Employees are going to be losing out on all kinds of benefits. You’ve got to wonder what’s going to happen to the next generation of workers.”

No, you don’t. A study released last September by the Employee Benefit Research Institute and the Investment Company Institute found that Americans do a fine job with their 401(k) plans. Even with the rotten stock-market conditions of the early 2000s, the average account balances of 401(k) participants rose about 40 percent, to $91,000. And remember, these workers still have two decades to retirement. -

Guidant Accepts J&J’s Offer

Eddy Elfenbein, January 14th, 2006 at 11:05 amIt’s finally over. Guidant (GDT) will go with Johnson & Johnson (JNJ) for $71 a share. Both boards still need to approve the deal. I guess the hedge funds aren’t powerful as everyone thought. In the end, all Boston Scientific (BSX) did was make a bad deal cost more money.

-

This is Our Final Offer…Today

Eddy Elfenbein, January 13th, 2006 at 3:53 pmThis is getting weird.

Boston Scientific (BSX) told Guidant (GDT) that it has until 4 p.m. ET today to accept its offer. Then BSX came out with a press release extending the deadline by two hours. Then they came out with another press release telling us ignore the first press release. The 4 p.m. deadline is still on. -

5,000% Profits in Hansen Natural

Eddy Elfenbein, January 13th, 2006 at 1:58 pmFrom “Dave Barry’s Money Secrets,” a sure-fire way to beat the market:

Step 1. Gather all available financial data on the top 1,000 stocks for the past 25 years.

Step 2. By conducting a thorough analysis of each stock—select the 10 stocks that have performed best in this time period.

Step 3. Using a time machine, go back 25 years and buy these stocks.There’s of course one major drawback to this idea. Since we have an efficient market, someone else already invented the time machine and bought those stocks thereby erasing any profit opportunity.

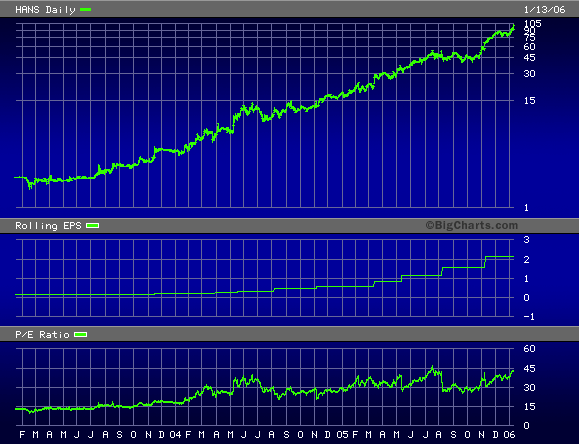

Personally, I’d only go back three years ago to buy shares of Hansen Natural (HANS). Hansen is quickly becoming the stock to own of the decade. If you’re not familiar with Hansen, the company is known for its Monster Energy drink. These drinks are basically massive amounts of sugar and caffeine, with a tiny portion reserved for water so that the drink can in fact be drunked.

How well has Hansen done? You could have picked up some shares in early 2003 for $2 a piece. A little lower if you were lucky. The stock is up another $11 in today’s trading to $103 a share. So we’re looking at a 50-fold increase in three years. That’s better than Google (GOOG) or Apple (AAPL) or Toll Brothers (TOL). Even gold.

The reason for today’s surge is—you guessed it—a price target increase. Gregory Badishkanian of Citigroup raised his price target from $88 (psst) to $130 (kewl!).Over the next five years, Badishkanian said he expects Hansen to grow 20 percent compared with an 8 percent earnings-per-share growth rate for the mature beverage giants. The analyst added he also sees Hansen’s earnings growth sailing past its peer group of smaller beverage and food companies, which are expected to grow 12 percent in the next five years.

Please. To echo Richard Dreyfus in Jaws, the idea that these analysts can predict Hansen’s earnings growth five years out is a million to one. Put it like this, even if they get the numbers right, the chances that they’d know why are another million to one. Could anyone in January 2001 predict the market environment of today?

The Hansen Natural of today is largely the brainchild of two South African businessmen. They bought a shell company and then went searching for a company to buy. In 1992, they bought Hansen for $14.5 million. After seeing the success of Red Bull, the pair moved Hansen into the energy drink market. Their first drink was a flop so they decided to turbocharge it. Hansen offered its drinks in 16-ounnce cans, plus they doubled the caffeine dosage. The drinks cost about $2 a can. What’s really set Hansen apart is it ability to target younger consumers.

Hansen has about an 18% share of the market, which is growing very quickly. However, the major soda players have moved in with their own offerings. (The cola wars continue, just on another front). According to Rodney Sacks, Hansen’s CEO:The energy-drink category is growing 50% a year and that there’s room in the market for everybody. “These are the new soft drinks of the world,” he declares. Sacks and Schlosberg are fending off the attack by diversifying. They’ve launched Joker, an energy drink sold exclusively in Circle K convenience stores, and Rumba, a caffeine-laced juice drink designed to be a morning pick-me-up. And they introduced Monster Assault, which comes in a black-and-gray camouflage can that says “Declare war on the ordinary!” It’s a slogan that could describe the juiced-up strategy of this formerly sleepy beverage player.

I just heard Jim Cramer say on CNBC that Hansen is where Google was a year ago.

-

Hip-Hop Capitalists

Eddy Elfenbein, January 13th, 2006 at 11:21 amNPR (audio link) looks at the business savvy of today’s rap artists.

-

Why Buybacks Are a Lame Idea

Eddy Elfenbein, January 13th, 2006 at 10:58 amBusiness Week is on the case:

The problem, says Thomas M. Doerflinger, an equity strategist at UBS, is that you can’t easily tell how much of what companies say they’re spending actually gets to investors. In a recent report on what he calls “vanishing buybacks,” Doerflinger found that the number of shares in the S&P 500 has continued to increase despite the bigger share-repurchase outlays by companies. In 2004, when companies reported spending some $197 billion on buybacks—nearly 2% of the market value of the index—the number of shares outstanding increased by 1.8%. In the 12 months through June 2005, shares increased 0.7%, and only a third of the companies actually shrank their share counts by at least 1%.

Consider Microsoft Corp. During its three fiscal years ending in June, 2005, the company reported spending $18 billion to buy back 674 million shares. At the same time it issued 666 million shares for $8 billion. In the end, Microsoft, which has some 10.6 billion shares outstanding, had reduced its total count by a negligible 8 million shares and had spent just $10 billion—$6.6 billion after tax. Yet Microsoft execs present the gross sums they spend repurchasing stock as being on par with dividends they pay, including the huge $33 billion special dividend in December, 2004. “Many companies are very vocal about the money they spent buying back stock, but they’re not very vocal about what percentage of that money goes to counteract options,” says Merrill’s Osha. Microsoft responded in a written statement that it regularly evaluates its buybacks and dividends to “best meet the interests of its diverse shareholder base.”Share buybacks are a great idea in theory, but in the real world, I’d rather get a cash payment. If the company wants more of my equity, that’s a decision best left to me.

-

Gazprom and PlayStations

Eddy Elfenbein, January 13th, 2006 at 10:38 amUgh.

“Pretty soon we’re all going to be Gazprom traders,” Kizenko said. “You’ve got to have it. Just like a PlayStation, you’ve got to have Gazprom.”

-

Stop the Presses

Eddy Elfenbein, January 13th, 2006 at 5:42 amWendy’s Facing Tomato Shortage

I hope they catch up. (BA!)

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His