Archive for October, 2006

-

It was 19 Years Ago Today…

Eddy Elfenbein, October 19th, 2006 at 7:18 am…Sgt. Pepper taught the band to play.

Well, not exactly. But it was the day that the stock market crashed. On October 19, 1987, the Dow dropped 508 points. In just a few hours, the index lost of 22.6%.

How have things gone since then?

The Dow is up 590%. Add in dividends, the Dow is up 1,010%. (That should teach you to reinvest your dividends!)

Inflation has increased by 76%.

And for all you gold bugs out there, the yellow metal is up 23%.

To match the Dow, gold needs to get up to nearly $6,600 an ounce.

The Dow has also outperformed the Wilshire 5000 which is up 493%, and 785% with dividends. -

Larry Ellison and the Art of War

Eddy Elfenbein, October 19th, 2006 at 6:51 amIn the movie Wall Street, Gordon Gekko tells Bud Fox to bone up on Sun-tzu’s The Art of War (you remember, “every battle is won before it is ever fought,” crap like that). Sure, this stuff is nice for the films, but it turns out Larry Ellison takes it seriously. I’m not making this up.

First some background. Larry has what you might call a troubled relationship with Hasso Plattner, the top dog at SAP.Not since SAP AG founder Hasso Plattner dropped his pants in front of Larry Ellison’s support vessel in a 1996 yacht race have tensions between the rival software makers been so high.

Of course, that would depend on what he dropped his pants for. But as the sports announcers say, “these two just don’t like each other.”

A normal relationship between SAP and Redwood City, California-based Oracle these days includes dueling press releases amid claims that stretch reality, SAP and analysts said. During Oracle’s first-quarter conference call Sept. 19, Ellison said SAP was delaying its next major product until 2010 while abandoning its strategy of internal growth helped by small acquisitions.

Oh, no he dint! No he dint!

Ellison’s comments were “a complete misrepresentation” of SAP’s products and strategy, Walldorf, Germany-based SAP said the same day. Only once before, in 2000 when Oracle said it was first in sales of business-management software, had SAP issued a statement responding to Oracle claims.

“Both times the distortion of facts about SAP were so significant we had to clear the record,” SAP spokesman William Wohl said in an interview. SAP said no senior-level executive would talk about the company’s current jousting with Oracle.But wherever did Larry get this idea from?

The tactics are classic Ellison, famous for his admiration of “The Art of War,” the treatise on battle tactics written by the sixth-century BC Chinese general Sun Tzu.

Ah, yes. It’s coming back to me now.

Bud Fox: All warfare is based on deception. If your enemy is superior, evade him. If angry, irritate him. If equally matched, fight and if not: split and re-evaluate.”

-

WallStrip.com

Eddy Elfenbein, October 18th, 2006 at 4:02 pmIf you haven’t seen it yet, check out WallStrip by Howard Lindzon. It’s sort of a Rocketboom for Wall Street.

Herre are the first three shows:

October 16

October 17

October 18 -

Burying the Lede

Eddy Elfenbein, October 18th, 2006 at 11:53 amHere’s a perfect example of Old Media missing the real story. This is from a WSJ article about Wal-Mart holding its analyst meeting in New York instead of Arkansas.

Coinciding with the two-day event is a dinner on Monday hosted by film moguls Bob Weinstein and Harvey Weinstein to honor Wal-Mart Chief Executive Lee Scott “for his commitment to environmental sustainability,” according to an invitation for the event. Also slated to attend the event are 18 heavyweights of entertainment and finance, including Cablevision Systems Corp. CEO James Dolan, hedge-fund billionaire Paul Tudor Jones, Robert Wright, chairman of General Electric Co.’s NBC Universal unit, and television host Charlie Rose. The event is closed to the public, as is the rest of the two-day meeting.

The Eagles will perform at the dinner. Also performing during the meeting will be country singer Garth Brooks, a regular fixture at Wal-Mart events now that his CDs and DVDs are sold exclusively by the retailer.The Eagles! You lead off with that. The rest of the story writes itself. The only question left is, who’s selling out here, Wal-Mart or the Eagles.

-

Inflationpalooza!

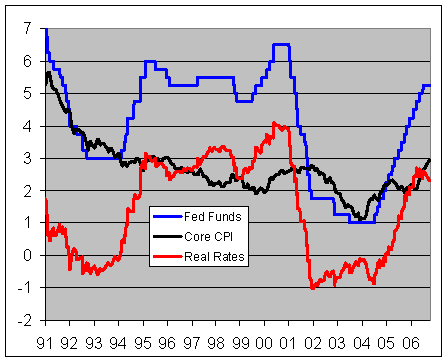

Eddy Elfenbein, October 18th, 2006 at 9:27 amThe idea of Core CPI comes in for a lot of ribbing, but today’s report shows why it can be more valuable than the headline number. Thanks to the big drop in oil, headline inlfation dropped 0.5% last month, but the core rate rose 0.2%.

What’s more, the data from one year ago included a big jump in energy prices, this was just after Hurricane Katrina. So the year-over-year number for headline inflation dropped from 3.8% in August to 2.1% in September.

By looking at the core rate, it also seems that the Fed still might be going too easy on inflation. Real rates are currently running at around 2.3%, which is less than where they were during much of the 1990s.

Note that this is an imperfect data set because it compares trailing inflation to today’s Fed funds rate. -

SEI Investment’s Earnings

Eddy Elfenbein, October 18th, 2006 at 9:09 amSEI Investments (SEIC), our top performer on the Buy List this year, just reported earnings of 60 cents a share for the third quarter. This is three cents more than the Street was looking for.

Net income climbed to $60.5 million, or 60 cents per share, from $49.2 million, or 48 cents per share, in the year-ago period.

Revenue rose 54 percent to $298.1 million, including $75.1 million from the consolidation of SEI’s 43 percent stake in LSV Asset Management, versus $193.7 million last year.

Analysts polled by Thomson Financial expected profit of 57 cents per share on revenue of $289.6 million.

Operating profit in SEI’s private banking and trust business rose 21 percent to $27.9 million, while operating margin improved to 38 percent from 36 percent. Total operating profit grew 59 percent to $97.6 million, with operating margin up a percentage point to 33 percent.The stock is up 58.8% for the year.

-

Investment Don’ts

Eddy Elfenbein, October 17th, 2006 at 2:56 pm

Steve Wynn recently sold Picasso’s “Le Reve” (pictured above) for $139 million. Art can be a great investment. He bought it nine years ago for “just” $48.4 million. That’s an annualized return of 12.4%.

Unfortunately for Steve-o, he accidentally poked a hole in it:“Oh shit,” he said. “Look what I’ve done.”

The rest of us were speechless.

“Thank God it was me,” he said.

For sure.

The word “money” was mentioned by someone, or perhaps it was the word “deal.”

Wynn said: “This has nothing to do with money. The money means nothing to me. It’s that I had this painting in my care and I’ve damaged it.”Oopsie.

-

BBBY’s Back-Dating

Eddy Elfenbein, October 17th, 2006 at 1:42 pmHere’s Jack Ciesielski’s take on Bed Bath & Beyond’s back-dating probe:

Lots of other interesting stuff, though. For instance, Wall Street wonders why it takes so long to complete these investigations. One reason: Bed Bath & Beyond’s investigation covered 19,000 individual grants. The special committee’s counsel interviewed 31 officers, directors, employees, advisors and others.

Also interesting is the way the company “positioned” the occurrence of the improper transactions. There were a variety of options grants made over BBBY’s publicly-traded life: annual grants, monthly grants, and special grants. They were handled by two different compensation committees: one composed of inside directors (”Committee A”), the other composed of outside directors (”Committee B”). The most interesting conclusion about the process: “Excluding grants only to Form 4 filers beginning in 2003, almost all annual grant dates in 1998-2004 likely were selected with some hindsight.” At the same time, “the special committee found no evidence that either the Company or any person involved in the grant process had engaged in willful misconduct.” Seems contradictory: how can you select grant dates with some hindsight without willfully doing so? Only if you’re completely mistaken, probably. And that leaves open the question of negligence. (We’ll leave that to the attorneys to fight over.)As they say, read the whole thing.

-

Are Liberal Stocks Better?

Eddy Elfenbein, October 17th, 2006 at 11:14 amResearch from Blue Investment Management found that stocks with “Democratic Values” (note large D) significantly outperform the rest of the stock market. The company even offers investors a Blue Large Cap fund and a Blue Small Cap fund (blue…as in state, get it?).

Color me skeptical. First, as Jane Galt points out, back-testing can show lots of thing, or really, almost anything. I’ve carefully back-tested data and come up with the rule that you should always sell on the 29th year of each century. Hey, it’s a proven strategy.

But my greater concern is the idea that “progressive values” yield business success. Well, it could be. There are certainly lots of left-leaning businesses that I admire. The Sandlers of Golden West Financials or Peter Lewis and Progressive (check out this chart).

But my hunch is that this blue investing theory might be the wrong way around. Progressive values don’t breed success, but success may breed progressive values. To quote one well-known progressive, Willie Sutton: “That’s where the money is.” -

The Cubs Have Bought the White Sox!

Eddy Elfenbein, October 17th, 2006 at 9:50 amWell, not exactly…but the CME and CBOT are merging:

The combined company will be named CME Group Inc., and will be headquartered in Chicago (no duh). The news sent CBOT shares soaring $21.50, or 16 percent, to $156.01 in premarket trading on the INET, indicating the stock may open above its 52-week high of $140.67. CME shares rose $17.75, or 3.5 percent, to $521 in early electronic activity.

CBOT stockholders will have the right to receive 0.3006 shares of CME common stock for each CBOT share, or cash equal to the value of the exchange ratio based on a 10-day average of closing prices of CME common stock at the time of the merger.

The cash portion of the purchase price won’t exceed $3 billion. If no shareholders elect to receive cash, shareholders of CME will own 69 percent of the merged company and CBOT holders will own 31 percent, with CME issuing about 15.9 million shares valued at about $8 billion.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His